TGIF Dispatchers.

A 28-year-old from Plano, Texas sits at the centre of arguably crypto's most elaborate scandal since FTX.

With tousled blonde hair and boyish appearance, Hayden Davis more closely resembles the college soccer player he once was than the architect of a system that has moved billions of dollars and implicated presidents.

Appearances can be deceiving.

As the self-described "launch strategist" behind presidential memecoins like $LIBRA and $MELANIA, Davis has engineered tokens that briefly reached multi-billion dollar valuations before spectacularly collapsing — leaving retail investors devastated while insiders walked away with fortunes.

His recent confessions about these operations have triggered international diplomatic incidents, potential impeachment proceedings, and investigations by law enforcement agencies across multiple countries.

Read: 'I Have $100 Million And Nowhere To Run'👱🏻♂️

Who exactly is Hayden Davis, and how did a business graduate from Liberty University become the lynchpin in a global web of crypto manipulation?

Personal Security Layer for Crypto Transactions

The Making of a Crypto Operator

Despite his sudden notoriety, Davis remains something of an enigma.

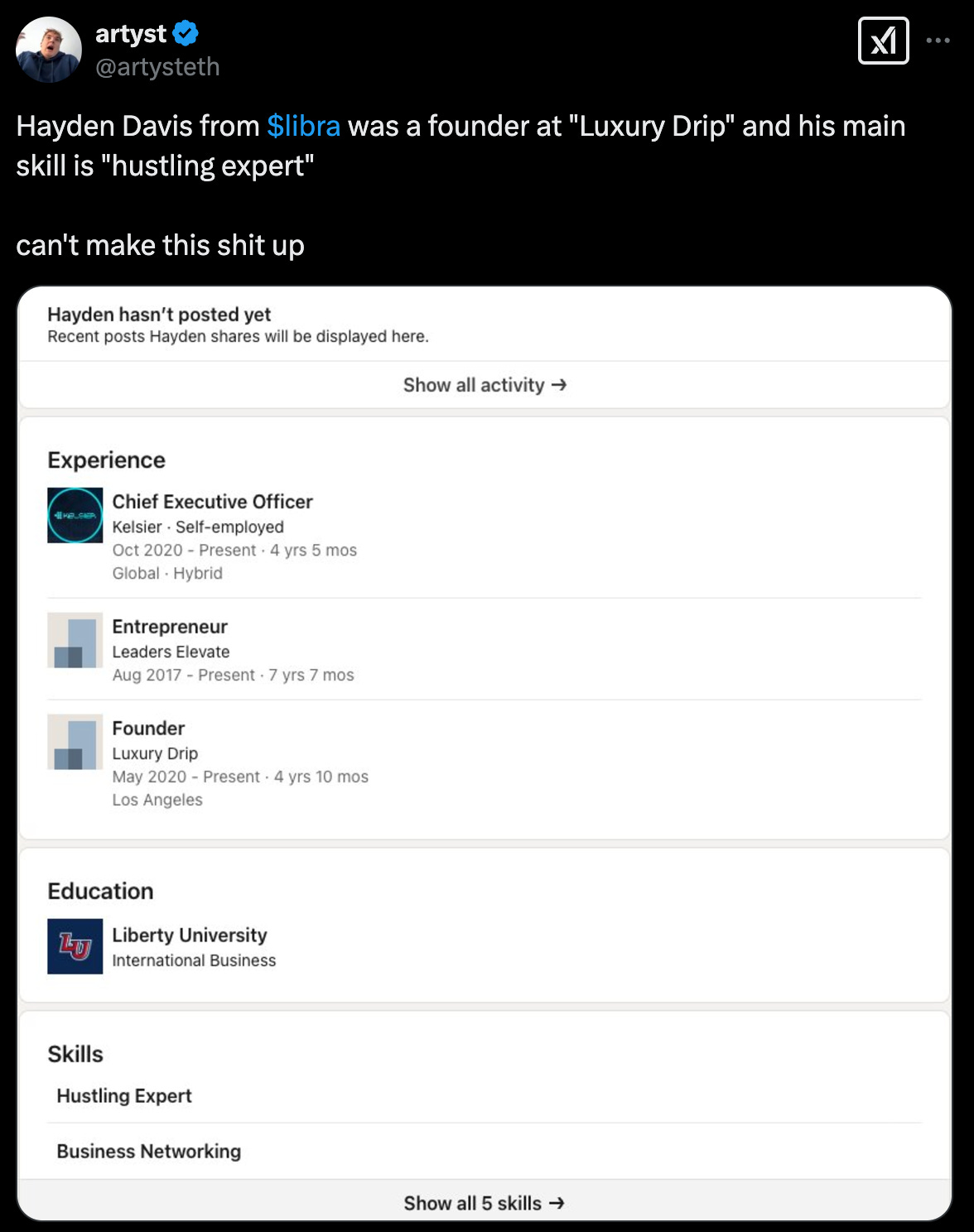

His LinkedIn profile (now set to private) portrayed him as a serial entrepreneur who began his journey in August 2017, running a company called Leaders Elevate focused on leadership coaching.

By May 2020, he had founded Luxury Drip — a company that cannot be traced to an industry.

Five months later, in October 2020, he assumed the role of CEO at Kelsier Ventures, the firm that would eventually become notorious for its involvement in presidential memecoins.

What's striking about Davis's career trajectory is how little public footprint he left before erupting into headlines.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

Davis's education at Liberty University, the Virginia school founded by right-wing evangelical pastor Jerry Falwell, offers few clues about his eventual path. He studied business and played soccer there, giving no indication of the crypto mastermind he would become.

The Family Business

To understand Hayden Davis, one must understand Kelsier Ventures — and to understand Kelsier, one must meet the Davis family.

Far from a traditional venture capital firm, Kelsier operates as a Davis family enterprise. Hayden serves as CEO, his father Tom as chairman, and his brother Gideon as COO.

