Hello Dispatchers!

Is it just us, or does something feel different in crypto lately?

While everyone's been busy tracking prices and memes, some fascinating data has landed on our desk.

Five major research firms dropped their 2025 reports last week, and well ... the findings are too juicy to not share.

Today we're unpacking …

What Security.org discovered about America's crypto habits

Gemini's surprising findings about who's really buying crypto

The institutional plot twist from Coalition Greenwich

Coinbase's revelations about actual crypto usage

What Cointelegraph Research thinks comes next

Driving the Next Generation of Wealth

Blockchain applications and digital assets change the fundamentals of how we invest, save, and grow our financial resources. This is the future Nexo is building.

It brings blend cutting-edge blockchain technology with time-tested financial principles, offering a platform where your assets can truly work for you 🫵

Your grandparents probably thought the internet was a fad.

In 1995, even astronomer Clifford Stoll confidently declared in Newsweek that "no online database will replace your daily newspaper."

We all know how that prediction aged.

Today, we're watching a similar story unfold with cryptocurrency.

From Wall Street's marble halls to Seoul's bustling streets, from Gen Z's digital wallets to institutional trading desks, how people think about, use, and trust digital assets is transforming.

A flood of recent research reports from Security.org, Gemini, Coinbase, and others paint a picture so dramatic it deserves careful unpacking.

These stats are breadcrumbs leading us toward a fundamental transformation in how the world views and uses money.

Let's follow them.

