Goodbye Friend.Tech 👋

Friend.tech shuts down, creators walk off with $44M. Americans lost $5.6B in crypto-related scams in 2023. SEC crypto enforcement hits $4.7B, up 3,000% from 2023. Crypto scammers deepfake Apple CEO.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Remember Friend.Tech, the social network where you could buy access to celebrity feeds with crypto?

Well, it's officially a ghost town.

The developers just threw in the towel. Renounced control of the platform's code.

The creators walked away with around $44 million.

What was Friend.tech? A decentralised social network.

Read: Who is a friend? 🫂

The founders? Roham Gharegozlou, the CEO of Dapper Labs, and Jesse Walden - a prominent figure in the crypto space and co-founder of the investment firm Variant.

Friend.Tech burst onto the scene last year, letting users buy "keys" to unlock the feeds of influencers and other bigwigs.

It was a hit – for a while. Daily earnings even surpassed Ethereum's for a brief moment.

Not the "follow" button.

On Friend.tech, creators control access to their content through "keys."

These are digital tokens you need to buy (or "mint") to join a creator's exclusive group chat.

The price of a key is determined by a "bonding curve," meaning it goes up as more people buy them and down if many sell.

By controlling the key price, creators can directly monetise their content and community.

Users who value exclusive access or the creator's expertise are willing to pay for a key.

Influencers earn a 5% commission from each sale, with an additional 5% going to the platform.

Friend.tech focuses on one-to-many communication.

Creators broadcast messages to all their Key holders, but Key holders can't directly chat with each other – it's about getting insights from the creator, not a public forum.

