Today’s edition is brought to you by Cryptohopper. Customisable automated crypto trading bot to manage all your exchange accounts and trade from one place 🫵

Hello, y'all. Got your Monday coffee? You'll need it. The memecoin world is struggling to keep up with rest of the crypto universe.

"Dino coins" revive while new memes struggle

Evolution or extinction for the memecoin sector?

PEPE hits $11B market cap, flips Uniswap

Pump.fun banned in UK

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

When Murad Mahmudov took the stage at Token2049 in September, he painted a picture of a $1 trillion memecoin future.

The crypto world didn't just listen - it believed. And why not?

While Bitcoin and Ethereum crawled up 22%, older memecoins like Dogecoin and Shiba Inu jumped 105%, and newcomers like PEPE and PNUT soared over 2000%.

The total market cap of memecoins is well over $140 billion, as per Coingecko.

But as we enter December 2024, something curious is happening.

The memes aren't capturing retail attention like they used to.

Instead, money is flowing into what crypto-natives dismissively call "dino coins" - those prehistoric remnants of crypto's past like XRP and TRX.

And even Binance’s CZ thought memecoins were getting weird.

The question on everyone's mind: Is this the end of the prophesied supercycle, or just a pause in the programme?

A Tale of Three Cycles

To understand where we are, we need to understand where we've been.

The memecoin story isn't just about funny dog pictures - it's about the evolution of crypto culture itself.

The first cycle (2017-2018) was Dogecoin's solo show. From a modest $23 million market cap, DOGE surged 8,700% to hit $2 billion. This wasn't just a price movement - it was proof that internet culture could create real market value.

The second cycle (2020-2021) was the pandemic-fuelled retail trading boom. With everyone locked at home and stimulus checks in hand, DOGE reached an almost unbelievable $88 billion market cap. More importantly, it spawned imitators.

Shiba Inu emerged from literally nothing to peak at an $0.000081 price point - a return that required scientific notation to express.

Read: Why Dogecoin Refuses To Die 🐕

Now we're in the third cycle, which kicked off in March 2024. The total memecoin market cap has grown from $20 billion to $110 billion - an impressive run by any measure. But something feels different this time.

The Evolution Problem

The challenge facing memecoins today isn't lack of interest - it's oversupply.

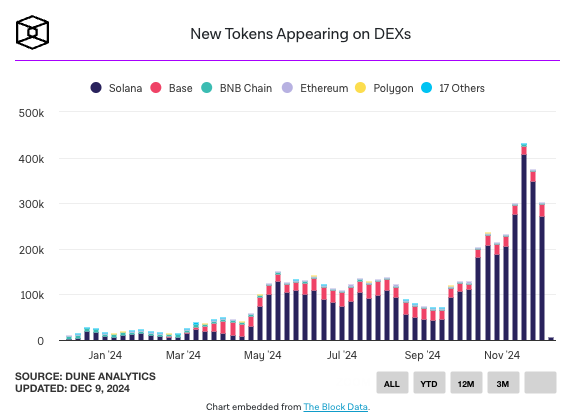

Thanks to platforms like Pump.fun and similar launchpads, anyone can create a token with a few clicks.

The result? Solana accounting for around 348,000 new tokens out of around 375,000 launched across all tracked chains in the month of November - around 92% of the total.

This democratisation of token creation has a downside: when everything's a meme, nothing is.

Is the market is suffering from "meme fatigue"?

Or the very nature of what constitutes a "memecoin" is changing.

The Old Guard's Revenge

While fresh memes struggle to maintain momentum, crypto's old guard is having a renaissance. XRP surged over 420% in a month. Tron's TRX is hitting all-time highs. Even Cardano's ADA and Chainlink's LINK are showing remarkable strength.

Read: The Cardano Underdog Is Awake 😳

The reason might be counterintuitive: after years of watching "utility tokens" pump and dump, traders have developed a strange preference for older projects - even if their utility claims are questionable.

