Hello dispatchers!

Is the crypto party over? The lights just came on. The music has stopped.

$4.75 billion in institutional money vanished in just four weeks. Altcoins are bleeding. The fear is growing.

Yet, beneath the surface, something doesn't add up.

Some funds are moving against the crowd. Smart money is making unexpected bets. Market signals are contradicting each other in ways that puzzle even veteran traders.

The White House promised a crypto revolution, but the market delivered something else entirely.

Is this capitulation or opportunity? The answer lies in the data few are discussing. What happens next might surprise even the most jaded crypto observers.

Stake Smarter, Stay Liquid – With Marinade Finance!

Why choose between earning staking rewards and keeping your SOL accessible? With Marinade Finance, you get the best of both worlds.

Stake SOL in seconds & earn rewards effortlessly

Stay liquid with mSOL—use it across Solana DeFi

Non-custodial & secure—your assets remain yours

Boost Solana’s security while maximising your yield

No lockups, no waiting—just smarter staking designed for flexibility and growth. Whether you're a DeFi pro or just getting started, Marinade makes staking seamless and rewarding.

Stake your SOL today with Marinade Finance!

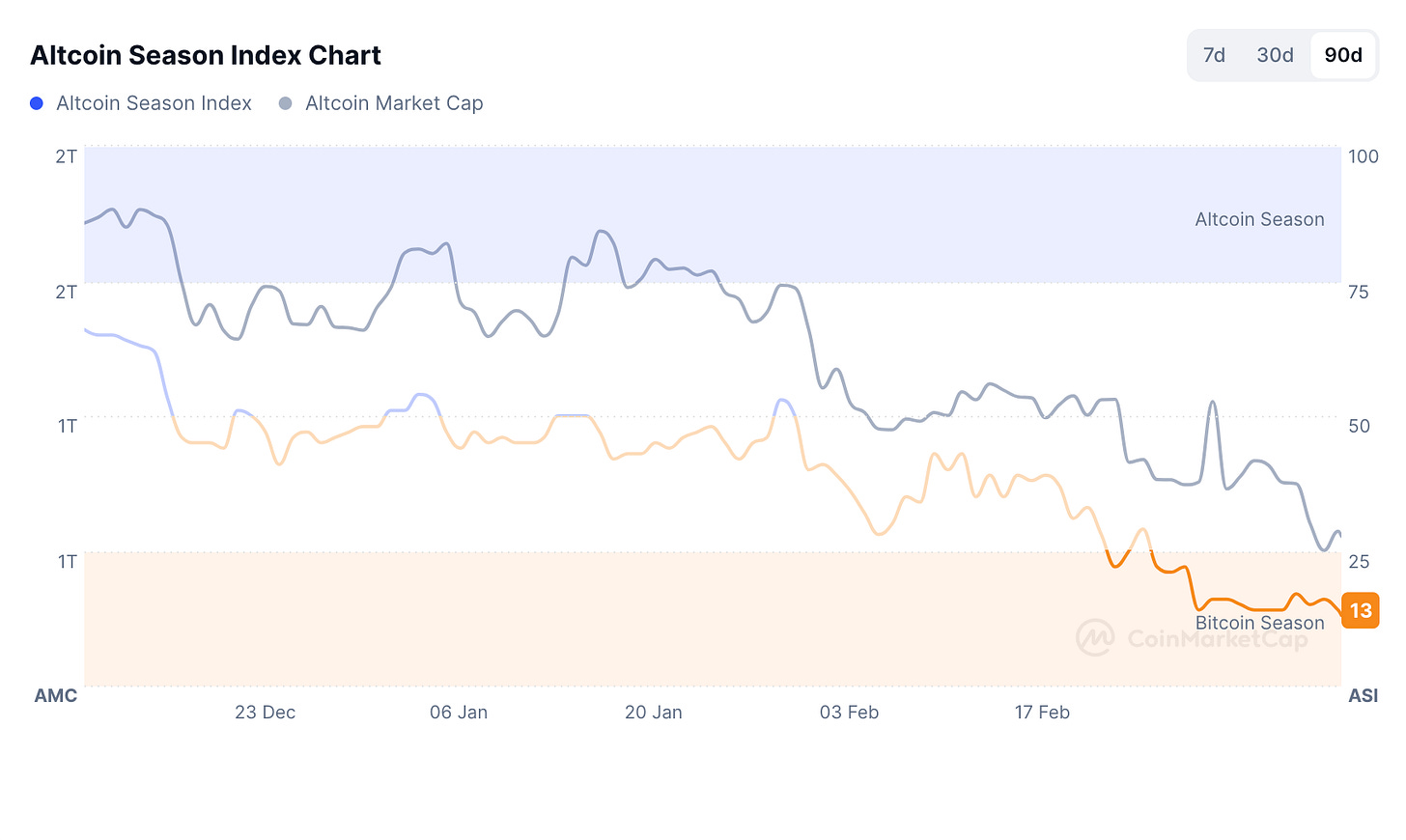

The crypto market was in "extreme fear" territory last few days as the Altcoin Season Index hits a record low of 13 — meaning only 13 of the top 100 altcoins have outperformed Bitcoin in the last 90 days. The market's swift descent from euphoria to anxiety has caught many investors off guard, with leading altcoins experiencing brutal drawdowns.

