Hello dispatchers!

We understand the radio silence.

The blood flows freely through the crypto streets. Red is indeed the colour of this crypto season.

Today we tell you what's driving the carnage across crypto. The dips that have become a rolling stone down the slope, and if we might finally hit the floor (hint: we may not be there yet).

Last 48 hours, we saw 👇

Bitcoin crashing below $86K (down 20% from January's high)

A staggering $1.5 billion in liquidations

Market cap retreating to November 2021 levels

Fear & Greed Index nosediving from 49 to "Extreme Fear" (25)

Explore Verified DApps - All in One Place!

The Market Carnage

Time flies fast.

Less than five weeks ago, Bitcoin was celebrating a new all-time high above $109,000. Today, it's struggling to hold above $88,000 — a 20% plunge that has dragged the entire crypto market with it.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

Solana has been hit even harder, down a staggering 50% since January 19, trading around $138 from its peak near $280. ETH has fared little better, falling over 14% in the past 24 hours alone.

The damage isn't limited to prices.

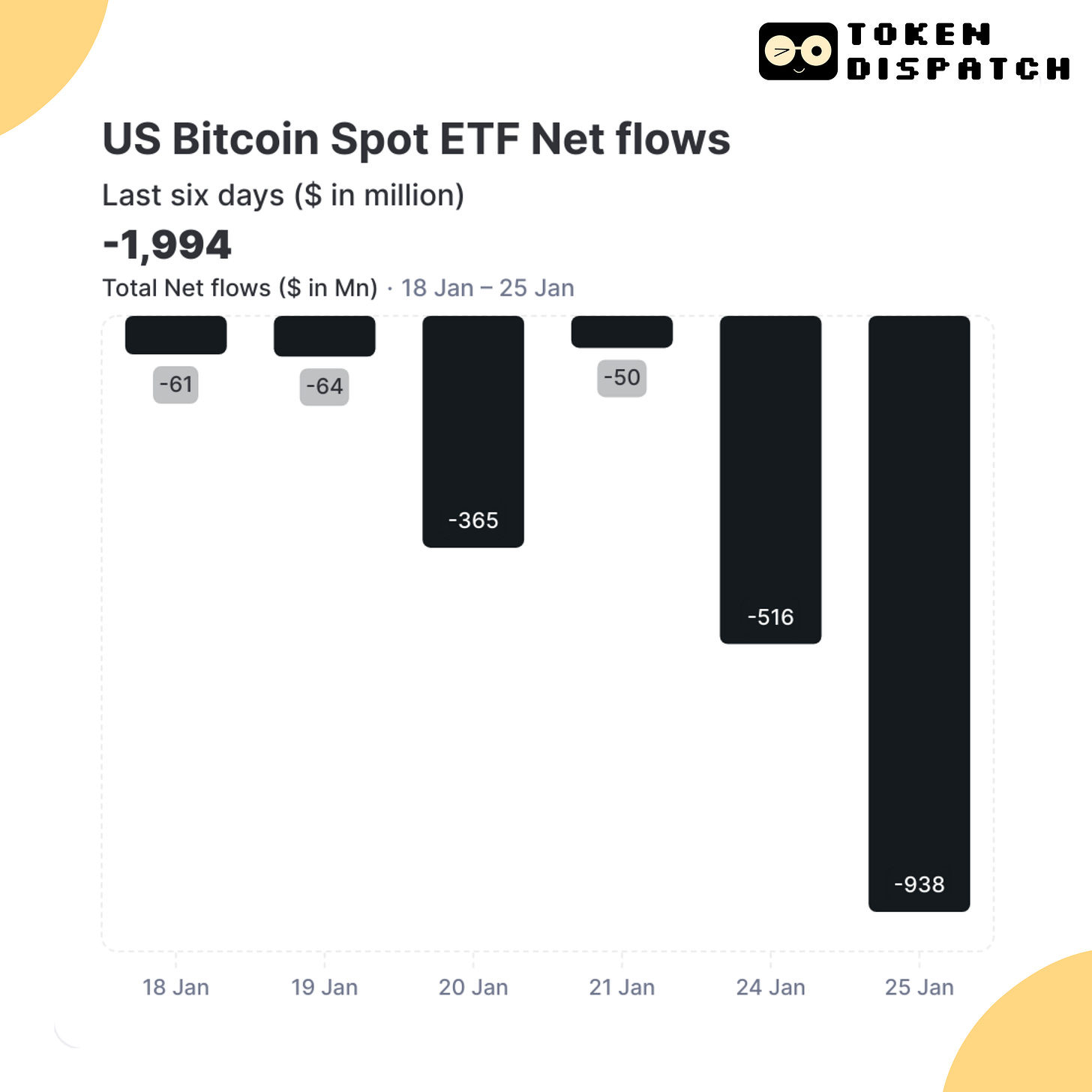

US spot Bitcoin ETFs witnessed over $937 million and $516 million in net daily outflows on Tuesday and Monday — recording the largest and seventh largest single-day exodus since their launch in January 2024.