Upgrade to paid to get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

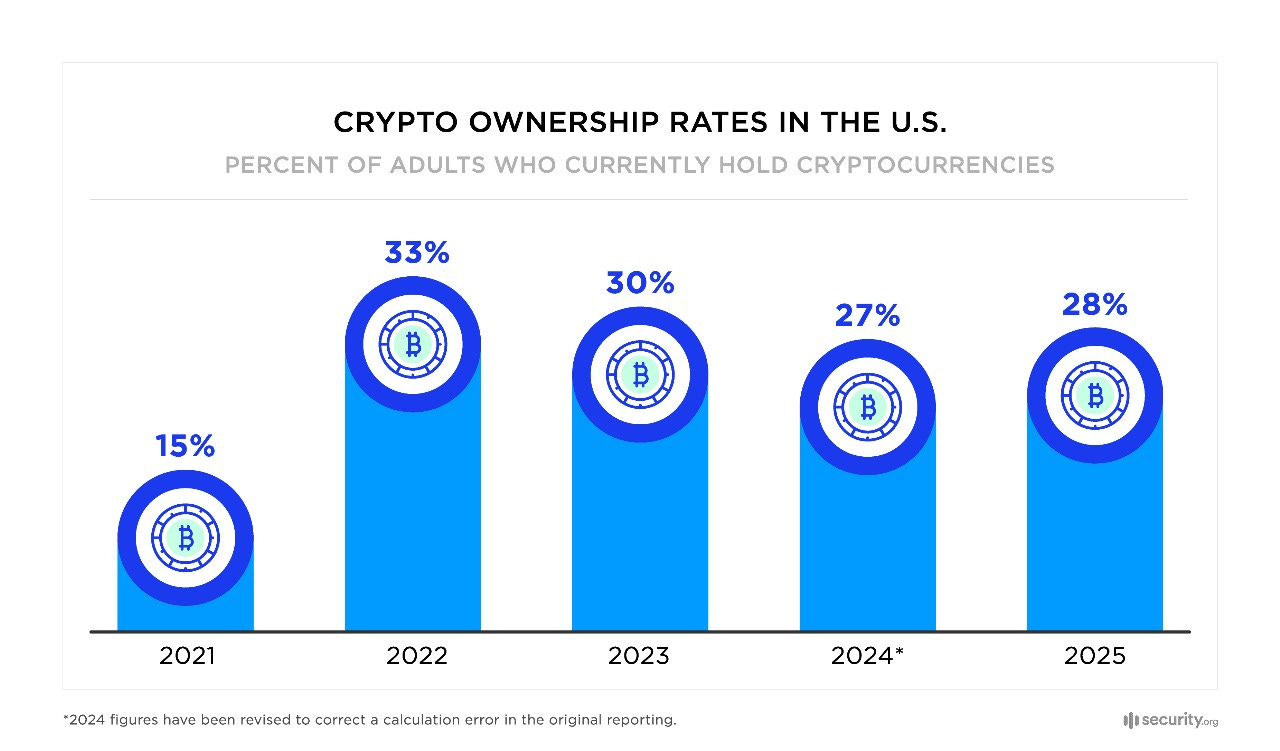

America's Crypto Revolution

When Security.org released their fifth annual cryptocurrency study for 2025, even the researchers were surprised by what they found.

28% of American adults now own cryptocurrency.

That's approximately 65.7 million people, nearly double the number from just three years ago.

The Ownership Pattern

67% of current owners are men

Median age is 45

Most owners hold at least two different cryptocurrencies

14% of non-owners plan to enter the market in 2025

Another 48% are "open to doing so"

While crypto critics love to focus on losses, the data read something like this …

69% of current crypto owners are operating at a profit

Among early adopters (pre-2019), 76% show gains

Only 10% report a net loss

16% are breaking even

The Timing Factor

The study revealed a fascinating pattern in when people first bought their crypto.

