Good Morning Trump's USA ☀️

Bitcoin breaks all-time high two days in a row. Crypto market cap hits $2.5T. Total of 261 pro-crypto candidates got elected to Congress. Being anti-crypto is bad politics? Billionaire charts on fire.

Hello y'all, Today’s crypto dose of Token Dispatch through the periscope of markets on fire in Trump’s America.

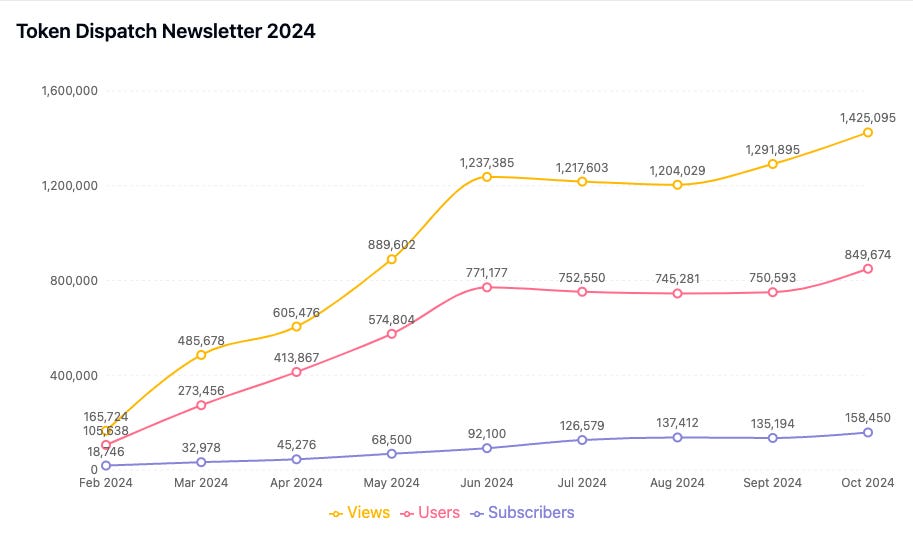

Want to reach out to 150,000+ subscriber community of the Token Dispatch? Ride with us👇

The US stock market is a sea of green.

Crypto market is a sea of green.

The Donald Trump Republican booster shot has sent everything up.

Let's put some numbers on the table

Bitcoin shattered its all-time high, two days in a row. Touching $76,509.56

Spot Bitcoin ETFs saw $6 billion in total trading volume across all funds

IBIT alone pulled in $1 billion in the first 20 minutes of trading

The total crypto market cap swelled 7% overnight to $2.5 trillion

This wasn't just regular market movement.

This was Wall Street voting with its dollars, and they were casting those votes with unprecedented enthusiasm.

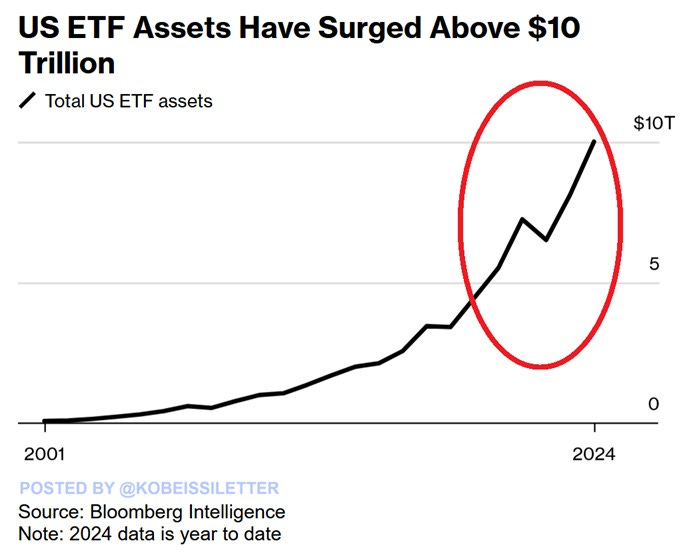

US ETFs are a big deal, over the last five years the US ETF market has doubled from $5T to $10T. 👇

What's got Wall Street in such a crypto frenzy?

This is what happens when the "Trump Trade" meets Wall Street meets crypto Twitter.

Crypto's throwing the biggest party since January's ETF approval.

Trump won.

