Hello y’all! Welcome to Wednesday’s crypto dose.

The US regime change brought in a lot of crypto winners. One stands out - Ripple.

XRP issuer's fairy tale run keeps getting better - or does it?

The wins keep stacking up: RLUSD's successful launch, a 485% price surge of XRP’s price in the last year with about 50% rise this month alone, and growing whispers about potential inclusion in America's strategic crypto reserve.

It’s the last one there - whispers around XRP’s inclusion in the national digital assets stockpile that’s gotten the crypto Twitter talking.

In today’s Token Dispatch we look at

Washington debate on which digital assets should be included in the stockpile

CEO Brad Garlinghouse’s close proximity to Trump administration

What’s irking Bitcoin maximalists

Massive XRP sell-offs by the insiders at Ripple

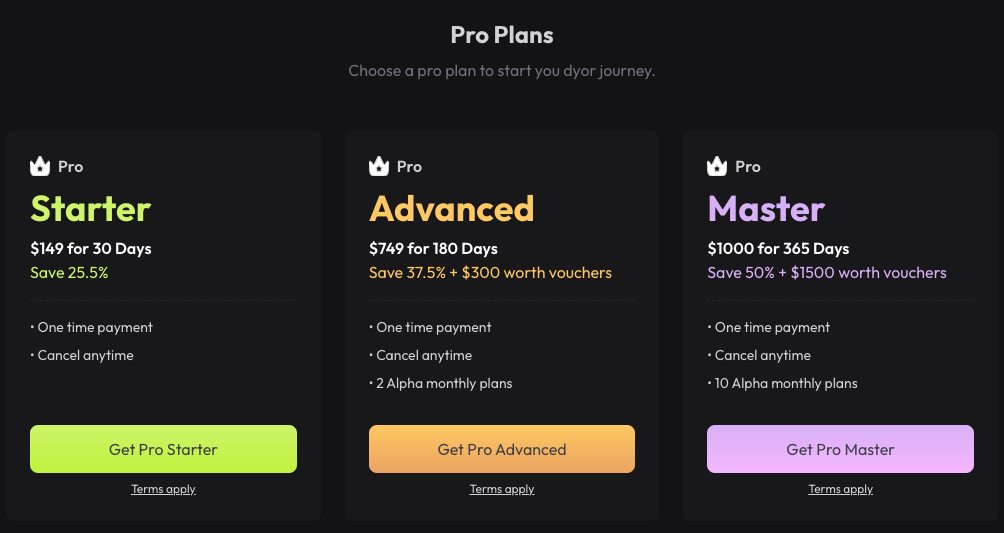

One Simple Platform. Everything You Need.

Dyor offers blockchain data and features for digital asset trading strategies, risk management and on-chain research.

Aggregated Fundamental Data

Asset Model Price

Crypto Trading Datasets

Alpha Telegram Bot

Data AI Agent (Upcoming)

Get your crypto alpha with Dyor Pro.

Staking Claim on Stockpile

Less than 24 hours ago, Ripple Labs chief legal officer Stuart Alderoty said in an X Spaces discussion that he was hopeful that the potential next head of the US Securities and Commissions Exchange (SEC) will dismiss civil suits against crypto firm.

Amid this victory lap, Ripple is eyeing a bigger gameplay.

While Washington is busy debating which digital assets should be included in the government's stockpile, Ripple is looking to grab a share of the pie.

This has got some of the Bitcoin maximalists upset and charged up at the XRP advocates.

Some for rightly concerning reasons, while some not so logically based.

Upgrade to paid to get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

What’s Cooking?

It all started with XRP’s rise coinciding with Ripple’s CEO Brad Garlinghouse’s growing proximity with Donald Trump.

The Bitcoin maximalists army didn’t like the game Garlinghouse was playing to get a seat for XRP in the government’s digital asset stockpile.

They charged at Ripple - and in some cases at Garlinghouse, too.

Vice-president of Research at Bitcoin mining firm Riot Platforms accused Ripple of “aggressively lobbying” against the strategic Bitcoin reserve.

Even went on to spell-check Garlinghouse when he entered the conversation.