These "dino coins" represent something new memecoins can't replicate: survival.

They've weathered multiple crypto winters, regulatory challenges, and market cycles. In a weird way, their longevity has become their utility.

And there’s the community factor.

Block that quote 🎙️

Kun, a pseudonymous trader

"The difference is XRP holders truly believe in the fundamentals, they aren't buying them as social cults."

This speaks something crucial about the current market dynamic. While memecoin communities formed around shared jokes, "dino coin" communities built themselves around shared beliefs in actual (whether realistic or not) use cases.

Automated Trading Made Simple

Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace.

Take your emotion out of the equation. You don't need to be an expert to trade like one. Join the Social Trading revolution.

In crypto's attention economy, belief might be more valuable than humour.

Take XRP's community, for instance. Through years of SEC litigation and market uncertainty, they've maintained an almost religious conviction in their token's future role in global finance. Whether that belief is justified is almost beside the point - the belief itself has become the value.

Read: XRP Leads the Altseason 🪙

The Tech vs Meme Divide

Mahmudov's original thesis rested partly on the idea that retail investors don't care about technical sophistication.

But the success of "dino coins" suggests something more nuanced: while retail investors might not care about technical details, they do care about narratives of utility, even if those narratives are more aspirational than real.

The Evolution Solution

But declaring the memecoin supercycle over might be premature. What we're seeing could be evolution rather than extinction.

Take GOAT, for instance. What started as a memecoin has become tied to the Truth Terminal AI phenomenon. Or ANON, which provides actual utility for anonymous Farcaster posting. These examples suggest successful "memecoins" might need to be more than just memes.

Read: The Goatse Singularity 🐐

This hybrid approach - combining meme culture with actual utility - might be the future. After all, even Dogecoin, the original memecoin, is working on adding smart contract functionality.

The Platform Effect?

The evolution of memecoins is also being shaped by the platforms they're built on. Solana has emerged as a major player in this space, with its low fees and high speed making it ideal for memecoin trading.

