June Rollercoaster 🎢

Macro economics jitters for crypto. Bitcoin goes down, comes back up. Donald Trumps wants all the remaining Bitcoin made in the USA. ZKsync to airdrop 3.6 billion ZK tokens. Tether’s $1B tech fund.

Hello, y'all … hearts will go on, always 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Bitcoin fell over 5% on June 11, touching around $66,000 levels.

Bitcoin dipped below $67,000 as the US market opened on June 12.

Bitcoin is back around $70,000 early US hours.

Talk about roller coaster, eh? Always a ride.

This mirrors a classic pre-inflation report jitters and Fed meeting anxiety.

Liquidations? The Bitcoin tumble and rise isn't kind to leveraged traders. If June 11 got the longs, on June 12 shorts got cornered.

Liquidation in the choppy market is getting them all.

The big day

The Consumer Price Index (CPI) and Federal Open Market Committee (FOMC) announcements are scheduled for June 12 – keeping investors on their toes.

One of them is through

The US announced that the unadjusted CPI annual rate in May was 3.3%, which was expected to be 3.4% and the previous value was 3.4%.

The unadjusted core CPI annual rate in May was 3.4%, which was expected to be 3.5% and the previous value was 3.6%.

The core CPI annual rate was the lowest since April 2021.

What happened? The US CPI unexpectedly fell in May due to a drop in gasoline prices. The market expects the Fed to cut interest rates by 25 basis points in November with a 100% chance. A rate cut in September remains in doubt.

The FOMC is expected to maintain its current stance without any rate cuts or changes to quantitative tightening.

What’s expected? Market is positioning for an upside surprise. A all-in-order CPI data and neutral FOMC outcome can push crypto market to retest its highs.

What are we looking at?

ETFs bleed: Bitcoin ETFs witnessed a net withdrawal of over $64 million on June 10 and 200 million on June 11, the first time this has happened since late May - ends 19 days inflow streak.

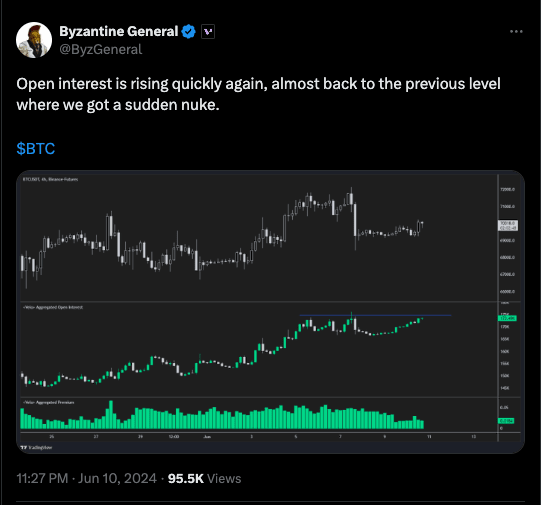

Open Interest: This metric, which reflects outstanding futures contracts, recently hit a record high of $37.6 billion in June.

A rising OI typically indicates increased leverage and speculation in the market, which can lead to sharp price movements in either direction.

While OI has decreased slightly with the price drop, it still hovers above $35 billion.

Bitcoin has been consolidating below its all-time highs for almost three months.

Is it a big deal? Some traders see this as a potential buying opportunity near the $64,000 support level. Some call it just "noise" within the established trading range.

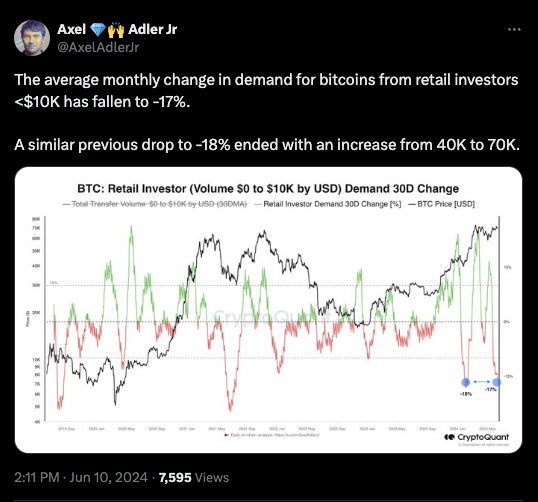

Retail demand slumps

Bitcoin retail investors are sitting on their hands, with demand dropping to a 5-month low. Back in January, we saw a similar drop in demand followed by a 75% Bitcoin price surge - coincided with approval of spot Bitcoin ETFs in the US.

Whale movement

A Bitcoin whale holding 8,000 Bitcoin (over $536 million), woke up from its 5.5-year slumber and moved its entire stash.

Bitcoins from a Coinbase cold storage wallet, where it sat since December 2018.

Transferred to a Binance deposit address, speculation of a potential sell-off.

