GoDaddy x ENS 🤝

You can now use .com domain as Ethereum address. $1.6 billion worth of trust assets up for sale. Crypto voters' impact. Bitcoin miners hit by winter storms. Vitalik Buterin to decrease block size?

Hello, y'all. If you think you know your music, then this is for you frens👇

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

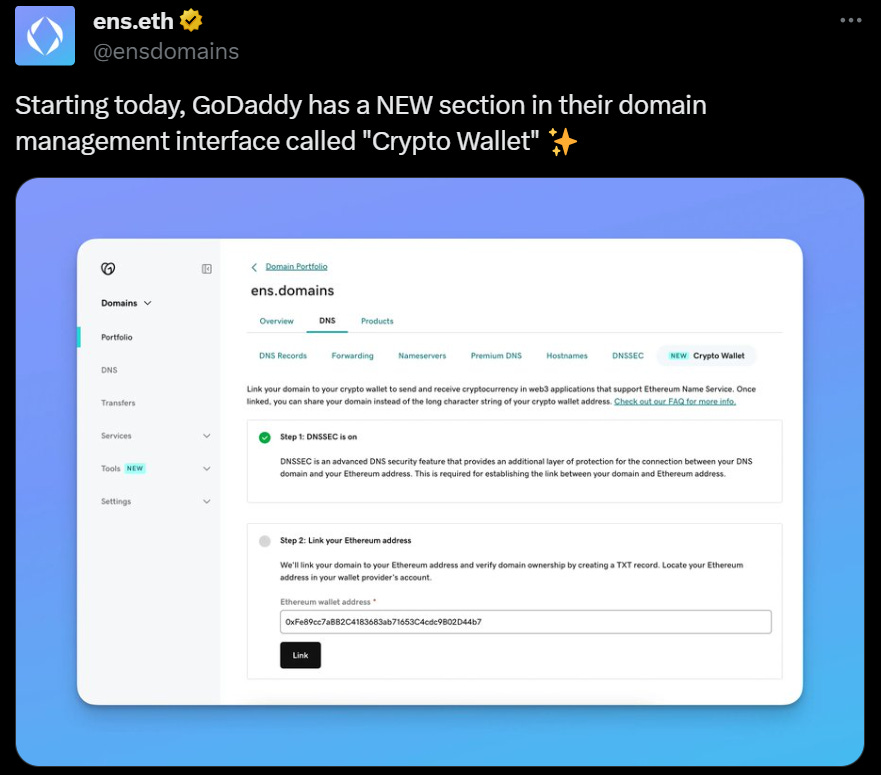

ENS (think Web3 address book) teams up with GoDaddy (big-time web host).

This means?

Now, it super easy for users to connect their .com (or any domain) to their crypto wallets.

DNS and ENS Integration: DNS is your regular internet GPS. Similar to how the Domain Name System (DNS) translates IP addresses into easy-to-remember domain names, ENS does the same for complex wallet addresses.

Now, with GoDaddy's collaboration, users can connect their ENS addresses with DNS domains.

Easy Crypto Payments: For GoDaddy's massive user base (we're talking 20 million folks), this means tapping into ENS blockchain perks, like getting crypto payments with ease. ENS lets you swap those headache-inducing long Ethereum addresses for something a bit more human-friendly.

Merging Web2 and Web3 sounds cool, but there's a catch - the big C, censorship.

Remember this?👇

ENS domains (.eth) are known for their resistance to censorship and tampering. Nick Johnson, ENS's founder, emphasized that even the ENS DAO can't revoke or restrict a .eth domain.

However, domains imported from DNS, including those via GoDaddy, remain under the registrar's control and subject to their rules and those of ICANN.

In the Numbers 🔢

$1.6 billion

Genesis Global Capital seeks court approval to sell $1.6 billion worth of trust assets.

The assets for sale include shares in:

Grayscale Bitcoin Trust (GBTC) valued at approximately $1.38 billion (87% of Genesis' total portfolio).

