Hey Crypto, what now? 👀

With global geo-political tensions in front and centre, it's hot out there for all asset classes. It's wait-and-watch everywhere. In US elections backdrop, crypto owners are emerging political force.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Crypto goes up. Crypto comes down.

Bitcoin bounced back after a dip.

And now Bitcoin is diving again.

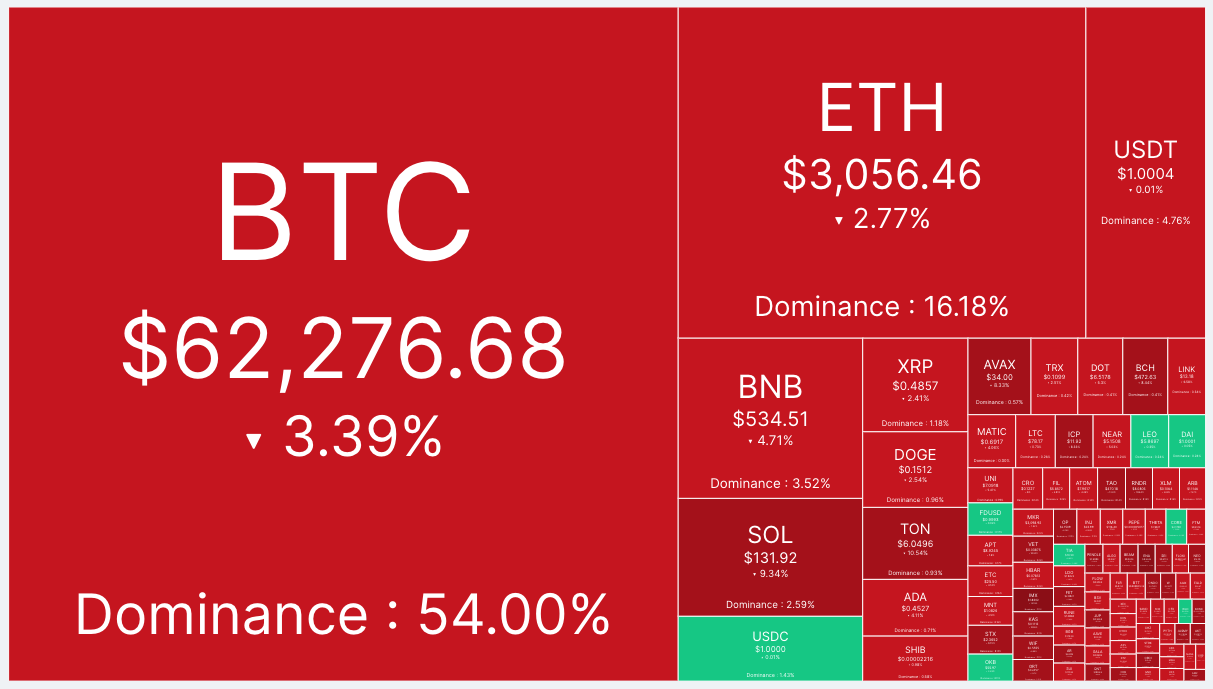

The sea of red is back.

That's the uncertainty all markets are dealing with.

Read this: Middle-East Pain 🙈 Hong Kong Approval 🙉

What are we looking at?

1. Whales are Staying on the sidelines

That's big money investors not making a play.

So, are we in a pickle?

Whales are known for savvy timing, and their lack of buying suggests they expect Bitcoin to fall further.

What's the data saying? Blockchain analysts say whale buying is way down compared to a similar price dip in March.

Onchain data from IntoTheBlock shows that addresses owning at least 0.1% of BTC's circulating supply have added just over 3,000 BTC on April 16.

This is significantly less than the net inflow of nearly 80,000 BTC seen after the dip below $61,000 on March 20.