A significant portion entered during 2020-2021

Another third bought between 2016-2018

Less than 10% are newcomers from the past year

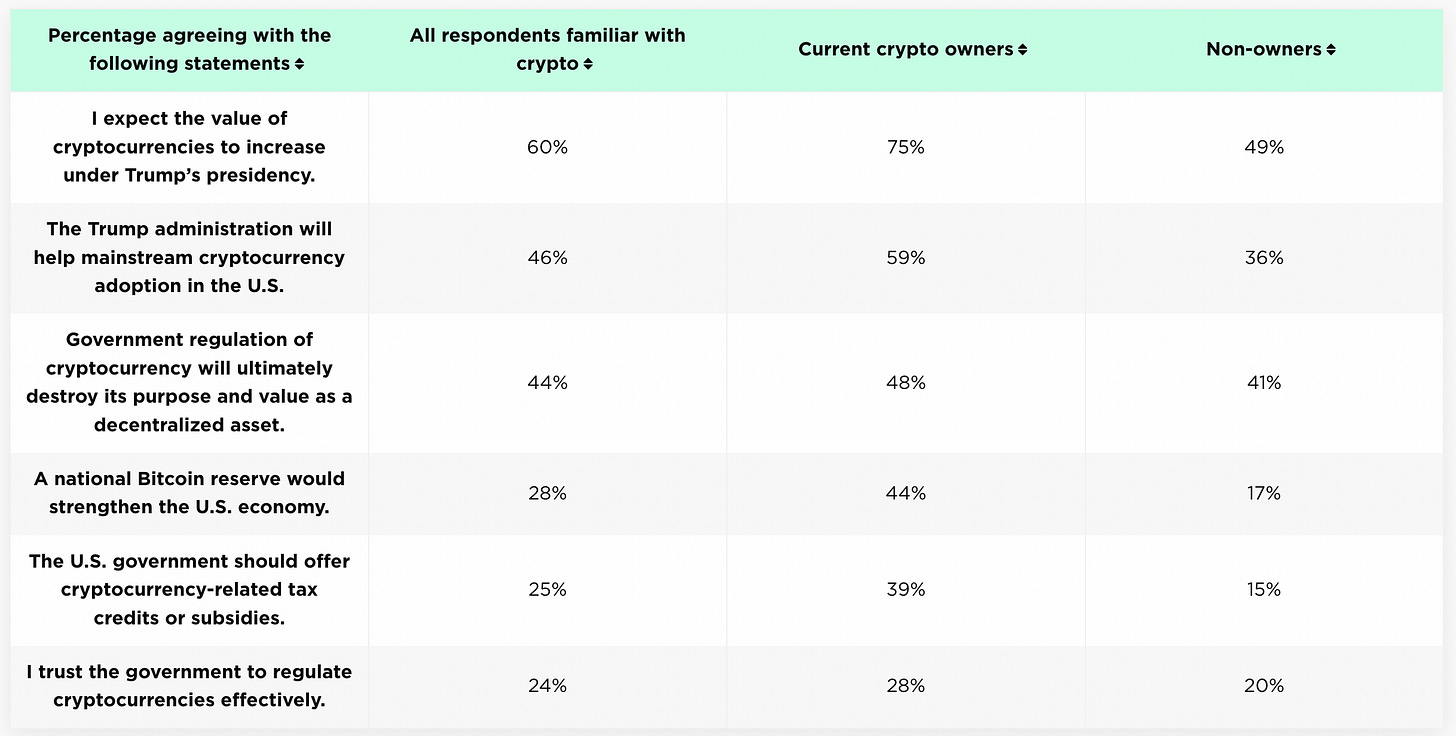

The Political Angle

Perhaps most intriguingly, the study found strong correlations between political expectations and crypto sentiment—60% believe crypto values will rise during Trump's second term:

Despite growing adoption, security concerns persist.

The study found that 59% of those familiar with crypto aren't confident in its security. Even among owners, 40% harbour doubts about the technology's safety.

One particularly troubling statistic: Nearly one in five cryptocurrency owners have had difficulty accessing or withdrawing their funds from custodial platforms.