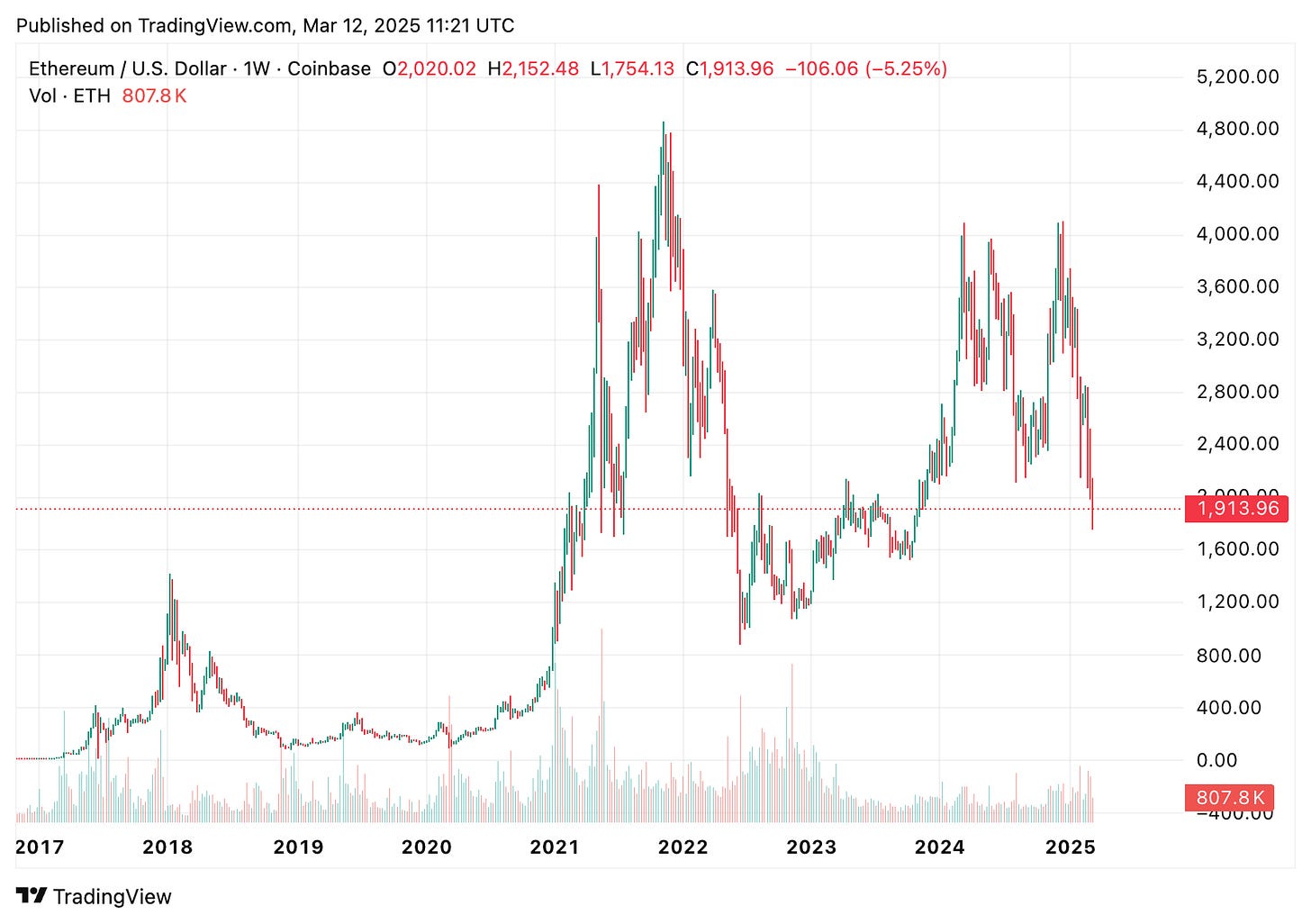

Solana has tumbled more than 50% since January. Ethereum has slipped below $1,900 for the first time since November 2023. XRP crashed 16% in a single week. Even the much-anticipated White House Crypto Summit failed to stem the bleeding.

What's happening beneath these dramatic price moves, and why is capital fleeing at such an alarming rate?

Trump's Pump Meets Macro Reality

Just weeks ago, the crypto landscape seemed poised for a transformative bull run. President Trump's announcement of a "strategic crypto reserve" sent tokens like XRP, SOL, and ADA soaring by as much as 60%.

The narrative was compelling: government adoption would drive institutional investment and mainstream acceptance.

Reality has proven far harsher.

Read: XRP, SOL, and ADA: What’s Beyond Trump’s Reserve? 🔄

Trump's executive order revealed that the "strategic reserve" would consist primarily of already-seized cryptocurrency rather than new acquisitions. The anticipated White House Crypto Summit on March 7 ended without the bold announcements many had expected, delivering only a framework for stablecoin legislation and promises of lighter regulation.

Read: Trump’s BTC Reserve ✅ Rally ❌

"The summit signalled for more optimism," Kevin Guo, Director of HashKey Research, told CoinDesk. "Despite expectations for more substantial announcements, crypto assets continue to follow US equities in a negative trend."

Meanwhile, global markets have taken a hit amid an escalating tariff war initiated by Trump. The widely tracked dollar index has fallen to its lowest since November, traditionally a bearish signal for risk assets like cryptocurrencies.

This macro uncertainty has triggered a mass exodus from crypto investment vehicles.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Altcoin Bloodbath

The damage to altcoins goes far beyond mere percentage drops. In raw numbers, it's staggering.

Over $600+ billion has evaporated from the altcoin market cap – a 38% collapse from its all-time high of $1.64 trillion.

Crypto derivative markets haemorrhaged $407 billion in liquidated positions in a single 24-hour period as leveraged bets were forcibly unwound.

The carnage is so severe that only 1 out of 57 tracked altcoins has outperformed Bitcoin over the past 72 hours, according to data from Alphractal. The market has become a one-way street downward, with few safe havens beyond stablecoins.

"Bitcoin-driven crypto asset rotations have effectively ended with regulations and institutional adoption," argues Ki Young Ju, CEO of CryptoQuant. "New capital would flow through stablecoins or widely adopted altcoins – nothing like a traditional altseason."

