Memecoins Boss 2024 Q1 🔥

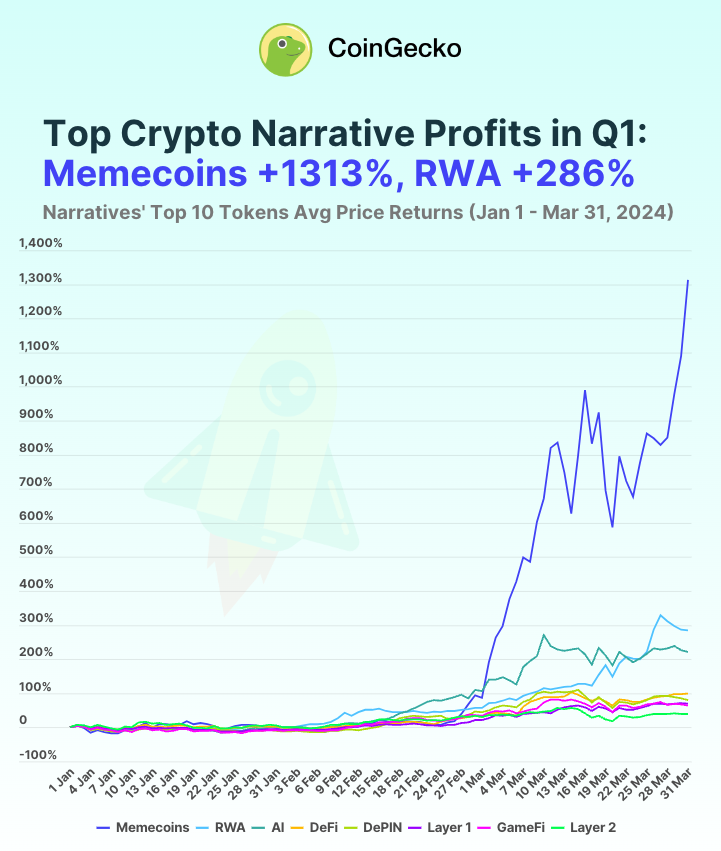

1,312.6% average return across the top memecoins. Ethereum earnings tripled in Q1 2024, reaching $370M. Holding Bitcoin now profitable 99.92% of all days. Crypto exchange insurance funds grows by $1B.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Memecoins were the undisputed kings of crypto in Q1 2024.

Delivered 1,312.6% average return across the top tokens.

That's right, over 10x your money on average.

Brand new memecoins like Book of Meme (BOME), Brett, and Cat in a Dogs World (MEW) launched in March and rocketed into the top 10 by market cap by the end of the quarter.

BRETT was the MVP, boasting 7,727.6% gain, followed by Dogwifhat (WIF) with 2,721.2% increase.

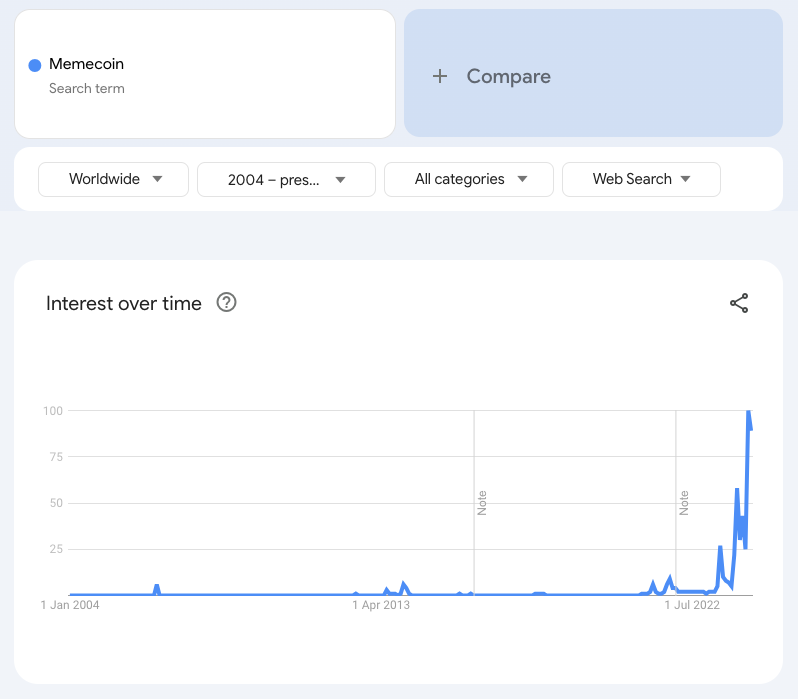

Search traffic for "memecoins" hit an all-time high in March, showing a surge in interest.