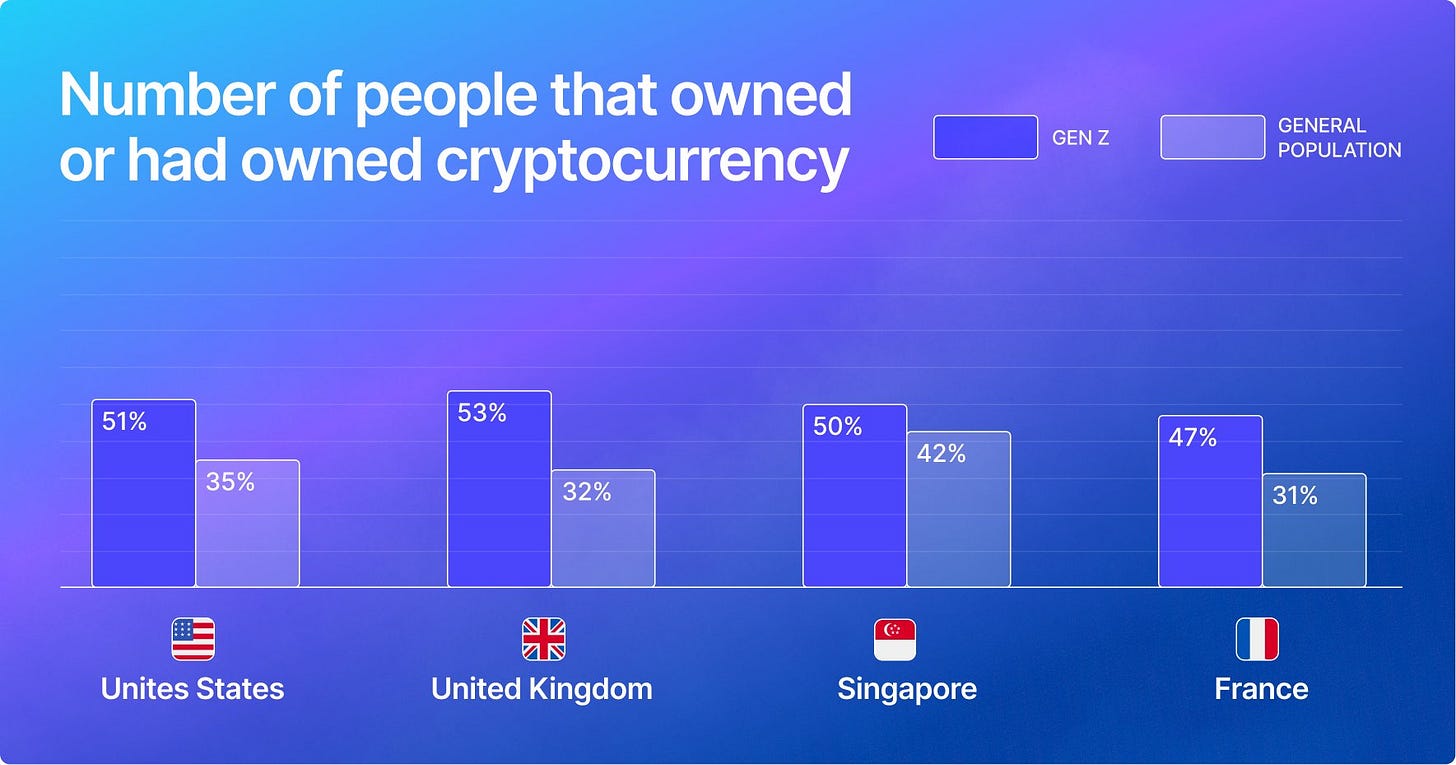

Gen Z's Digital Gold Rush

If Security.org showed us what's happening in America, Gemini's State of Crypto report reveals something even more fascinating about who's driving global adoption.

51% of Gen Z globally has either owned or currently owns cryptocurrency — it's a glimpse into the future of decentralised finance.

Look at the geographical breakdown.

In the UK, 42% of Gen Z crypto owners explicitly cite inflation protection as their motivation. They're using it as a hedge against traditional financial system failures.

Perhaps most tellingly, Gen Z shows a markedly different attitude toward regulation.

31% of Gen Z globally strongly agrees on the need for increased government regulation