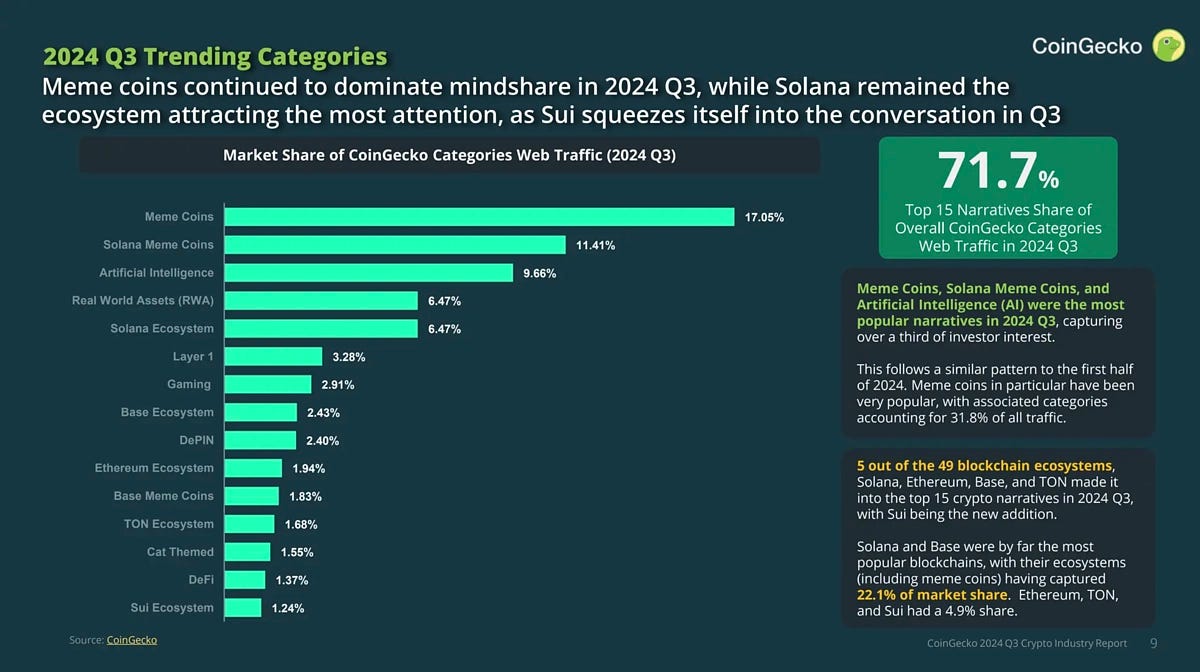

According to CoinGecko's Q3 2024 report, Solana memecoins and general memecoins combined accounted for 28% of their category web traffic - far outpacing traditional sectors like DeFi (1.37%) and the Ethereum ecosystem (1.94%).

The Evolution Mechanism

What's happening in crypto right now isn't just about memes versus utility. It's about the democratisation of token creation itself.

Platforms like Pump.fun and Clanker have made launching tokens as easy as posting on social media. As

David Hoffman notes, "Each bull market brings a new mechanism."

2013: Bitcoin forks

2017: ERC-20 tokens

2021: NFTs

2024: One-click token launches

This progression isn't just about technology - it's about accessibility. Every new wave makes it easier for the average person to participate in token creation.

A Week of Memecoin Meltdowns

The End of Fun in the UK

The UK's Financial Conduct Authority (FCA) just dropped the hammer on Pump.fun, the platform that turned memecoin creation into a one-click affair.

After issuing a stark warning about the platform operating without authorisation, the Solana-based token factory has now blocked all UK users.

Though some users are already sharing VPN workarounds, this marks the first major regulatory pushback against the democratisation of token creation.

The irony? The platform that generated over $288.4 million in revenue since January has been stopped not for the quality of its tokens, but for the simple fact that making money shouldn't be too easy.

When Pet Love Goes Wrong

Mark Longo's story reads like a crypto tragedy in three acts.

First, his pets Peanut (a squirrel) and Fred (a raccoon) were euthanised by state officials.

Then, he criticised crypto traders for making money off his tragedy through the PNUT token. Finally, he launched his own token - JUSTICE - which promptly collapsed 99%.

The twist? After JUSTICE's failure, Longo tried again with a new token (JFP), only to watch it drop 67% since creation. Sometimes, the call is coming from inside the house.