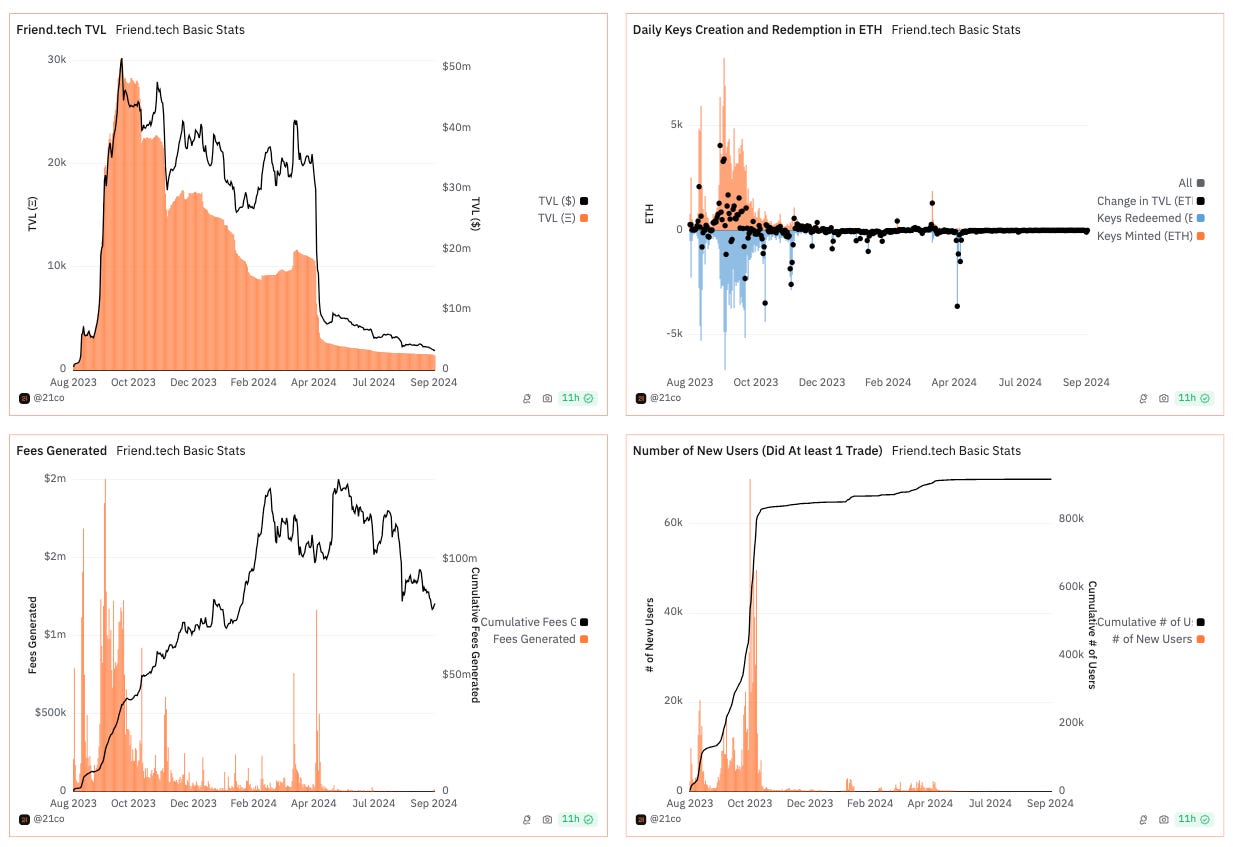

The numbers were good too

Since its launch on August 10, 2023, Friend.tech has gained significant traction, with over 317,000 unique buyers and approximately 11,000 ETH in revenue generated by October 2023.

The app reached $67 million in trading volume within just two weeks of its launch.

Well, only until lately

The platform has experienced a big decrease in user engagement, with deposits plummeting 92% from a peak of $52 million in October 2023 to just $4 million.

Daily new users have dwindled to single digits, and fees generated daily have decreased from $2 million to less than $100.

Following the launch of Version 2 (v2) in May 2024 alongside a token airdrop, the FRIEND token price dropped sharply.

While v2 brought some users back, protocol fees stagnated, earning only around $60,000 since June 2024.

And that’s when they decided to shut down

On September 9, 2024, the creators transferred admin and ownership rights of the protocol's code to a null address.

This prevents any further changes or updates to the protocol.

The social network will continue to function in its current state, but without the ability to implement updates or collect fees.

Yes, the original team has abandoned the project.

But, there is potential for users or other teams to revive it by forking the code, as seen in previous instances with other crypto projects.

Revenue generation?

Since its launch, Friend.tech has generated nearly $90 million in fees. The half of that amount is allocated to the development team.

Friend Tech team earned $52.4M through the protocol.

No good news for investors - The FRIEND token has seen a significant decline, dropping 98% in value since its launch in May.

Following the shutdown announcement, the token fell an additional 21% before showing recovery by 45%.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

In The Numbers 🔢

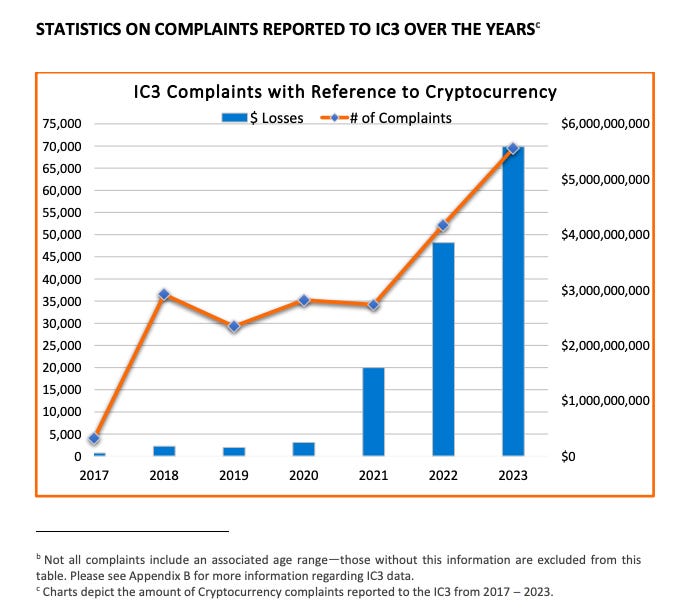

$5.6 billion

That’s how much Americans lost to crypto fraud in 2023 - FBI report.

A 45% increase from 2022.

What do we know?

Crypto-related complaints accounted for 10% of all complaints received by the FBI.

These complaints represented nearly 50% of the total financial losses reported.