This contrasts sharply with 46% of the general population

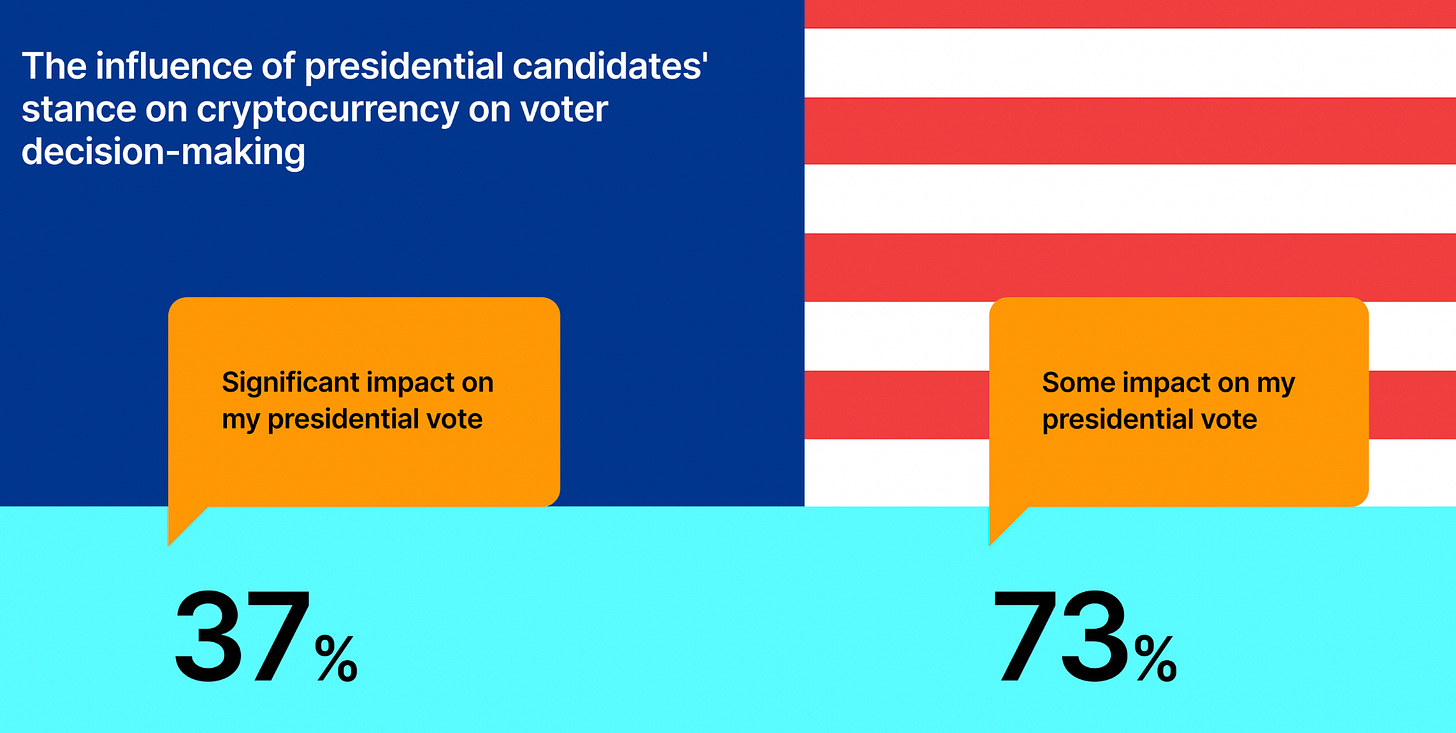

And they did vote with their wallets …

While Gen Z leads in adoption, they're also more likely to engage with crypto's underlying technology, suggesting that it's a technological revolution in the making.