Read: From Crypto With ❤️

Crypto stocks also join the run

Coinbase (COIN): +31% in a single day

Robinhood: +19.6%

Marathon Holdings: +19%

MicroStrategy: +13% (their $19B Bitcoin stack looking mighty fine)

CleanSpark: +23%

Riot Platforms: +26% (the OG miner's comeback)

It was a complete sector rerating.

Bernstein's analysts are now projecting Bitcoin to hit $90,000 by year-end and an eye-watering $200,000 by the end of 2025.

Why's everyone so hyped? The campaign promises.

But here's the real kicker – it's not just about Trump.

Republicans flipped the Senate too. Those crypto bills gathering dust? They might finally see daylight.

The crypto world's been flooding social media with reactions 👇

Block That Quote🎙

Brian Armstrong, Coinbase CEO

“Being anti-crypto is simply bad politics.”

A mic-drop moment from Coinbase's chief, who's spent tens of millions backing pro-crypto candidates through Fairshake PAC. His exchange's stock surged 31% on election day, proving his point in dollars and cents.

Casa's Jameson Lopp went full cypherpunk

"Bitcoin was born to operate in an adversarial environment. Foolish politicians thought they could wage war against us. Today they received our response.

Legacy media can't comprehend that their polls were wrong and Polymarket was right. Money talks. You just have to listen."

Paul Grewal, Coinbase CLO, sent a stern message to SEC

"Stop suing crypto. Start talking to crypto. Initiate rulemaking now. There's no reason to wait."

Ripple's Brad Garlinghouse celebrated the 'crypto voter'

"To everyone who doubted it: the crypto voter is here to stay, loud and clear!"

Jan3 CEO Samson Mow sees bigger implications

"Get ready for nation-state adoption and strategic bitcoin reserves."

Bitcoin Magazine's David Bailey kept it focused

"The people have spoken. Tomorrow we start work on fixing the money."

