Hello dispatchers!

Remember the famous rebranding of Facebook dropping the ‘the’? Or when Kanye turned Ye?

Who doesn’t love a minimalistic, fancy makeover?

Now the obsession has caught up with Bitcoin’s largest corporate champion. Well, at least in name.

MicroStrategy is now just "Strategy" - dropping the "Micro" prefix after 35 years. There's nothing small though about their Bitcoin holding worth over $45 billion.

Let's dive into the rebranding story of the largest corporate Bitcoin hodler.

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

Software Meets Satoshi

What happens when a 90s software company transforms into the world's biggest Bitcoin treasury company? You get a rebranding that would make Mark Zuckerberg proud.

With this rebranding, the company put to rest all the lurking questions about what its core operation is - providing business intelligence or piling Bitcoin.

“Strategy (Nasdaq: MSTR) is the world’s first and largest Bitcoin Treasury Company. We are a publicly traded company that has adopted bitcoin as our primary treasury reserve asset,” read the company’s ‘About’ section in its latest statement.

🎙 Block That Quote

Michael Saylor, Executive Chairman, Strategy

"Strategy is one of the most powerful and positive words in the human language. Perfection is achieved not when there is nothing more to add, but when there is nothing left to take away."

The rebrand goes beyond dropping five letters.

Strategy's new visual identity screams one thing - there is nothing ‘Micro’ about a company that’s clearly on the path of Bitcoin maximalism. From the orange colour scheme representing "energy, intelligence, and Bitcoin" to the stylised ₿ in its logo.

Crypto Twitter had a field day, with everyone making the same "The Social Network" joke about dropping "The" from Facebook.

Beyond the memes and branding, there have been changes on the business front, too.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

The Numbers Story

Strategy isn't a software company anymore. Its legacy business intelligence unit brought in $120.7 million in Q4 revenue (down 3% year-over-year), that's barely a rounding error in its $80 billion market cap.

The company's value proposition is simple: it's the easiest way for Wall Street to get Bitcoin exposure through a regulated entity.

The market is paying a premium for the privilege.

We explained this in detail here: Saylor Strategy: 0️⃣ Interest, ♾️ Bitcoin?

Let's put this in perspective

Software revenue: $120.7 million quarterly

Bitcoin holdings: $45 billion+ value

Traditional business: <1% of market cap

Bitcoin premium: Trading well above BTC holdings value

The headline $670.8 million net loss might seem big, but a little context around its Bitcoin holdings tells the story of a company all-in on its conviction behind the largest cryptocurrency.

New Money, New Metrics

How do you measure success when your business model is "buy Bitcoin faster than anyone else"?

Strategy's answer to this is a bunch of key performance indicators (KPIs) designed specifically for Bitcoin treasury operations.

The Bitcoin Scorecard

BTC Yield: The metric showing percentage change between Bitcoin holdings and outstanding shares. Hit 74.3% in 2024, though the company's targeting a more modest 15% for 2025.

BTC Gain: An accumulation metric measuring new Bitcoin added in a period multiplied by the BTC Yield. Simple way to track how effectively Strategy is growing its Bitcoin per share.

BTC $ Gain: Dollar value translation of BTC Gain, helping traditional investors understand the real-world impact of Strategy's accumulation programme.

The company also introduced "Stack Effect" - a multiplier showing how each dollar invested translates into Bitcoin holdings after accounting for leverage and funding costs. Currently showing a 1.5x multiplier, meaning every dollar invested yields $1.50 in Bitcoin exposure.

Beyond merely numbers, these metrics are Strategy's answer to the age-old question: how do you convince Wall Street to value you as a Bitcoin company rather than a software firm with a crypto hobby?