Tom Davis' backstory reads like a redemption narrative. According to his own accounts, he had a troubled childhood, at 18, he experienced suicidal ideation before eventually running afoul of the law for identity fraud.

When caught by the FBI, Tom claims he chose complete honesty, confessing even to crimes they hadn't uncovered. After serving a year in federal prison, he reinvented himself as a youth pastor and humanitarian, eventually becoming CEO of Children's HopeChest, a charity focused on helping orphans.

Later, Tom pivoted to the restaurant industry, operating a chain of 34 establishments along the East Coast. It was during a business expansion trip to Dubai that Tom discovered the city's ambition to become a "crypto valley," which ignited his interest in blockchain technology.

"What excites me even more is that this venture is not just mine; it's a family business," Tom revealed in a podcast episode of "Young Dumb & Woke," where he was interviewed by his sons Hayden and Gideon.

The younger brother, Gideon, also has a crypto past. In 2022, while still a college junior, he was involved with a metaverse project called NeoNexus, built on the Solana blockchain. The project raised millions through NFT sales before suddenly "running out of funds" in March 2022 and ceasing operations — what many in the community labelled a "soft rug."

This family dynamic — with a father who transitioned from felon to pastor to restaurateur to crypto entrepreneur, and a brother already associated with a failed blockchain project — provides crucial context for understanding Hayden's approach to the industry.

The Rise of Kelsier Ventures

On paper, Kelsier Ventures presents as a legitimate, Delaware-registered Web3 firm founded in 2021 that invests in blockchain innovations.

Their portfolio supports this narrative. They've backed DeFiTuna, Scallop Group, UpRock, Saturn, and E Money Network with millions in funding, creating an air of credibility.

Insiders have a darker version of the story. One source told PANews bluntly: "This Kelsier market maker is a notorious meme rugger from Dubai."

BoDoggos Entertainment CEO Nick O'Neil exposed Kelsier's actual operation through a service quote he received:

Wash, deploy, snipe

Market make

Dump tokens (20%)

Wash & extract

The fee? 2% of tokens, 0.1% maximum daily sales, plus $3,000 daily or 20% of withdrawals — whichever was higher.