Who are the victims?

Individuals over 60 years old, frequent victims - losses of almost $1.6 billion.

~71% of crypto fraud cases were related to investment schemes.

~10% involved call centre fraud and government impersonation scams.

Types of fraud?

Confidence schemes, with victims often lured by promises of high returns.

Play-to-earn scams: Users paid to purchase tokens for online games, only to have their wallets frozen.

Fake recovery services: Businesses claiming to help recover lost crypto funds.

Crypto ATMs and risks?

The FBI recorded 5,500 cases involving crypto kiosks, resulting in losses exceeding $189 million. Scammers prefer ATMs for their anonymity and ease of use in executing fraudulent transactions.

Trade safe 🙂

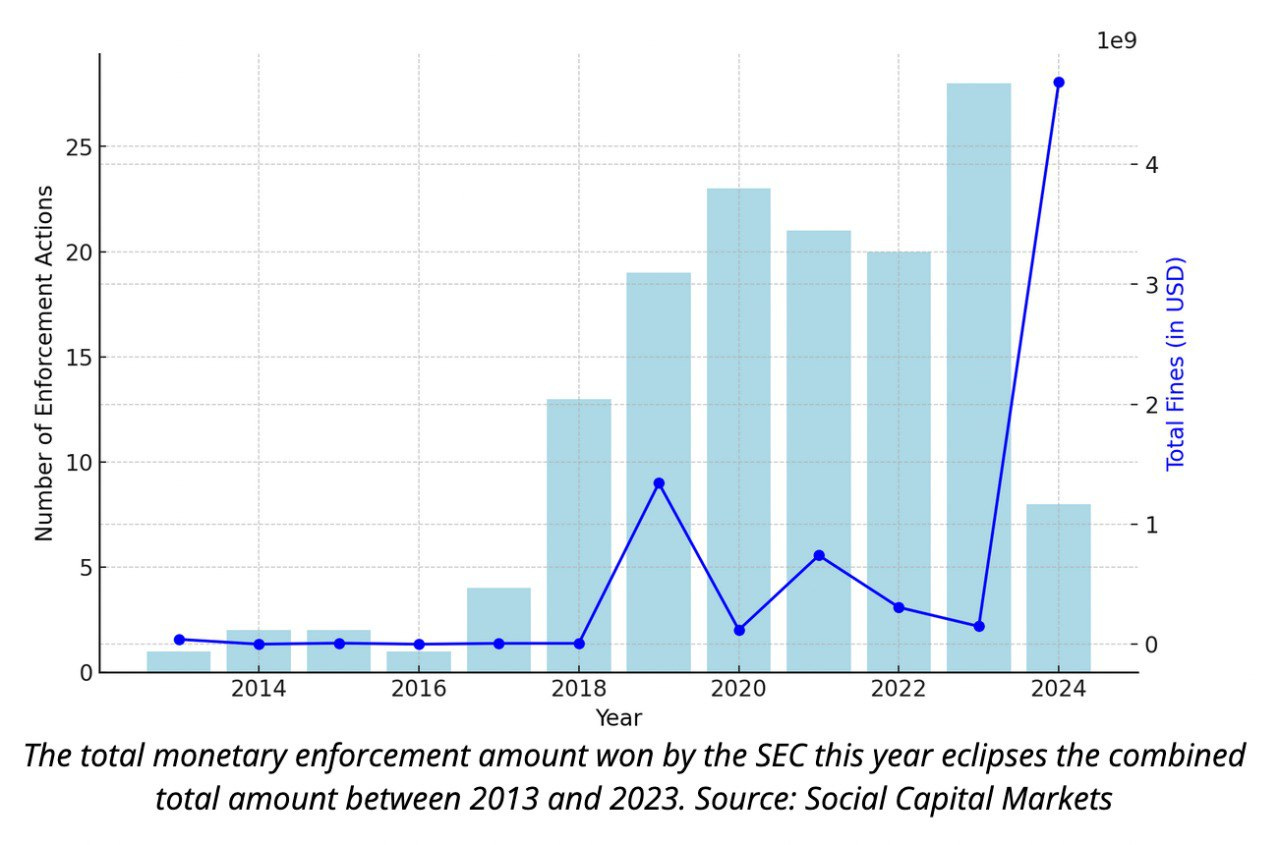

SEC Crypto Enforcement Up 3,000% from 2023

The US Securities and Exchange Commission (SEC) slapped crypto firms and execs with $4.7 billion in enforcement actions in 2024.

