Here Comes SOL ☀️

VanEck files for Solana ETF, says SOL is a commodity. Coinbase is suing SEC and FDIC. US Judges rein in SEC powers. All the ETH ETF launch buzz. Crypto losses to deep fakes could reach $25B in 2024.

Hello, y'all. Happy weekend then 👊

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Bitcoin ETFs launched.

Ethereum ETFs approved.

Solana ETFs? FILED.

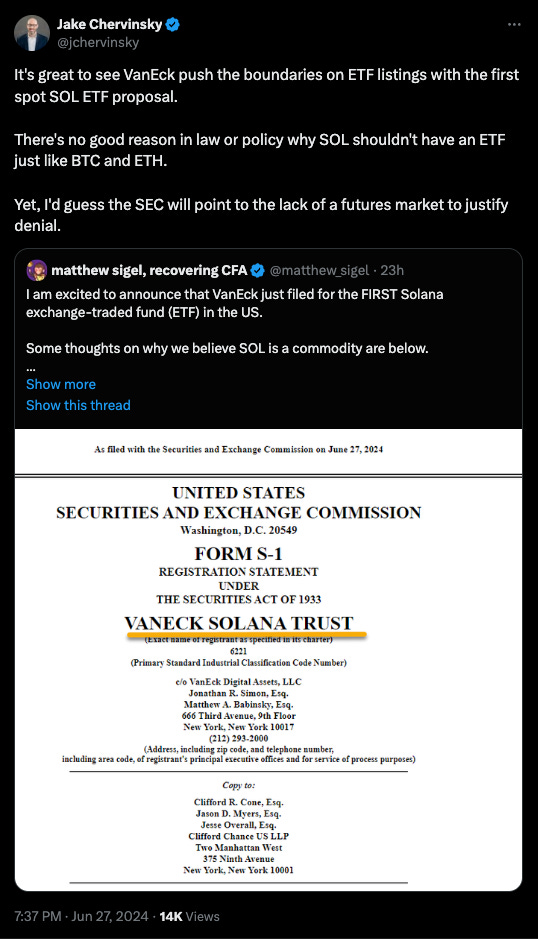

VanEck filed an application for the first-ever Solana (SOL) spot ETF.

They already have a spot Bitcoin ETF (HODL) approved by the SEC.

Awaiting approval for a spot Ethereum ETF.

Now they want a SOL ETF.

What do we know?

VanEck Solana Trust ETF will track the price of SOL and trade on the Cboe BZX exchange.

VanEck claims SOL functions similar to Bitcoin and Ethereum, established as commodities.

VanEck Solana Trust will hold the underlying SOL tokens for investors.

This filing comes amidst anticipation for the SEC's green light on several spot Ethereum ETFs.

A Challenge to the status quo

Commodity or Security? The application argues SOL is a commodity, unlike the SEC's stance on cryptocurrencies.

SEC previously insisted on a regulated futures market for the underlying asset before approving spot crypto ETFs.

SOL currently lacks such a market in the US.

If successful, SOL would join Bitcoin and Ether (pending approval) as the only crypto assets with spot ETFs.

Matthew Sigel, VanEck’s head of digital assets research explains in his tweet.

“SOL’s decentralised nature, high utility, and economic feasibility align with the characteristics of other established digital commodities, reinforcing our belief that SOL may be a valuable commodity with use cases for investors, builders, and entrepreneurs looking for alternatives to the duopoly app stores.”

First mover advantage: VanEck is the first US firm to file for a Solana ETF, mirroring 3iQ's recent filing for a Solana ETP (Exchange Traded Product) in Canada.

A sign of change?

VanEck is betting on a more crypto-friendly regulatory environment.

Why? With the upcoming elections, both Biden and Trump appear to soften their stances towards crypto.

The SEC's recent about-face on Ethereum ETF applications adds fuel to this speculation.

Trump has voiced his support openly.

Read: 'Give Me Liberty, or Give Me Death!' 🤌

There’s a slight change in attitude from Democrats as well.

The Biden campaign's team is considering the acceptance of crypto donations.