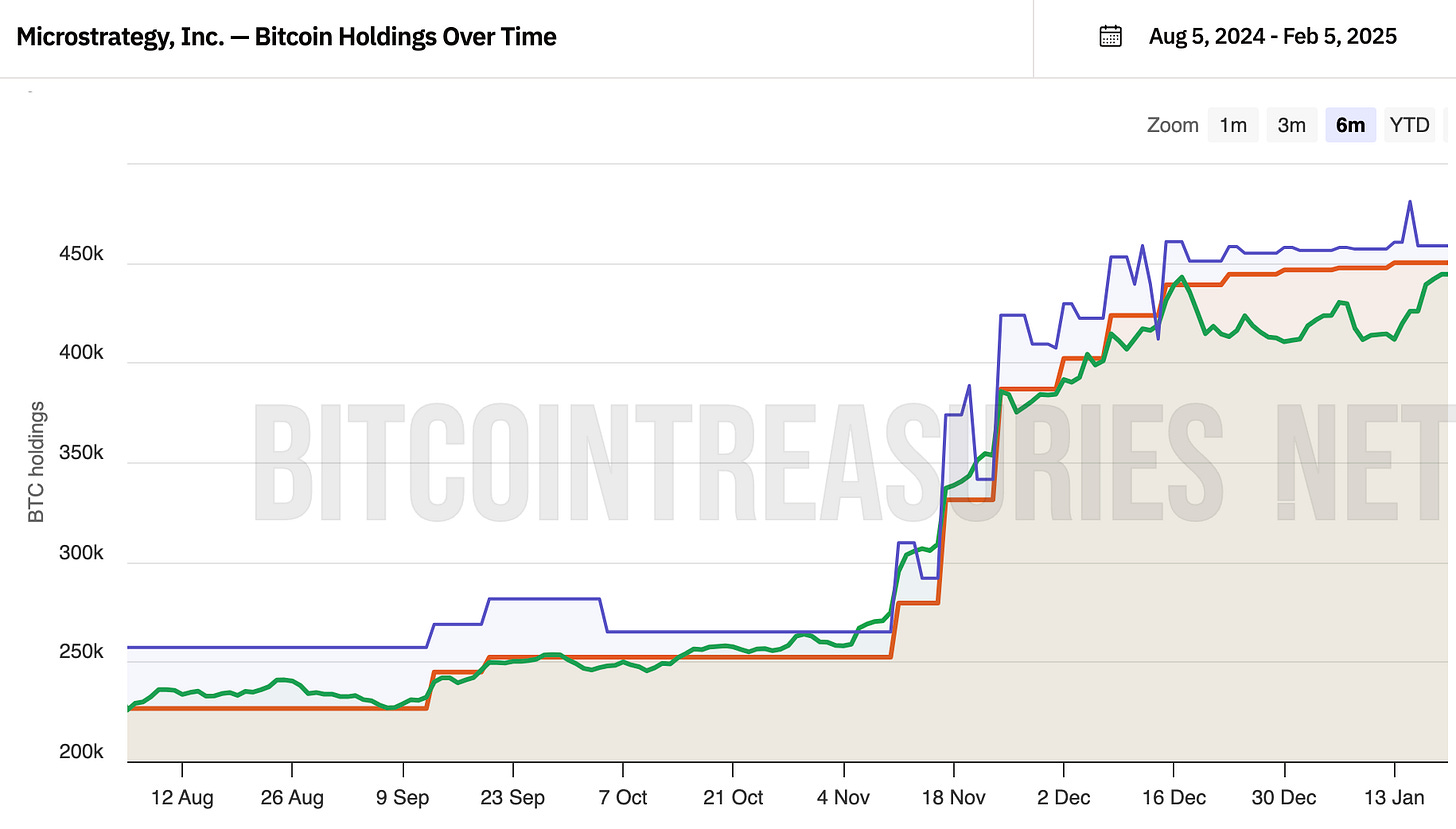

The BTC Machine Pauses

After 12 consecutive weeks of record-breaking Bitcoin purchases accumulating about $20 billion, Strategy's relentless shopping finally took a breather this week.

The company announced Monday it made no purchases last week.

Q4 saw Strategy add 218,887 Bitcoin - more than the total holdings of its next three corporate competitors combined.

"We are significantly ahead of our initial timeline and well-positioned to further enhance shareholder value by leveraging the strong support from institutional and retail investors for our strategic plan," said Phong Le, Strategy CEO.

Which plan?

The dream to become the leading "Bitcoin bank", raise $100-150 billion in Bitcoin and grow to a $300-400 billion company.

Read: Saylor's Trillion-Dollar Dream 💰

Evolution of the Bitcoin Factory

Looking Ahead

The road ahead for Strategy looks both ambitious and complex.

Market Projections

Mizuho's target: 783,000 BTC by 2027

Projected value: $130 billion

Stock price target: $511

Managing quarterly STRK dividend payments while navigating a $670.8 million Q4 loss requires careful balance.

The company must also consider the market impact of its aggressive accumulation strategy, especially with new Bitcoin ETFs emerging as competition.

The implications of Strategy's transformation extend far beyond its balance sheet.

The company is setting new precedents for corporate treasury management and institutional Bitcoin adoption. Its innovative financing models are creating a blueprint for Bitcoin-backed corporate finance.

Most significantly, Strategy is demonstrating that a complete pivot from software vendor to Bitcoin powerhouse isn't just possible - it can be profitable.

Token Dispatch View 🔍

The transformation of MicroStrategy into simply "Strategy" represents more than minimalistic rebranding - it's a snapshot of crypto's evolution from making rebellious noise to Wall Street darling.

The name change also signals the end of crypto's "micro" era. When a 35-year-old software company can transform into an $80 billion Bitcoin powerhouse, it shows how digital assets have moved from the fringes to the financial mainstream.

This mainstreaming comes with its own challenges - can Strategy maintain its nimble Bitcoin accumulation strategy as it grows into a financial giant?

The introduction of Bitcoin-specific metrics like "BTC Yield" and "Stack Effect" reveals something crucial about crypto's institutional future. Traditional financial metrics don't capture the unique dynamics of Bitcoin accumulation. Beyond buying Bitcoin, Strategy is creating a new financial playbook for corporate crypto adoption.

We are already seeing a new public entity entering the Bitcoin adoption game every now and then.

The most intriguing aspect isn't Strategy's ambitious target of controlling 4% of all Bitcoin by 2027, but what that means for the market. As the company's accumulation machine grows, it faces a fundamental challenge: how to keep growing without becoming the centralised financial power that Bitcoin was created to disrupt.

Looking ahead to 2025's latter half, the biggest test for Strategy will be navigating the tension between being both a disruptor and an institution.

Its success or failure could determine whether Bitcoin becomes a true institutional asset class or remains perpetually on the edge of mainstream finance.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.