That's a 3,000% jump from 2023.

The biggest settlement? $4.47 billion settlement with Terraform Labs and its former CEO, Do Kwon, in June 2024.

The SEC conducted 11 enforcement actions in 2024.

That's a 3,018% increase compared to $150.3 million in fines in 2023, despite taking 19 fewer actions.

The total monetary enforcement amount in 2024 surpasses the combined total from 2013 to 2023.

The SEC appears to be focusing on fewer but larger fines?

The average fine in 2024 has risen above $420 million, majorly influenced by the Terraform Labs case.

The average fine rose nearly 2,000% year-on-year following the Telegram case($1.24 billion) in 2019, which set a precedent for large fines in the crypto space.

Other entities fined over $100 million include GTV Media Group and Ripple Labs, alongside individuals like John and Tina Barksdale.

Block That Quote 🎙️

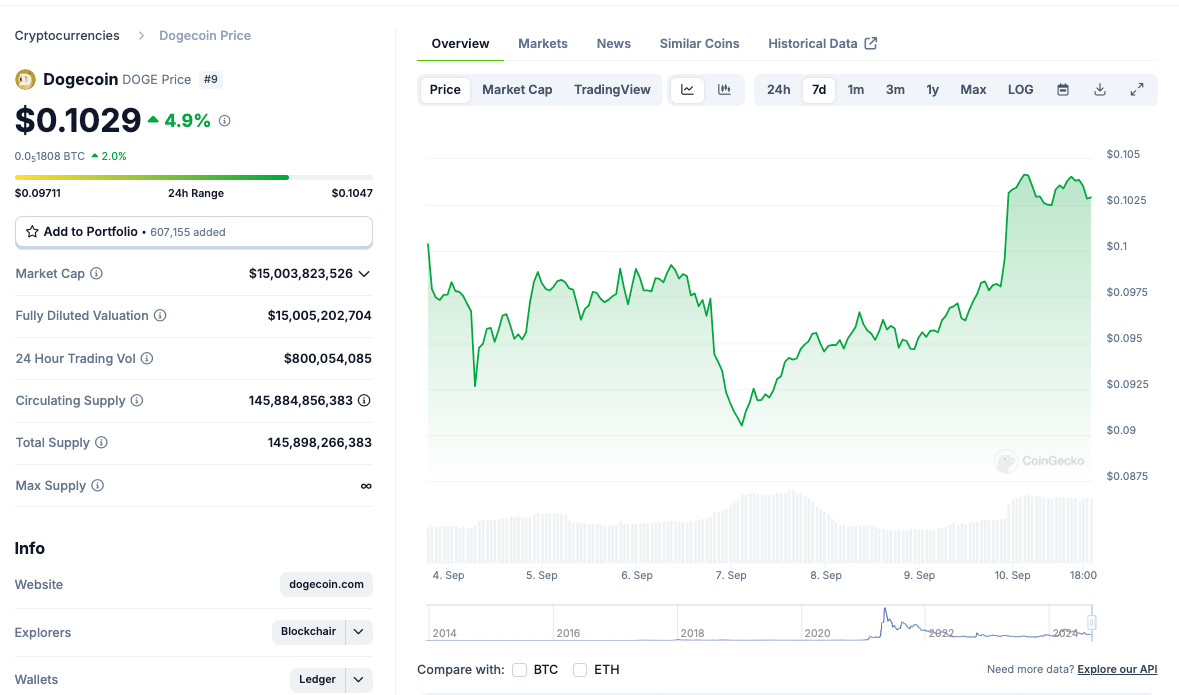

Tesla founder and most followed person on X, Elon Musk

"Department of Government Efficiency." -

Musk posted an AI-generated image of himself seated behind a desktop placard with the letters "D.O.G.E." printed on it.