Read: The P'Nut Story 🐿️

The Hawk That Didn't Soar

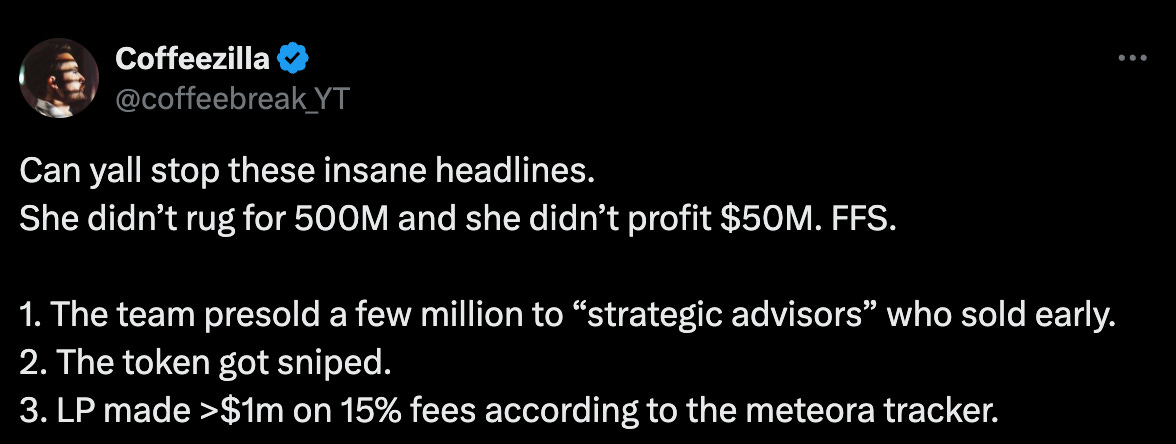

When internet star Hailey Welch (aka Hawk Tuah Girl) launched her HAWK token, it briefly touched a $500 million market cap. Thirty minutes later, it was worth less than $50 million. The culprit? A combination of insider trading, bot sniping, and an unlocked "strategic allocation" that made up 17% of the supply.

While Welch's own tokens are locked for a year, the $2 million in launch fees went straight to a mysterious Cayman Islands foundation. As YouTube investigator Coffeezilla notes, there's plenty to criticise here even without the exaggerated headlines.

The real lesson? In the gold rush of the memecoin supercycle, the only guaranteed winners are the shovel sellers - until the regulators come calling.

The Token Dispatch View 🔍

So, is the memecoin supercycle over? The answer is more nuanced than a simple yes or no.

The pure meme play - launching tokens with nothing but a funny image and hope - might be reaching its limits. But the broader trend of community-driven tokens with elements of both utility and meme culture could just be getting started.

As Mahmudov himself notes, "It's not just about getting rich - memecoins give people family, identity, community, friendship, and a sense of purpose."

Maybe the next phase of the cycle isn't about abandoning memes, but about building something more substantial around them. For those still betting on memecoins, the landscape demands a new approach.

Look for hybrid tokens that combine meme appeal with actual utility or strong narratives

Pay attention to platform effects - Solana's ecosystem seems particularly fertile ground

Watch for strong, engaged communities that persist beyond the initial hype

Consider the "dino effect" - sometimes longevity itself can be a form of value. Perhaps the most interesting aspect of this current market phase is what it tells us about the maturation of crypto culture. The industry might be growing up, but it's not growing boring.

Instead, we're seeing a fusion of the serious and the silly, where tokens can be both jokes and genuine vehicles for value creation. The next wave of successful projects might be those that manage to walk this line most effectively.

Former Binance CEO CZ called memecoins "weird" – and maybe that's exactly what they need to be. In a market where everything is becoming institutionalised, maybe there's still room for a little weirdness.

After all, in crypto as in evolution, it's not the strongest that survive, but the most adaptable.

The question isn't whether the memecoin supercycle is over - it's whether memecoins can evolve fast enough to keep it going. And judging by the current state of the market, that evolution is already underway.

Welcome to the post-meme era, where the joke might just be on the skeptics.

The Surfer 🏄

Venture capitalist Felix Hartmann is sceptical about the sustainability of the current altcoin rally and suggested that it may be "tapped out for now" due to increasing profit-taking by institutional investors. Despite impressive gains among altcoins, he warns that a shift in momentum could lead to sharp sell-offs in the market.

NFT sales kicked off December with $187 million in weekly volume, surpassing November's peak of $181 million. Ethereum led the charge with $92 million in sales, driven by strong performances from collections like Pudgy Penguins, which saw a 346% increase to $25 million, and CryptoPunks, which recorded $16.5 million in sales.

Over 400 million cryptocurrency wallets now hold a non-zero balance, signalling a significant rise in crypto adoption as the market enters a bullish phase, according to Chainalysis.

The US Senate Banking Committee is set to vote on December 11 regarding the renomination of SEC commissioner Caroline Crenshaw, a known critic of cryptocurrencies, which has raised concerns within the crypto industry.

El Salvador's President Nayib Bukele announced that the country's unrealised gains from Bitcoin investments have surpassed $300 million as BTC recently broke the $100,000 milestone. Since adopting Bitcoin as legal tender, El Salvador has invested nearly $270 million in BTC, now holding around 6,180 BTC.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