Is Bitcoin a Strategic Asset? 🤔

Republicans are pushing for making Bitcoin a strategic reserve asset. How does that play with Bitcoin's original narrative of decentralisation and if it is a feasible idea for government to consider.

Hello, y'all. For the music fans by the music lovers. Give it a go, will ya?👇

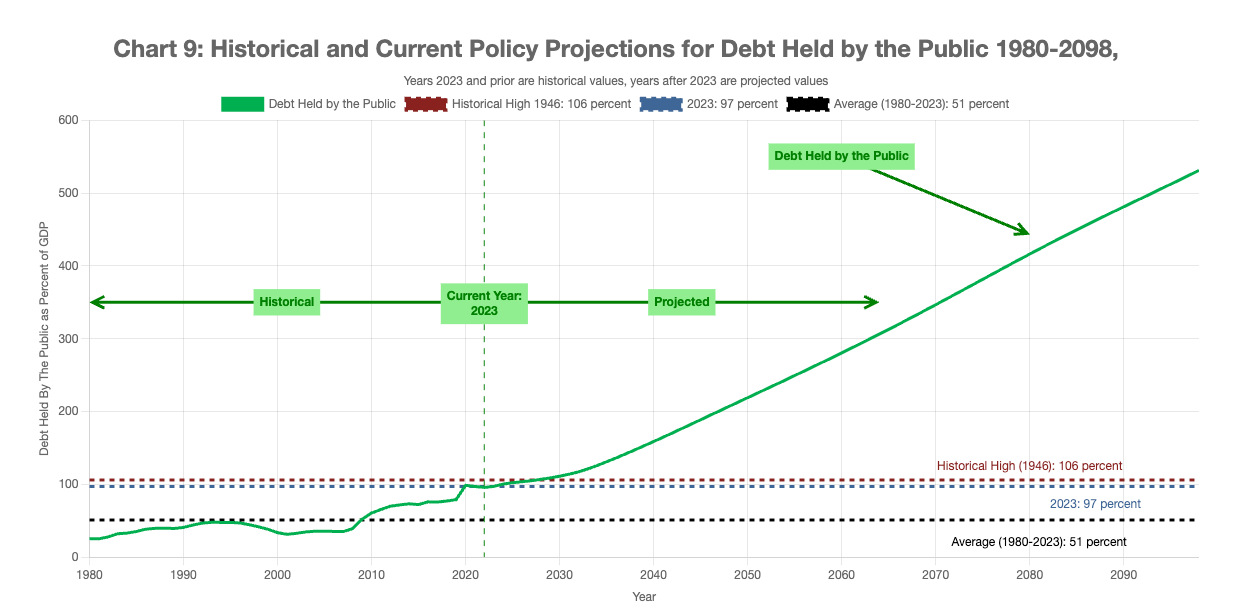

The US is in debt

We are talking more than $35 trillion.

What does that mean?

Senator Cynthia Lummis has a proposal: a US Strategic Bitcoin Reserve.

Presidential candidate Donald Trump said +1.

He lit up the Bitcoin 2024 with his everything-for-bitcoin speech.

He even teased paying the US debt with Bitcoin in an interview.

The Donald Trump promise

“And so as the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the bitcoin the US government currently holds or acquires into the future, we'll keep 100%. I hope you do well, please.

This will serve, in effect, as the core of the strategic national bitcoin stockpile … Most of the bitcoin currently held by the United States government was obtained through law enforcement action. You know that they took it from you. Let's take that guy's life. Let's take his family, his house, his bitcoin.

We'll turn it into bitcoin. It's been taken away from you, because that's where we're going now. That's where this country is going to – fascist regime. And so as I take steps to transform that vast wealth into a permanent national asset to benefit all Americans.

The federal government almost has 210,000 bitcoin or 1% total supply that will ever exist. But for too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin.”

Robert F. Kennedy’s four million ambition

“I intend, as President of the United States, to sign an executive order on day one, directing the Department of Justice and the US Marshals to transfer the approximately 200,000 bitcoin held by the U.S. government to the United States Treasury, where it will be held as a strategic asset.

On day one as president, I will sign another executive order directing the US Treasury to purchase 550 bitcoin daily until the U.S. has built a reserve of at least 4 million bitcoins, ensuring a position of dominance that no other country will usurp.

Our nation holds approximately 19% of global gold reserves. This policy will give us about the same proportion of total bitcoin. The cascading impact of these actions will eventually move bitcoin to a valuation of hundreds of trillions of dollars.”

Senator Cynthia Lummis proposal

“With a strategic Bitcoin reserve, we will have an asset that can cut our debt in half by 2045.”

Her expectation: Bitcoin will go to the moon by 2045.