Following Musk's post, Dogecoin reached a 24-hour high of 5%.

Does this mean Musk has political ambitions?

Former President Donald Trump has.

“Elon, because he is not very busy, has agreed to head that task force. If he has the time, he's a good one to do it and he has agreed to do it.” - Trump said.

Read: Trump's Got A Job for Musk 😲

Musk retweeted a video of Trump's remarks, stating "This is badly needed."

Musk is currently the CEO of Tesla, SpaceX, xAI, and the owner of Neuralink, The Boring Company, and X (formerly Twitter). Busy enough?

Musk has also been involved in various high-profile activities, including conflicts and lawsuits.

Renewed his lawsuit against OpenAI and CEO Sam Altman, claiming he was misled about the organisation's true intentions.

Accepted a challenge to fight Venezuelan President Nicolas Maduro on live TV.

Most recent: UK Parliament may summon Musk to discuss operations of his social media platform, X.

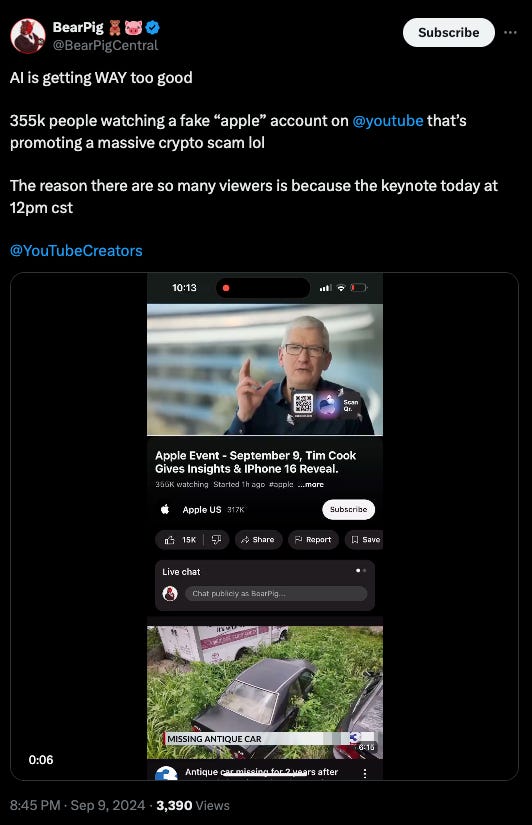

Crypto Scammers Deepfake Apple CEO

Amidst the excitement of Apple's iPhone 16 launch, a wave of deepfake scams hit YouTube.

This features a chillingly realistic artificial intelligence impersonation of Tim Cook.

Lured unsuspecting viewers into sending cryptocurrencies like Bitcoin, Ethereum, Tether, or Dogecoin to a fake address.

The promise? A hefty return on their investment. But of course,

The reality? One-way ticket to crypto scammers’ land.

The deepfake claimed that Apple would double the deposited amount, a common "double-your-money" scam.

Scam context? The fake streams coincided with Apple's official "Glowtime" event, which unveiled new iPhone models.

Some scam channels impersonated legitimate Apple accounts, complete with verification badges, to enhance credibility.

Thankfully, YouTube wasn't fooled for long. They quickly identified and removed the scam videos, shutting down the fraudulent accounts.

The associated accounts are closed now.

Some of these scam streams managed to rack up hundreds of thousands of views. The damage had already been done.

The Surfer 🏄

US and Canadian investors will receive full reimbursement for losses incurred in the GSB Group investment scheme. The GSB Group, linked to Josip Heit, is accused of running a fraudulent multilevel marketing scheme involving crypto and metaverse investments.

FTX has reached a deal to access over $600 million in Robinhood shares through a settlement with Emergent Technologies. FTX will pay Emergent $14 million to cover administrative expenses in exchange for withdrawing claims to 55 million Robinhood shares and cash.

Singapore is investigating unauthorised sales of Worldcoin accounts and tokens amid concerns over data misuse and potential criminal activity. The investigation focuses on individuals involved in third-party sales of Worldcoin, which may relate to money laundering and terrorism financing.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