These ETFs have now experienced six consecutive days of outflows, totalling almost $2 billion.

Sentiment indices showed similar narrative.

The Fear and Greed Index's nosedive from 49 (neutral) to 25 ("extreme fear") in just 24 hours — one of the sharpest single-day sentiment shifts since September.

Daily long liquidations on futures exchanges tracking Bitcoin hitting $560 million on Tuesday alone.

Macro Economic Pressures

US President Donald Trump's announcement that tariffs on imports from Canada and Mexico "will go forward" next week has spooked investors and traders. The prospect of a 25% import tax on goods from America's closest trading partners has economists concerned about rising inflation and potential trade wars.

"Crypto's taking a hit from big-picture economic pressures and US tariffs targeting Canada and Mexico," Dominick John, an analyst at Kronos Research, told DL News.

This tariff anxiety has been compounded by Walmart's cautious outlook. The retail giant warned that growth into 2026 will be slower than expected, sending its stock down nearly 7% — its biggest slide since 2022. Considered as a bellwether for US consumer spending, Walmart's concerns have rippled across all risk assets.

Meanwhile, the Federal Reserve's fight against inflation faces new complications. The January Fed minutes revealed growing concern that Trump's immigration and trade policies could hinder the central bank's efforts to control prices. With the Consumer Price Index hitting a nine-month high in February, hopes for additional rate cuts have been dashed.

These macroeconomic headwinds aren't unique to crypto, but they're hitting digital assets particularly hard due to their position as "ultra risk-on" assets in most institutional portfolios.

"Bitcoin's place remains far out on the periphery as an ultra risk-on asset to be readily sold at the very hint of troubles ahead," noted Petr Kozyakov, CEO at payment infrastructure platform Mercuryo.

Crypto's Self-Inflicted Wounds

Besides external market forces, crypto has also been hurt by actors within its own ecosystem.

On February 21, Bybit, the third-largest crypto exchange by volume, suffered the largest hack in crypto history when attackers — reportedly North Korea's state-backed Lazarus Group — made off with a staggering $1.5 billion in Ethereum and ETH-based tokens.

Read: Crypto's Biggest Heist Rocks Bybit 🦹🏻♂️

Though Bybit quickly announced that user funds were safe and secured 80% of the lost funds via a bridge loan, the event severely rattled investor confidence. Worse yet, security researchers reported that the hackers were using popular memecoin platform pump.fun to launder the stolen funds, further tainting the already controversial sector.

That wasn’t all.

Few things damaged crypto's reputation in the last couple of months more than what the presidential token debacles did.

First came the Trump administration's ill-timed launch of "TRUMP" and "MELANIA" tokens on Solana during inauguration weekend. These tokens initially rocketed to multi-billion dollar valuations before crashing spectacularly, leaving most investors with massive losses while insiders walked away with profits.

Then Argentine President Javier Milei promoted the "Libra" token on February 14, which soared to a $4 billion valuation before collapsing 95% in what Galaxy Digital described as a "$4.6 billion rug pull."

Read: When Presidents Play With Memes 🏛️

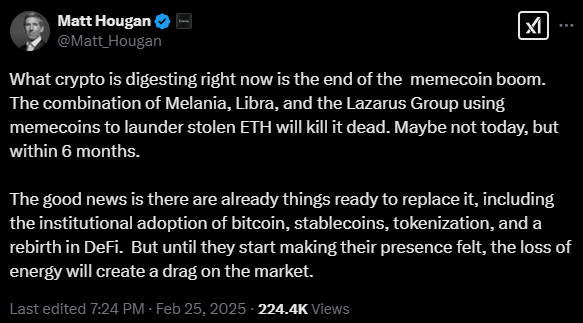

Combination of state-sponsored hacking, presidential token disasters, and alleged fraud has created what Bitwise CIO Matt Hougan calls "the end of the memecoin boom."

Have We Hit the Bottom Yet?

With Bitcoin now testing levels not seen since November, the question on everyone's mind is: where's the bottom?

Block That Quote 🎙️

Geoffrey Kendrick, Standard Chartered Head of Digital Assets Research

"Do not buy the dip yet. A move to the low 80s is on."

Kendrick warns that we haven't seen the worst yet, suggesting to watch out for a specific indicator: a day with over $1 billion in ETF outflows. "Before buying the dip is attractive I think we get a $1B ETF outflow day," he noted.

Less than a day later, US BTC ETFs returned a $937-million outflow. Time is ripe to buy the dip, then?

