FTX big sale 🛒

What's inside FTX's crypto treasure chest and why is crypto bothered? BTC ≠ Coffee Money, says PayPal's co-founder. And who does half-a-million-dollar mistake?

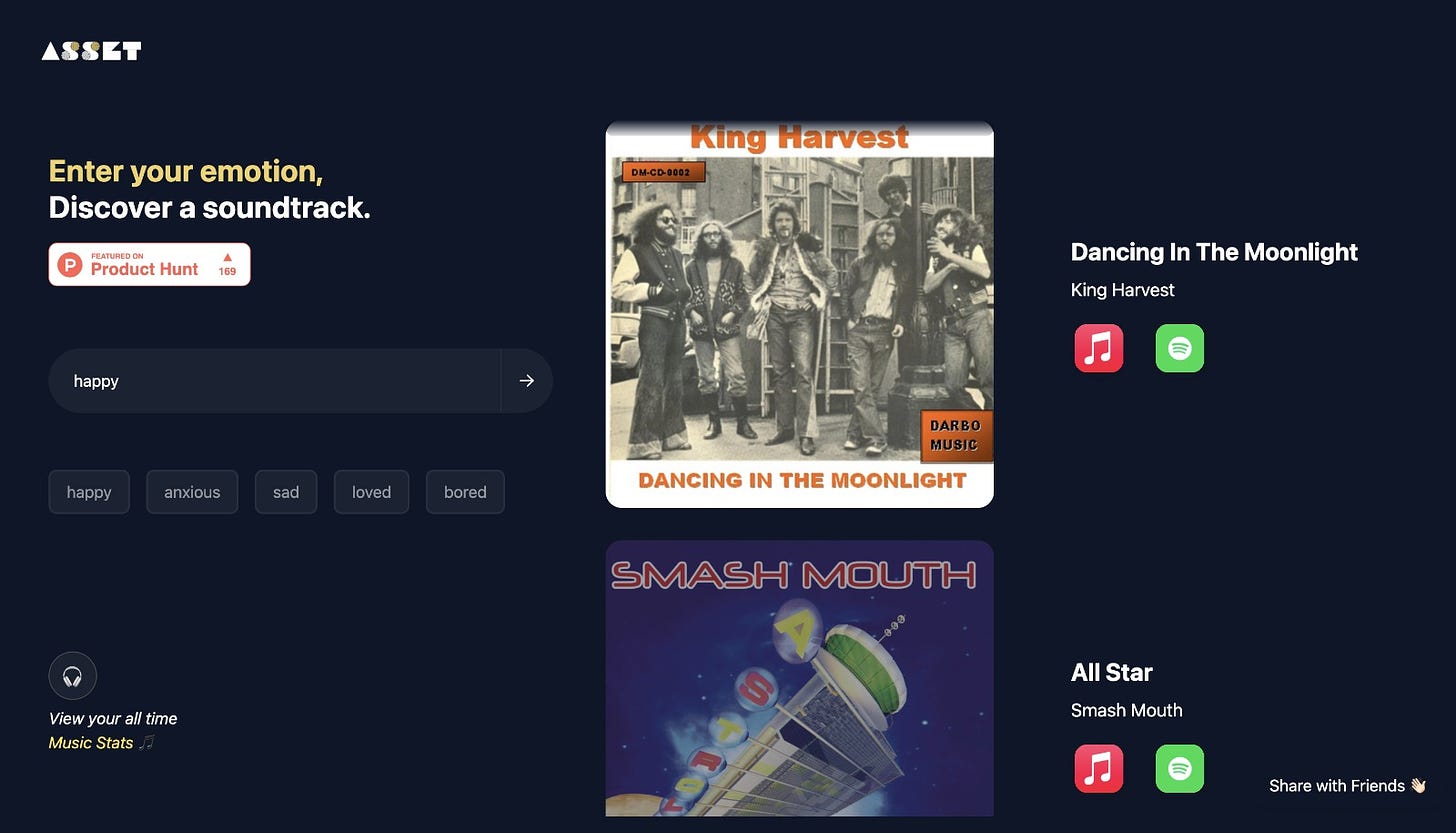

Hello, y'all 👉 ImFeeling - Let music be your companion 🙌

This is The Token Dispatch, you can hit us on telegram 🤟

The FTX sale in upon us. As the court ruling comes around to sort some serious money matters.

How big? Try $3.4 billion.

FTX is seeking a thumbs-up from regulators to convert $3.4 billion in crypto assets into cold, hard cash.

FTX ain't playing. They're also taking LayerZero, an on-chain interoperability protocol, to court, hoping to recover a rather specific $21 million.

There's a major meeting on September 13 where the Delaware Bankruptcy Court will decide on FTX's ambitious asset sale plan.

FTX's Crypto Treasure Chest

Solana (SOL) - $1.16 billion - accounts for a massive one-third of FTX's $3.4 billion liquid crypto portfolio.

