Today’s edition is brought to you Koinly. Simple and reliable platform to calculate your taxes. Get the end of year deal - 30% off your on crypto tax reports 🫵

Hello y'all! Happy Friday - here's something to read while Wall Street figures out how to tokenise your coffee ☕️

How 2024 became the year of RWA tokenisation

Why $3.99B in tokenised treasuries is just the beginning

What's cooking for 2025

Why regulators are suddenly crypto's biggest fans?

First up, show us some love on X 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 190,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Big money voted with its wallet.

BlackRock? In. Franklin? In. Ripple? All in.

2024's biggest story isn't just about memecoins or ETFs. It's about bringing the "real world" onto the blockchain. And Wall Street's leading the charge.

BlackRock, the world's largest asset manager with $11 trillion under management, did something that would have seemed absurd just a few years ago: they put US Treasury bills on a blockchain.

Within four months, their digital fund, BUIDL, accumulated over $500 million in assets.

Franklin Templeton followed. Then UBS.

By year's end, even Tether, the cryptocurrency industry's controversial money printer, had launched its own tokenisation platform.

This was traditional finance — the suits, the regulators, the big banks — embracing blockchain technology not for speculative trading, but for something far more profound: transforming how we own and trade every real-world asset imaginable.

As 2024 draws to a close, we're standing at the cusp of what could be the biggest transformation in asset ownership since the invention of the stock certificate.

From Manhattan air rights to nuclear fuel, if it has value, someone's figuring out how to tokenise it.

Let's unpack what happened this year, why it matters, and what's coming next. Because if you think 2024 was transformative for asset ownership, just wait until you see what's coming in 2025.

In The Numbers 🔢

$15 billion

Real World Asset (RWA) tokenisation exploded from $8 billion to over $15 billion in 2024. That's almost 100% jump in a single year.

$3.99 billion

That's the current tokenised US treasuries market, with an average yield of 4.09%.

January 2024: $700M in tokenised treasuries.

December 2024: Nearly $4B.

Why such explosive growth? Institutional FOMO.

BlackRock's entry sparked a chain reaction

Traditional banks scrambling to catch up

Regulatory clarity driving adoption

Rising interest rates making treasuries attractive

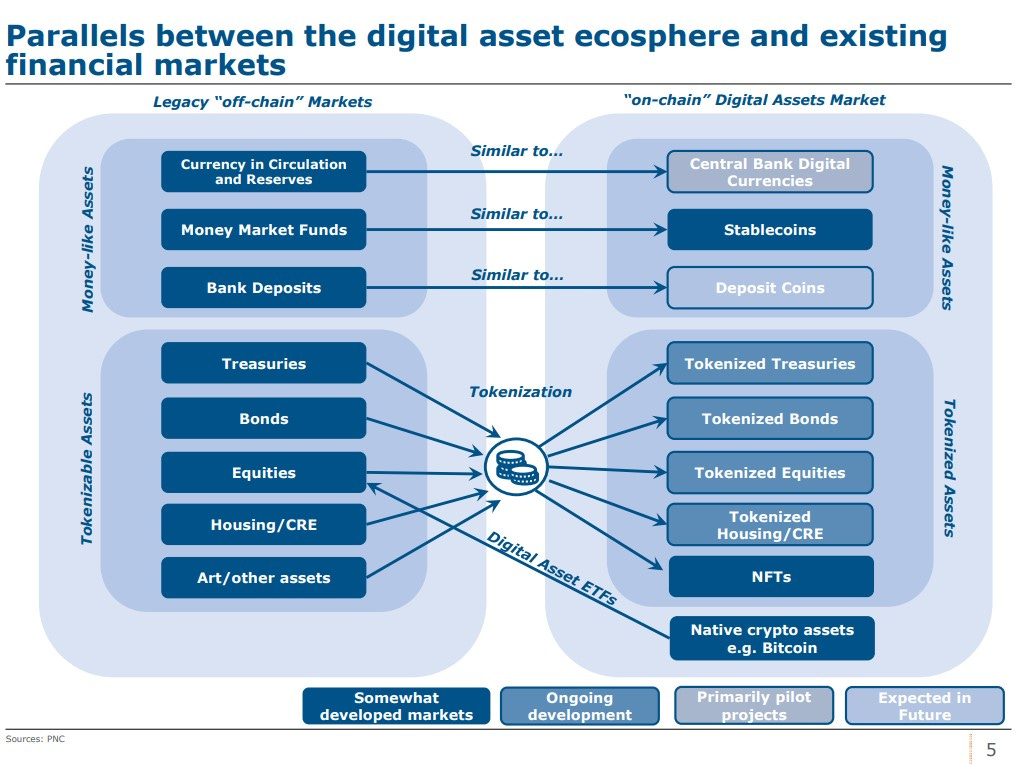

What Are We Even Talking About?