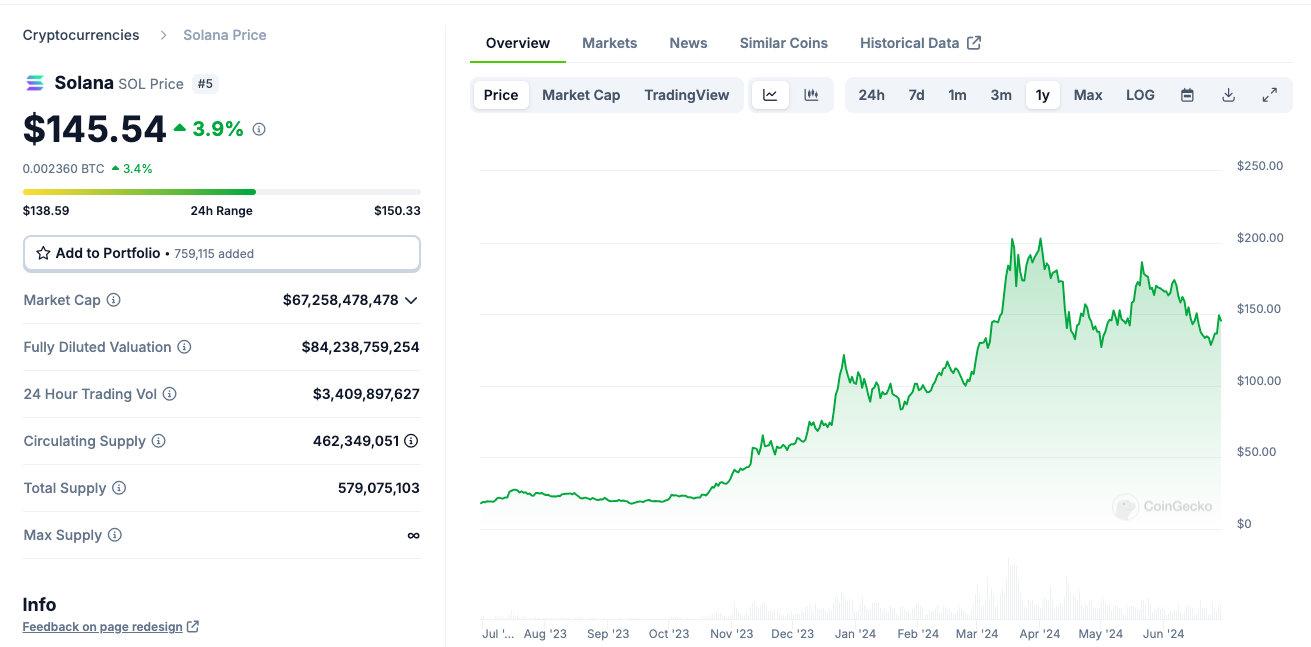

SOL market reacts positively

Solana (SOL) saw a healthy jump of over 6% after VanEck filed the paperwork.

Big winner: 8% up in 7 days and 787% up in a year.

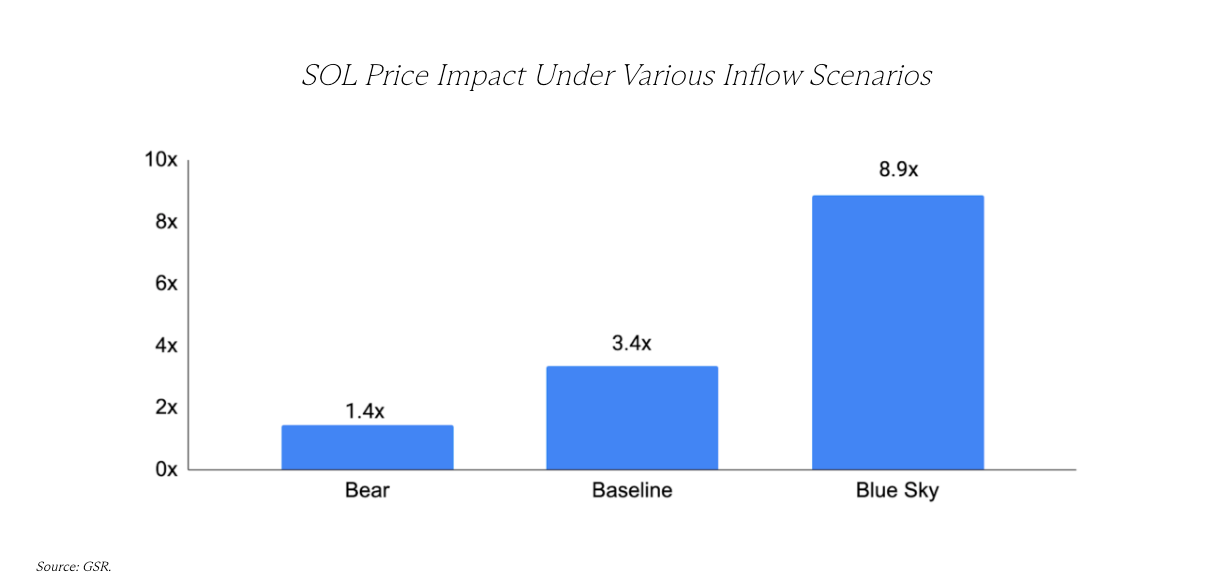

Market Maker GSR takes long position on SOL: Predicts a 9x increase in price if a spot Solana ETF is approved.