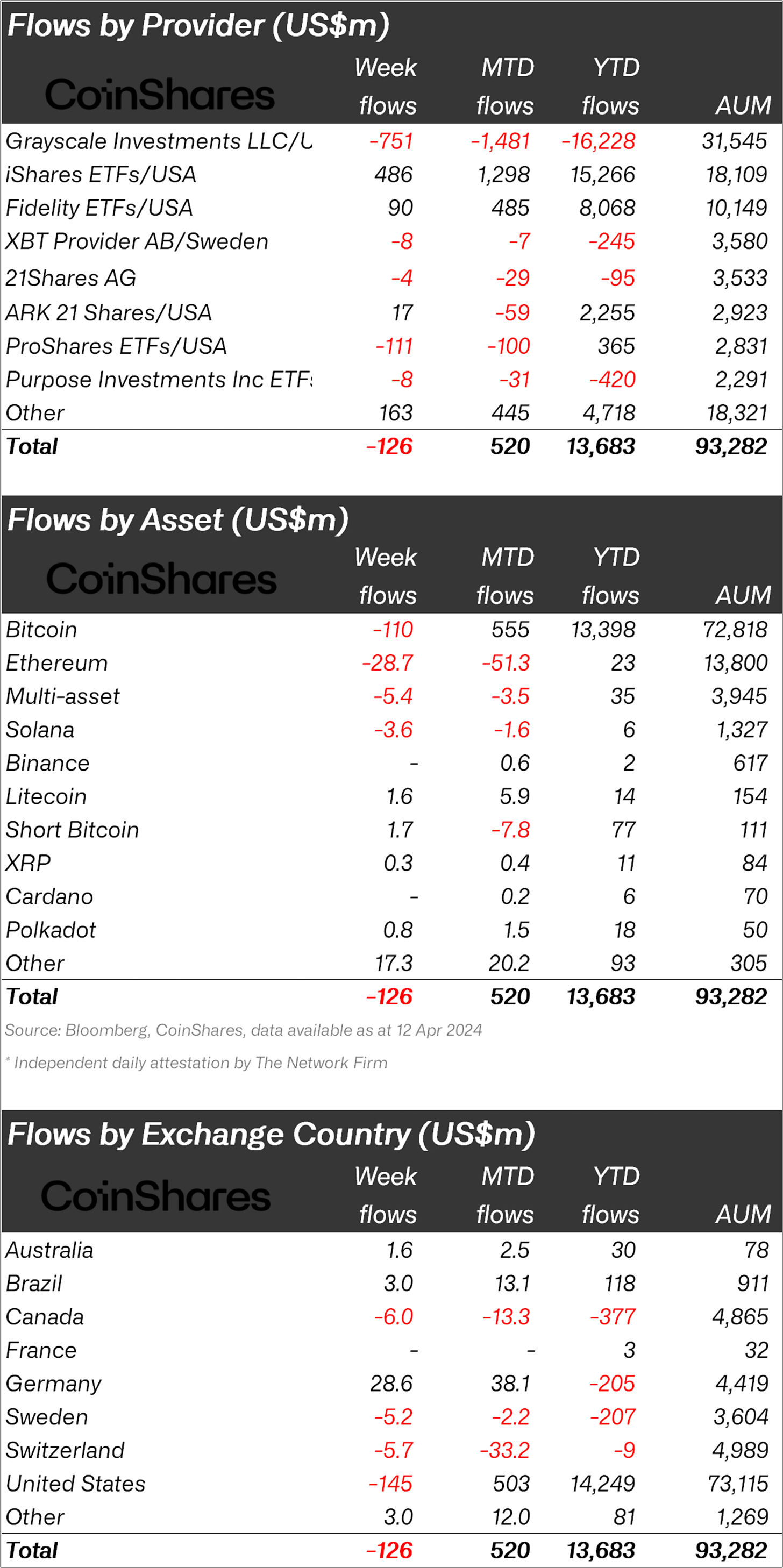

2. Bitcoin investors pull out big money

Investors yanked $110 million out of Bitcoin investment products last week, spooked by recent events.

Total crypto investment products seeing total outflows of $126 million this past week.