Bitcoin (BTC) - $560 million - based on the BTC price as of August 31.

Ethereum (ETH) - $196 million

Aptos (APT) - the 36th largest crypto by market cap - $136 million

Venture Bets

Solana's Investment: $137 million

NEAR Token: Comes second with $80 million.

The Enigmatic "Category B"

This category encompasses tokens that are either not that liquid or seem to be heavily influenced by FTX.

Serum (SRM) Tokens: Roughly 10 billion in quantity.

Mango (MNGO) Tokens: A sizeable 269 million.

Now, if we're talking about huge sales in the crypto world, the vibes can get pretty tense.

Digital asset investment firm Galaxy to assist with the sales.

The LayerZero Legal Labyrinth

LayerZero Labs finds itself at the heart of a swirling legal tempest with FTX. But what's all the hubbub about?

In early September, in the hallowed halls of the United States Bankruptcy Court in the District of Delaware, documents were filed alleging that LayerZero allegedly pulled a fast one by withdrawing $21.37 million from FTX just as the exchange was about to crumble.

A previous agreement: Alameda's venture capital branch, in a bid to acquire a 4.92% share in LayerZero, had previously paid out a hefty $70 million in two distinct transactions between January and May 2022. And now, FTX believes LayerZero didn't stick to their side of the deal.

FTX's Claim: LayerZero allegedly didn't play fair. FTX is coming at them with:

Four counts of fraudulent transfers

Four counts of preferential transfers

One count of disallowance of claims

One count of property recovery

And the assets in question? LayerZero is said to have siphoned off substantial sums of various cryptocurrencies, including APT, AVAX, BNB, BUSD, FTM, MATIC, USDC, and USDT, all from FTX's coffers. Naturally, FTX is gearing up to reclaim these assets.

But it's not just LayerZero as an entity that FTX is after. Individual players are also on the hook. Ari Litan, once the COO of LayerZero, is on the line for $13.07 million. There's also a subsidiary, intriguingly named Skip & Goose, which has reportedly moved assets into its wallets, and FTX wants its $6.65 million back from them.

Now, what is all this doing to the crypto market?

Tiki-Taka. Down yesterday, back up again.

What next? No one is quite sure

Ethereum Feels the Weight

Institutional investors have been selling off Ethereum, with $108 million worth of outflows this year, making it the "least loved digital asset," according to CoinShares. The cryptocurrency saw $4.8 million in outflows last week alone, surpassing Tron as the most sold digital asset by large entities.

Also, Ethereum transaction fees have dropped to their lowest levels since 2022, as on-chain activity from NFT sales, meme coin trading, and Telegram bots subsides. This decrease in demand for gas on Ethereum has led to the cryptocurrency becoming inflationary, with its supply increasing by 4,092 ETH tokens in the past week.

TTD Blockquote🎙️

PayPal Co-Founder, David Marcus.

"Bitcoin is not the currency that people will use to buy things"

Here's a curveball from PayPal's co-founder, David Marcus! Even though he's a hardcore Bitcoin enthusiast, he just can't see Bitcoin as your regular Joe payment method.

BTC ≠ Coffee Money ☕

While David Marcus dreams of a world where we're not stuck in the "dial-up era of global payments", he's just not convinced that Bitcoin will be the superstar coin for our everyday shopping sprees. "Our view is actually that Bitcoin is not the currency that people will use to buy things," he spilled during his chat on CNBC’s Squawk Box.

Where the Lightning Strikes ⚡

Marcus, aside from being a PayPal mastermind, also helms Lightspark, a firm sculpting on Bitcoin’s lightning network. He's placing his bets on this network—a layer-2 solution for BTC—that's geared to make Bitcoin transactions zippier, thriftier, and niftier for those tiny transactions.

PayPal & Crypto: Still a Love Story 💙

David's not the only PayPal honcho smitten by Bitcoin. His co-founder buddy, Peter Thiel, also sings praises, viewing BTC as a nifty escape from wobbly central banks. And they're now flirting with their very own stablecoin, PYUSD.

Now, PayPal is expanding its crypto services by introducing an "off ramp" feature that allows users to convert digital currency into USD. This comes after the company launched an "on ramp" service for buying crypto. With the new feature, users can convert their crypto directly into their PayPal balance, enabling them to shop, send, save, or transfer to their bank or debit card.

The service is available to wallets, dApps, NFT marketplaces, and is live on MetaMask. Additionally, Web3 merchants can utilise the integration for enhanced security controls and tools for fraud management.

Where’s ETF?🚨

The recent court setback for the SEC has narrowed the discount on Grayscale Bitcoin Trust shares, making the price of the underlying asset, Bitcoin, more important in the Bitcoin ETF trade👇🏻

TTD Blunder 🙊

Mistakes happen... but a half-a-million-dollar one? A Bitcoin enthusiast mistakenly paid a whopping $500,000 in fees for a measly $200 transaction.

