Hello dispatchers!

More than 90% gone in 10 hours.

One moment, $OM was trading at $6.30 before a series of liquidations caused its price to fall to $0.5115.

Layer-1 blockchain for real-world asset (RWA) tokenisation Mantra's OM token shed 94% of its value in a financial free-fall wiping out $5.4 billion in market cap.

The crash exposed the gap between Mantra's RWA narrative and its centralised reality.

In today's deep dive, we look at

How a 94% wipe out of OM's value, triggered about $70 million in liquidations

Claims of insider trading emerged

A $6-billion market cap built on just $4.2 million in actual DeFi value

What Mantra's implosion means for the entire RWA narrative

Which "blue-chips" might be next?

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

The Crash Timeline

Mantra’s $OM token fall was one of the worst collapses ever witnessed in the crypto ecosystem.

For context, the Terra LUNA collapse destroyed more value in total, but played out over several days. OM's destruction was compressed into what felt like a financial blink of an eye.

By Monday, a recovery had materialised, with the price briefly touching $1.20 — still an 80% loss for anyone who didn't react within those critical minutes.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

What caused the descend?

Two competing explanations emerge.

"The crash was triggered by reckless forced closures initiated by centralised exchanges on OM account holders," said John Patrick Mullin, Mantra co-founder.

OM tokens were being used as collateral on exchanges, Mullin claimed. When these platforms "decided that it was not the position they wanted to maintain anymore," they liquidated the collateral, triggering cascading sell pressure.

The Mantra team's official statement emphasised that neither their investors (Shorooq Partners) nor management team members sold tokens leading up to or during the crash.

Exchange executives tell a different story.

"This is a big scandal to the whole crypto industry." Star Xu, OKX CEO

Xu pointed to public on-chain data showing large token deposits to exchanges before the crash, suggesting more calculated action than simply exchange-triggered liquidations.

Meanwhile, Binance released an update stating their initial findings indicated the price crash resulted from cross-exchange liquidations.

Major investor Laser Digital (part of Nomura Group) quickly issued a statement denying any involvement in the crash or token dumping.

What happened then? The on-chain evidence dropped some clues

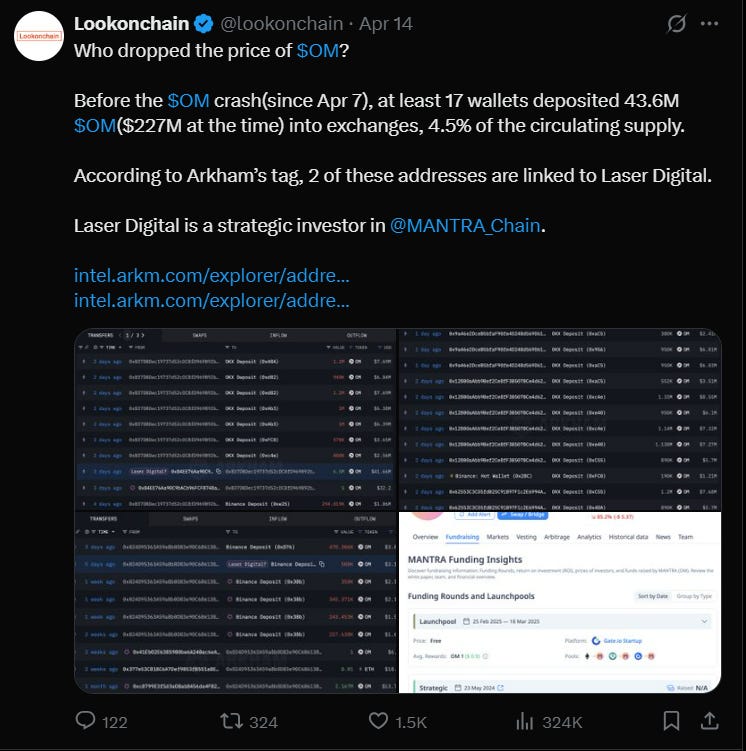

Blockchain data from Arkham Intelligence provides a clear picture of what happened in the days and hours before the crash.

17 wallets collectively deposited 43.6 million OM tokens (worth approximately $227 million) to exchanges in the days before the crash

Blockchain investigator ZachXBT reported that Reef Finance founder Denko Mancheski and X user Fukugo Ryōshu allegedly sought massive loans against their OM tokens hours before the crash

The initial trigger appears to have been a wallet, possibly associated with the OM team, depositing 3.9 million tokens on the OKX exchange

These movements, occurring just before the crash during low-liquidity weekend hours, raise questions about whether key stakeholders anticipated the collapse.

Red Flags & Structural Issues

The most revealing aspect of this crash is the contrast between Mantra's market positioning and on-chain reality.