This business model would eventually scale to presidential proportions, culminating in the $LIBRA token that brought Davis's operation into the global spotlight.

Presidential Memecoin Machine

The pattern emerged in January 2025 with Trump's inauguration token. According to Davis, early investors gained access at a private Washington DC dinner, buying in at a $500 million valuation before the contract address was public.

Soon after came MELANIA, which briefly hit a $2 billion market cap before crashing 75% within 24 hours. Davis admitted to being directly involved.

The crowning achievement, though — and the eventual downfall — came in $LIBRA. When Argentina President Javier Milei tweeted his endorsement, the token soared to $4.24 billion in just 30 minutes. When he deleted his post hours later, denying any association, the market cap collapsed to $300 million.

The formula was consistent: secure high-profile political endorsement, watch retail investors flood in based on perceived legitimacy, then extract value before the inevitable crash.

"Every single one of these launches gets sniped. A handful of elite traders extract liquidity before the public even has a chance," Davis explained.

A Sophisticated Network

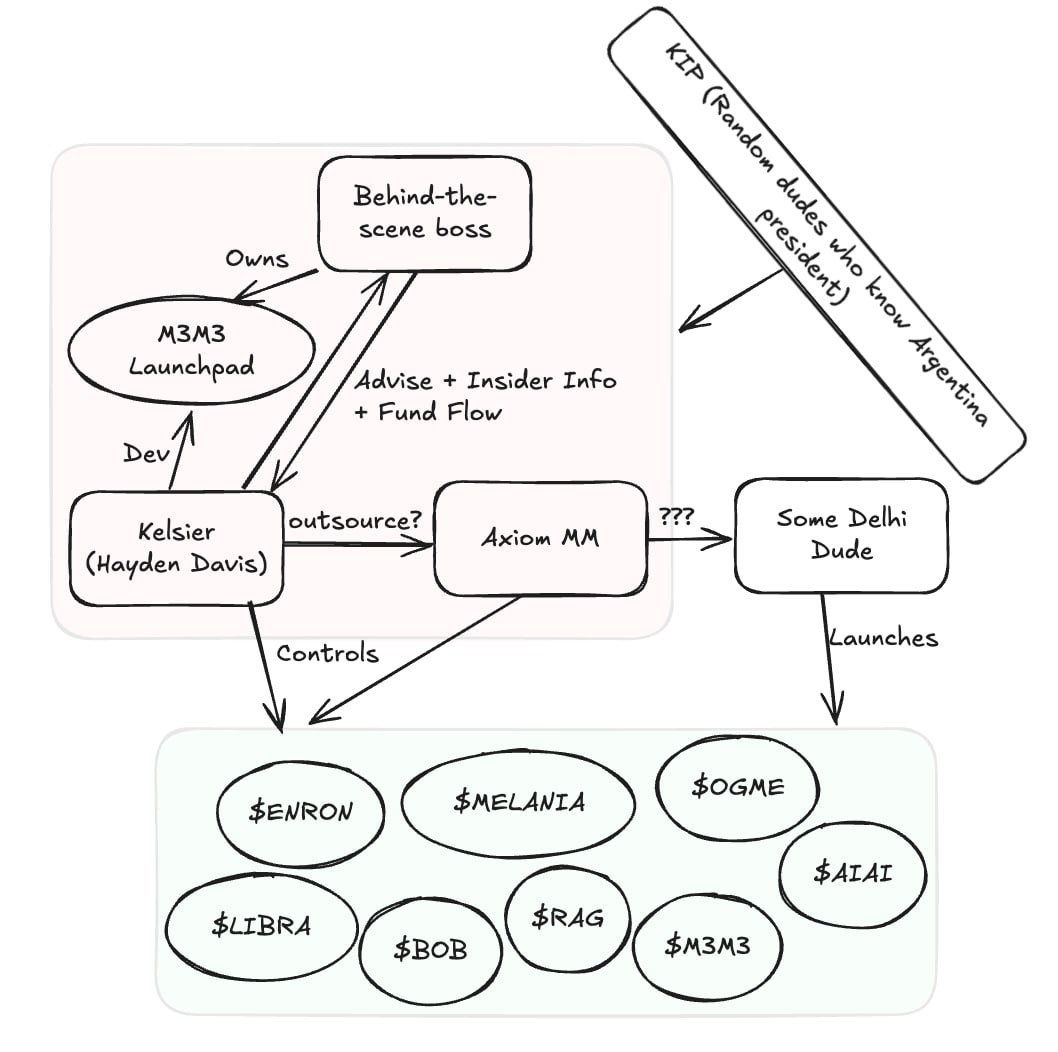

Kelsier's operation relied on an extensive web of partnerships and front organisations.

M3M3 Launchpad: Supposedly independent, but reportedly controlled by Meteora co-founder Ben, who’s now resigned, and used by Kelsier for price manipulation. Launched tokens like AIAI, MATES, and ENRON.

Axiom MM: A Solana ecosystem market maker allegedly used for insider trading. On-chain data shows "abnormal trades" surrounding LIBRA's launch.

Cube Exchange: Reportedly a Kelsier client, with Davis providing consulting and marketing services.

KIP Network: Listed as LIBRA's project manager in Argentina, though CEO Julian Peh later claimed they were only "invited post-launch."

This network allowed Kelsier to maintain plausible deniability while controlling every aspect from deployment to extraction.

The Political Web

The most explosive element was Davis's alleged political reach.