Before we dive into the deep end, let's get our bearings.

Real World Assets (RWAs) are exactly what they sound like — actual, tangible things that exist in the meat-space world, not just on a blockchain.

We're talking everything from Treasury bills to real estate, from fine art to uranium (yes, actual uranium — more on that wild story later).

Tokenisation is the process of taking these assets and creating digital tokens that represent ownership of them on a blockchain.

Think of it as converting the deed to your house into a million digital pieces that can be bought and sold instantly.

But why would anyone want to do this? That’s what you wanna know.

The Trillion-Dollar Opportunity

The traditional asset world has a problem: it's stuck in the past.

Take real estate.

Want to sell a portion of your building? Good luck with that paperwork.

Want to trade corporate bonds after hours?

Sorry, market's closed.

Want to invest in a piece of fine art? Hope you've got a few million lying around.

Tokenisation changes all that for assets.

Divisible (own 1% of a Picasso)

Liquid (trade 24/7)

Programmable (automated dividends anyone?)

Accessible (invest with $100 instead of $100,000)

This isn't just theory. In 2024, we saw it in action.

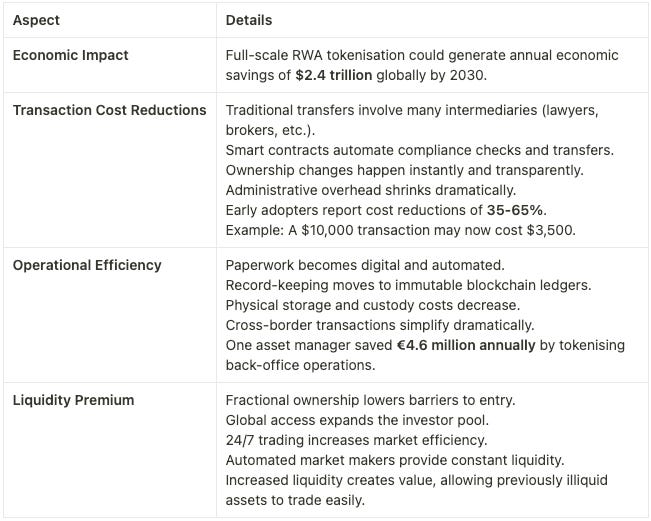

The Economics of Tokenisation: Follow the Money

While the technology behind tokenisation captures headlines, the real revolution lies in the numbers.

By 2030, full-scale RWA tokenisation could generate annual economic savings of $2.4 trillion globally.

Let's break down where these savings come from.