Grayscale Ethereum Trust (ETHE) worth about $169 million (10% of the portfolio).

Grayscale Ethereum Classic Trust (ETCG) totalling $38 million (3% of the portfolio).

They're asking for a speedy hearing on this sale motion set for February 8.

The recent SEC approval on Jan. 10 allows GBTC, now converted to a spot Bitcoin ETF, to redeem shares in cash.

FTX, also in bankruptcy, cashed out all its GBTC shares, a move valued close to $1 billion.

Legal Tangles: On the block are GBTC shares previously pledged as Gemini Earn program collateral and shares from Three Arrows Capital's downfall. There's a dispute over an additional 31 million shares promised to Gemini but stuck in legal limbo.

Gemini sees this sale as a big step, especially after GBTC's recent nod as an ETP.

Who said that?🎙️

Paul Grewal, Coinbase's chief legal officer.

"A few thousand passionate voters who say crypto matters to them can punch way above their weight."

Paul Grewal suggests that the passionate and growing group of 52 million crypto owners in the US could significantly influence election outcomes, especially in closely contested states.

With the nation divided on several major issues, Grewal points out that in states where elections are won by slim margins, a dedicated group of crypto-focused voters could have a disproportionate impact.

Stand With Crypto Campaign: Coinbase is rallying crypto enthusiasts through its nonprofit, Stand With Crypto, aiming to mobilise support in key states like Ohio and New Hampshire. The campaign encourages crypto voters to support and donate to lobbying efforts reflecting their interests.

Many agree with Coinbase.

“Crypto voters are not just a niche group; they’re a diverse and influential group that could shape the 2024 election landscape." - said Brett Quick, Head of Government Affairs for Crypto Council for Innovation.

Where’s ETF?🚨

ProShares, a major issuer of Bitcoin futures-based ETFs, does not see any threats from the launch of spot Bitcoin ETFs in the US👇

Bitcoin production dips🔻

Major public bitcoin miners saw a decrease in bitcoin production this January, attributed to energy usage curtailment triggered by winter storms.

Marathon Digital reported a 42% drop in bitcoin production from December, producing only 1,084 BTC in January.

The company faced challenges including weather-related energy curtailment and equipment failures.

Core Scientific and Riot Platforms: Core Scientific, fresh from bankruptcy, produced 1,027 BTC, down from December's 1,177 BTC, due to several power consumption reductions. Riot Platforms saw its production fall to 520 BTC from 619 BTC due to increased power demand from Texas' extreme cold.

Other Miners Affected: CleanSpark, Cipher Mining, and Bitfarms also experienced around 20% drops in their bitcoin production. Weather-induced power grid programs were cited as the main reason for the declines.

Vitalik’s fixing✅

Ethereum co-founder Vitalik Buterin and the Ethereum Foundation are exploring options to reduce Ethereum's maximum block size.

This move aims to align with Ethereum's rollup-centric roadmap and ensure efficient block space usage. And proposes few solutions:

Raise Calldata Cost: Increase calldata cost from 16 to 42 gas to reduce block size and allow higher block gas limits, potentially affecting calldata-heavy apps.

Balance Calldata and Opcode Costs: Boost calldata prices while lowering costs for other operations to maintain network efficiency without overly penalising specific uses.

Calldata Cap: Limit the amount of calldata per block to directly decrease block size, which might discourage its use for data availability.

Calldata Fee Market: Introduce a dynamic pricing model for calldata to adjust costs based on demand, adding complexity but offering flexibility.

EVM Loyalty Bonus: Provide incentives for apps that rely heavily on calldata to offset higher usage costs.

The Surfer 🏄

Ripple to hand over additional financial information and details about institutional sales of its crypto, XRP, following a request from the SEC.

Several executives of cryptocurrency yield platform Haru Invest have been arrested in South Korea on charges of embezzlement.

EigenLayer saw its TVL increase by $1 billion in just eight hours after temporarily removing its staking cap.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