Memecoins are now a $60 billion market, surpassing heavyweights like DePINs and zero knowledge proofs.

CoinGecko analyst Lim Yu Qian

“Notably, the memecoin narrative was 4.6 times more profitable than the next best-performing crypto narrative of tokenised real-world assets (RWA), and 33.3 times more profitable than the layer 2 narratives with the lowest returns in Q1 this year.”

Memecoin initiatives rises

BNB Chain is offering a $1 million reward to attract memecoin developers. Hoping to attract creators to build meme tokens on their blockchain.

Avalanche also launched a $1 million memecoin liquidity provider program in March.

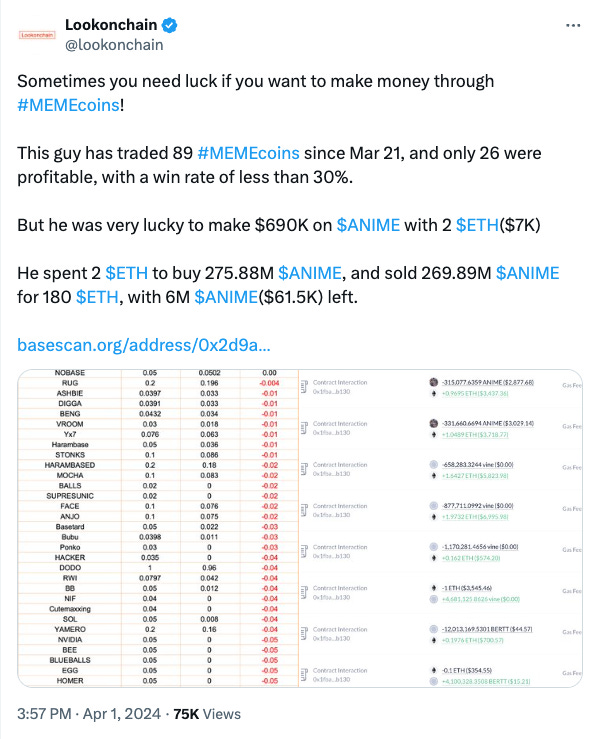

There are many lucky traders

One who turned $13K into $2M...

This guy made $2 million within an hour by investing in a brand new meme coin called Donotfomoew (MOEW) created by Bitget Wallet.

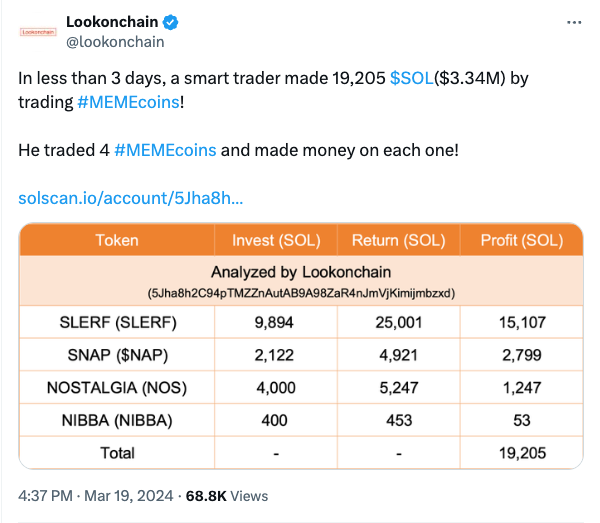

One who made $3 million in 3 days...

This guy started with 9,894 SOL in Slerf (SLERF) and flipped it for a hefty profit, then repeated the feat with SNAP ($NAP), NOSTALGIA (NOS), and NIBBA (NIBBA).

And many others...

Block That Quote 🎙️

FalconX’s global head of revenue and business, Austin Reid.