This follows a month of heavy inflows, with over 99% going into Bitcoin.

3. Spot Bitcoin ETFs holding fort, how long?

BlackRock's Bitcoin ETF (IBIT) is the only US spot Bitcoin fund to see inflows in the past two days.

4. Satoshi-Era Bitcoin HODLERS waking up?

Will see more of the old-school Bitcoin holders booking profits this season?

A wallet holding 50 Bitcoin mined in 2010 (think pennies per coin) just moved for the first time in 14 years

That Bitcoin is now worth a cool $3.2 million

87,000,000% gain

5. The Hong Kong ETF silver lining

But, they might not be the game-changer some are expecting.

Bloomberg's Eric Balchunas predicts a measly $500 million in inflows, a far cry from the rosy $25 billion predictions.

Why?

Tiny market: Hong Kong's ETF market is dwarfed by the US giant, limiting potential investment.

Limited access: These ETFs won't be easily accessible to mainland Chinese investors.

High fees: Expect fees around 1-2%, way more than "dirt cheap" US options.

Less liquidity: The underlying market for these ETFs might be less efficient, leading to wider spreads.

Block That Quote 🎙️

Pro-crypto lawyer John Deaton.

"I'm not a pro-crypto candidate, I'm a pro-freedom candidate."

John Deaton is running for the U.S. Senate in Massachusetts against Senator Elizabeth Warren.

He associates Bitcoin with freedom and is a fierce advocate for cryptocurrencies.

"When I was on Anthony Scaramucci’s podcast, at the end of the interview, we did a word association — he would say a name or a word, and he wanted my immediate reaction. He said "Bitcoin." And I said "freedom."

Galaxy Digital's latest report highlights an emerging political force: Crypto Owners.

"As we inch closer to November and investors begin to narrow in on ballot implications for markets, the crypto industry may play a larger role than it ever has."

According to a March poll by Paradigm, 19% of registered voters now own cryptocurrency, including over 11 million with holdings above $1,000.

OKX launches ETH L2

Crypto exchange OKX is taking a swipe at Coinbase by launching its own Ethereum layer-2 network, X Layer.

What do we know?

X Layer leverages Polygon technology to offer smooth transfers between different blockchains.

Coinbase's Base network uses Optimism's technology for a similar purpose.

Both networks aim to reduce transaction fees compared to Ethereum's mainnet.

X Layer boasts access to over 170 decentralised applications (dapps), with more to come.

X Layer utilises zero-knowledge (ZK) proofs, potentially enabling greater future interoperability.

In the Numbers 🔢

$3.5 million

A Nebraska man is facing serious charges for allegedly stealing millions of dollars in cloud computing services to mine crypto.

Name: Charles O. Parks III

Accusation: Using someone else's computing power (cryptojacking) to mine over $1 million in crypto.

Charges: Wire fraud, money laundering, and illegal monetary transactions.

Stolen: $3.5 million in services from cloud providers by using fake identities and avoiding billing.