The plan involves acquiring up to 200,000 Bitcoin annually over five years, totalling 1 million Bitcoin.

Bitcoin would be stored in decentralised vaults across the US for maximum security.

Gold-Backed Funding: A unique aspect of this proposal is using the revaluation of the Federal Reserve's gold holdings to fund the Bitcoin purchase.

This involves updating the value of gold certificates to reflect the current market price, generating substantial funds.

The Bitcoin reserve would be locked in for at least 20 years, with strict limitations on future sales.

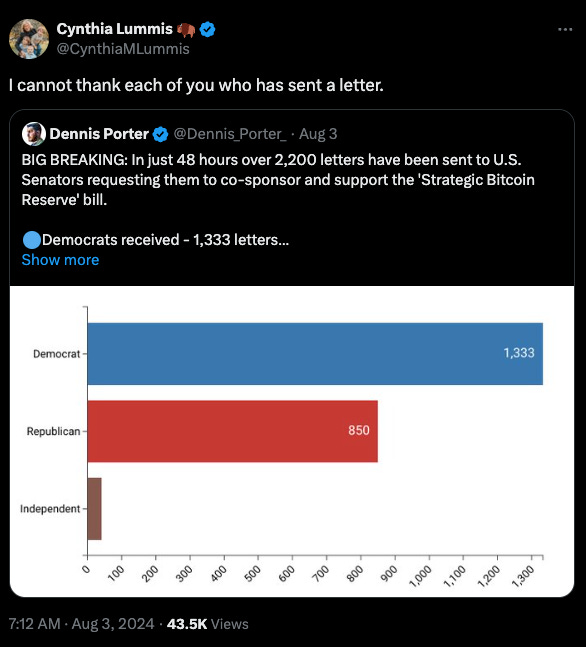

Lummis introduced the bill on July 31

Over 2,200 letters were sent to United States senators in 48 hours, urging them to co-sponsor and support Lummis's newly proposed Strategic Bitcoin Reserve bill.

Democratic Party senators received 1,333 letters.

Republican Party senators received 850 letters.

Independents received 41 letters.

But before any decision, how would Bitcoin work as a strategic reserve?

A strategic reserve of Bitcoin would mean that a government, like the US, holds a significant amount of Bitcoin as a part of its national assets.

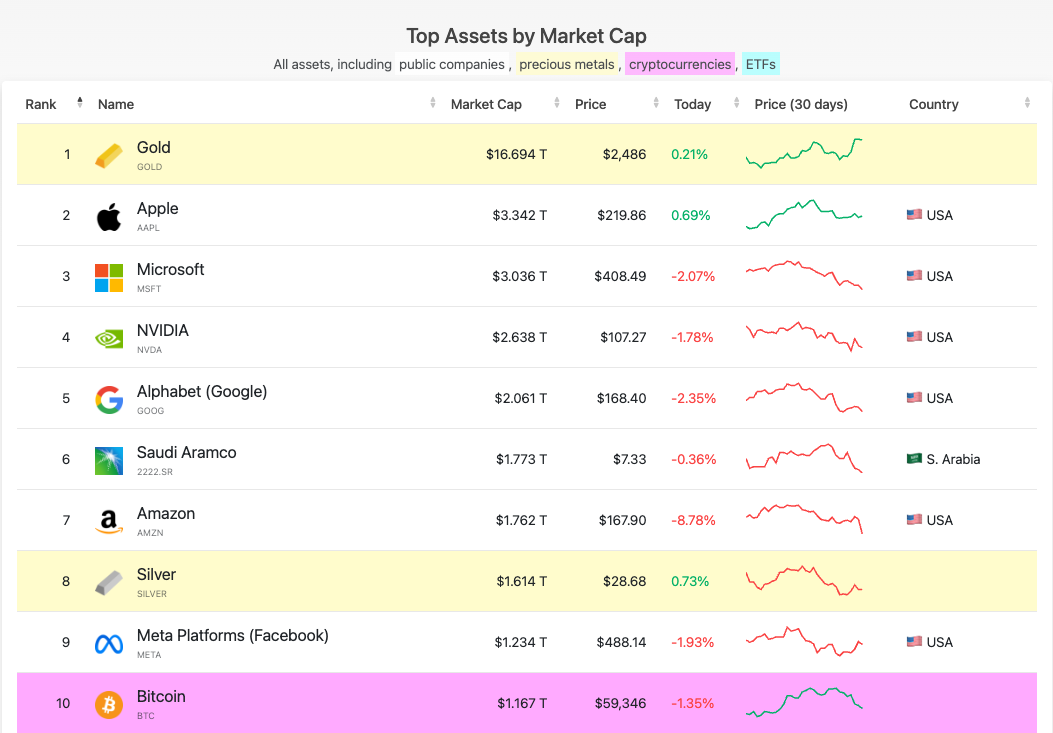

The government would buy and hold Bitcoin, treating it like a valuable asset, similar to gold or oil.

