Kamala Takes Lead. Crypto On Edge 🤦♀️

Harris takes lead over Trump on Polymarket’s $572M prediction market. Harris rise makes BTC weak? Democrats like crypto? Trump back on X, Musk interviews him. Crypto startups raise $2.7B in Q2 2024.

Hello, y'all. If elections are beyond understanding, make sure Web3 isn’t. Check out Decentralised.co ✅

Long-form articles trusted by the best in Web3. Hundred hours of research into 20 minute articles. No propaganda. Only good writing. Right in your inbox 👇

The US presidential elections have been a lot about crypto.

Pro-crypto Republicans. Anti-crypto Democrats.

Why would it not be, when former president, and Republican candidate Donald Trump has been playing brothers in arms will the whole of crypto fraternity.

So vocal. So supportive. So in love. Crypto loves Trump.

Read: Hello Bitcoiners 👋

Something has changed though. Joe Biden out. Kamala Harris in.

Democrats seem to have slipped through the sidewalk to get ahead in the race.

Really? Oh yes.

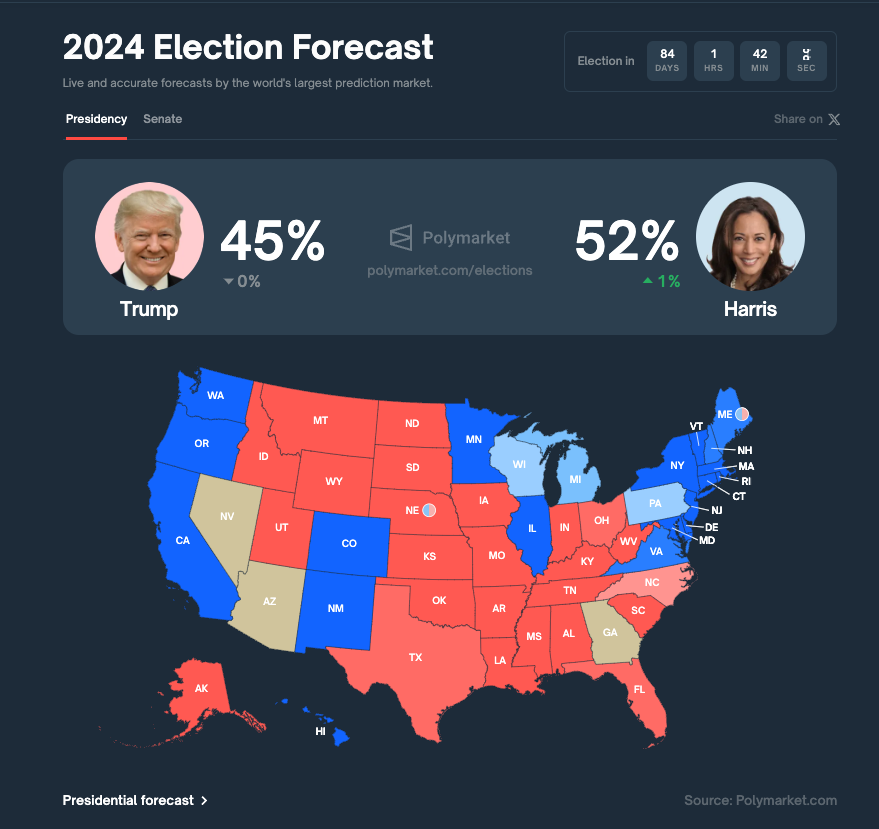

US Vice President Kamala Harris has surpassed Donald Trump in prediction market odds on Polymarket.

Her chances of winning the November election rising to 52%, while Trump’s odds have dropped to 46% from 70% in mid-July 2024.

When Harris announced her candidacy, it was only 33%.

Harris is ahead of Donald Trump in the key battleground states of Michigan, Wisconsin and Pennsylvania, according to a new New York Times/Siena College poll.

The US election remains the largest prediction market on Polymarket, currently reaching over $572 million in volume.

Read: The 7 Oddest Political Betting Pools on Polymarket

Harris's team has begun engaging with the crypto industry.

There is even a Crypto4Harris now, with Mark Cuban and Sheila Warren, rallying support for Harris within the crypto community.

Read: Crypto's $200M Election War Chest 🪖

Is that why Bitcoin is weak? Bernstein thinks so.

