Gensler On His Way Out? 🚦

SEC Chair hints at potential exit. 18 states file a historic lawsuit against him. 'Crypto Dad' clarifies his disinterest in replacing him. Trump's new pro-crypto appointments.

How are you all? Welcome to your Friday's crypto dispatch. Today we explore Gensler's swan song at SEC and Trump's regulatory chess moves.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

Sometimes the most important messages come wrapped in the most mundane packages.

For crypto watchers, that moment came yesterday.

Buried in a speech about car keys and football analogies at a securities regulation conference.

As Bitcoin touched $93K and eighteen states filed lawsuits against him, Gary Gensler was busy reminiscing about his parents who "never worked in finance or even completed college."

It wasn't exactly a resignation letter.

But in Washington, where every word is measured and every pause calculated, Gensler's nostalgic tone spoke enough.

The SEC's most controversial chair since Joseph Kennedy is preparing for his exit?

The timing is, well, pure Gensler – delivering what sounds suspiciously like a farewell address just as the industry he spent years trying to regulate reaches new heights.

Is crypto's biggest critic finally hanging up his regulatory hat?

Speaking at Practicing Law Institute’s (PLI) 56th Annual Institute yesterday, Gensler went full retrospective.

"It's been a great honour to serve with them, doing the people's work..."

Sounds like a goodbye speech? We think so too.

But before we pop the champagne, let's rewind a bit.

Since 2021, Gensler's SEC has been crypto's biggest headache.

"Everything is a security" approach

Aggressive enforcement actions

Ripple, Coinbase, Binance in the crosshairs

Billions in fines and penalties

Innovation exodus to friendlier shores

The Numbers?

Over 50% of ALL crypto enforcement actions since 2015 happened under Gensler

Total fines since 2013: $7.42 billion

2024 fines alone: $4.68 billion (63% of ALL fines ever!)

Increase from 2023 to 2024: Mind-boggling 3,018%

Total enforcement actions: 148 since 2013

Now you know why the crypto world seems unusually happy today.

But here's where it gets interesting – Gensler's not going quietly…

His parting manifesto

Defended every enforcement action

Claimed court victories across the board

Took credit for Bitcoin ETF approvals

Warned about ongoing investor risks

Stood firm on securities classifications

Claims to have promoted innovation

Says he's protected investors

"Court after court has agreed with our actions," he declared, doubling down even as the exit signs flash.

"Not every asset is a security. Bitcoin is not a security, and the Commission has never treated Bitcoin as a security."

Instead, he argues, the focus was on "some of the 10,000 or so other digital assets" – representing less than 20% of the total crypto market and a microscopic 0.25% of global capital markets.

Overall it’s a fun one-time read, if you fancy.