By keeping Bitcoin as a reserve, the government aims to protect itself against economic downturns or inflation, as Bitcoin is seen by some as a store of value.

Holding Bitcoin could increase confidence in the cryptocurrency market, potentially stabilising prices and encouraging more people to invest in Bitcoin.

A strategic advantage against rivals like China and Russia. A Bitcoin reserve could enhance a country's financial power on the global stage, especially against nations that may not support cryptocurrencies.

The government would likely plan to hold Bitcoin for many years, hoping that its value increases over time, which could help improve the nation's financial health.

What does this mean for Bitcoin?

A Strategic Bitcoin Reserve implies the US signalling its recognition of Bitcoin’s value.

Other nations might follow the suit = high demand for Bitcoin worldwide.

That will invite new investors, more adoption and a price boost.

All of this leads to more comprehensive regulatory frameworks for cryptocurrencies.

But, the number needs to go up. A LOT!

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Blockworks’ Byron Gilliam did the math

US federal debt is projected to hit a staggering 200% of GDP by 2045, which translates to around $154 trillion.

To halve this debt, Bitcoin's value would need to skyrocket to $77 trillion by 2045 - 1,200x increase.

That would make Bitcoin worth 20 times the entire US stock market.

The verdict? A long shot.

A 1,200x increase in just 20 years is a stretch, to say the least?

Read: 🟪 Is bitcoin a strategic asset?

A never seen before idea

Unlike gold or foreign currency holdings, which have served specific purposes in the past, there's no clear historical justification for government-held Bitcoin.

Hong Kong is on it too

Hong Kong legislator Johnny Ng is already exploring the feasibility of incorporating Bitcoin into Hong Kong's financial reserves.

On July 28, Ng tweeted that Hong Kong should consider including Bitcoin in its strategic financial reserves.

“The global acceptance of Bitcoin is constantly increasing,” Ng wrote. “In the future, it is indeed possible to research and consider including Bitcoin in strategic financial reserves, as long as it is compliant.”

Token Dispatch View

Bitcoin can diversify a reserve portfolio and protect against inflation or economic downturns. Adopting Bitcoin could be a win-win situation for both the government and the crypto.

But, government involvement in the Bitcoin market could distort prices and Bitcoin is supposed to be purely “decentralised.”

Yes, Bitcoin's price has been volatile. But, its long-term value proposition as a strategic asset remains unclear.

But, acquiring a Bitcoin reserve would require substantial funds. Proposed methods include using existing Treasury funds or revaluing gold certificates, but the ultimate financial burden falls on US taxpayers?

Week That Was 📆

Saturday: Gold To Trigger Bitcoin Bull Run? 🔑

Friday: Crypto Q2 2024 Results 🧪

Thursday: Tether's $5.2 Billion Profit 🚀

Wednesday: Artists Sue US SEC 🤦

Tuesday: $2B Silk Road Bitcoin 🏃♀️

Monday: ETFs - BTC v ETH 🧐

Week in Funding 💰

Layer2 Financial. $10.7M. Platform to provide fintechs and their customers with fully compliant payments, banking and digital asset wallets for multiple currencies.

Breakout. $4.5M. Prop trading firm for traders of cryptocurrency, FX and indices. Focus on tight spreads, strong risk management and superior liquidity.

Jokerace. $3M. Governance platform for projects to launch contests and hackathons, issue grants, and offer incentives to community members on-chain.

Raad Labs. $2.5M. Incentive network for data management and collection processes for local, regional, and large-scale weather data and intelligence.

Mintify. $3.4M. An NFT terminal for pro traders. Our all-in-one toolset features historical and real-time data for both long-term holders and emerging NFT quants.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

This is The Token Dispatch 🙌 find all about us here 🤟

So long. OKAY? ✋

Trump’s commitment to holding 100% of the US government’s Bitcoin as a strategic asset is a bold move. While it could solidify Bitcoin’s status as a valuable asset, what safeguards could be put in place to mitigate the risks associated with Bitcoin’s price volatility?

So, it looks like the US might be going from “In God We Trust” to “In Bitcoin We Trust!” I guess the next step is a Bitcoin-backed national anthem? 🎶🎤 Can’t wait to see the Statue of Liberty sporting a Bitcoin hoodie! 🤣 The thought of the US Treasury buying Bitcoin daily and eventually holding 4 million of them sounds like a wild rollercoaster ride, but I’m not sure if I’m ready to invest in a ticket just yet! 🚀💸