Gold ⚖️ BTC and ETH ⚔️

Glassnode's Scoop: Bitcoin and Ethereum are outshining Gold. Hayes waves a yellow flag on the Bitcoin ETF parade. Nike's digital sneakers are not just walking and zkSync's narrow miss.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

What are we feeling?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Crypto had a really bad time last year, but only to change things for better?

The way everyone looks at Bitcoin and Ethereum is going to change.

Thanks to institutional interest in crypto.

As the digital asset market evolves through 2023, it’s clear that Bitcoin (BTC) and Ethereum (ETH) are leading the charge, outpacing traditional safe havens like gold significantly.

Here's some insights from Glassnode: The Capital Waterfall

Market Performance in 2023

BTC and ETH have shown resilience, with BTC up by 93% and ETH by 39% against gold.

Market corrections are shallower for BTC and ETH compared to previous cycles, suggesting sustained investor support.

ETH’s performance? Picture it like a high-dive act with a -26% swoop from its peak, which is like barely making a splash compared to past belly flops.

The Rotation Pool

Altcoin market? It's getting some sun, but Bitcoin’s the one with the VIP cabana, commanding over 53% of the market.

Altcoins have appreciated in value, yet their growth is modest next to Bitcoin's expansive rise.

Bitcoin has surged over 30% recently, fuelled by anticipation around ETF decisions and its outperformance against traditional asset classes.

The Altseason Indicator flipped on like pool lights on October 20th, just before Bitcoin made a wave from $29.5k to $35.0k.

Despite a positive uptick for altcoins against USD, their performance pales in comparison to Bitcoin’s rally.

Bitcoin’s market cap has risen by 110% YTD, overshadowing the altcoin market's growth.

Investor Sentiment and Profitability

ETH is trading above its realised price, indicating a moderate profit for the average holder.

MVRV Ratio suggests that the market is not yet in a strong positive momentum phase, with investors still cautious after the 2022 downturn.

What is happening to the market lately?

Cathie Wood of ARK Invest is a well-known proponent of Bitcoin.

Her latest statements reiterate her belief that Bitcoin serves as "digital gold" and can act as a hedge against both inflation and deflation.

This is because, unlike traditional currency, Bitcoin is decentralised, has a limited supply (capped at 21 million coins), and does not rely on any counterparty, which makes it independent of traditional financial systems.

Spot Bitcoin ETF Prospects: The ETF.com report suggests that a spot Bitcoin ETF might be approved by the SEC soon. Steven McClurg of Valkyrie indicates that the concerns previously held by the SEC, such as market manipulation and pricing issues, have been addressed.

Galaxy Digital Predicts?

Galaxy Digital estimates that spot Bitcoin ETFs could see inflows of $14.4 billion in the first year of issuance, suggesting significant demand and confidence from investors.

They further project that this could increase to $27 billion by the second year and $39 billion by the third year. According to Galaxy Digital, a spot Bitcoin ETF would serve as a better investment vehicle over existing products like trusts and futures, which collectively hold over $21 billion.

Also👇🏻

Peter Brandt says?

Veteran trader Peter Brandt believes that Bitcoin has already hit its bottom and could reach new all-time highs by the end of 2024.

However, he warns investors to expect a volatile and unpredictable market in the meantime. Brandt dismisses other cryptocurrencies like Chainlink, stating that he focuses solely on Bitcoin.

He has been using a specific trading blueprint for nearly two years and favours the weekly Renko graph for analysing Bitcoin price movements.

TTD Blockquotes 🎙️

Arthur Hayes, BitMex founder.

“If the BlackRock ETF gets too big ... it could actually kill bitcoin because it’s just a bunch of immovable bitcoin that’s just sitting there.”

Amidst the buzz over a potential spot Bitcoin ETF, Arthur Hayes, founder of the Maelstrom Fund, waves a flag of caution.

Hayes maintains Bitcoin is the antithesis of overbearing state money, proudly stating it’s “that is here for us, the people.”