There were no test transactions before moving this massive sum.

Block That Quote 🎙️

Donald Trump, US presidential candidate.

“We want all the remaining Bitcoin to be MADE IN THE USA!!! It will help us be ENERGY DOMINANT!!!”

Trump really wants crypto votes.

Trump hosted a meeting with executives from US crypto mining firms at his Mar-a-Lago residence.

Meanwhile, president Joe Biden has proposed a 30% electricity tax on Bitcoin miners in the US.

TeraWulf board member Amanda Fabiano

“Our industry has faced an enormous amount of political struggle, fuelled by misinformation and misguided narratives … Our industry needs politicians that are interested in learning about the benefits of Bitcoin and Bitcoin mining.”

Trump also started accepting crypto to fund his presidential campaign and hosted a dinner for holders of his Mugshot NFTs.

Crypto odds of winning?

Where Are We With Ethereum ETF?

We are still stuck in waiting mode.

Companies submitted their initial applications (S-1 filings) on May 31st, expecting feedback from the SEC by June 7th.

As of June 10, two sources from different issuers confirm they haven't heard a peep.

The S-1 filings represent the second step in a two-act play for Ethereum ETFs.

The first act, the 19b-4 form approvals, concluded successfully on May 23rd.

This echoes SEC Chair Gary Gensler's previous statements about the approval process taking "some time."

The total timeline remains unclear, but one source anticipates at least two more rounds of revisions before the S-1 forms get the green light.

ProShares throws hat in the ring: Filed an application with the SEC, joining the queue. The SEC is currently reviewing ProShares' proposal, and the public has 21 days to submit comments. A final decision is expected by late July.

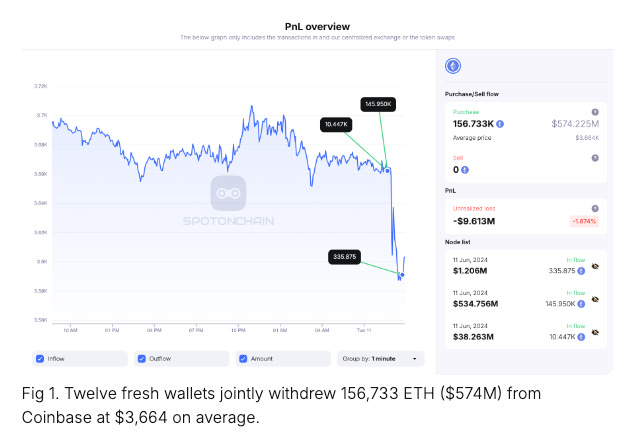

Big money moves in

Investors have been on a buying spree.

Scooping up $574 million worth of ETH in a single transaction.

That's 156,733 ETH withdrawn from Coinbase at an average price of $3,664 each.

Experts point to the dwindling supply of Ethereum on crypto exchanges as a potential explanation.

Data shows exchange reserves are at a 7-year low, suggesting a supply squeeze could be brewing.

This could be a major factor behind the recent buying frenzy, as some anticipate a price spike due to limited availability.

Read: Ethereum to $5k?🪁

In The Numbers 🔢

$1 Billion

Tether’s tech fund.

This move comes on the heels of a record-breaking $4.52 billion profit for Tether in Q1 2024, powered by by Bitcoin and gold holdings.

Invest in artificial intelligence (AI), alternative financial solutions, and biotech startups.

They've already sunk $2 billion into similar ventures over the past two years.

Offer invested firms access to powerful AI computing resources, game-changer for smaller players.

Reduce reliance on tech giants like Google, Amazon, and Microsoft by backing alternative solutions.

Unlike traditional VCs, no pressure startups to meet strict profit targets, but long-term strategic partnerships.

