Today’s edition is brought to you by Nexo. The premier wealth platform for digital assets since 2018 👇

Hello y’all! Stay safe and look long Bitcoiners.

If you thought market drama was done for 2024, Thursday just said "hold my beer."

Bitcoin slips below $100K as Fed plays party pooper

Arthur Hayes' bold prediction for 2025

MicroStrategy's rumoured January vacation

The $68B tsunami of institutional money

Japan's Bitcoin treasury experiment

First up, show us some love on Twitter, Telegram & Instagram🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Bitcoin just performed its favourite party trick.

Making $5,000 disappear in the blink of an eye.

On Tuesday, the flagship cryptocurrency briefly dipped below $100,000 for the first time since December 13.

Panic through the crypto markets. And we are still in the bloodbath.

But here's the thing about market shakeouts — they're as predictable as they are theatrical.

The catalyst this time?

Fed Chair Jerome Powell announced the rate cut.

What happened?

25 basis point rate cut (4.25%-4.50% range)

Third consecutive cut this year

100 basis points total cuts since September

But ... hawkish 2025 outlook.

Powell suggested that there might be only two rate cuts in 2025 instead of the previously projected three.

Adding to the bearish sentiment, the Fed raised their 2025 inflation outlook from 2.1% to 2.5%, acknowledging the potential impact of upcoming Trump administration policies.

Between 2 and 3 am UTC on December 19, Bitcoin hit a low of $99,047.

What did Powell say?

During Powell's press conference, the Fed chair had to address questions about Trump's proposed strategic bitcoin reserve.

Powell confirmed that the Fed "isn't allowed to own bitcoin" per the Federal Reserve Act and isn't seeking a law change.

This comes as Senator Cynthia Lummis circulates a draft bill that would direct the US Treasury to buy one million bitcoin over five years — a move that could dramatically impact market dynamics if implemented.