Three potential price increase scenarios.

Conservative Estimate: 1.4x surge

Base Case: 3.4x surge

Optimistic Scenario: 8.9x surge

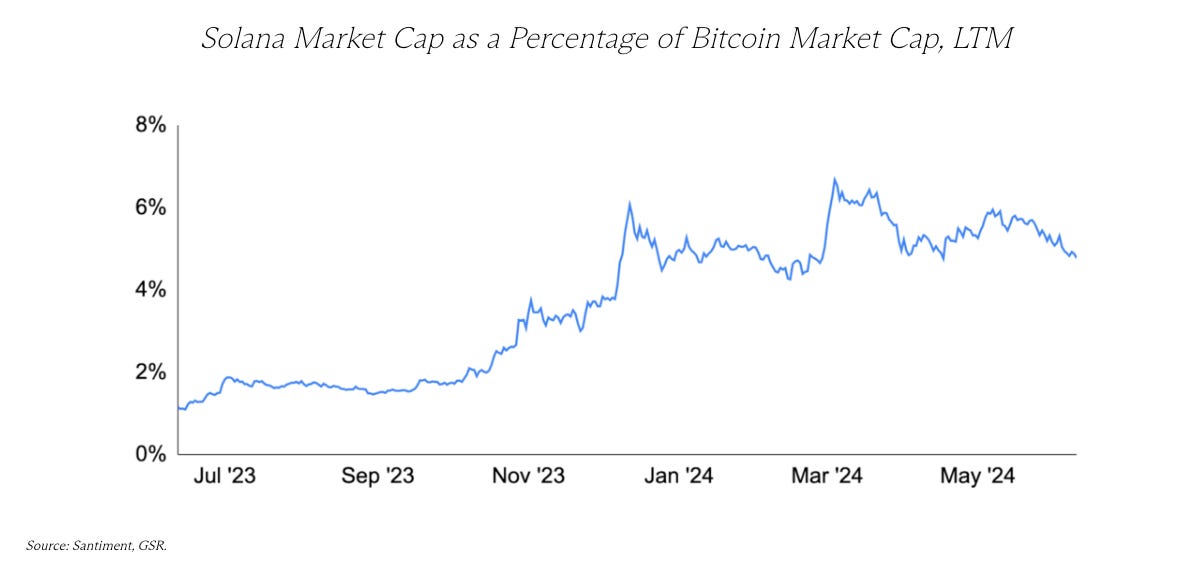

GSR believes Solana's smaller market cap compared to Bitcoin could lead to a more explosive price increase.

What’s the buzz?

Anthony Pompliano is bullish: “VanEck filing for a Solana ETF is further proof that altcoins are coming to Wall Street.”

A shift in leadership could work out

“Early thoughts are that this only has a shot to launch sometime in 2025 if we have a new admin in the White House and SEC. Even then not guaranteed.” - James Seyffart

“If change at POTUS i think anything poss. Just imagine Hester Peirce (or someone like that) running the SEC..” - Eric Balchunas

Regulatory hurdles, not ignored: Solana lacks a well-developed futures market.

Haseeb Qureshi, Dragonfly Capital: “There's no way this gets done; I suspect it's buying goodwill and laying the groundwork to get the ball rolling. SEC has explicitly stated they believe SOL is a security. This administration will not walk this back.”

Adam Cochran isn't so convinced.

What else for Solana?