This challenges the conventional wisdom that Bitcoin rallies eventually lead to altcoin seasons. The structural market changes brought by institutional adoption and clearer regulatory frameworks may have fundamentally altered these historical patterns.

Joao Wedson, CEO of Alphractal, remains hopeful that an altcoin season could emerge in the coming days, citing exhaustion in large-cap selling and the potential for small-cap pumps.

Remember the dip in the altcoin season index that we mention above? That was followed by a sharp rebound. Market cycles often rhyme, even if they don't repeat exactly.

Binance founder CZ acknowledged the challenge of outperforming Bitcoin in the current environment, calling the altcoin season metric a "tough ranking system" and suggesting that "50 is probably a really good score" – far above the current reading of 17.

The $4.75 Billion Capital Flight

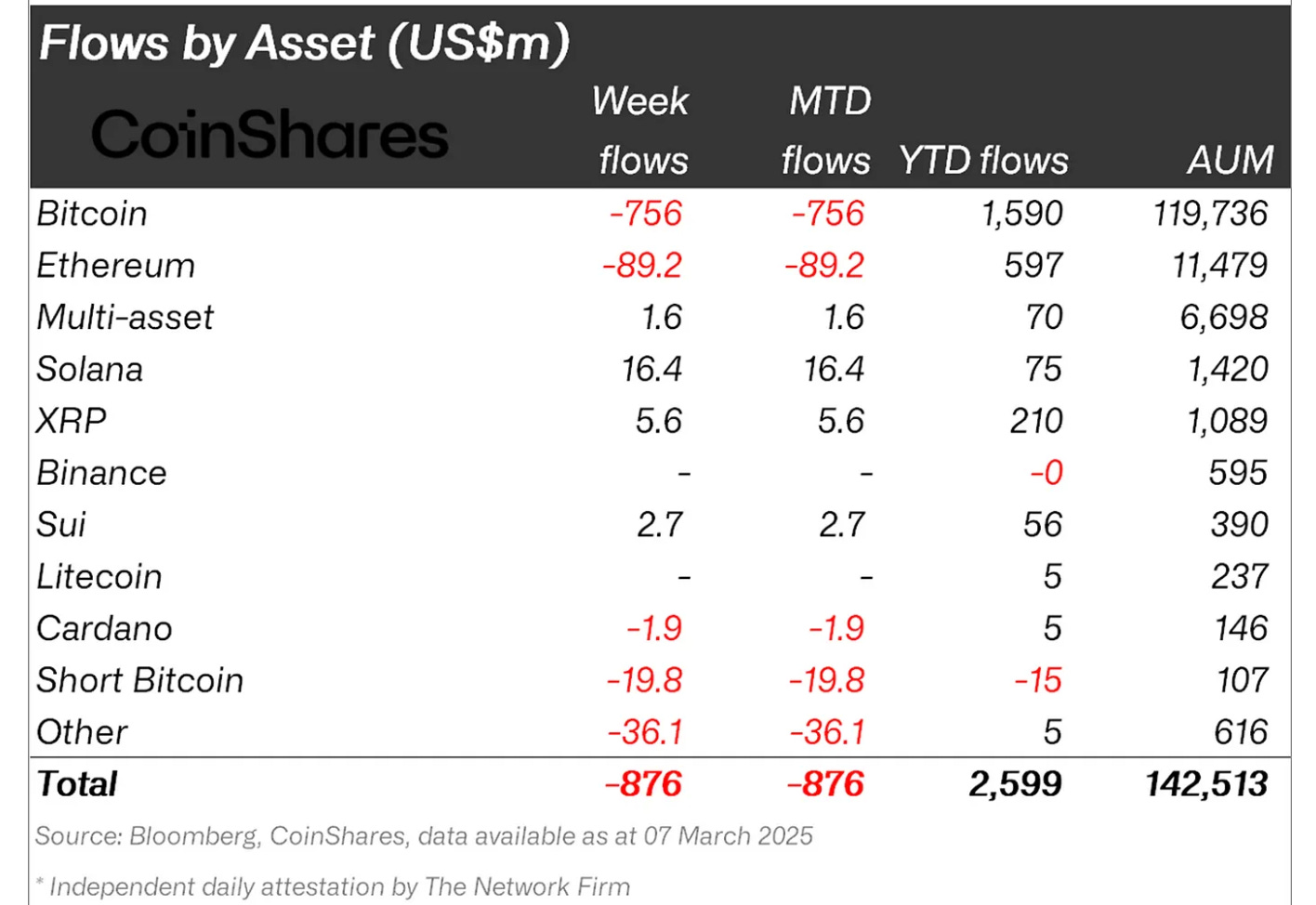

According to asset manager CoinShares, global crypto investment products just experienced their fourth consecutive week of outflows, losing $876 million last week alone. The cumulative damage? $4.75 billion has left these funds over the past month.

US investors have been the most aggressive sellers, withdrawing $922 million last week despite Trump's executive order establishing the Bitcoin Strategic Reserve. The sustained outflows and falling asset prices have pushed total assets under management down by $39 billion from their peak to $142 billion — the lowest level since November.

"Although this indicates a slowdown in the pace of outflows, investor sentiment remains bearish," CoinShares Head of Research James Butterfill noted.

This wave of selling has hit Bitcoin-focused products hardest, with $756 million fleeing these funds last week.

Some investors are selectively buying the dip in specific altcoins, even as broader market falters. Products focused on Solana, XRP, and SUI bucked the trend, attracting net inflows of $16.4 million, $5.6 million, and $2.7 million, respectively. Some investors appear to be selectively buying the dip in specific altcoins, even as the broader market falters.

Ethereum's Mixed Signals