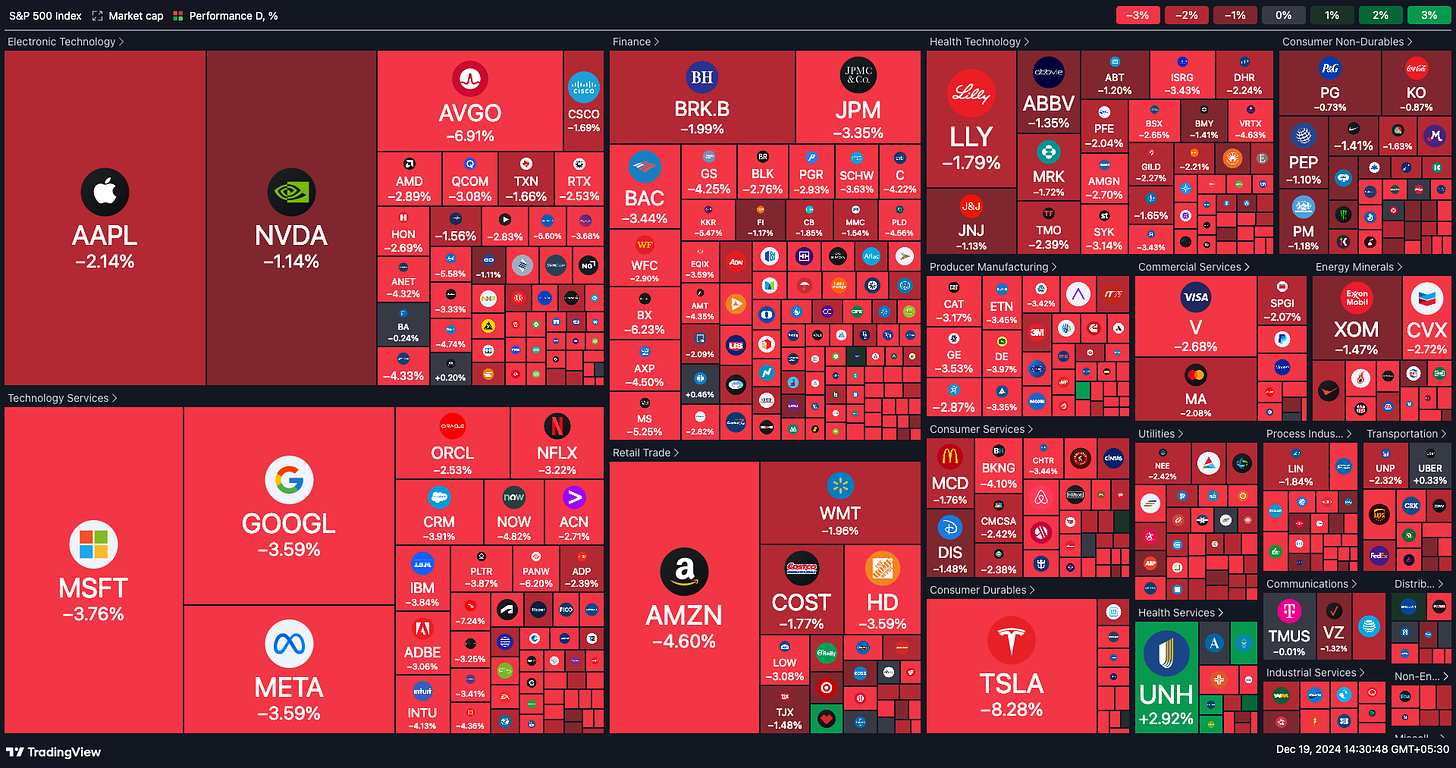

The drop wasn't isolated — the crash was across the markets. Over $1.5 trillion was wiped out from the US stock market.

But here's where perspective becomes crucial.

"This pullback is pretty normal for Bitcoin. We've had 8 of them since October," as Bitcoin Archive pointed out.

In fact, if you're selling your Bitcoin based on Fed comments, you might want to revisit your investment thesis - Matt Hougan of Bitwise explains.

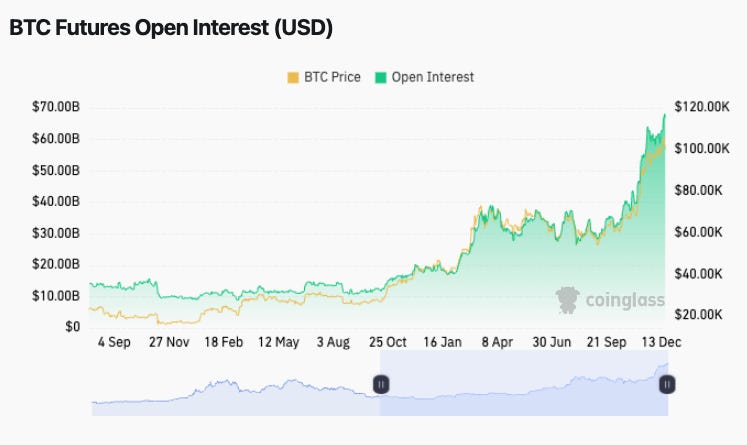

The Leverage Factor

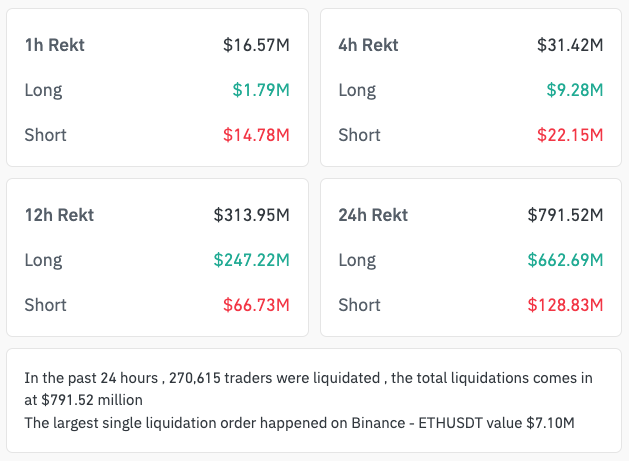

The real story here isn't about the Fed at all — it's about leverage.

Over-leveraged long positions. When markets get too comfortable, corrections follow. It's like clockwork.

The price drop looks bigger because of these leveraged positions getting liquidated, creating a cascade effect that amplifies the downward movement.

Technical Signals and Market Cycles

Technical analysts like Rekt Capital note that Bitcoin is developing a "bearish engulfing weekly candlestick formation."

But before you rush to hit that sell button, consider this: we're only in Week 7 of price discovery — a period historically known for its volatility.

This isn't surprising given that Bitcoin only surpassed its previous all-time high of $73,679 on November 5.

