Hello, y'all. Happy Saturday.

Last week gave a glimpse of what precisely one can expect under a crypto-friendly Donald Trump 2.0 administration. Binance and the US Securities Exchange Commission (SEC) jointly filed a motion to pause their high-stakes legal battle for 60 days.

Significance? It's potentially the beginning of the end for one of crypto's most famous regulatory battles. The motion specifically cites the SEC's new crypto task force under Commissioner Hester Peirce may "impact and facilitate the potential resolution of this case."

For Binance, securing a favourable outcome in the US would mark an extraordinary comeback, especially considering the exchange already paid $4.3 billion in penalties to the Department of Justice in 2023.

For the crypto giant, the SEC battle may be cooling down, but the global regulatory marathon is far from over.

French authorities have launched a sweeping investigation into the exchange for alleged money laundering and tax fraud. The UK maintains operational restrictions, and Nigeria is demanding an $81 billion penalty.

In this week’s Wormhole, we dive deep into Binance’s legal tussles across the globe and why it matters to the larger crypto ecosystem.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

The Rise of Binance

How did a company founded in 2017 manage to become the undisputed titan of crypto in just eight years?

By early 2025, Binance had amassed an estimated 250 million users and processed a mind-boggling $100 trillion in trading volume. The exchange handles over $21 billion in digital asset trades daily—more than many traditional stock exchanges.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

Binance captured millions of new investors entering the market during the 2017 cryptocurrency boom. While competitors struggled with clunky interfaces, Binance offered a streamlined trading experience that appealed to both novices and veterans.