Tron Founder, Justin Sun is looking forward to the future

In The Numbers 🔢

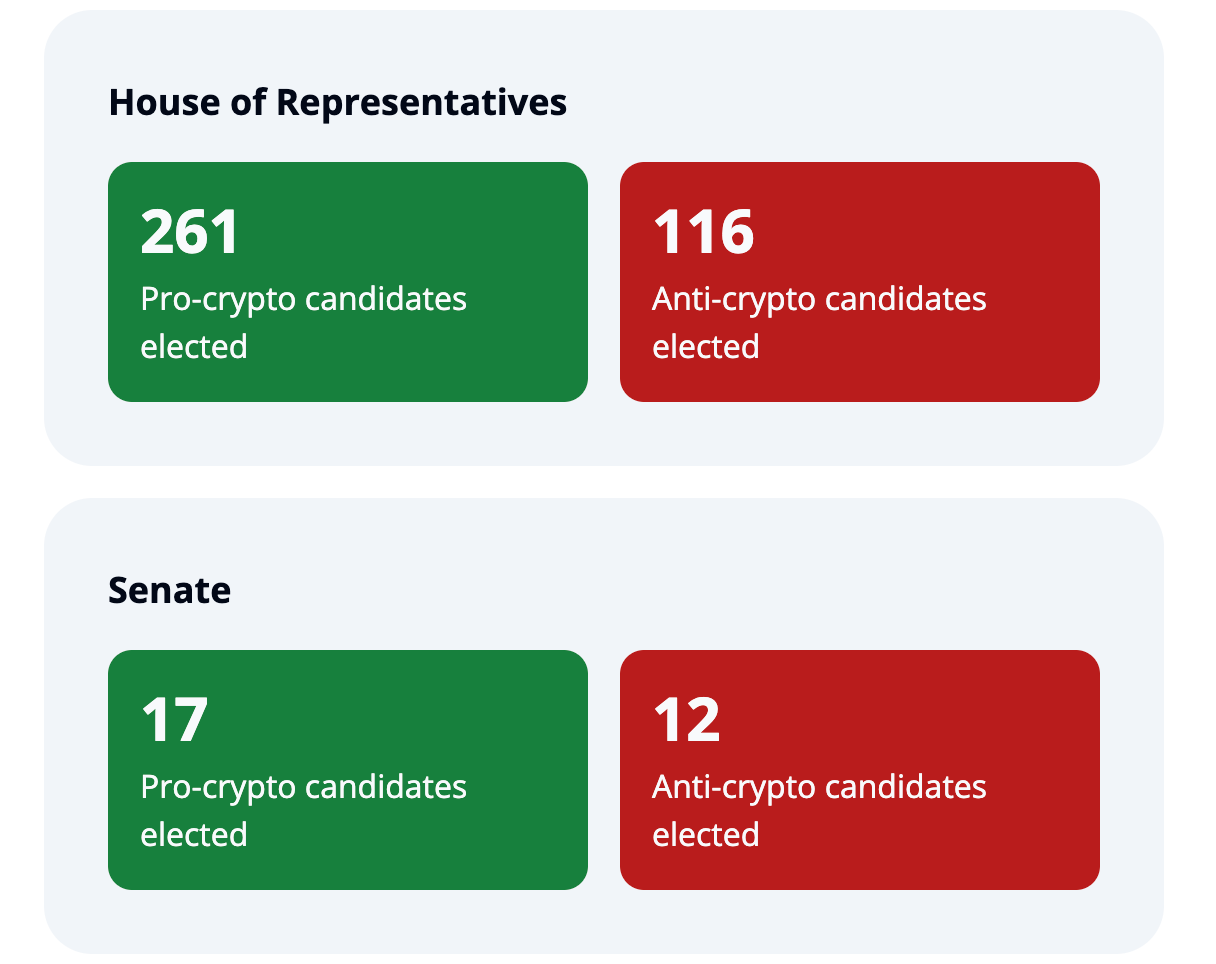

261

That's how many pro-crypto candidates just got elected to Congress. But wait, there's more ...

Breaking it down

House: 250+ pro-crypto winners vs 115 anti-crypto

Senate: 16 pro-crypto senators vs 12 anti-crypto

Geography: Pro-crypto victories in 45 out of 50 states

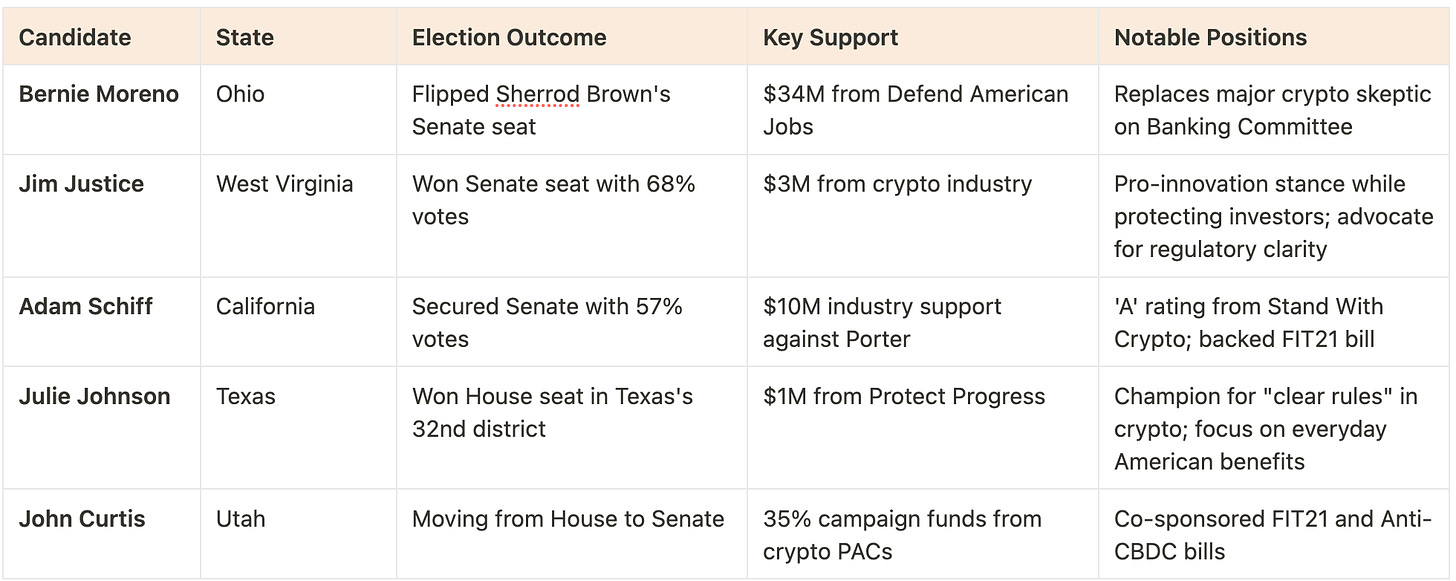

Meet The New Crypto Allies 👥

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

FIT21? The Bill's Dead, Baby 💀

That "good enough" crypto bill everyone was eyeing for the lame duck session?