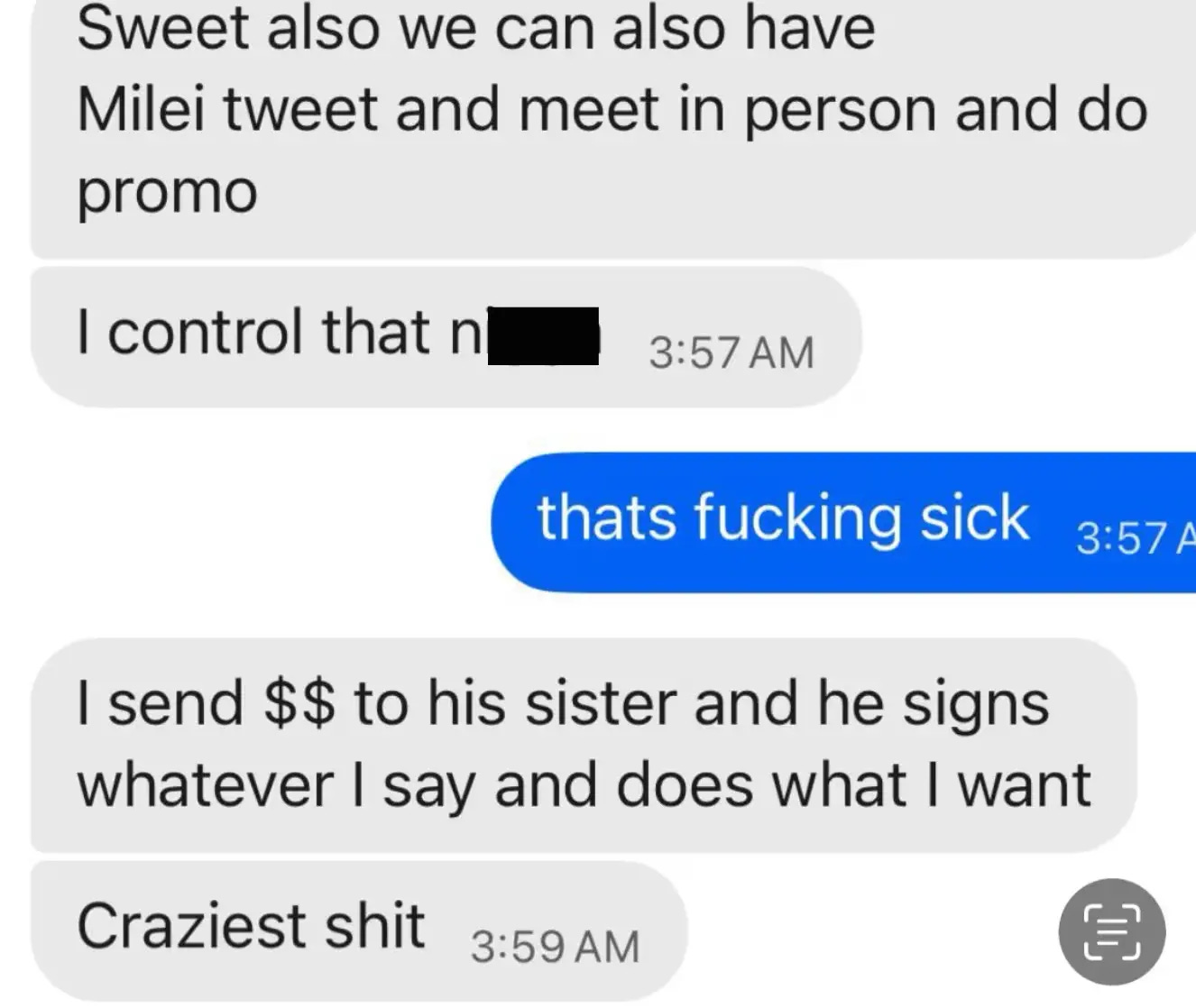

In December 2024, Davis reportedly texted that he could "control" President Milei by sending money to Milei's sister Karina, the Secretary General of the Argentine Presidential Office. When this claim surfaced, Davis's spokesperson dismissed it as "politically motivated," claiming Davis had no recollection of such a message.