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

In The Numbers 🔢

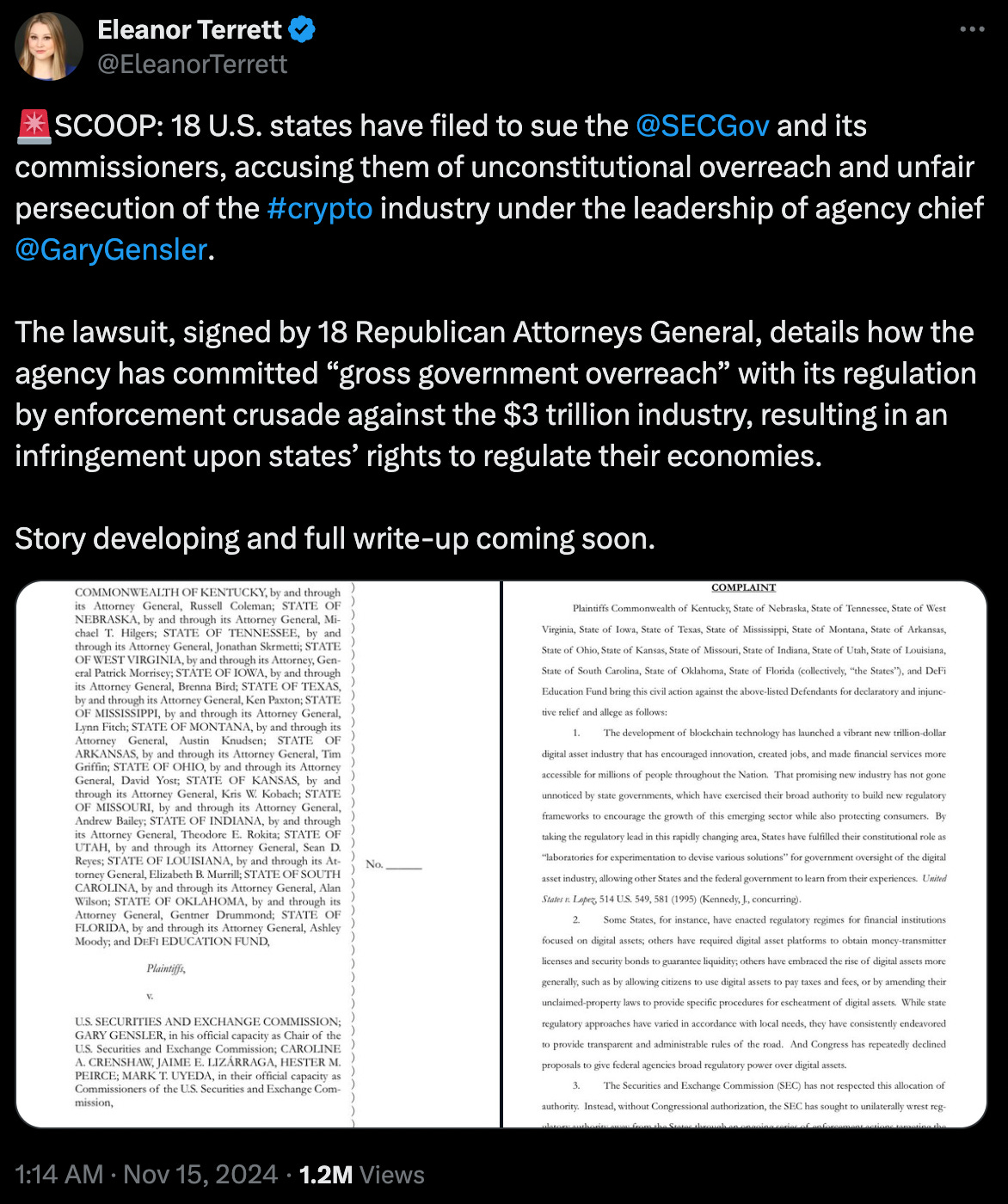

18

That's how many states are teaming up to take on Gary Gensler's SEC in a historic lawsuit.

18 Republican state Attorneys Generals united.

AGs for Kentucky, Nebraska, Tennessee, West Virgina, Iowa, Texas, Mississippi, Montana, Arkansas, Kansas, Missouri, Indiana, Utah, Louisiana, South Carolina, Oklahoma, Florida as well as the DeFi Education Fund filed their lawsuit .

There have been 0 prior cases of states collectively suing SEC over crypto.

What are they fighting?

SEC's "gross government overreach"

Unilateral control over digital assets

State authority being undermined

Enforcement-first approach

Howey Test interpretation

"The Securities and Exchange Commission (SEC) has not respected this allocation of authority. Instead, without Congressional authorisation, the SEC has sought to unilaterally wrest regulatory authority away from the States through an ongoing series of enforcement actions."

"The SEC’s sweeping assertion of regulatory jurisdiction is untenable. The digital assets implicated here are just that — assets, not investment contracts covered by federal securities laws,"

The timing? Chef's kiss.

Why? Because Trump's coming.

Remember that moment at Bitcoin 2024? "On day one, I will fire Gary Gensler."

And who’s the next SEC Chair?