“Our interpretation of current market sentiment is that a Trump win is bullish, and Harris win is bearish (at least in terms of the immediate market reaction). The rising shares of Harris on Polymarkets has made the crypto markets nervous, with Bitcoin being range bound and unable to reclaim its previous June highs of $70,000.”

Can crypto still influence the US presidential election result? Paradigm thinks so.

Crypto venture capital firm Paradigm released a report that says that "making inroads with crypto owners" could boost Vice President Kamala Harris' chances of winning the 2024 US presidential election.

The report, based on polling data, found that plenty of "crypto voters are up for grabs" among Democrats, as the party's stance on crypto policy remains uncertain.

The Biden administration's crypto policies, including enforcement actions by the US SEC, have been criticised as "too hostile" by 21% of Democrats who don't favour Harris, according to Paradigm's survey.

The report estimates that 1-2% of Democrats could vote for Trump due to the Biden administration's hostility towards crypto.

Paradigm's surveys show that crypto owners are more likely to be Republicans, with 17% of Republicans currently owning crypto compared to 12% of Democrats.

Both Democrats and Republicans felt that the government should have a limited view into personal financial transactions, with 94% of Republicans and 72% of Democrats expressing this sentiment.

Trump is back

Ousted from Twitter, back on Elon Musk’s X.

So the two had a conversation. It was eventful even before it started.

The interview was delayed as Musk claimed massive DDoS attack. The Trump-themed memecoins went up with the build up, and then crashed after.

What did Trump say about crypto? Nothing.

About Bitcoin? Nada.

Tesla? Zilch.

Quite an event then, eh?

Unlock Web3 Insights with Decentralised.co

Three articles each week for people who like to stay updated on Web3 without being glued to Twitter. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

If you like stories with depth, insight & numbers on how the internet is evolving.

Written by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth

Block That Quote 🎙️

Pump.fun attacker Jarett Reginald Dunn (known as Stacc on X)

“My whole life has been a mental episode, so it’s hard to tell. My sister doesn’t think I’ll survive in prison, But I’ll be fine, I’ll be fine.”

That’s Mr Dunn. Telling it as it is?

Now, who is that?

Jarett Dunn drained approximately $2 million from Solana meme coin platform Pump.fun in May 2024.

He has pleaded guilty to fraud and transfer of criminal property at the hearing at London's Wood Green Crown Court.

The judge noted the offense likely constitutes a 1A category, carrying a minimum sentence of seven years in prison, though Dunn's guilty plea and other factors may influence the final sentence set for October 2024.

The court heard the direct loss was around $2 million, but consequential losses could reach nearly $12.8 million.

As a former employee, Dunn transferred 14,716 SOL to random wallet addresses, claiming the platform had "inadvertently hurt people for a long time."

Dunn has been diagnosed with mental health conditions, including schizoaffective bipolar disorder, and has been attending substance recovery meetings.

The judge granted him bail with conditions to support his mental health.

The incident drew mixed reactions, with some viewing Dunn as a Robin Hood figure for targeting a platform associated with pump-and-dump schemes.

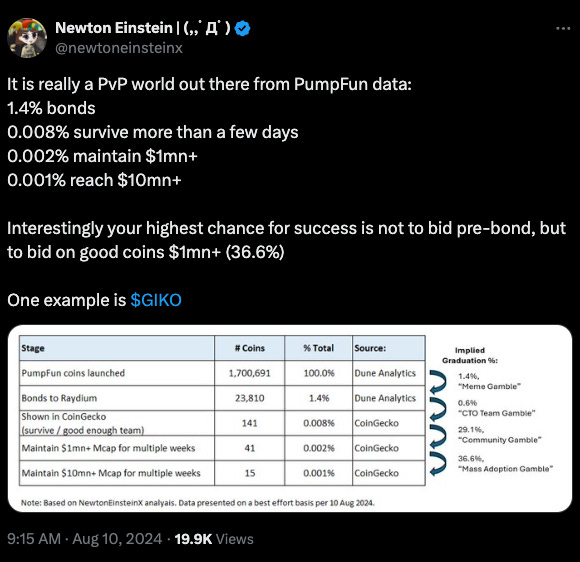

Newton Einstein's research on PumpFun

PumpFun has launched a total of about 1.7 million tokens. , of which 23,800 were listed on Raydium, 141 were listed on CoinGecko.

