Is The Dumb Money Back? 💸

Roaring Kitty returns, meme stocks and memecoins back into focus. Crypto hedge fund's winning memecoin strategy. Tether hits back at Ripple over CEO's remarks. Hong Kong crypto ETFs record outflow.

Hello, y'all. Guess who's back, back again?

Shady's back, tell a friend | You waited this long, now stop debating … 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Memecoins just need a reason to always go back up.

This time it’s the return of Roaring Kitty.

Roaring who? Keith Gill, the man behind the GameStop short squeeze of 2021.

After a two-year hiatus, Gill's Twitter account revived with a simple picture. No mention of GameStop, but …

This was enough to send shockwaves through the market.

GameStop’s stock to spike more than 100%, closed over 70%.

DOGE and SHIB up about 8%.

PEPE rallied 34%, hit all time high - trading volume jumped 245%.

The Memecoin KITTY went up over 6000%.

Stocks related to Gill and other “meme stocks” also rallied.

Solana-based meme coin named GME skyrocketed 1,900%.

Lucky trader: A trader even turned $3,000 into $94,000 with KITTY.

Read: LookOnChain insightful thread on TheRoaringKitty.

Why the Frenzy? People see a potential repetition of history.

The History

Keith Gill, better known as Roaring Kitty from his YouTube days or DeepFuckingValue on Reddit, went from a finance enthusiast to a key figure in the 2021 GameStop trading frenzy.

Early Ambitions: Initially, Keith aimed for a career in track and field, even getting a shoutout in Sports Illustrated. However, an injury pivoted his path from athletics to finance.

Finance Career: After his track dreams ended, Keith moved into the financial world, securing a position at MassMutual. His interest in stocks grew, leading him to explore trading on his own.

Reddit Fame: Keith joined Reddit and started sharing his stock picks under the alias DeepFuckingValue. He focused on companies he believed were undervalued, like GameStop.

GameStop Surge

Keith was a vocal advocate for GameStop, posting bullish arguments when most of the market had given up on the retailer.

His posts gained traction on the r/WallStreetBets subreddit, inspiring a wave of retail investors to buy into GameStop.

This surge led to a "short squeeze," where the stock's price skyrocketed, severely impacting hedge funds that had bet against the company.

The Memecoin Craze

The meme stock frenzy wasn't the only market phenomenon Gill influenced.

Remember Dogecoin's meteoric rise (and fall) in 2021?

Retail investors, fuelled by the meme stock craze, piled into Dogecoin, sending its price soaring from fractions of a cent to over $0.50.

Congressional Testimony

As the situation gained media attention, Keith was called to testify before Congress, where he emphasised his role as an individual investor sharing his analysis, not a market mover.

There’s even a movie based on this whole thing: Dumb Money

Keith then stepped away from social media, and now, he returned after 151 weeks.

Solana is flooded with memecoins

Following Gill's cryptic meme tweet, 14,500 memecoins launched on pump.fun in a single day.

GME Stonks, GameOver, and KiethGillWifHat are just a few of the GameStop-themed tokens riding the hype wave.

Note: Pump.fun lets anyone create a meme coin for a measly $3, making it a meme coin minting factory.

Read: Is anyone having fun on Pump.fun?

What does this mean for crypto? GameStop's rise suggests retail traders are back in the game, potentially eyeing crypto next. Crypto memecoins thrived during the last retail surge, and some see a repeat on the horizon.

Block That Quote 🎙️

Rennick Palley, founding partner of Stratos

“But it was unique in that… it had a hat.”

That’s the winning strategy of crypto hedge fund, Stratos, while buying the hottest meme coin, Dogwifhat (WIF).

It not just a hat: “It is literally everything. Because it would just be shit [without the hat].”

300x Returns: While other hedge funds were busy crunching numbers, Stratos scooped up WIF at $0.01. Now, it's trading at a whopping $2.76.

Stratos isn't just a one-hit wonder with WIF. They're bullish on meme coins in general, predicting a "memecoin supercycle."

Palley offers an explination

“I think meme coins as an asset class within crypto are going to be probably the best performing sector this cycle. So we're going to continue to have an overweight position in memes as a category. But we're not going to increase the amount of risk that we take on trying to find the next WIF.”

No missing out on the biggies

“Let's not over leverage, let's not spend all our time punting on memes and then miss the boat on Bitcoin, ETH and SOL—which is actually what's driven most of our performance ... The key in crypto is survival. So that's our focus.”

Tether And Ripple Reigniting Feud?

Ripple CEO Brad Garlinghouse threw the first punch, claiming on the World Class with Chris Vasquez podcast that "the US government is going after Tether … that is clear to me.”

He offered no real evidence to support this claim.

Tether wasn't going to take this lying down. They responded by calling Garlinghouse "uninformed" and pointing out that Ripple is already facing an SEC lawsuit.

And then Garlinghouse had to reply

Tether Troubles

Scrutiny from Regulators: In October 2023, US Senator Cynthia Lummis and Representative French Hill raised concerns about Tether's potential support for terrorism.

