Hello dispatchers!

Memecoins made big play last week. The tremors are still on. Why would it not be when the head of states go down the launch-and-dump route. This time is was $LIBRA.

This time it was another president absolving himself of the responsibility. Donald Trump then, Javier Milei now. The fire was then fuelled by shocking confession of the modus operandi by the mastermind behind all of this.

Today, we're diving into the this saga: Solana’s decentralised exchange (DEX) Meteora co-founder Ben Chow's dramatic resignation. The LIBRA scandal that wiped out $4.4 billion in market value and left Argentina's president facing fraud charges.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

Meteora-Libra Connection

The resignation came after a whirlwind weekend that saw the controversial $LIBRA token implode, taking with it not just billions in market value, but also the reputation of several key industry players.

Read: When Presidents Play With Memes 🎮

What started as a memecoin crash quickly unravelled into something far more complex. At the centre of the storm was Meteora's relationship with Kelsier Ventures, particularly its CEO Hayden Davis, who had become crypto's most controversial token deployer.

In a candid video interview with Coffeezilla that sent shockwaves through the industry, Davis admitted that the LIBRA team had sniped their own token at launch. He suggested this was business as usual, claiming pre-launch insider knowledge was "standard procedure" for major memecoin launches.

Read: 'I Have $100 Million And Nowhere To Run'👱🏻♂️

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

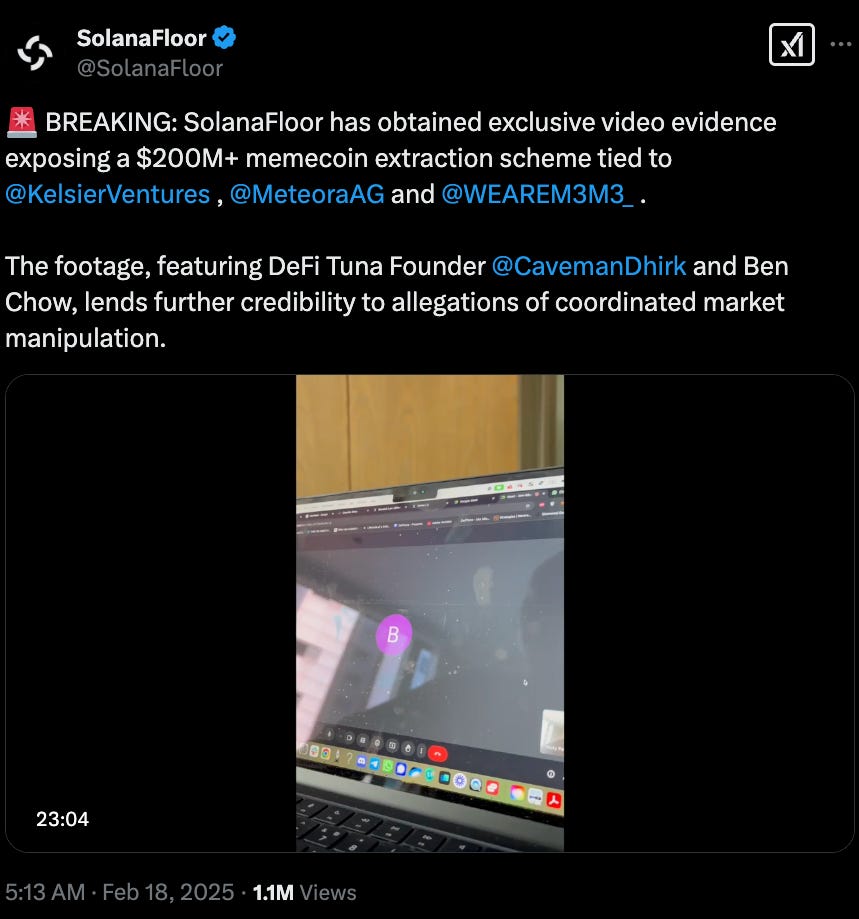

Chow initially maintained distance, stating Meteora's involvement was limited to "IT support." But a leaked video conversation with DefiTuna founder Dhirk would tell a different story.

"When we launched our new memecoin AMM platform in December 2024, I asked Hayden and Kelsier Ventures if they would be interested in launching a token on the M3M3 platform in order to provide an initial case study on how it worked," Chow admitted in his X post.

In the recording posted by SolanaFloor, Dhirk claimed to have witnessed Kelsier team members engaging in token sniping during his visit to Barcelona.

Chow's reaction was telling.

"I feel so sick, because I gave him Melania... I fucked up because I enabled the guy that should not have been enabled... I'm going to have to step down."