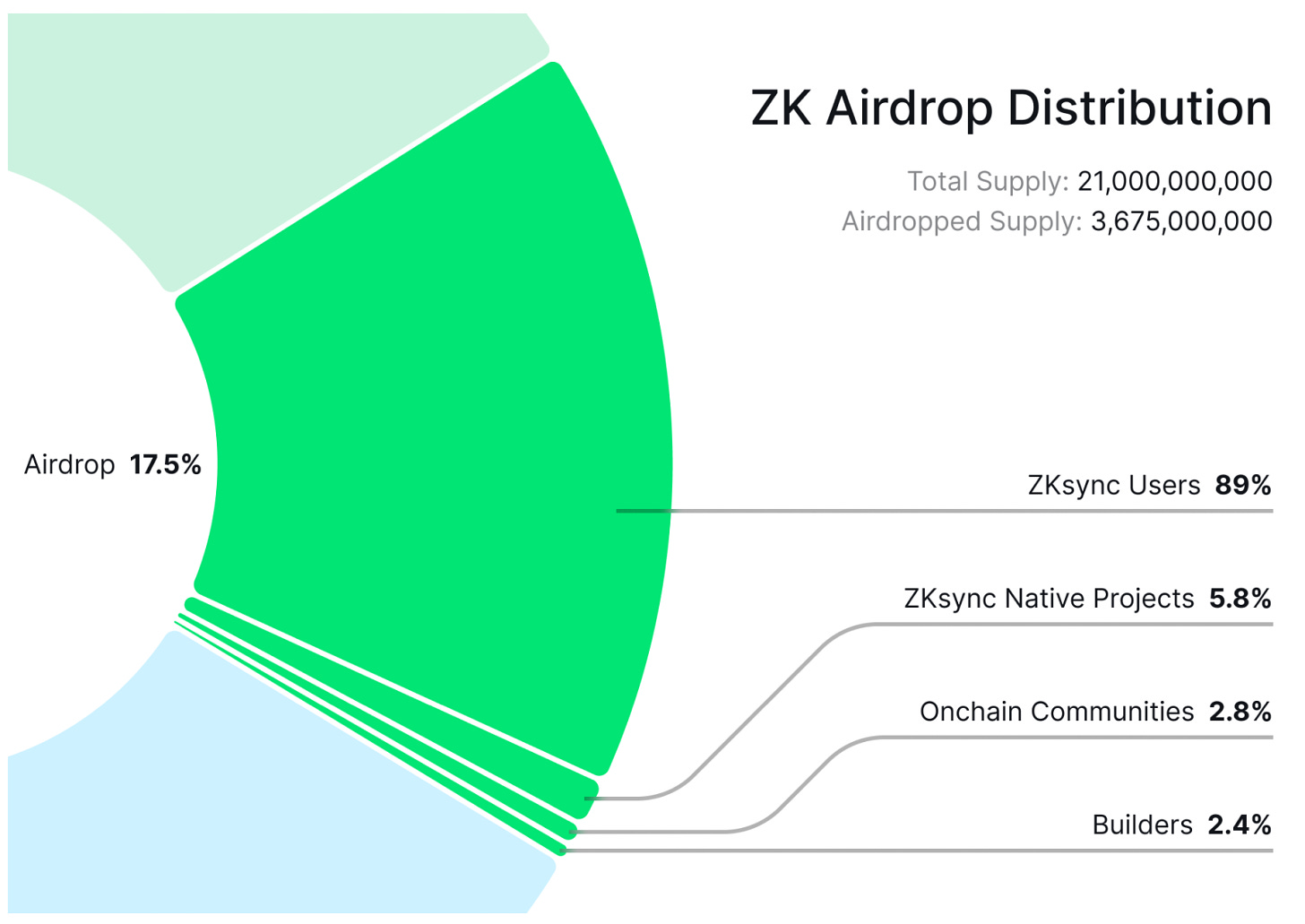

3.6 Billion ZK tokens Airdrop

ZKsync, a Layer 2 network for Ethereum is airdropping ZK tokens next week.

Read all about it on their blog.

Total Supply: 21 billion ZK tokens

Airdrop Amount: 3.675 billion ZK tokens (17.5% of total supply)

Start Date: Next week (around June 18th, 2024)

Claim Window: Until January 3, 2025 (users) & June 24, 2024 (contributors)

What is Zksync? ZkSync is a layer 2 protocol that scales Ethereum's security and values through zero-knowledge cryptography.

Scalability: Faster transaction times and lower fees.

Security: Enhanced security through anonymous transactions.

Privacy: Protects personal data and maintains confidentiality.

Complexity: Simplifies transaction verification and reduces implementation costs.

Withdrawal Speeds: Faster withdrawal speeds for enhanced user experience.

ZkSync took a snapshot of user activity on March 24th.

Rewards for those who actively participated in the network.

The more you participated, the bigger your airdrop.

Matter Labs is the company behind the ZKsync protocol, which consists of the ZKsync Lite and ZKsync Era blockchains.

Alex Gluchowski, the co-founder and CEO of Matter Labs, emphasised the ZK token’s utility. - “It’s not a financial thing … It’s really a governance token.”

Backlash from crypto industry watchers

Mudit Gupta from zkSync rival Polygon claims it lacks anti-bot measure.

The Surfer 🏄

Polygon launches $720 million Community Treasury for blockchain grants. Treasury will fund blockchain projects within Polygon and Ethereum ecosystems. Initial allocation of 35 million MATIC tokens (worth $25 million) for Community Grants Program.

MetaMask has launched a pooled staking service for Ethereum. The service is initially not available to users in the US and UK. Users can stake any amount of ether to contribute to Ethereum network security and earn rewards.

OKX cryptocurrency exchange is investigating multi-million dollar account thefts after SIM swap attacks. The theft occurred on June 9 through an SMS attack, resulting in the loss of millions of dollars of assets.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