The Institutional Lens

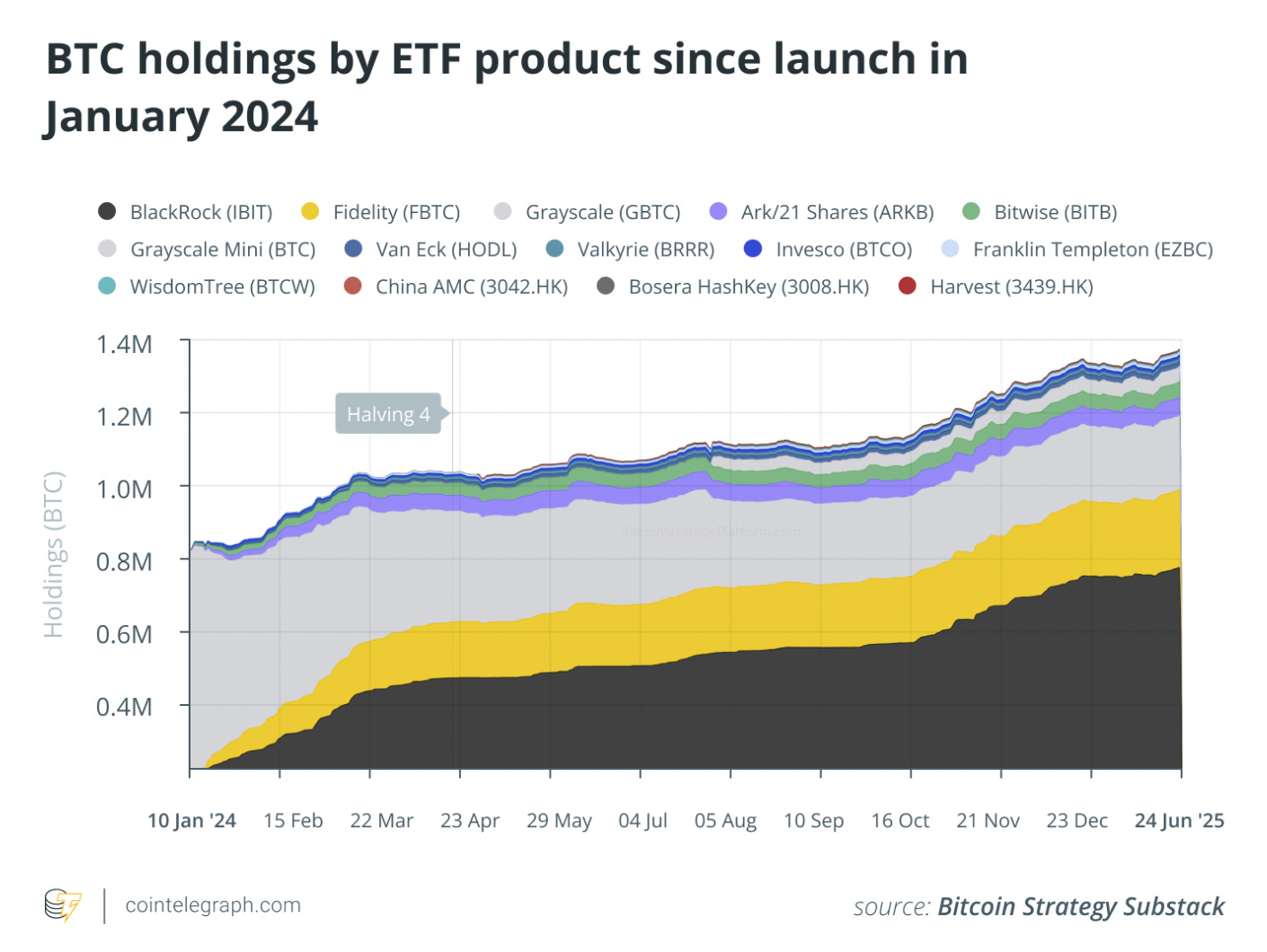

Cointelegraph Research: The 2025 Industry Outlook

Bitcoin's institutional embrace has reached new heights.

Over 1.1 million BTC now held in ETF products

Total Altcoin market exceeding $1.5 trillion

Bitcoin breaking through $100,000

They project DeFi's total value locked could surpass $200 billion by 2025, driven by decentralised exchange adoption and liquid staking evolution.

The stock market's response has been telling.

MicroStrategy shares up approximately 400%

Bitdeer showing roughly 165% growth

Sustainable practices emerging as a key differentiator

Meanwhile, Coalition Greenwich report, says 40% of fund managers now want exposure to 10 or more altcoins.