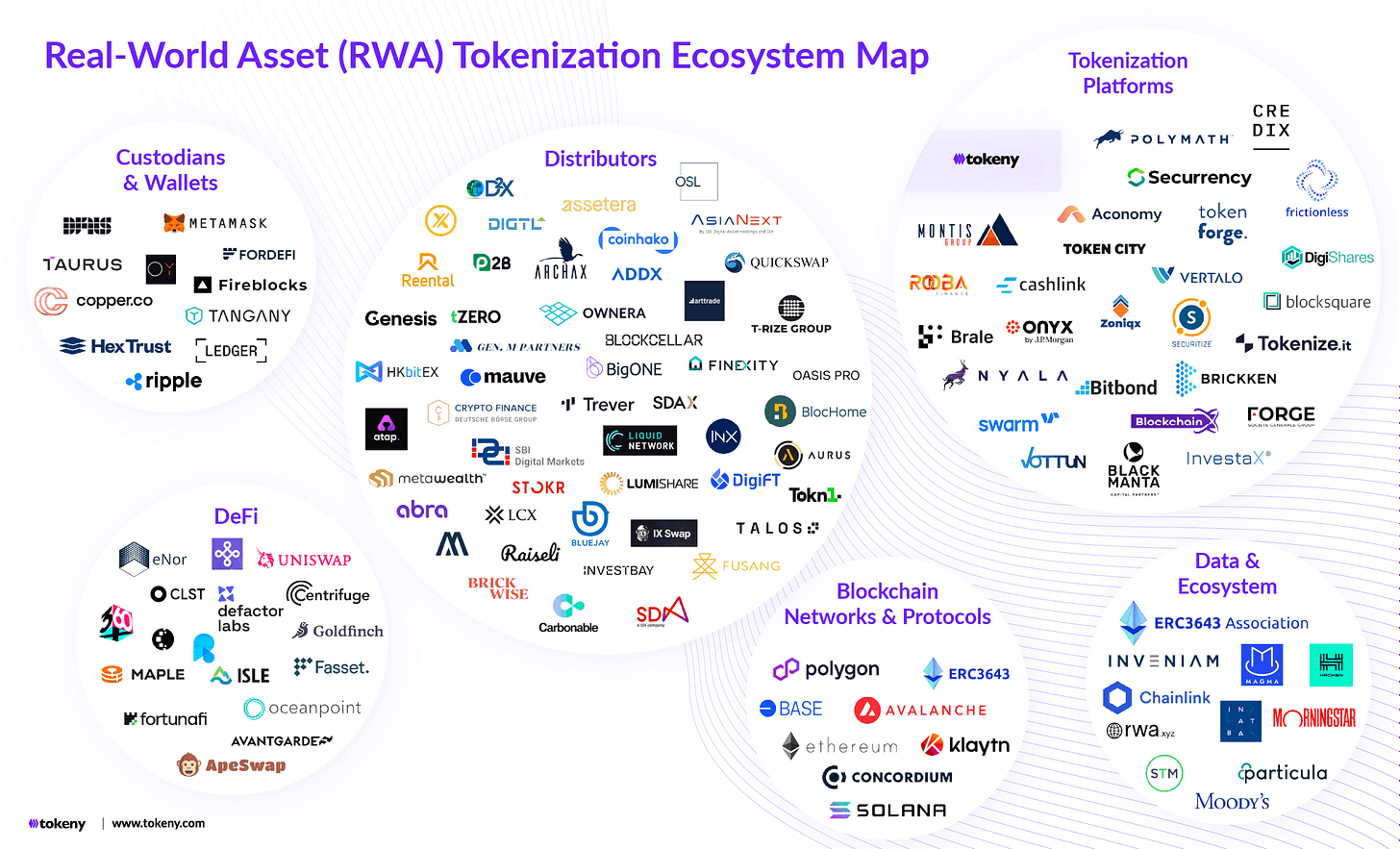

The Infrastructure Build-Out

While everyone was watching the billions flow into tokenised Treasuries, something equally important was happening behind the scenes: the plumbing of the future financial system was being built.

Chainlink integrating with Coinbase's Project Diamond

Swift partnering with UBS for tokenised fund settlement

BNB Chain launching no-code tokenisation tools

German fintech 21X securing the EU's first tokenisation license

Tether unveiling Hadron, its tokenisation platform

Ripple and Archax just launched the first tokenised money market fund on XRP Ledger

DNA Holdings opened a desk for tokenised startup equity

Venture firm Lazard partnered with Bitfinex Securities for tokenised funds

These might sound like boring technical developments, but they're the rails on which the trillion-dollar tokenisation train will run.

The Wild World of What's Being Tokenised

In 2024, if you could own it, someone probably tried to tokenise it.

Take Uranium.io, launched on Tezos blockchain with backing from major uranium producer Cameco.

It's the world's first tokenised uranium marketplace, bringing nuclear fuel trading to the masses (what could possibly go wrong?).

Or consider SkyTrade, which tokenised $35 million worth of air rights above Manhattan.

They're selling tokens representing the actual air above buildings. Even coffee got the tokenisation treatment.

Agridex settled the first-ever tokenised coffee trade on Solana, slashing transaction fees from 7% to 0.5% and settlement times from weeks to instant.

The Regulatory Tide Turns

The most significant shift in 2024 was regulatory: governments stopped fighting tokenisation and started embracing it.

Hong Kong launching subsidies for tokenised bond issuance

Germany granting its first EU-compliant tokenisation license

The US Treasury acknowledging stablecoins' positive impact on T-bill demand

El Salvador enabling tokenised T-bill trading through Bitfinex Securities

This regulatory clarity gives institutions the confidence to enter the space. And enter they did.