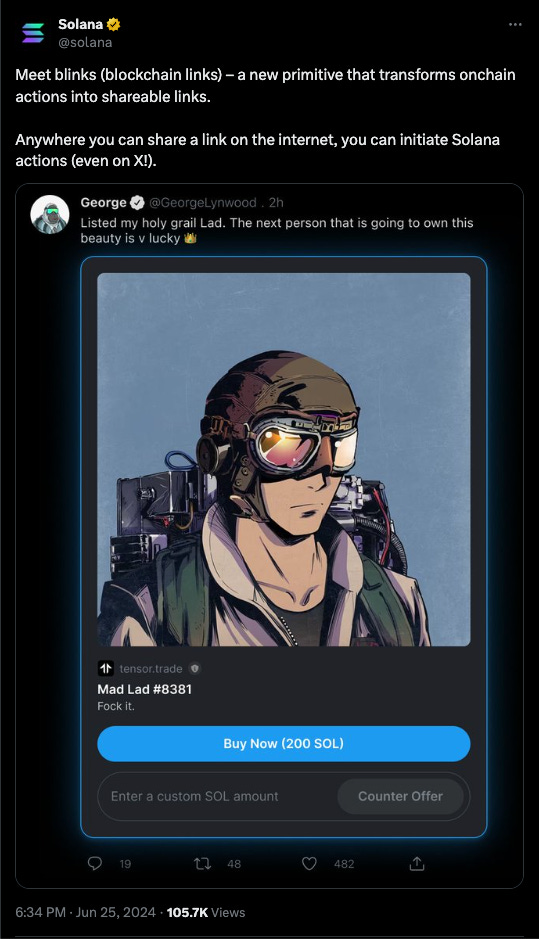

1/Solana Blinks

The Solana Foundation just unveiled new tools called "Actions" and "blinks" to make crypto transactions as easy as clicking a link.

With Actions, users can now initiate crypto transactions on websites, social media platforms, and even by scanning QR codes.

Blinks take things a step further. They transform any Action into a shareable link.

Imagine this: You see a post on X about a hot new meme coin.

With Solana's features, you can click a button embedded in the post and instantly initiate a transaction to buy the coin using your existing Solana wallet.

No need to navigate confusing exchanges.

2/ZEX Token

Solana-based derivatives exchange Zeta Markets launched its ZEX token.

An airdrop of 100 million ZEX tokens (10% of total supply) is distributed.

Aims to reward early users and encourage long-term participation.

ZEX powers governance, staking, and incentives on the platform.

3/World ID support

Worldcoin's World ID, a blockchain-based identity verification system, is expanding to the Solana ecosystem.

Wormhole Labs received a $70,000 grant from the Worldcoin Foundation to facilitate this integration.

Block That Quote 🎙️

Crypto Exchange, Coinbase.

"The SEC’s stonewalling violates its Freedom of Information Act (FOIA) obligations."

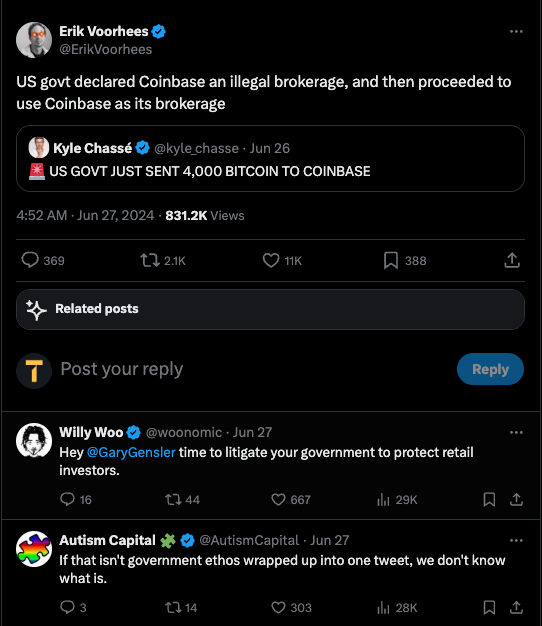

Coinbase sues SEC, FDIC over crypto crackdown

Coinbase filed FOIA requests with the SEC and FDIC seeking information on crypto regulations and enforcement actions.

Both agencies denied the requests.

Coinbase sued them in D.C. District Court on June 27th.

Coinbase's Accusations against SEC and FDIC.

Delaying decisions on crypto regulations.

Issuing "pause letters" pressuring banks to halt crypto-related activities (Coinbase calls it "Operation Choke Point 2.0").

Withholding information on past investigations (e.g., Ethereum 2.0).

They argue the requested info is crucial for understanding the SEC's and FDIC's stance on crypto, allowing the industry to adapt.

"The SEC’s rationale for withholding documents from investigations that concluded in settlements years ago is tailor-made to frustrate the legitimate purposes for which Coinbase sought the Coburn and Enigma MPC documents in the first place — to understand the view of the law that underlies the SEC’s enforcement blitzkrieg against the digital-asset industry."

This isn't Coinbase's first fight with regulators.

They previously sued the SEC for failing to provide clear crypto regulations and challenged the agency's security token lawsuit against them.

But, here’s another blow.

“When the SEC adjudicates the matter in-house, there are no juries.” - Supreme Court of the United States.