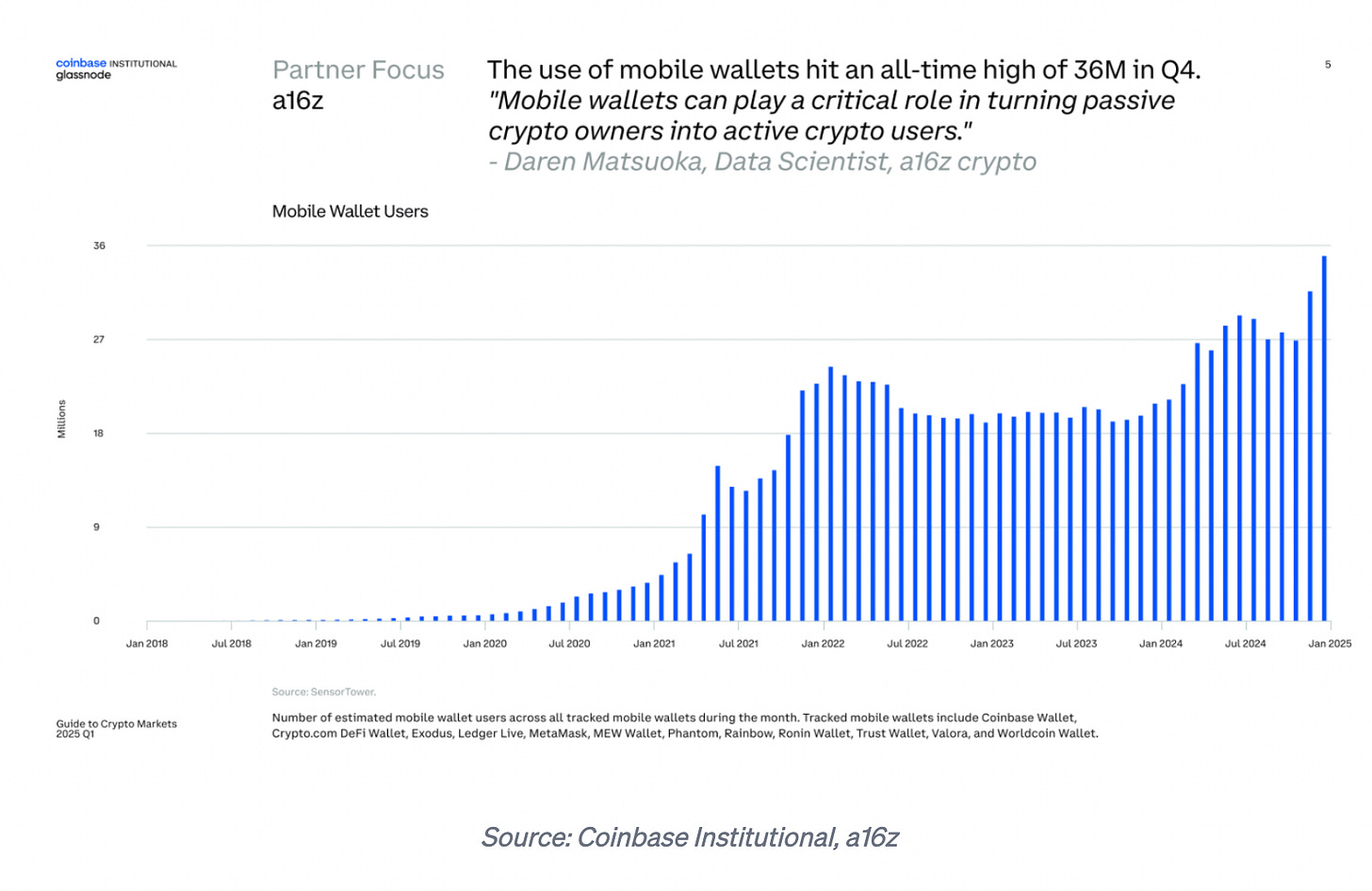

Coinbase Quarterly Report: The Usage Explosion

The mobile revolution is real.

36 million active mobile wallet users in Q4 2024

Set against 560 million total crypto holders worldwide

Record stablecoin activity:

Supply up 18% in Q4 2024

Trading volume hit $30 trillion in 2024

December alone saw $5 trillion volume

Peak inflows reached $9.7 billion on November 21

Token Dispatch View 🔍

The wrong questions are being asked.

Everyone wants to know if Bitcoin will hit $200,000, or when the next altcoin season will start, or whether Trump's return will pump or dump the market.

Buried in these reports is something far more fascinating.

When Security.org reports that 28% of American adults own crypto, it's not about market cap or adoption curves. It's about grandmothers asking their grandchildren about NFTs. It's about teenagers buying Dogecoin with their allowance.

While debates rage about whether crypto is a good investment, stablecoins quietly processed $30 trillion in volume last year. That's utility.

That's people actually using this technology to solve real problems.

Fund managers are asking for multiple cryptocurrency exposure. The same institutions that called Bitcoin a fraud five years ago are now building entire trading desks around it.

It echoes that old saying about truth: first they ignore you, then they laugh at you, then they fight you, then you win.

We're somewhere between the fighting and the winning.

Think about it:

A generation that prefers crypto

Institutions scrambling to catch up

Infrastructure being built at breakneck speed

Even governments fighting over who gets to be the next crypto hub

This is transformation.

And yet, the market still argues about price predictions.

The story isn't about where Bitcoin will be in six months. It's about what happens when the 36 million active mobile wallet users become 360 million.

It's about what occurs when DeFi's $200 billion locked value becomes $2 trillion.

Because if these reports tell us anything, it's that we're past the point of asking whether crypto will succeed.

That question was answered somewhere between the millionth mobile wallet download and the trillionth dollar of stablecoin volume.

What kind of success will it be?

Will this technology simply replicate the existing financial system with faster computers? Or will something entirely new emerge?

Will the inherent understanding that Gen Z seems to have about this technology shape its future? Or will institutions domesticate crypto until it's just another asset class?

These are the questions that matter now.

Because 2025 is the year that decides what this revolution actually means.

The data is clear. The technology is ready. The users are here.

The only question left is: What gets built with it?

Looking at these reports, it's hard not to sense something momentous approaching. Not because of the prices or the percentages, but because for the first time, there's an opportunity to fundamentally reimagine how money works.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.