While Rochard’s interest in Bitcoin is obvious, he is not wrong about throwing around “$ millions at politicians”.

Ripple, along with Coinbase and Andreessen Horowitz, led a $300 million super PAC campaign.

Then, the $5 million contribution to Trump's inauguration fund.

Read: Ripple Rides Trump Wave 🌊

Others joined the party.

"Ripple is actively spending millions of dollars trying to undermine a strategic Bitcoin reserve in the United States of America. This is not just an attack on Bitcoin, but on principles of transparency," Bitcoin maximalist Jack Mallers of Zap said in a video posted on X.

Few others showed concerns around insider movement and massive XRP token sell-offs by insiders.

Less than two weeks ago, Ripple co-founder Chris Larsen moved $60.5 million worth of XRP to unknown wallets, while another whale transferred over 31 million XRP to Coinbase.

The timing is particularly notable - just days before Trump's inauguration and amid heated debates about which cryptocurrencies should be considered for the national digital asset stockpile.

What do these transfers mean? Centralisation concerns.

The large insider movements highlight Bitcoin advocates' core argument: While Bitcoin's creator remains anonymous and uninvolved, XRP's close ties to Ripple and its executives' significant holdings present potential risks for a national strategic reserve.

The stark contrast between both …

Bitcoin: No central authority, no insider selling

XRP: $60.5 million moved by co-founder amid key policy discussions

CFTC relationship: Kalshi got approval, Ripple settled

Corporate influence: Growing concerns about concentration

TL;DR - Bitcoin advocates on Twitter allege one thing, Ripple lobbied Trump’s team to remove the word ‘Bitcoin’ from his crypto executive order.

Ripple’s Response

CEO Garlinghouse wanted the ecosystem to “work together” instead of “tearing “each other down”. Called maximalism “the enemy of crypto progress”.

Allegations of political lobbying? Completely skirted the topic.

The Bitcoin troop charged back at him.

Riot Platforms’ Rochard said “reserves and stockpiles should be strategic (and) based on the needs of the nation aligning with specific properties of assets.”

Blockstream’s Samson Mow wasn’t buying any of Garlinghouse’s call for brotherhood.

“We have no goals in common because our goal isn’t to fleece retail investors with blockchain mysticism,” Mow replied to Garlinghouse’s post.

It’s understandable for Bitcoin maximalists having vested interests to bat for a 100% Bitcoin-only stockpile. But not all are against the idea of having a mix of cryptos.

Investor and Bitcoin maxi Fred Krueger is one of them.

Despite being a Bitcoin advocate, Krueger looks at the practical possibilities under Trump’s administration.

Where’s the Government Heading?

There's a reason Trump's recent executive order referred to a "digital asset" stockpile rather than specifically mentioning Bitcoin.

The administration wants to keep its options open - but recent insider movements might narrow those options.

Moreover, the cat and dog fight between the two factions can make decision-making complicated for the representatives.

“It makes our job almost impossible if they're not on the same page. Man, I hope they can speak with one voice,” said Sen. Cynthia Lummis, who has been championing for a government-held Bitcoin reserve.

Token Dispatch View 🔍

The battle over America's digital asset reserve reveals a fundamental tension in crypto's transition to mainstream finance. While Bitcoin maximalists argue for ideological purity, Ripple demonstrates that in Washington, relationships often trump technology.

However, both sides are missing the bigger picture. A national digital asset reserve is beyond technical specifications or political connections. It has to factor in government’s strategic flexibility in an increasingly complex financial world.

Bitcoin's strength lies in its decentralisation and immutability, while XRP offers institutional familiarity and cross-border efficiency. The decision of inclusion will eventually boil down to whether America's interests are best served by diversification.

The insider selling at Ripple raises valid concerns, but it also highlights an important truth: the crypto industry is maturing beyond ideological battles. Just as the Federal Reserve holds multiple asset classes, a digital reserve might benefit from different tools for different purposes.

The next few weeks will test whether crypto's old guard and new establishment can find common ground.

2025 may be remembered not for which crypto made it into the reserve, but for whether the industry was mature enough to have that conversation constructively.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.