Ethereum presents perhaps the most puzzling picture in this market correction. While its price has slumped to yearly lows below $1,900, on-chain data reveals a potentially bullish divergence.

According to IntoTheBlock, Ethereum witnessed significant outflows worth $1.8 billion from exchanges over the past week — the highest weekly outflow since December 2022. This massive movement of ETH off exchanges typically signals accumulation rather than capitulation.

CryptoQuant's data paints a similar picture. The 30-day simple-moving average of Ethereum net-flows dropped to roughly 30,000 ETH last week, a level last seen in late 2022.

Adding to this bullish thesis, Ethereum's MVRV (market value to realised value) ratio has dropped to 0.8 for the first time since October 2023. An MVRV ratio below 1 indicates undervaluation and has historically signalled buying opportunities. The last time this metric fell to 0.8, Ether formed a local bottom near $1,600 before beginning its 2024 bull run.

Yet these potentially positive signals must contend with Ethereum's broader technical weakness. The token's weekly chart closed below the 200-day EMA level for the first time since October 2023 — a development that has preceded extended downtrends in the past.

The Puzzling Contrarian Bets

There were surprising inflows into select altcoin funds last week - even as their prices plummeted.

Products focused on Solana attracted $16.4 million in new capital despite SOL price dropping 37% in the last ten days.

XRP-based funds saw $5.6 million in inflows while the token's price collapsed 16% in a week, dropping below the critical $2 level.

This apparent contradiction between price action and fund flows points to a strategic divergence between retail and institutional investors. While retail panic-selling has driven prices lower, some institutional players appear to be positioning for a potential rebound.

For XRP specifically, the upcoming final decision on the Ripple lawsuit expected on April 16 could explain this apparent disconnect. Despite the broader market downturn, some investors may be accumulating in anticipation of a favourable ruling.

Meanwhile, SUI-based products pulled in $2.7 million in fresh capital last week, suggesting select Layer-1 alternatives are still attracting interest despite the risk-off environment.