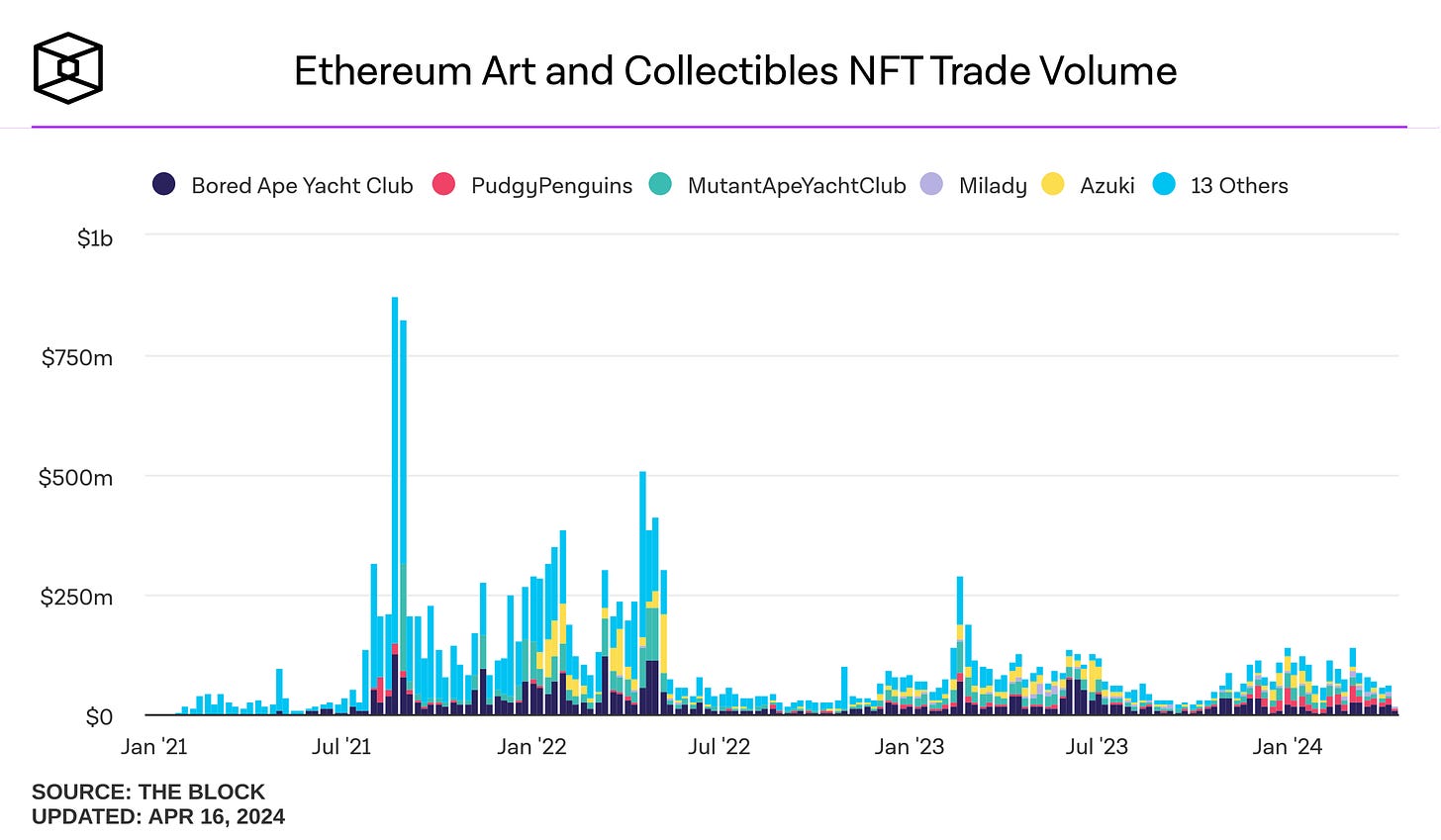

Bored Ape Yacht Club Suffers A Price Drop

The once-booming Bored Ape Yacht Club (BAYC) NFTs are experiencing a harsh reality check.

Their floor price, the minimum asking price for an NFT in the collection, has plunged to its lowest point since August 2021.

Current floor price: 11 ETH - lowest since August 2021

All-time high: 128 ETH (around $395,000) in April 2022

That's a drop of over 90%

The Surfer 🏄

Microsoft is investing $1.5 billion into G42, a leading AI company in Abu Dhabi. They plan to use Azure, Microsoft's AI computing platform, to make these technologies more accessible.

Polymarket is offering a bet that pays 8.7% if China doesn't invade Taiwan. This is almost 7 times the return on Taiwan government bonds. "No" shares on Polymarket are currently trading at 92 cents.

Elon Musk, the X owner is planning to charge new users to post in an effort to curb the platform's crypto spam problem. New X users might have to pay a small fee to tweet. This aims to stop the "relentless onslaught of bots", according to Musk.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