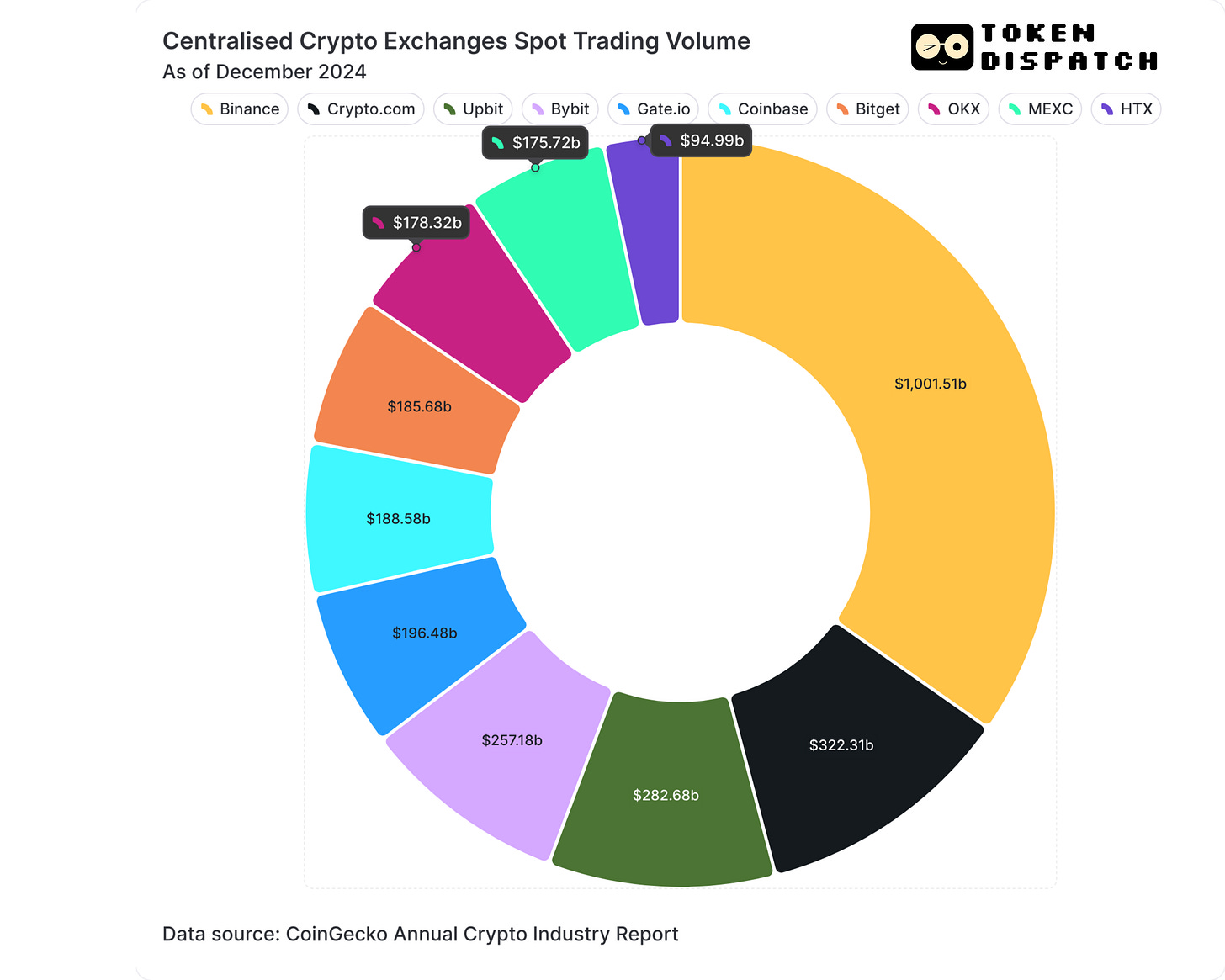

As of December last year, Binance commanded more than 33% market share in each of the months through 2024.

The unique selling preposition? While others were offering an exchange, Binance built an entire ecosystem. The launch of Binance Smart Chain in 2020 transformed the platform into a development hub where teams could build decentralised applications and financial products. This created a virtuous cycle—more developers meant more products, attracting more users, generating more fees.

Their aggressive global expansion strategy was equally crucial. While US exchanges like Coinbase focused primarily on regulated markets, Binance pursued a ‘move fast, ask forgiveness later’ approach, quickly establishing footholds in emerging markets across Asia, Africa, and Latin America.

Low fees became another competitive edge. By consistently undercutting rivals, Binance made itself the default choice for cost-conscious traders. Combined with constant innovation—from futures trading to NFT marketplaces—the platform became a one-stop shop for all things crypto.

The Legal Whack-a-Mole

As Binance conquered the crypto world, it inadvertently created another record: becoming the most legally challenged exchange on the planet.

The list of countries where Binance has faced regulatory scrutiny reads like a United Nations roll call. The company has battled authorities in at least 10 countries between 2021 and 2025, with allegations ranging from operating without proper licenses to facilitating money laundering.

The United States delivered the most punishing blow in 2023, when Binance and founder Changpeng Zhao (CZ) pleaded guilty to violating anti-money laundering laws. The price tag? A staggering $4.3 billion settlement. CZ served four months in prison and stepped down as CEO—a humbling fall for crypto's most recognisable figure.

That was just one front in a multi-continental legal war.

In France, prosecutors recently launched an investigation into alleged money laundering and tax fraud between 2019 and 2024. The UK's Financial Conduct Authority banned Binance from conducting regulated activities back in 2021. Nigeria detained Binance executives over currency manipulation allegations. Australia's securities regulator took legal action against Binance's derivatives arm for misclassifying retail clients as wholesale investors.

The common thread? Regulators repeatedly cited Binance's rapid growth outpacing its compliance infrastructure.

The exchange's decentralised structure—operating without a traditional headquarters—initially helped it evade regulatory oversight. That strategy eventually backfired, fuelling suspicions that Binance was deliberately avoiding accountability.

"As we scaled from six team members to thousands, there were gaps in compliance," current CEO Richard Teng told Cointelegraph, calling these "historical issues" the company is working to resolve.

Why the US Market Matters

For all its global dominance, Binance's willingness to pay a $4.3 billion fine and sacrifice its founder to resolve US legal issues reveals an uncomfortable truth: America remains the kingmaker in crypto.

Firstly, there's an established channel for institutional capital. Wall Street's growing interest in digital assets means billions in potential trading volume, but these established players demand regulatory clarity before committing. A Binance without US regulatory blessing would be locked out of this lucrative opportunity.

Second, the US dollar remains crypto's primary on-ramp and off-ramp. Access to banking relationships and dollar liquidity is vital for any exchange aspiring global leadership. Regulatory troubles in the US threatened these essential financial pipelines.

Third, and perhaps most importantly, US regulatory decisions set precedents worldwide. When the SEC labelled certain tokens as securities in its Binance complaint, the ripple effects were felt globally as other regulators adopted similar positions.

This explains why Binance created a separate entity, Binance.US, specifically to navigate American regulations. It also clarifies why the exchange has been willing to make extraordinary concessions to resolve its US legal troubles.

The approach appears to be working. The joint motion to pause the SEC lawsuit suggests the most existential threat to Binance's operations may be subsiding. Under acting SEC Chair Mark Uyeda's direction, the regulator's stance seems to be softening considerably.

For Binance, securing peace with US regulators while maintaining access to American markets would represent a strategic victory of the highest order—even if it comes at a multi-billion-dollar cost.