Davis later told Coindesk: "Reports claiming I paid President Milei or his sister to launch Libra are completely false. Their only concern was ensuring proceeds would benefit Argentina."

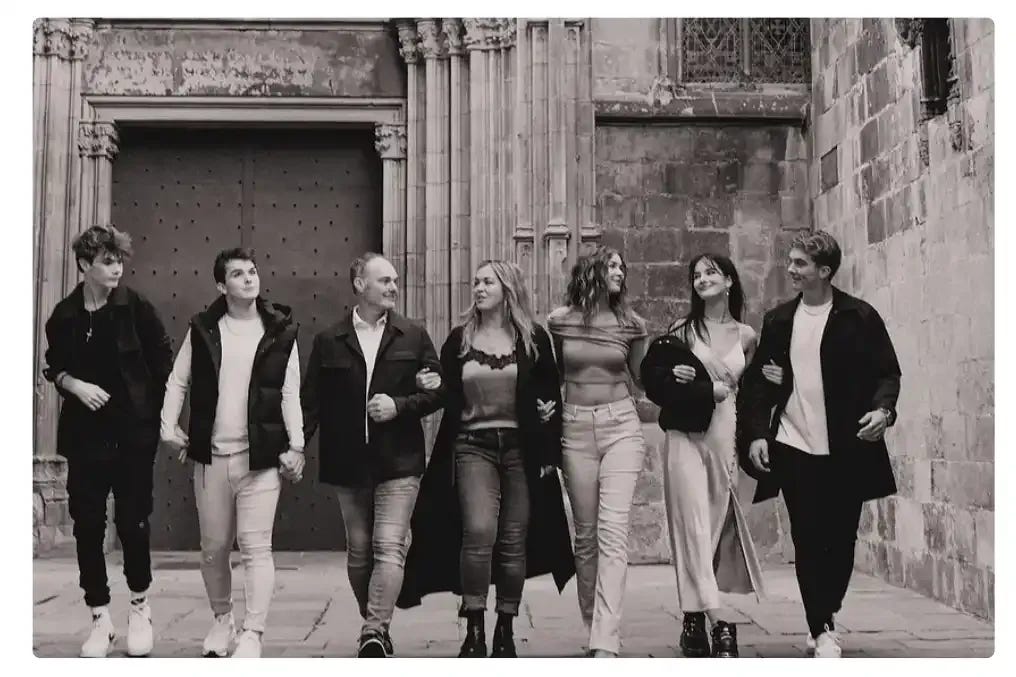

Yet photographs of Davis with Milei have surfaced, raising questions about how an unknown crypto entrepreneur gained access to a world leader.