"World's largest hedge funds only just starting with crypto"

Reid noted a significant uptick in institutional engagement in crypto, driven by market turns and the ETF announcement.

Discussed post-ETF changes in market liquidity and the challenges of sourcing it for large orders due to market fragmentation.

Emphasised the importance and growth of the crypto derivatives market, foreseeing more regulated derivatives markets in the US and globally.

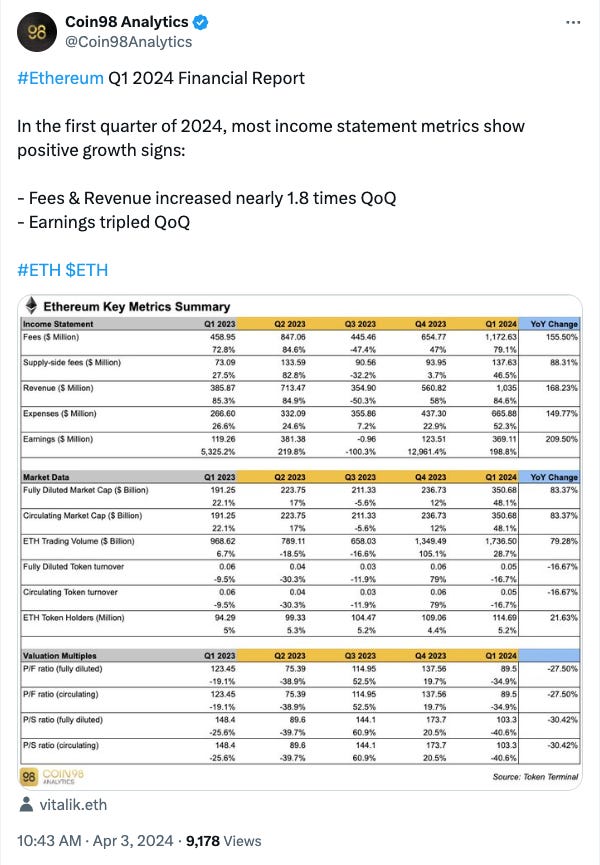

Ethereum Had A Blockbuster Q1 in 2024

A quick rundown

Revenue tripled to reach $369 million

Transaction fees surged by 79%

Network usage grew with a transaction increase of 8.4%

DeFi on Ethereum boomed as total value locked (TVL) skyrocketed by 86%

Meanwhile, The SEC is seeking public comments on proposed rule changes for three spot Ether ETFs - Bitwise, Fidelity, and Grayscale.

In the Numbers 🔢

$1+ billion

The amount top crypto exchange insurance funds has grown this bull market.

Binance's Secure Asset Fund for Users (SAFU) holdings in Bitcoin, BNB, Tether, and TrueUSD surpassed $2 billion as of April 3, compared to their initial $1 billion in January 2022.

Bitget's protection fund, launched in November 2022 with $300 million, has grown to $612 million due to appreciation of Bitcoin holdings.

Bitcoin price has surged 136% and BNB 79.36% in the past year, contributing to the growth of these insurance funds.

Holding Bitcoin profitable 99.92% of all days

Bitcoin has been profitable for 99.92% of all days since its launch in 2009.

Only six days out of the past 3,732 resulted in a loss for Bitcoin investors.

Bitcoin hit a new high of $73,600 in March.

Since then, the price has settled around $68,000-$70,000.

Only those who bought between March 9-13 and March 25-29 are currently underwater.

Even small investors, with wallets under $1000, have likely seen gains.

The Surfer 🏄

Meta's metaverse loss is big. Since changing its name in 2021, its VR/AR division, Reality Labs, has lost $40 billion. Meta's core social media business (Facebook, Instagram) is booming, bringing in record profits.

Crypto exchange insurance funds have surged by over $1 billion during the ongoing bull market. Binance's Secure Asset Fund for Users (SAFU) now holds over $2.03 billion, compared to its initial $1 billion in January 2022.

Galaxy Digital is launching a $100 million fund to invest in early-stage crypto companies. Think financial apps, infrastructure building blocks, and the protocols that make crypto tick. Up to $1 million per company, with a goal of backing 30 startups over the next three years.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