Global vs Local Strategy

Resolving conflicts in the US is just one part of the problem. Globally, Binance is battling multiple regulatory battles. It’s doing so with different strategies in each of those markets.

In the European Union, it’s securing regulatory approvals in strategic jurisdictions like France, Italy, and Spain to create operational footholds.

In smaller markets, Binance seems to take a different approach.

When the Netherlands demanded stringent regulatory compliance in 2023, Binance simply exited the market rather than adapt. Similarly, when Japan imposed tough rules, the exchange initially withdrew before strategically re-entering once the market's importance justified the compliance costs.

This selective approach reveals its strategy: comprehensive compliance where the market size justifies the investment, and strategic withdrawal where it doesn't.

Critics argue this tiered approach to compliance reveals the true priorities. When a new market emerges, Binance often enters aggressively before regulatory frameworks are established, capturing market share first and addressing compliance later.

This strategy has powered its expansion but also generated friction with regulators worldwide. Even in countries where Binance has secured approvals, like France, investigations into past practices continue—suggesting that legitimising operations doesn't necessarily erase regulatory concerns about previous conduct.

For smaller nations, Binance's enormous size creates an inherent power imbalance. When Nigeria detained Binance executives, the company faced a delicate balance between protecting its personnel and challenging a sovereign government's actions.

The Path Forward

With new leadership under Richard Teng and an expanded compliance team of 645 full-timers (a 34% increase), the exchange is signalling its intent to transform from crypto's rebellious pioneer to a legitimate financial institution.

"User funds, security and safety remain sacrosanct," said CEO Teng, distancing the company from its compliance-light past.

The potential thawing of relations with the SEC may mark the beginning of the end of its legal troubles in the US. This favourable resolution in the US, could validate its costly pivot toward regulatory compliance and potentially create a template for resolving challenges in other jurisdictions.

Questions remain about whether a more compliant Binance can maintain its competitive edge.

Rivals like OKX and Bybit continue to operate with fewer regulatory constraints in certain markets, allowing them to list tokens more aggressively and offer products that Binance has had to restrict. The company must now innovate within regulatory boundaries rather than around them.

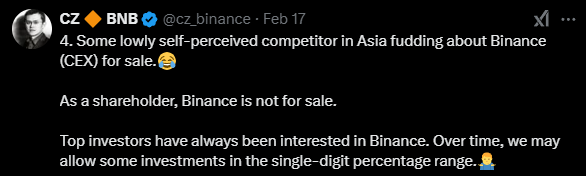

Meanwhile, persistent rumours about potential sales or acquisitions swirl around the company. In February, co-founders CZ and Yi He publicly denied rumours that Binance was for sale, with Yi He even suggesting the exchange was open to buying competitors.

The expansion of the exchange's institutional offerings suggests Binance is preparing for a future where regulated, institutional-grade services drive growth rather than retail speculation. Enhanced KYC procedures, sanctions screening, and cooperation with law enforcement have become central to its operations—a far cry from the company's early days.

Token Dispatch View 🔎

Don’t mistake Binance's pivot toward regulatory compliance as some noble transformation. It's cold, calculated business strategy.

The exchange has simply recognised that continued growth requires regulatory acceptance, particularly in markets where institutional money flows.

The math is straightforward: the $4.3 billion fine and leadership change in the US is a painful but necessary investment to access the world's deepest capital markets. Binance knows that institutional adoption — the next frontier of crypto growth — will never materialise without regulatory clarity. Wall Street firms won't risk their reputations and assets on platforms operating in regulatory gray zones.

Allowing users to circumvent restrictions via VPNs might preserve short-term trading volume, but it fundamentally prevents them from enabling mass adoption of crypto. Banking partnerships, payment integrations, and institutional custody solutions—all essential for bringing the next billion users to crypto—require ironclad regulatory compliance. No major financial institution will partner with an exchange known for regulatory workarounds.

Beyond business considerations, Binance's legal challenges have revealed the limits of the "move fast, break things" approach in financial services. The regulatory heat has diverted resources, attention, and talent from product innovation to legal defense. Each new investigation creates uncertainty that competitors can exploit.

Teng's expanded compliance team is an acknowledgment that sustainable growth requires playing by established rules.

For all its revolutionary rhetoric, Binance has recognised a fundamental truth: to change the financial system, you eventually need to work within it.

The test for Binance will be to maintain its competitive edge while operating within regulatory boundaries. The exchange built its empire by moving faster than regulators could react. Now it must learn to innovate within constraints that competitors like Coinbase have navigated from day one.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.