On the "On the Margin" podcast, he imagines a scenario where finance heavyweights like Larry Fink could monopolise Bitcoin, turning it into a sedentary asset within ETFs.

This, Hayes suggests, could strangle Bitcoin's utility and ethos, transforming it from the people’s currency into a static financial instrument.

Hayes is wary of the institutionalisation of Bitcoin, especially if firms like BlackRock, which he calls "agents of the state," use their influence to shape the crypto landscape.

He questions whether such entities would back necessary upgrades to maintain Bitcoin's security and privacy, hinting at a potential conflict with their traditional finance roots.

The essence of Bitcoin, as Hayes sees it, is its role as a decentralised, global currency — a stark contrast to state-controlled fiat money.

However, he raises an eyebrow at the future of Bitcoin if it ends up concentrated in the hands of a few powerful institutions.

While acknowledging that mainstream adoption could skyrocket Bitcoin’s fiat value, Hayes prompts the community to consider the long-term implications, suggesting we might be trading a short-term high for a potential future calamity.

Where’s ETF?🚨

The global market for Spot Bitcoin ETFs has reached a value of $4.16 billion, indicating a growing acceptance of these financial instruments👇🏻

TTD Numbers 🔢

$1.4 billion

Nike-RTFKT collections trading volume.

It ain't just walking; but sprinting ahead with $170 million in earnings.

And oh, did they shake the NFT scene last month?

With a trading leap of over 600%, sneaker lovers showed that their appetite for exclusive Phygital goodies is just insatiable.

Prominent figures like LeBron James and influencers in the NFT community are helping to drive interest and validate the concept.

While RTFKT's diverse collections contribute to their success, the CloneX series remains the heavyweight champion, largely responsible for the impressive trade volumes.

Owning these NFTs has also unlocked the ability for consumers to get their hands on exclusive Nike sneakers.

RTFKT's recent "forging" events have turned NFTs into golden tickets for ordering custom Nike sneakers.

These events have created a significant uptick in trading volume, indicating a strong consumer desire to merge collectible culture with wearable fashion.

The forging process for the Dunk Genesis Cryptokicks led to a notable uptick in trading, with transactions for the necessary NFTs in October surpassing $500,000.

While the forging of the Dunk Genesis Cryptokicks set the NFT price at around $220, the secondary market saw listings as high as $1,000 per pair.

This price variation reflects the NFTs' value beyond their digital presence.

The use of blockchain and NFC (Near Field Communication) tags for authentication is highlighted as a major benefit, helping combat the issue of counterfeit goods.

TTD New 🚀

Magic Eden, with Yuga Labs—the masterminds behind the Bored Ape Yacht Club—announces the end-of-year launch of a new Ethereum-based NFT marketplace.

This platform is not just another marketplace; it carries the distinct feature of being "contractually obligated" to respect and enforce creator royalties.

Here's the features of the new NFT marketplace

Launch by the end of the year

Contractual obligation to pay creator royalties

Uses ERC-721 Ethereum NFT standard

Royalties enforced via marketplace contract properties

No change in trader interaction or new KYC requirements

Technological solutions to ensure royalty payouts

Open to adoption by other marketplaces for standardisation

Non-exclusive arrangement, welcoming broader marketplace engagement

A Commitment Set in Code

The upcoming marketplace pledges to integrate smart contracts with a unique twist.

These contracts, integral to the functionality of decentralised apps, are engineered to ensure that royalties are automatically paid out during secondary market transactions.

The Royalty Enforcement Mechanism

On this new marketplace, NFTs minted within the “properties of the marketplace contract” will have a compulsory royalty component.

This pivotal move aims to maintain the integrity of creator earnings without altering the user experience for traders—no additional KYC hurdles will obstruct their path.

Royalty Disputes and Market Dynamics

The latter half of 2022 saw NFT sales slump, triggering a ripple effect where marketplaces began sidestepping royalties to attract traders.

Even OpenSea, a significant player, retreated from its initial stance to enforce royalties, drawing criticism from creators and industry leaders, including Yuga Labs.