About 41 tokens could maintain a market value of more than $1 million for multiple weeks, and only 15 tokens can maintain $10 million.

Marathon to Raise $250M to Buy BTC

Marathon Digital (MARA) plans to sell $250 million in convertible notes through a private placement to fund Bitcoin purchases and general corporate purposes.

The notes will pay interest semi-annually and mature on September 1, 2031, with the interest and conversion rates set during the pricing process.

Marathon currently holds over 20,800 BTC, valued at approximately $1.2 billion

In Q2 2024, the company sold 51% of its mined Bitcoin to cover operating costs.

Purchased $100 million worth of Bitcoin to re-adopting a strategy to fully hold BTC on its balance sheet.

Following the announcement, Marathon's shares fell 3.2% in pre-market trading.

Argo Blockchain repays a $35 million loan from Galaxy Digital: The repayment was ahead of the schedule, and was facilitated through cash flow from operations and the sale of non-core assets. The stock shot up 7% on the Nasdaq.

Bitdeer reported a net loss of $17.7 million in Q2 2024: An improvement from $40.4 million in the same quarter last year, the stock fell 3.55% drop on Nasdaq. Despite the loss, total revenue increased to $99.2 million. The self-mining revenue rising significantly from $21.6 million to $41.6 million due to a higher hash rate.

TeraWulf reported a 21% decline in Bitcoin production: They mined 699 BTC in Q2 2024, while revenue rose to $35.6 million, slightly exceeding estimates. The company posted a loss of $0.03 per share, missing expectations, and noted a 243% increase in mining costs due to rising network difficulty and the recent Bitcoin halving.

In The Numbers 🔢

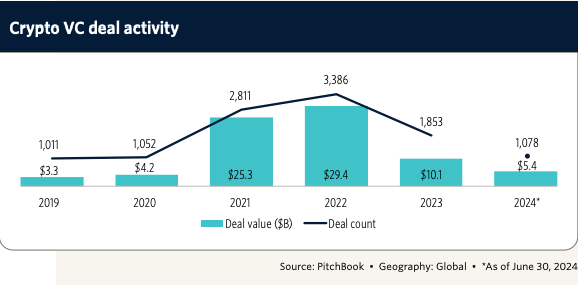

$2.7 billion

Value of venture capital funding in the crypto sector, according to PitchBook report.

2.5% increase in invested capital compared to Q1 2024.

12.5% drop in deal volume to 503 deals.

The report highlights

The focus shifted from higher deal volume in Q1 to larger investments in fewer companies in Q2 2024.

Infrastructure startups led the way in securing funding, with Monad ($225M Series A), Berachain ($100M Series B), and Babylon ($70M early-stage) raising significant rounds.

Blockchain-based social media platform Farcaster raised $150M in Series A, reaching a $1B post-money valuation.

Seed and early-stage valuations surged by 97% to $23M and 166% to $63.8M, respectively, while late-stage valuations declined by 36% to $40.8M.

$650M Fraud Charges Against NovaTech

The US Securities and Exchange Commission (SEC) has sued NovaTech and its founders, Cynthia and Eddy Petion, for allegedly defrauding over 200,000 investors of about $650 million through a crypto pyramid scheme from 2019 to 2023.

The lawsuit follows a similar action by New York Attorney General Letitia James, targeting the scheme's recruitment of primarily Haitian-American investors.

Six promoters are also charged with fraud, and the SEC seeks permanent injunctions, disgorgement of profits, and civil penalties.

Martin Zizi, one promoter, has agreed to a partial settlement involving a $100,000 civil penalty.

The Surfer 🏄

El Salvador has secured a $1.62 billion investment from Turkey's Yilport Holding to develop its seaports for the Bitcoin City project. The investment is expected to create thousands of jobs and enhance local infrastructure as the country continues to strengthen its cryptocurrency initiatives.

Japanese investment firm Metaplanet Inc. announced the purchase of an additional 57.1 bitcoin worth $3.3 million, bringing its total holdings to 303.095 BTC. The Tokyo-listed firm secured a $6.8 million loan last week to expand its crypto investments amid a 600% surge in its stock price this year.

DBS Bank has launched a pilot for "DBS Treasury Tokens" in collaboration with Ant International. To enhance treasury and liquidity management through its permissioned blockchain. This initiative seeks to reduce intra-group transaction settlement times from days to seconds.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