Read: Who Will Replace Gary Gensler? 👀

Block That Quote

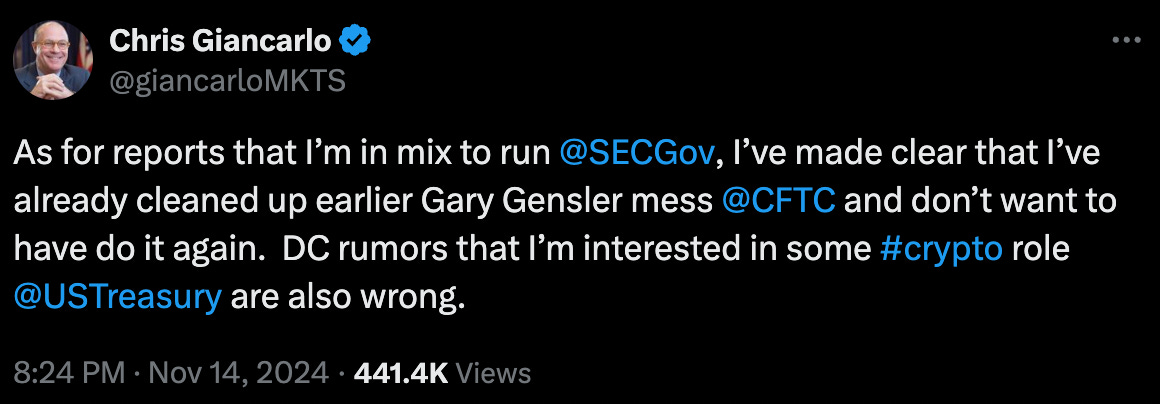

Chris Giancarlo, Former CFTC Chair

"I've already cleaned up earlier Gary Gensler mess and don't want to have [to] do it again"

Affectionately known as "Crypto Dad" to the digital asset community, Giancarlo has a history of succeeding Gary Gensler's.

Back in 2014, he stepped into the CFTC just months after Gensler's departure, inheriting what he's now quite openly calling "a mess."

Now, as Washington buzzes with speculation about who might replace Gensler at the SEC, Crypto Dad has a simple message: once was enough.

After all, Giancarlo seemed like the perfect candidate on paper.

He's got the nickname ("Crypto Dad"), the credentials (former CFTC chair), and even the blockchain street cred (co-founder of the Digital Dollar Project).

But he doesn’t seem to want the unenviable chair, though.

Trump's New Picks Are Turning Heads 👀

The president-elect isn't wasting any time reshaping crypto's regulatory landscape.

Just this week

Matt Gaetz → Attorney General (big Bitcoin fan)

Jay Clayton → US Attorney for Manhattan (plot twist!)

Summer Mersinger leading CFTC chair race

Matt Gaetz → Attorney General (big Bitcoin fan) – the same congressman who once visited El Salvador's Bitcoin-loving president and came back wanting Americans to pay their taxes in BTC. A detail that probably didn't hurt his chances with the president-elect.

Jay Clayton → US Attorney for Manhattan - Trump tapped his old ally for the role. Yes, the same Clayton who kickstarted the Ripple lawsuit on his last day as SEC chair, but also the one who later declared himself a "huge believer" in blockchain technology.

Summer Mersinger leading CFTC chair race - Mersinger, the commissioner who's been fighting against "regulation by enforcement," emerged as the frontrunner for the chair position. Her credentials? A history of pushing for clearer rules around DeFi and a powerful connection to newly-minted Senate leader John Thune.

The Surfer 🏄

Donald Trump's DeFi project - World Liberty Financial (WLFI) - has partnered with Chainlink to enhance its integration within the crypto ecosystem by utilising Chainlink's pricing data and cross-chain interoperability services.

The Kingdom of Bhutan has transferred 365 Bitcoin, valued at about $33.3 million, to Binance, raising speculation about a potential sale as Bitcoin approaches its all-time high of over $90K.

Tether has launched Hadron, a new tokenisation platform that enables users to tokenise a variety of assets, including stocks, bonds, stablecoins, and loyalty points. Real-world assets are increasingly getting tokenised with current tokenisation value standing at $6.5 billion.

Solana has emerged as the leading blockchain for new token launches, with 89% of the 181,000 new tokens introduced last week on its network.

Franklin Templeton has launched its On-Chain US Government Money Market Fund (FOBXX) on the Ethereum blockchain, expanding its reach beyond other blockchains like Avalanche and Stellar. With this, FOBXX becomes the first money market fund to utilise a public blockchain for transaction tracking and ownership verification, currently managing around $410 million in assets.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Thought-provoking article!

Well-crafted article! It captures the perfect storm of regulatory shifts, political moves, and market momentum driving the next era of crypto innovation.