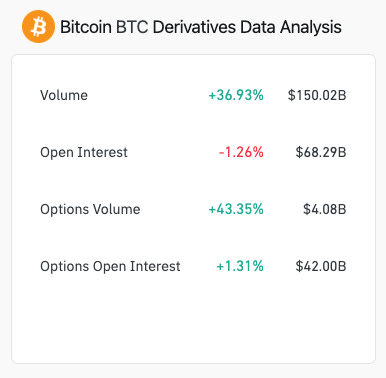

What the Derivatives Markets Tell Us

The sophisticated side of the market paints a more nuanced picture.

QCP Capital analysts observe a cautious tone in the options market, where put options continue to dominate over calls. This suggests traders are prioritising hedging risk rather than aggressively chasing the rally — a sign of market maturity rather than panic.

Driving the Next Generation of Wealth

Blockchain applications and digital assets change the fundamentals of how we invest, save, and grow our financial resources. This is the future Nexo is building.

It brings blend cutting-edge blockchain technology with time-tested financial principles, offering a platform where your assets can truly work for you 🫵

Block That Quote 🎙

Arthur Hayes, BitMEX Co-founder

"There are no politically acceptable solutions available to Trump to quickly bring about such change."

While the market's busy dreaming about Trump's crypto promises, Hayes is playing a different game.

His take? We're all a bit too optimistic about how fast things can change.

"The market believes that Trump and his people can immediately achieve economic and political miracles ... the market will instantly wake up to the reality that Trump has, at best, one year to enact any policy changes on or around January 20th. This realisation will lead to a vicious sell-off in crypto and other Trump 2.0 equity trades."

And he's not just talking - he's acting on it.

What's Hayes Planning? His investment fund, Maelstrom, is already preparing.

Trim positions before inauguration

Buy back at lower prices in H1 2025

Stay flexible for market shifts

Keep core positions ready

In The Numbers 🔢

$17.5 billion

That's how much MicroStrategy splurged on Bitcoin in just two months. Mad lad energy? You bet.

Shopping Cart

Total Bitcoin value: $46.02B

Unrealised profit: $18.9B

December purchases: $3B+

Stock performance: +460% YTD

Now they might have to take a January vacation.

Due to a rumoured blackout period, Michael Saylor's company could be forced to pause its aggressive Bitcoin accumulation next month. The restriction, possibly linked to NASDAQ 100 index inclusion or standard trading blackout rules, comes just as Bitcoin tests the $100,000 level.

Interesting timing. Innit?