The Costly Blunder: In what might be one of the most cringe-worthy blunders in crypto history, a user accidentally dished out almost 20 bitcoin ($500,000) in transaction fees just to move a mere 0.008 bitcoin (worth $200).

Sets the record for the priciest transaction fee (in USD) for a single Bitcoin move.

Seasoned Player's Slip: The wallet behind this transaction isn't new to the crypto game. This "Bitcoin pro" has been involved in over 120,000 transactions. Casa CTO Jameson Lopp speculated that this colossal error might be the result of some faulty exchange or payment processor software.

Time's Ticking for Recovery: The fat fee landed in the lap of F2Pool, a well-known Bitcoin mining pool. F2Pool's co-founder, Chun Wang, has generously decided to hold onto the 20 bitcoin for a grace period of three days. If the original sender wants their cash back, they've got this window to knock on F2Pool's door. If not, this treasure trove will be divided amongst the pool's bitcoin miners.

TTD Coinbase 🧿

What is happening to Coinbase and its operations in India.

Reports flew in, and then got muddled.

First the news trickle suggested that Coinbase might be shutting down its services for Indian customers. Major outlets like TechCrunch and Economic Times jumped on the story.

According to these sources, an email from Coinbase warned Indian users to pull their funds from the platform before a looming September 25 deadline.

But, Coinbase is setting the record straight. The said notice was not a blanket statement for all Indian users. Instead, it targeted a select group, specifically those not meeting the platform's updated standards.

What Did the Email Say?

“We are reaching out to inform you that we will be discontinuing all Coinbase Retail services linked to your above-mentioned account, as we will be disabling access for the retail accounts that no longer meet our updated standards for these services."

“Please note that this does not impact your access to/use of Coinbase Cloud services which will continue to be accessible to you through your account.”

Coinbase explains that the decision was driven by certain accounts not aligning with their "updated standards." Some users might have flouted these, leading to the step. And to clear the air, affected users can still move their funds or use other crypto providers till September 25.

The story went wild on social media platforms, especially on X (previously Twitter).

Rumours also hinted that Coinbase blocked new Indian users from registering on its exchange. The truth? This change has been in place since June, restricting only the exchange accounts. But, you can still get their wallet app, the "Coinbase Wallet."

Coinbase's Commitment to India 🤝🇮🇳

Coinbase assures its commitment to the Indian market. While they did pause new sign-ups in June, they continue to maintain a solid tech hub in the country, offering live products like their Coinbase Wallet.

"We are committed to India over the long term and continue to explore ways to strengthen our presence in this important market,”

A Brief Timeline ⏳

April 7, 2022: Coinbase makes its grand debut in India.

April 11, 2022: A quick pivot! Coinbase stops payment services via the United Payments Interface (UPI) for Indian users, thanks to local regulatory pressures. But, Indians could still indulge in peer-to-peer (P2P) trading with existing crypto assets.

Today, Indian Coinbase users can only transfer their existing crypto assets.

TTD India 🇮🇳

India's Crypto Legislative Roadmap

Ban Ruled Out: India is sidelining the notion of a crypto ban, considering its global acceptance.

Five-Point Framework: Under guidance from the IMF-FSB, India is building a crypto legislative plan:

Advanced KYC measures integrating global standards.

Real-time proof-of-reserve audits for crypto entities.

Standardised taxation policies.

Elevating crypto exchanges to authorised dealer status, akin to banks, under RBI.

Instituting mandatory roles like Money Laundering Reporting Officer.

India, echoing global sentiments, recognises banning crypto is counterproductive. Regulating the industry can curb illicit activities. India imposed a 30% tax on crypto gains in 2022. But the IMF-FSB guidelines hint at a brighter, more regulated future for the nation's crypto landscape.

G20's Vision for AI

The members of the G20: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, the Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States and the European Union.

As the G20 presidency transitioned from India to Brazil, nations emphasised the ethical use of AI.

The G20 seeks AI's equitable benefits and its potential to address challenges while ensuring safety and rights.

Nations will tackle issues related to data protection, biases, and human-centric oversight.

Recognising AI's worldwide impact, the G20 aims for cohesive policies and regulations, while respecting each country's autonomy.

The G20 stands by its AI principles crafted in 2019 that promote trustworthy AI. They emphasise innovative regulations that balance benefits and potential AI risks.

In sync with the UN's vision, G20 aims to harness AI for global peace and prosperity.

TTD Surfer 🏄

Google has launched the Digital Futures Project, a $20 million fund to promote responsible AI development.

Microsoft has revealed the Xbox Mastercard, a credit card that allows cardholders to earn points for gaming perks.

Meta is reportedly building AI data centers and hiring a new team to develop an AI system that can compete with OpenAI's ChatGPT.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