In response to the royalty debate, Yuga Labs has taken a stand, refusing to support OpenSea's marketplace contracts for future collections.

A Subtle Nudge Against OpenSea

The alliance between Yuga Labs and Magic Eden doesn't just bring about a new marketplace; it also serves as a veiled critique of OpenSea's policies.

Emphasizing their unwavering stance on royalties, the partnership calls out other marketplaces for abandoning creative entrepreneurs.

The press release read:

The companies have “made it unequivocal that respecting creator royalties is non-negotiable, a clear stance amidst a sea of other marketplaces who turn their backs on creative entrepreneurs.”

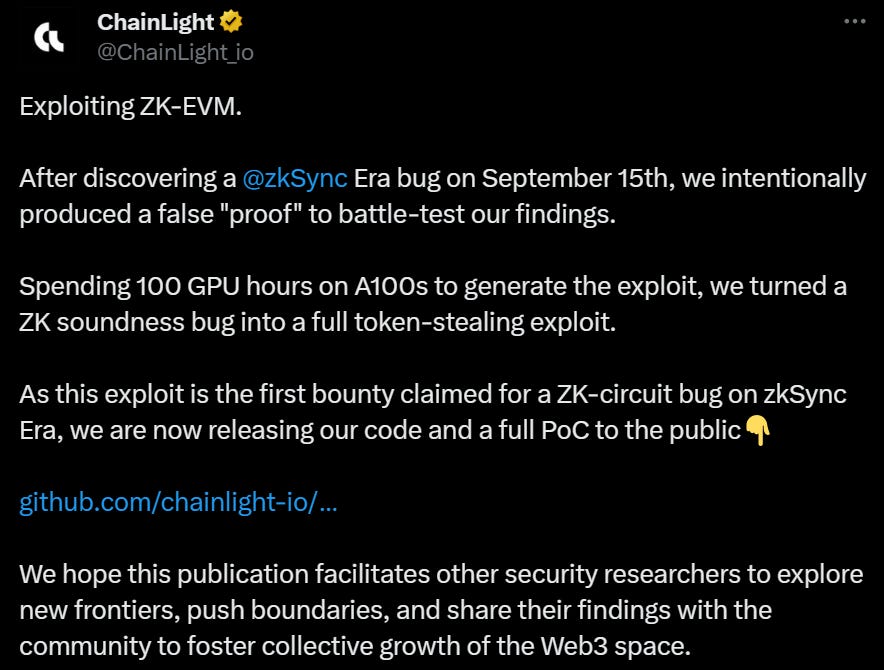

TTD Exploit 🦹🏻

zkSync Era, Matter Labs' second-layer scaling solution for Ethereum, narrowly evaded a massive security breach thanks to the vigilance of ChainLight, a blockchain security audit firm.

A critical vulnerability capable of draining approximately $1.9 billion in ether (ETH) was discovered and promptly addressed.

The Technical Flaw

The detected bug within these zk-circuits could have enabled an intruder to alter transaction values within a block, while still passing them off as legitimate during the verification process.

High Barriers to Exploitation

Despite the risk, zkSync's robust security architecture made the actual execution of such an exploit highly challenging.

An attacker would need extensive privileges, including backend access or the validator's private key, plus they'd face a 21-hour delay before any fund extraction.

Upon learning of the bug, Matter Labs quickly fixed the issue, highlighting the vulnerability's link to an older system soon to be outdated.

For uncovering this out-of-scope bug, ChainLight received a 50,000 USDC reward from Matter Labs, which values proactive security measures and recognises the vital role of external audits in safeguarding blockchain integrity.

This incident underscores the importance of multi-layered defenses and continuous innovation in preventing single points of failure in blockchain security.

TTD Surfer 🏄

Bankruptcy advisors for collapsed crypto exchange FTX have handed over customer information to the FBI, according to court records.

A lawsuit against Coinbase over its Dogecoin sweepstakes promotion will proceed in court after a federal judge denied Coinbase's motion to force arbitration.

A Uniswap user lost $700,000 by mistakenly adding the wrong value to a liquidity pool.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