While marketing itself as a purpose-built RWA L-1 Blockchain, Mantra's actual DeFi total value locked (TVL) was 4.2 million before the crash — a small fraction of its $6 billion market cap.

This disconnect highlights a fundamental vulnerability: despite the DeFi branding, Mantra operated with highly centralised token distribution and minimal on-chain liquidity, creating inherent fragility.

The crash demonstrates the differences between:

Transparent DeFi protocols with verifiable on-chain liquidity

Centralised projects with opaque operations and concentrated token control

Genuine community governance versus founder-controlled decision-making

Looking beyond the immediate crash, Mantra's structure had raised red flags that now appear prophetic in hindsight.

The most glaring concern: token supply concentration. Reports suggest the team controlled between 77-90% of OM's total supply, with data showing a single wallet on the Mantra blockchain holding approximately 77% of all tokens in circulation.

Mullin had previously claimed in March that these were merely "dummy tokens" used for cross-chain tracking, insisting that more than 90% of OM had been "distributed." However, this extreme supply concentration created a dangerously thin market where even modest selling pressure could trigger catastrophic price movements.

Equally concerning were the significant tokenomics changes implemented in October 2024. Mantra doubled its total token supply from 888,888,888 to 1,777,777,777 OM, while simultaneously transitioning from a capped supply model to an uncapped, inflationary one with an initial 8% annual inflation rate.

OKX highlighted these changes in their post-crash statement: "Per our investigations, we have identified major changes to the MANTRA token's tokenomics model since Oct 2024, based on both publicly available on-chain data and internal exchange data."

This isn't the first controversy surrounding Mantra's governance.

In April 2023, a Hong Kong court ordered six Mantra DAO members, including CEO Mullin, to disclose financial records following accusations of misappropriating funds. The plaintiffs alleged unauthorised withdrawals and a failure to produce regular financial reports.

While Mullin later stated the case was settled amicably, the litigation raised questions about the project's financial transparency.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

RWA Reality Check

Mantra isn't alone in the real-world assets space. The RWA narrative has been one of crypto's strongest growth stories over the past, with dozens of projects positioning themselves as bridges between traditional finance and DeFi.

The promise is compelling: tokenising real-world assets like bonds, real estate, and private credit to bring them on-chain, creating more liquidity, transparency, and accessibility.

Now, Mantra's collapse raises uncomfortable questions about the entire sector:

How many other RWA projects have similar token concentration issues?

Are market caps genuinely reflective of on-chain adoption, or merely speculative froth?

What happens when the gap between narrative and reality becomes too large to ignore?

The RWA sector has attracted significant institutional interest, with major players like BlackRock expressing interest in tokenisation. Mantra's implosion suggests the pathway to institutional adoption may be rockier than enthusiasts believe.

Could this be a one-off event? Possibly. But patterns in crypto tend to repeat, and when one high-flyer crashes due to structural weaknesses, others often follow.

Looking at other major tokens, several warning signs emerge that mirror Mantra's pre-crash conditions:

Many projects have a small number of wallets controlling the majority of tokens

Market caps that far exceed actual on-chain usage

Trading volumes that couldn't absorb significant selling pressure

Tokens used as collateral creating vulnerability to liquidation cascades

Tokens that have seen massive gains without corresponding fundamental growth

Token Dispatch View 🔍

Mantra's spectacular collapse sends shockwaves well beyond its immediate community, threatening to undermine confidence in the entire real-world asset (RWA) tokenisation sector – one of crypto's most promising institutional bridges.

As a Layer-1 blockchain built specifically for tokenising real-world assets with regulatory compliance, Mantra had positioned itself at the forefront of bringing traditional finance into the digital asset ecosystem.

Now that narrative faces serious scrutiny.

The fallout comes at a particularly sensitive time. Institutional players have been cautiously exploring RWA tokenisation, viewing it as a less volatile entry point into digital assets.

For Mantra specifically, rebuilding trust appears daunting. The project's $1 billion partnership with DAMAC Properties for real estate tokenisation now faces uncertainty. Similarly, its involvement in the UAE's regulatory framework for digital assets stands compromised.

A bigger concerning for RWA proponents is how Mantra's crash highlights the sector's vulnerability to the same speculative excesses that plague other crypto segments. The project's inflated valuation relative to actual usage suggests its price was driven more by narrative than fundamentals – precisely what RWA tokenisation was supposed to avoid.

The broader concern haunting the industry: If a project focused on regulatory compliance and real-world assets can experience such a catastrophic failure, what does that say about the maturity of the entire RWA ecosystem?

Competitors must now demonstrate significantly stronger safeguards against similar collapses if they hope to regain institutional confidence. This likely means more transparent token distribution, stricter exchange listing requirements, clearer governance structures, and robust circuit breakers to prevent flash crashes.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

I will be watching all their situation to see what will surface.