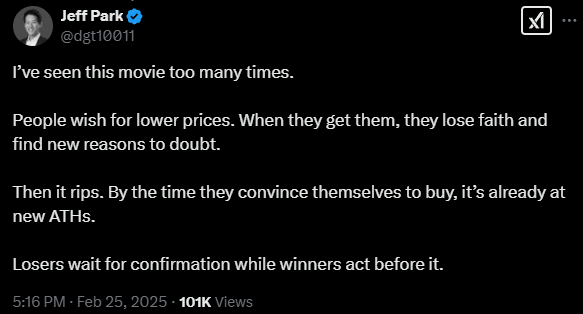

Jeff Park, who heads the Alpha Strategies at Bitwise, is reading the signs.

Meanwhile, BitMEX co-founder Arthur Hayes feels the bottom is further away.

Suggests Bitcoin could fall to $70,000 — what he colourfully terms "goblin town."

Hayes believes large hedge funds engaged in the ETF arbitrage trade (going long ETFs while shorting CME futures) are unwinding their positions as the basis spread narrows.

"These funds are currently in profit, and given that the basis spread is close to Treasury yields, they will unwind during US hours and realise their profit," he warned.

Historical patterns offer some perspective. Raoul Pal, founder of Global Macro Investor, points out that the current correction resembles the 2017 market structure when Bitcoin experienced 28% corrections five times, each lasting two to three months.

Meanwhile, technical indicators show Bitcoin has already broken through its short-term holder realised price of $92,000, with the 200-day moving average around $82,000 potentially providing the next support level.

Where’s the Money Moving?

As retail investors panic and leveraged traders get liquidated, money’s moving places within the crypto ecosystem.

As the memecoin sector faces an existential crisis, Bitwise's Hougan points to some areas poised to lead the next wave of crypto growth.

Institutional Bitcoin adoption continues to accelerate beyond ETFs. Major banks like Morgan Stanley are exploring ways to offer crypto "in a safe way," while other financial giants build out their digital asset infrastructure.

Stablecoins, now a $187 billion sector, have emerged as crypto's most practical use case. USDT alone processes more daily value ($151 billion) than its entire market cap, exceeding even Bitcoin's $98 billion in daily volume.

Tokenisation of real-world assets is gaining momentum, with projections suggesting a $14-16 trillion market by 2030. BlackRock's Larry Fink and SkyBridge Capital's Anthony Scaramucci have both positioned their firms to capitalise on this trend.

DeFi is quietly rebuilding after previous cycles' excesses. Projects like Uniswap, Aave, and Compound continue to develop fundamental infrastructure, while newer initiatives like BTCFi extend decentralised finance to Bitcoin itself.

"Until they start making their presence felt, the loss of energy will create a drag on the market," Hougan cautioned. The foundations for the next growth phase are being laid even as prices tumble.

Bernstein remains steadfast in its $200,000 Bitcoin price target, calling the current pullback "as another opportunity to participate in this cycle.” Their analysts believe that "institutional and corporate treasury inflows will continue to accelerate" despite the short-term volatility.

When Will the Bleeding Stop?

Industry insiders offer varying timelines for when the market might reverse course.

Hong Yea, co-founder and CEO of crypto exchange GRVT, believes we're in a consolidation phase rather than the end of the bull market.

"This dip from January's peak doesn't likely signal the bull market's end. Volatility is par for the course in crypto, with a potential rebound by March or April 2025," he told DL News.

Technical analysts highlight several key support levels to monitor.

The 200-day moving average around $82,000

The psychologically important $80,000 round number

Previous resistance-turned-support at $75,000

While most analysts expect further downside in the near term, there's growing consensus that this correction is cyclical rather than structural.

Token Dispatch View 🔍

Market bloodbaths like these have historically separated the tourists from the true believers in digital assets.

What we're witnessing is beyond a standard correction, it's the collision of macro fears with crypto's own excesses. The presidential token disasters did more than hurting investor wallets; they wounded the narrative that crypto had matured beyond its wild west days. When sitting presidents and state-sponsored hackers are playing in the same sandbox as retail investors, something had to give.

The clearest signal amid this carnage isn't in price charts but in capital flows. Money isn't evaporating anywhere, it's migrating. Bitcoin's dominance has silently climbed to 61% while speculative plays get decimated.

This flight to crypto "quality" mirrors traditional market behaviour during uncertainty, suggesting institutional players are moving to the upper decks, and not abandoning the ship.

What happens next depends less on charts and more on rebuilding trust. The sectors Hougan identifies: institutional adoption, stablecoins, tokenisation, and DeFi—share one critical trait: they're built on actual utility rather than speculation.

The market is violently enforcing this distinction. When the dust settles, the crypto landscape will look markedly different.

Those who use this correction to accumulate fundamentally sound projects rather than chasing presidential tokens might find themselves thanking this bloodbath for the opportunity it presented, even if it feels like financial torture in the moment.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

It's pretty wild of a drop but great for people waiting to get in imo.