The revelation that Chow had personally referred Davis to multiple projects, including the controversial $MELANIA token, painted a picture of deeper involvement than initially acknowledged.

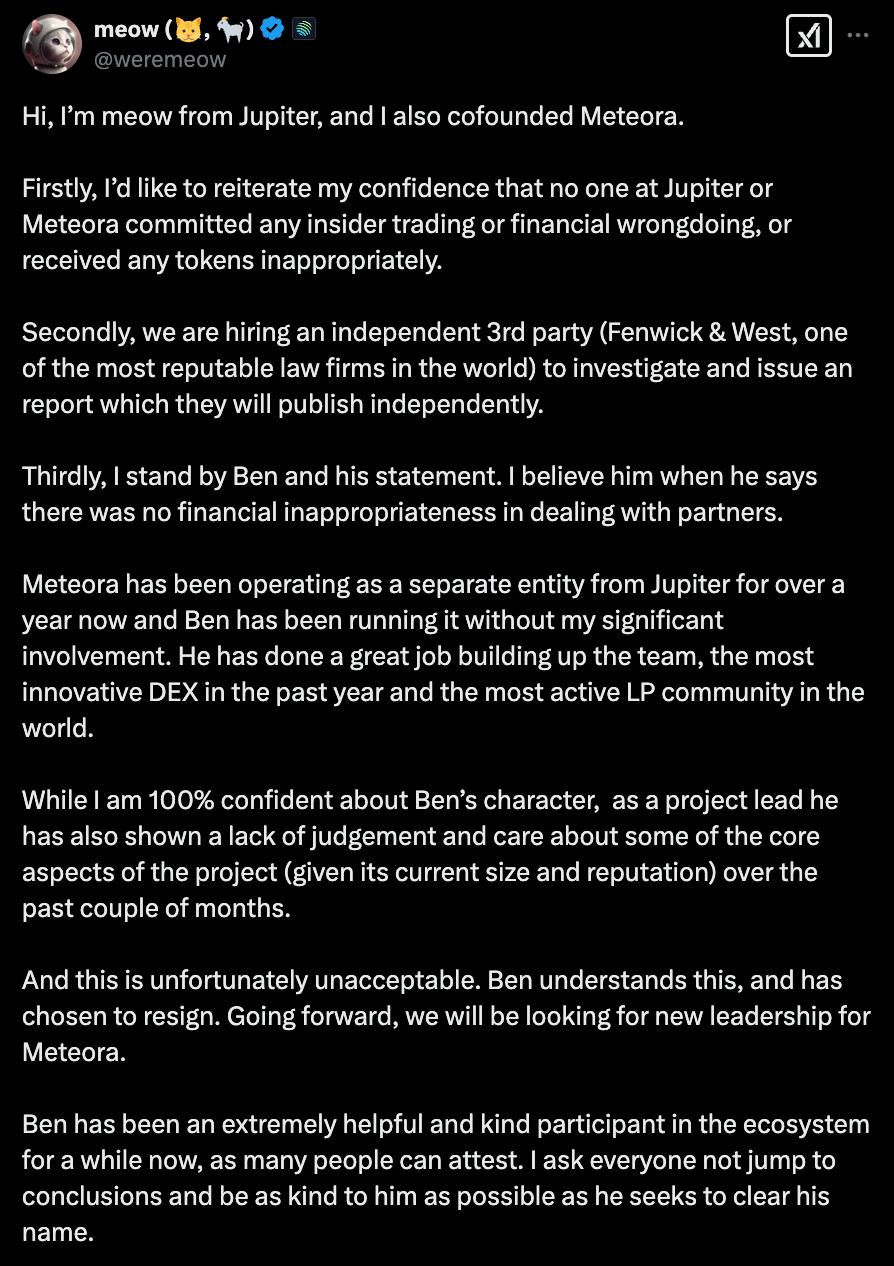

What to make out of Chow’s statement? Soon after his statement, his co-founder meow put out a statement on X.

When Meow, the pseudonymous founder of Jupiter DEX, announced Ben Chow's resignation late Monday night, it was the end of an era for one of Solana's most prominent DeFi platforms.

🎙 Block That Quote

Meow, co-founder, Jupiter and Meteora

"I stand by Ben and his statement. I believe him when he says there was no financial inappropriateness in dealing with partners... Ben understands this and has chosen to resign."

His lengthy statement addressed both the immediate crisis and broader industry implications.