Get Ahead on Your Crypto Taxes

Koinly helps you nail your taxes in three simple steps.

Easily import your trades: Add your exchange accounts via API or CSV files and connect your blockchain wallets using public addresses.

Preview your capital gains: Get a glimpse of your profit/loss for any tax year - for free.

Download your tax documents: Use the generated tax report to file the tax yourself, using a tax software like TurboTax or through your accountant.

🎙 Block That Quote

US Treasury Department's Q4 2024 Report

"Tokenisation can potentially improve liquidity in the trading of Treasuries by reducing operational and settlement frictions. Immutable ledgers could allow for greater transparency in Treasury market operations, reducing opacity, and providing regulators, issuers, and investors with more real-time insight into trading activities."

The government wants in on Web3. They have good reasons.

Enhanced operational efficiency

Reduced settlement friction

Real-time market insights

Better collateral management

And stablecoins are already proving the point. With $211B in total market cap, they're driving demand for T-bills.

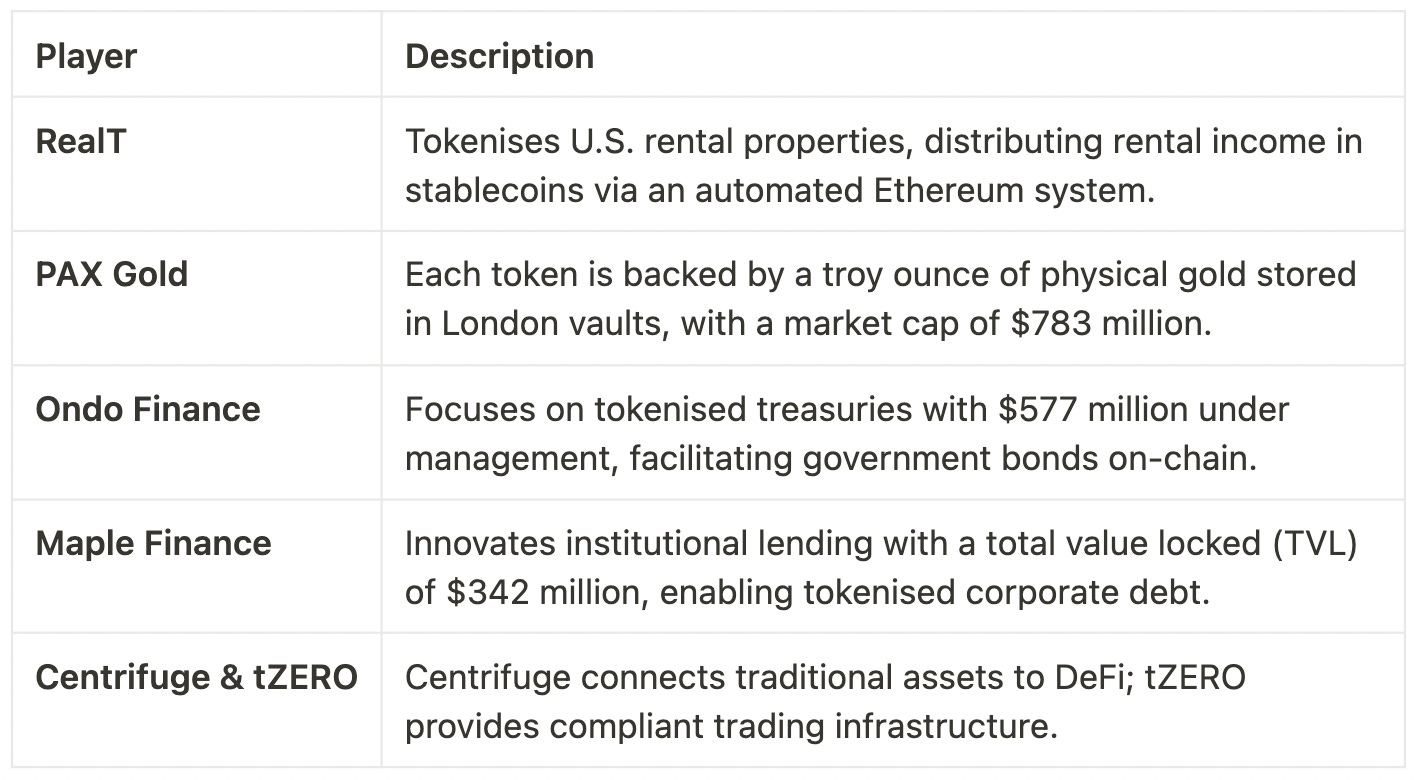

The Major Players of 2024?