The scandal has triggered impeachment calls against Milei, multiple legal complaints, and investigations spanning countries. According to The Big Whale, Kelsier is already negotiating with Nigerian officials to replicate their model there.

Davis maintains LIBRA wasn't a "rug pull" but a "failed plan." He claims the strategy was to remove liquidity temporarily to deter predatory traders, then reinvest once Milei released additional promotional content.

The Legal Storm

The implications of Davis's activities extend far beyond his personal liability.

In Argentina, the scandal has triggered multiple legal actions:

Attorneys Marcos Zelaya and Jonatan Baldiviezo have filed complaints accusing Milei of fraudulent behaviour in collaboration with Davis.

Lawyer Agustín Rombolá has initiated a separate complaint against Davis and his associates for financial misconduct and fraud, with plans to launch a class-action lawsuit to help investors recover their losses.

An Argentine law firm has filed a criminal lawsuit with the US Department of Justice and FBI, calling for an investigation into the masterminds behind the LIBRA token collapse and Milei's role.

The opposition Civic Coalition ARI has filed their own criminal lawsuit, demanding the DOJ investigate bribery and fraud allegations promoted by President Milei.

Several projects associated with Kelsier have already moved to distance themselves. DeFiTuna publicly announced they had refunded Kelsier's $30,000 investment and severed all ties. BOOGLE, a ghost-themed NFT project built on Solana, acknowledged that three Kelsier-related members were once NFT holders but claimed they had been removed.

Davis himself has reportedly hired a local attorney who specialises in white-collar defense, according to Argentine newspaper La Nacion.

What's Next for Davis?

As investigations continue and legal actions mount, Davis faces an uncertain future.

Despite his claims of good intentions, the evidence against him is substantial. His own admissions in public interviews provide prosecutors with a roadmap of potential charges, from securities fraud to market manipulation to potential violations of anti-corruption laws.

The crypto community's reaction has been mixed. Some see Davis as a whistleblower exposing the inherent corruption in the memecoin sector, while others see him as simply trying to save himself by shifting blame to political figures and other industry players.

Davis himself appears to be positioning his work in the crypto space as "an experiment" rather than a straightforward business endeavour. "I've made some money. I'm 28, I have objectives that are way past 28. I don't need to make shitloads of money at this very moment," he told interviewers.

"This was an experiment. There were much bigger things happening in the background. Tokenising a country."

Token Dispatch View 🔍

The Hayden Davis case fascinates not just for its audacity but for what it reveals about our crypto reality. How does a 28-year-old with modest qualifications orchestrate a multi-billion dollar, multi-presidential token operation spanning continents? Only in crypto could someone leap from college soccer player to controlling $100 million in illicit funds while having world leaders on speed dial.

The web Davis constructed defies conventional explanation. Building relationships with presidents across countries, establishing legitimacy through strategic investments, and creating an ecosystem of launchpads and market makers requires resources far beyond what appears in his background. This suggests either powerful hidden backers or a system so fundamentally broken that even amateurs can game it at scale.

Equally perplexing is his decision to confess everything publicly. Was this a calculated move to position himself as a whistleblower rather than perpetrator? A form of leverage against more powerful players? Or simply the hubris of someone who believes himself untouchable? His claim of seeking "guidance" on the $100 million rings particularly hollow when he controlled the machinery to disappear it completely.

Most concerning is the precedent this sets. The presidential memecoin playbook now exists in the wild, documented step-by-step through Davis's confessions. Even as he faces legal consequences, copycat operations are likely already forming, targeting different political figures in different regions.

The legacy of Hayden Davis won't be the money he extracted or even the presidents he compromised. It will be the blueprint he created for others to follow—a dark innovation in the monetisation of political influence that will echo through markets long after his name fades from headlines.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.