"I would like to apologise for the recent stress caused to the team, the community & the ecosystem as a whole. Even though we hold very high standards for ourselves for token integrity at Jupiter, I want to apologise that we haven't held other projects in the space to the same standard."

The call to conduct an independent investigation signals how seriously the ecosystem is taking these allegations.

Although Meow co-founded both Jupiter and Meteora, the latter had been operating independently for over a year, with Chow at the helm, the X post read.

"While I am 100% confident about Ben's character, as a project lead he has also shown a lack of judgement and care about some of the core aspects of the project (given its current size and reputation) over the past couple of months. And this is unfortunately unacceptable."

This organisational separation helps explain how Meteora could become entangled in the LIBRA controversy while Jupiter maintained its reputation for transparency.

The Solana Connection

What started as a leadership crisis has quickly evolved into a systemic challenge for Solana's entire DeFi ecosystem.

The Numbers Story

Meteora controls 31% of Solana's DEX liquidity

Over 200 protocols depend on their infrastructure

$450 million in institutional backing at risk

$2.1 billion in assets under LP management

47% of Solana DeFi relies on their technology

In fact, this crisis could trigger a larger destruction of trust in the memecoin industry.

"While a souring memecoin narrative had already begun following the liquidity suck caused by $TRUMP's launch, the fallout from the $LIBRA launch and dump could result in further destruction of the memecoin complex," Galaxy's Alex Thorn, Head of Research.

The fallout has also hit other aspects of Solana's ecosystem.

SOL plummeted 8.8% to $169.01, its lowest since December

Jupiter's JUP token shed 24% in 24 hours

Total ecosystem losses exceeded $7 billion

Trading volumes across Solana DEXs dropped 35%

The Path Forward

Meow outlined three key priorities for Jupiter moving forward.

Making jup.ag the best decentralised platform

Building Jupnet as the network to connect everything

Driving certainty, alignment, and transparency standards for the industry

For Meteora, the immediate future involves finding new leadership while maintaining its position as one of Solana's most innovative DEXs.

Industry Aftershocks

The scandal has triggered intense debate about ethical standards in token launches, with industry leaders calling for urgent reform.

"The entire LIBRA memecoin fiasco should serve as a reminder that all of us in the DeFi community have a responsibility to make this space safer for users. Even small gestures like a 'verified' label can be misconstrued as an endorsement," said Chris Chung, Titan Founder.

Harrison Seletsky, director at SPACE ID, warned that the industry has reached a critical juncture.

"The LIBRA meme coin, endorsed by Argentine president Javier Milei, has shown the worst side of cryptocurrency for all the world to see. We need to evaluate where the crypto industry is going and who is truly benefiting."

Token Dispatch View 🔍

The Meteora crisis marks a significant moment for DeFi, exposing fault lines that run far deeper than a single platform's leadership struggles.

When a platform controlling nearly a third of Solana's DEX liquidity becomes entangled in memecoin controversies, it forces us to confront uncomfortable truths about the ecosystem we're building.

Chow's resignation or even the $4.4 billion LIBRA implosion isn’t the moot point. It's how quickly the crisis spread through Solana's supposedly decentralised infrastructure.

With $2.1 billion in LP-managed assets and 200+ dependent protocols, Meteora's stumble sent tremors through the entire ecosystem. The $7 billion in broader market losses weren't merely about sentiment - they revealed how deeply intertwined these "independent" systems have become.

Irony? While we build systems meant to eliminate single points of failure, we've created new ones through platform interdependence and leadership concentration. When Meow has to publicly defend Chow's character while accepting his resignation for "lack of judgment," it exposes the lack of clarity within the team while attempting to balance between personal relationships and professional accountability that still governs much of DeFi.

The crisis also raises existential questions about DeFi's direction.

Can platforms serving as critical financial infrastructure also cater to speculative memecoin trading? Should protocols wielding billions in user assets operate with the same informal governance structures as early-stage startups?

Meow's roadmap for Jupiter - focusing on building robust infrastructure and raising industry standards - suggests at least one path forward.

The broader ecosystem faces a more fundamental choice: continue allowing the boundaries between speculation and infrastructure to blur, or establish clear divisions with corresponding governance frameworks.

The test for Meteora won't be about restoring market confidence or TVL metrics. It will do itself good if it instead focuses on figuring out if the DeFi ecosystem can mature without sacrificing the innovation that made it revolutionary in the first place.

With $450 million in institutional backing at stake and 47% of Solana's DeFi ecosystem dependent on Meteora's technology, the stakes couldn't be higher.

The growing pains are real, but they might be necessary. After all, you can't build the future of finance while running it like a memecoin casino.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.