The Dinocoin Comeback

Amid this market turmoil, an unexpected narrative is emerging: the potential return of "dinocoins" — older, established cryptocurrencies that have survived multiple market cycles.

According to research from K33, institutions are increasingly favouring "older, more established coins over the new shiny things with no track record." This institutional interest, in turn, is driving retail attention to these "boomer" or "dino" coins.

"The typical (young) altcoin trader favours the latest trending DeFi token or the latest memecoin looking to cook a 100x run. In contrast, cautious long-term participants seek out what they perceive as safer bets," K33 analysts wrote.

Coins like XRP, ADA, and even DOGE fit this profile. Despite their current price weakness, they've maintained their large, dedicated communities through multiple cycles. Their longevity might prove attractive to institutional investors seeking to limit downside risk while maintaining exposure to the crypto sector.

The emergence of this narrative coincides with Solana's struggles. Once the darling of the crypto market, SOL has plummeted more 50% from its January highs. Transaction fees on the Solana network last week stood at just 53,800 SOL, the lowest weekly amount since September 2024. Active addresses have declined 35% since January.

The dinocoin thesis suggests that in uncertain markets, investors may retreat to cryptocurrencies with longer track records rather than newer, more technically advanced alternatives.

Where does the altcoin market go from here?

In the short term, all eyes remain on macroeconomic developments. Traders are buying short-dated treasuries, expecting the Federal Reserve to cut interest rates as soon as May to keep the economy from deteriorating. This could provide relief to risk assets like cryptocurrencies.

Technical patterns offer mixed signals. Mikybull, a technical analyst, points to a potential "diamond price pattern" in Ethereum's price action, which could signal a bullish reversal. If this pattern plays out, Ether might rebound about 20% to $2,600 from its current price.

Meanwhile, Bitcoin's hold above $80,000 represents a crucial psychological level. If this support fails, it could trigger another wave of selling across the altcoin market.

For investors with longer time horizons, the Fear and Greed Index's reading, last few days ("extreme fear") might present a contrarian buying opportunity. Historically, periods of extreme fear have preceded significant rallies — but timing the bottom remains an inexact science at best.

As tariff fears, recession concerns, and technical breakdowns continue to drive capital flight from altcoins, one thing becomes increasingly clear: the market's expectations of an immediate crypto renaissance following Trump's election have collided with the harsh reality of macroeconomic uncertainty.

Token Dispatch View 🔍

Market sentiment has completely flipped. What the data reveals now is a classic disconnect between retail behaviour and institutional positioning.

This altcoin crash represents more than a temporary setback – it marks a necessary filtering process. The projects that survive this purge will emerge stronger, with battle-tested communities and genuine utility that extends beyond speculative fervour.

The contrarian institutional flows we're witnessing suggest the smart money views current prices as a discount rather than a warning. They understand that market psychology always overshoots in both directions.

Altcoins with enduring value propositions will recover, though perhaps not all at once or in equal measure. The rise of "dinosaur coins" signals a market maturing beyond shiny new narratives toward proven longevity. Their resilience through multiple cycles provides validation that mere white papers cannot.

As recession fears battle with technological adoption, remember that blockchain development continues regardless of market conditions. Teams keep building. Technology keeps advancing. The infrastructure for the next wave of adoption strengthens daily, even as prices suggest otherwise.

For investors willing to look beyond immediate price action, this period of extreme fear creates the entry points that retrospective analysis will identify as obvious. The difficulty, as always, lies in separating temporary market noise from fundamental shifts in the competitive landscape.

The altcoin apocalypse many fear may instead be proving ground that separates tomorrow's financial infrastructure from yesterday's speculation. Those who can maintain perspective amid panic position themselves to benefit when sentiment inevitably shifts again.

The market punishes the impatient and rewards the prepared. In crypto, this lesson is taught repeatedly, at increasing scale, with each market cycle.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The altcoin bloodbath is real, but panic-selling rarely ends well. Thanks for the article!