Yeah, about that...

Turns out, the crypto lobby's got bigger dreams now.

Why settle for compromise when you can write the rules?

"FIT21 was the awful compromise that the industry negotiated when it was about to die," a DC insider spills the tea.

What's changed?

Republicans swept Congress

Trump's heading back to the White House

Pro-crypto voices everywhere

Industry's got leverage

Senator Cynthia Lummis isn't wasting time either. Her first post-victory message?

We're going to build a strategic Bitcoin reserve.

Remember her Bitcoin Act from July? The one about buying 1 million BTC? Suddenly doesn't sound so crazy.

The reality for crypto is not that of a united front, but factions and split support. Even though crypto finds a say in larger scheme of things, crypto’s own battle lines are shifting

CEX vs DeFi

Bitcoin maxis vs Altcoin folks

Stablecoin issuers vs the rest

Sheila Warren, CEO of the Crypto Council for Innovation warns that the crypto industry might become its own worst enemy.

"We weren't aligned even when we were under attack, and now we're not under attack … there's a risk of becoming the dog that caught the car"

Looks like crypto's got the keys to the kingdom.

Question is: Can they agree on where to drive?

The Billionaire Bounce

If the crypto markets were hot, the billionaire charts were on fire. The day became a masterclass in how political outcomes can reshape fortunes in hours.

Leading the pack was Elon Musk, one of Trump's most prominent backers, whose net worth surged by a staggering $21 billion in a single day. Tesla's stock jumped 15% to $288.53, pushing Musk's fortune to $285.6 billion. But he wasn't alone in this wealth explosion:

Jeff Bezos: Up $7 billion to $223.5 billion

Larry Ellison: Added $12 billion, reaching $220.8 billion

Warren Buffett: Gained $7.6 billion, hitting $147.4 billion

Brian Armstrong: Coinbase CEO's worth jumped $2.6 billion to $11 billion

Michael Saylor: MicroStrategy founder added $600 million, reaching $6.6 billion

The surge was particularly pronounced among crypto-aligned billionaires. Coinbase's Armstrong watched his fortune swell as his company's stock soared 31%. Even Robinhood's co-founders, Vlad Tenev and Baiju Bhatt, each added about $300 million to their net worth as their stock jumped 20%.

Token Dispatch View

As the dust settles, the crypto industry finds itself in an unprecedented position. Trump's victory, combined with Republican control of Congress, could usher in what Bitwise's chief investment officer Matt Hougan calls a "golden age" for crypto.

But perhaps the most telling indicator wasn't the price action or the stock rallies – it was the vindication of crypto's own prediction markets.

Polymarket, which had consistently shown Trump in the lead despite mainstream polls suggesting otherwise, proved remarkably accurate.

Of course, campaign promises are one thing; implementation is another. The crypto community is already pressing for action, particularly on the Ulbricht pardon and Gensler's removal.

For an industry born in the aftermath of the 2008 financial crisis, this moment feels particularly poetic. Crypto, once a fringe movement, has become a decisive political force, capable of moving markets and influencing elections.

The question now isn't whether crypto will have a seat at the table – it's how many seats it will occupy.

The Surfer 🏄

SEC Commissioner Mark Uyeda is considered a strong candidate to replace Gary Gensler as SEC Chair, according to crypto lawyer Jake Chervinsky. Uyeda has openly criticised Gensler's regulatory approach, labelling it a “disaster for the whole industry” and advocating for a more collaborative regulatory framework.

France's National Gaming Authority is reportedly preparing to ban prediction market platform Polymarket following its substantial $3.5 billion trading volume during the US presidential election.

World Liberty Financial's WLFI tokens have seen minimal sales following Donald Trump's presidential victory, with less than $1,500 sold in the past 24 hours.

FTX co-founder Gary Wang is seeking to avoid prison time ahead of his sentencing scheduled for November 20, arguing that he was unaware of the extent of the fraud at FTX and has cooperated with authorities.

Tether has announced a significant cross-chain swap of over 2 billion USDT to the Ethereum network, with transfers coming from Tron, Avalanche, NEAR, and EOS. This move, conducted on behalf of a large exchange, will not affect the total supply of USDT.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

With pro-crypto candidates in Congress, crypto could finally get a friendlier regulatory framework.

"The Trump-crypto combo is a market powerhouse! Wall Street’s enthusiasm is speaking volumes.