While Wall Street made headlines, several key players quietly revolutionised asset tokenisation this year.

Look at the ecosystem.

2025: What are we looking at?

So what's next? Several trends seem poised to define 2025.

Institutional Adoption Goes Mainstream

Beyond just testing the waters, 2025 looks set to bring full-scale institutional deployment.

Major banks are preparing their own tokenisation platforms, following JPMorgan's lead with its programmable deposit solution.

Watch for at least five global banks to launch proprietary tokenisation services, particularly in private markets where the efficiency gains are most dramatic.

New Asset Classes Take Center Stage

While Treasuries dominated 2024's narrative, 2025 will likely see tokenisation spread into more complex assets.

Private credit markets, where tokenisation could unlock over $200 billion in previously illiquid assets

Infrastructure projects, with several governments exploring tokenised infrastructure bonds

Intellectual property rights, particularly in the entertainment and biotech sectors

Carbon credits, as climate markets seek better tracking and trading mechanisms

Retail Access Democratises

The infrastructure built in 2024 will enable more retail-focused products in 2025.

"Tokenisation-as-a-Service" platforms making it easier for smaller issuers

Mobile apps offering fractional ownership of premium real estate

Integration with traditional brokerages for seamless token trading

Lower minimum investment thresholds across all asset classes

Cross-Chain Integration Accelerates

Interoperability becomes crucial as the ecosystem matures.

Major protocols will launch cross-chain bridges specifically for tokenised assets

Standards will emerge for moving RWAs between different blockchains

Institutional-grade security solutions for cross-chain transactions

Integration of traditional finance settlement systems with multiple blockchains

Regulatory Frameworks Solidify

2025 could be the year of regulatory clarity.

The EU's DLT Pilot Regime will expand to include more asset types

Asian financial hubs will introduce comprehensive tokenisation frameworks

The US SEC might provide clear guidance on tokenised securities

Global coordination on tokenisation standards could begin

Real Estate Tokenisation Boom

Property markets could see particular disruption.

Major REITs exploring tokenisation of their portfolios

New platforms enabling fractional ownership of commercial properties

Integration with property management and rental income distribution

Cross-border real estate investment becoming more accessible

Industry projections for tokenisation by 2030 range wildly

Boston Consulting Group: $2 trillion

Standard Chartered: $30 trillion

McKinsey: $4 trillion

Various others: $10-16 trillion

The exact number matters less than the direction.

We're witnessing a fundamental shift in how assets are owned, traded, and valued.

Token Dispatch View 🔍

As we close out 2024, transformation has become undeniable - tokenisation has evolved beyond crypto jargon into a serious Wall Street priority.

The US Treasury's endorsement marked a watershed moment, opening the floodgates for traditional institutions to embrace blockchain technology.

Yet current market projections might be thinking too small.

While estimates for 2030 range from Boston Consulting Group's modest $2 trillion to ambitious forecasts of $30 trillion, these numbers could underestimate the scale of change ahead.

This transformation transcends the mere digitisation of existing assets. We're witnessing an expansion of what constitutes ownership itself.

Manhattan's air rights trade as tokens. Coffee shipments settle instantly on Solana. Uranium changes hands in fractional shares.

Each innovation pushes the boundaries of what we consider an asset.

This change is not without hurdles.

Technical scalability needs work. Regulatory frameworks stay fragmented. Market education lags. Infrastructure requires development. Questions about interoperability, standards, and governance demand answers.

Still, 2024 marked an irreversible shift.

The US Treasury's backing, BlackRock's BUIDL success, and Franklin Templeton's digital push have fundamentally altered the landscape.

Wall Street has moved from curiosity to conviction.

For 2025, three trends appear inevitable.

Innovation will accelerate

Traditional finance will drive adoption

The scope of tokenisation will expand

Focus now is not on if this transformation will happen, but on who will lead it.

While 2024 brought tokenisation mainstream, 2025 could reshape our entire conception of value.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