What does this mean for the SEC?

Previously, the SEC could use an internal process with its own judges to pursue charges and impose financial penalties.

This came in handy for certain cases, but now the SEC will have to rely solely on federal courts for enforcement actions.

Less power for the SEC: Legal experts see this as a significant restriction on the SEC's ability to enforce regulations and weakens its position in future cases.

Fairness for Defendants: The ruling prioritises defendant rights by ensuring they have a jury trial, potentially leading to a more balanced legal system.

What does this mean for crypto?

The SEC has used internal proceedings for some crypto-related cases, including actions against ICO Superstore and a virtual stock exchange creator.

This decision could force the SEC to take a different approach to future crypto enforcement actions.

Where is Ethereum ETF?

The SEC is expected to approve spot Ethereum ETFs by July 4, following discussions with asset managers like BlackRock and Grayscale Investments.

Potential Inflows: Galaxy Digital predicts up to $7.5 billion, in the first five months. Predicts 20% to 50% of the inflows as Bitcoin ETFs due to structural differences between the two crypto.

Bitwise predicts $15 billion.

The bullish bets

Quinn Thompson (Lekker Capital): Ether hitting $7,000 and Bitcoin attempting a $100,000 run by November's election.

Joe Lubin (Consensys): Brace for a "floodgate" of demand, leading to a supply squeeze and pushing prices higher.

Bernstein Analysts: Predict a 75% increase to $6,600.

ETFs take off in Asia-Pacific: Australia launched two Bitcoin ETFs in June, following hot on the heels of Hong Kong's six similar offerings in April.

Marks the beginning of a vibrant crypto ETF market in the Asia-Pacific region.

More than just BTC and ETH: Investment giant State Street and crypto leader Galaxy Digital are teaming up to launch a new ETF focused on the crypto industry.

This ETF, called the SSGA Active Trust, aims to provide investors with exposure to a broader range of crypto assets than just Bitcoin.

In The Numbers 🔢

$25 billion

Projected total amount of losses in the crypto market due to deep fake tricks and scams in 2024 - Bitget Research.

The number of deep fakes globally has grown 245% in 2024.

Witnessed a 217% increase in deep fake incidents compared to Q1 2023.

Q1 2024 already saw $6.3 billion lost to deep fake scams in crypto.

Deep fake crypto losses are expected to reach $10 billion per quarter by 2025.

Future of deep fakes

Bitget predicts deep fakes could be used in 70% of crypto crimes by 2026.

Scammers may use deepfaked voices to impersonate victims' relatives on phone.

Deep fakes could be used to circumvent KYC measures and steal user funds.

In the broader crypto industry, $572.7 million was lost to hacks and scams in Q2 2024 (72 incidents) according to Immunefi.

70.3% increase from Q1 2024, 112% increase from Q2 2023.

What’s Up In The Coinbase Universe?

Says no to ASI: Coinbase won't be supporting the switchover to the new Artificial Superintelligence Alliance (ASI) token. While SingularityNet, Fetch.ai, and Ocean Protocol are merging their AI projects and cryptocurrencies.

Coinbase is sitting this one out.

Teams up with Stripe: This means you'll be able to buy crypto with your credit card or Apple Pay directly within the Coinbase Wallet using Stripe.

Plus, Coinbase will use Stripe's system to send money worldwide using USDC, a special type of crypto pegged to the US dollar.

Denies data breach rumours: Remember that kerfuffle about a leak from a company called Au10tix? Coinbase assures everyone they're not aware of any breach of customer data. Au10tix is a platform that helps businesses verify user identities.

Their logo is on the Au10tix website, and Coinbase says their data is safe and sound.

Cheers women in sports: Coinbase high-fives the WNBA for their Commissioner's Cup Championship. Sponsored the whole thing and even treated fans at women's sports bars across the US to a night of cheering (and maybe a free beer or two).

Coinbase has been a supporter of both the NBA and WNBA for years.

The Surfer 🏄

Logan Paul is suing YouTuber Coffeezilla for defamation over videos about his failed CryptoZoo NFT project. Paul claims Coffeezilla made false statements accusing him of operating a scam with CryptoZoo.

Australian news broadcaster 7News' YouTube channel was hijacked by crypto scammers. The channel live streamed a deep fake Elon Musk talking about crypto and promising to double investments.

TRON founder Justin Sun wins a landmark defamation case in the People's Court of China. Chongqing Business Media Group ordered to remove false contents and issue a formal apology to Sun.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋

https://sociabuzz.com/denflow78/donate

https://sociabuzz.com/denflow78/donate