Department of Justice Probe: A US Justice Department investigation is reportedly looking into Tether's handling of crypto-linked funds with banks.

Reserve Transparency Issues: Tether has been criticized for not being fully transparent about the assets backing USDT. They've recently started quarterly audits to address this.

CFTC Fine: In 2021, Tether paid a $41 million fine for misleading customers about their reserves.

The Background

Ripple is entering the stablecoin market with a launch planned for later this year. Their coin will be backed by cash and treasuries, similar to Tether and USDC.

Tether, the current leader, is joining forces with blockchain analysis firm Chainalysis to fight crime. Chainalysis will provide Tether with tools to identify suspicious transactions and wallets potentially linked to illegal activities.

In the Numbers 🔢

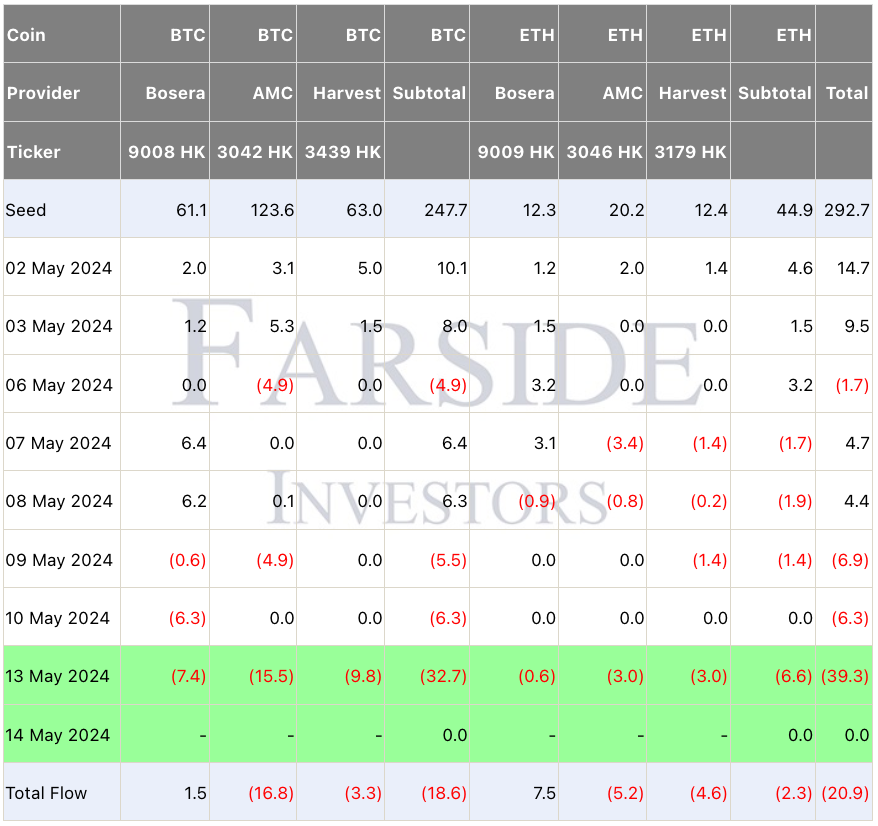

$39 Million

That’s Hong Kong crypto ETFs outflows in a single day (May 13th).

Two weeks of gains gone in a day.

Bitcoin ETFs: Bosera, ChinaAMC, and Harvest Global's Bitcoin ETFs saw a combined outflow of $32.7 million. ChinaAMC's Bitcoin fund was the biggest loser: $15.5 million.

Ether ETFs: Spot Ether ETFs from the same issuers saw $6.6 million in net outflows. Harvest Global and ChinaAMC each lost $3 million.

By May 10th, these ETFs had managed a total inflow of $18.4 million. But Monday's bloodbath turned that into a net outflow of $20.9 million.

Small fry compared to the US: The US boasts 11 spot Bitcoin ETFs with over $50 billion in assets under management. Hong Kong's six spot ETFs (Bitcoin and Ethereum) have a combined value just over $250 million.

US Blocks. US Seizes.

The US is taking a tougher stance on crypto, now for national security.

Chinese Crypto Miner Blocked: President Joe Biden banned a Chinese-owned crypto mining firm from operating near a Wyoming Air Force base, citing potential security risks. The company had recently acquired property just one mile from the base.

North Korean Crypto Accounts Seized: A US court froze 279 North Korean cryptocurrency accounts, likely used by hackers wielding new malware. North Korea uses new malware, "Durian," to bypass sanctions and the funds support North Korea's nuclear programs.

The Surfer 🏄

Chinese authorities shut down a $295 million underground bank using cryptocurrency for illegal currency exchange. Six suspects were arrested for exploiting crypto anonymity to convert yuan to won.

Japanese investment firm, Metaplanet, is hedging against a weak yen by making Bitcoin its reserve asset. This comes as Japan faces economic struggles with high debt and low interest rates.

El Salvador is now publicly sharing its Bitcoin holdings data through a special area called a mempool. This lets anyone see how much Bitcoin they hold, which is currently over $352 million worth. The government is buying more Bitcoin every day as part of a long-term plan.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