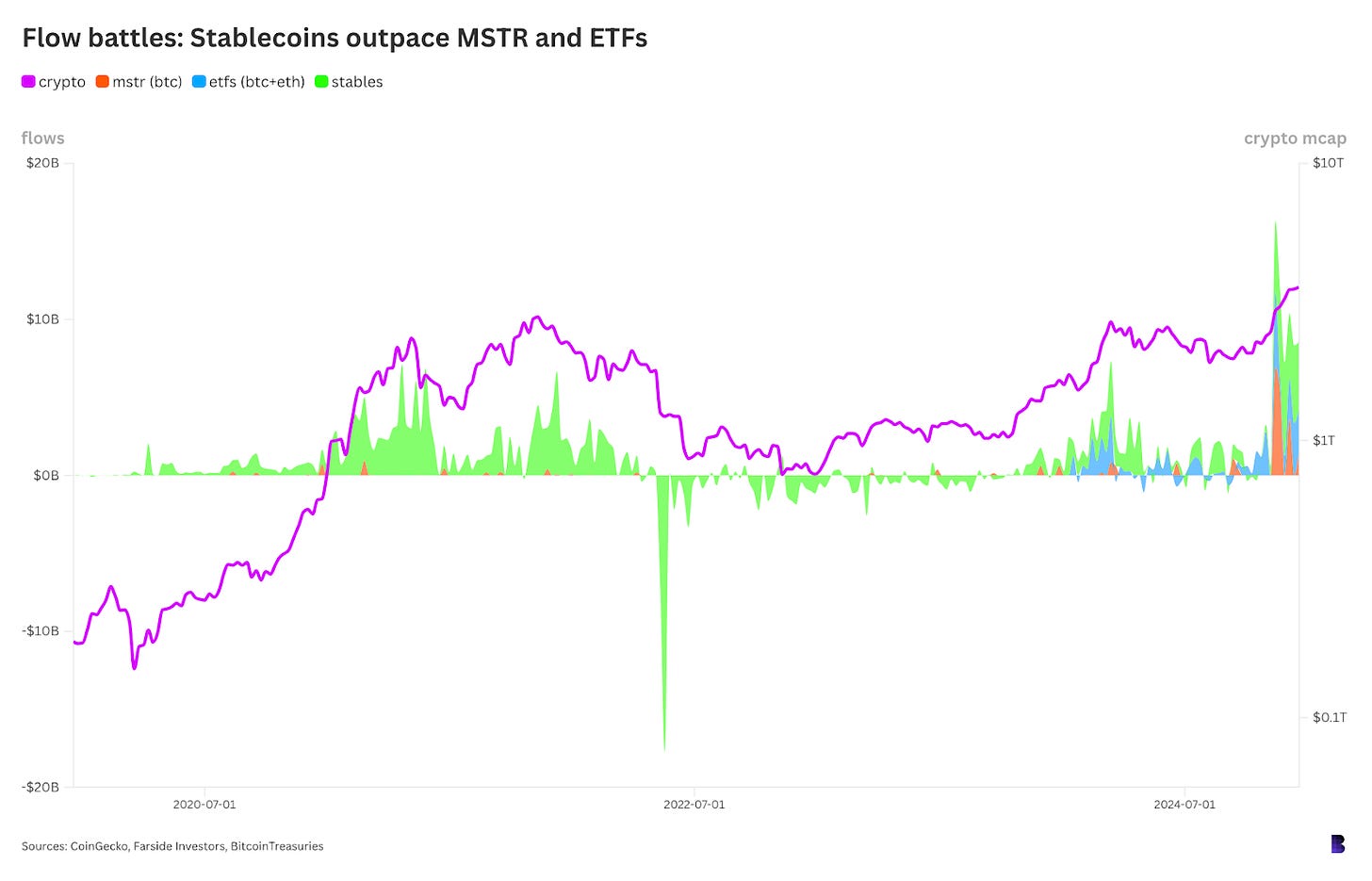

Yet zoom out and you'll see something remarkable: A $68 billion liquidity wave has hit crypto in just nine weeks, according to Blockworks.

MicroStrategy's $17.5B bitcoin purchases

ETF inflows of $16.5B

$30.8B in new stablecoin issuance

The Token Dispatch View 🔍

Markets, by their very nature, are designed to shake out weaker hands.

The same mechanisms that amplify downward moves work equally well in the opposite direction. When prices fall sharply, it's often not about fundamental changes but about market structure and leverage.

Recent regulatory tailwinds support this view.

The US Financial Accounting Standards Board's adoption of fair value accounting for Bitcoin makes it more attractive for corporate treasuries to hold the asset. This could spark what QCP Capital calls a "cross-asset feedback loop," where firms holding Bitcoin find it easier to raise funds.

While some traders might view this pullback as the beginning of a larger correction, historical patterns suggest otherwise. Bitcoin has shown remarkable resilience following similar dips, especially during price discovery periods.

What we're witnessing isn't just buying — it's a fundamental shift in how institutions view Bitcoin. MicroStrategy's potential pause isn't an exit; it's a pit stop.

The current market structure, with its mix of institutional interest and potential government adoption creates a unique backdrop for price action. Yes, corrections can be sharp and dramatic, but they're features of a healthy market, not bugs.

Markets don't go up in a straight line. Sometimes they need to test the resolve of their participants, shaking out those who borrowed too much hoping for a quick profit.

The same leverage that magnifies losses on the way down can amplify gains on the way up.

After all, that's just what markets do — they breathe in, and they breathe out. The only question is whether you'll still be holding when they take their next deep breath in.

The Surfer 🏄

MiCA-compliant stablecoins are driving the growth of Europe's cryptocurrency market by accounting for 91% of the market. Monthly euro trading volumes have surged, surpassing $42 billion in key months.

Solana has achieved a record-breaking 66.9 million daily transactions, surpassing the combined activity of all other blockchains, following the launch of the Pudgy Penguins NFT project's native token, PENGU.

Fartcoin (FARTCOIN) has surged to a new all-time high, reaching $0.95 and briefly surpassing a $1 billion market cap, while major memecoins like Dogecoin have seen significant declines.

A federal judge has ruled against BiT Global's request to block Coinbase from delisting Wrapped Bitcoin (WBTC), citing insufficient evidence of imminent harm. The decision allows Coinbase to proceed with its plans, which are partly motivated by concerns over potential control of WBTC by Justin Sun.

Bitwise has launched a Solana Staking ETP on Germany's Deutsche Börse, offering investors a low-cost way to earn staking rewards on SOL with an annual yield of about 6.48%.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