Today’s edition is brought to you by Muzify. A platform to unlock your music fandom through quizzes, stats and a lot of fun tools. Can you guess the track in 5 seconds 🫵

Welcome to your Tuesday’s dose of crypto. We’ve got a makeover 💃 hope you like it.

Enjoy the ride - one where the NFTs come back from the grave.

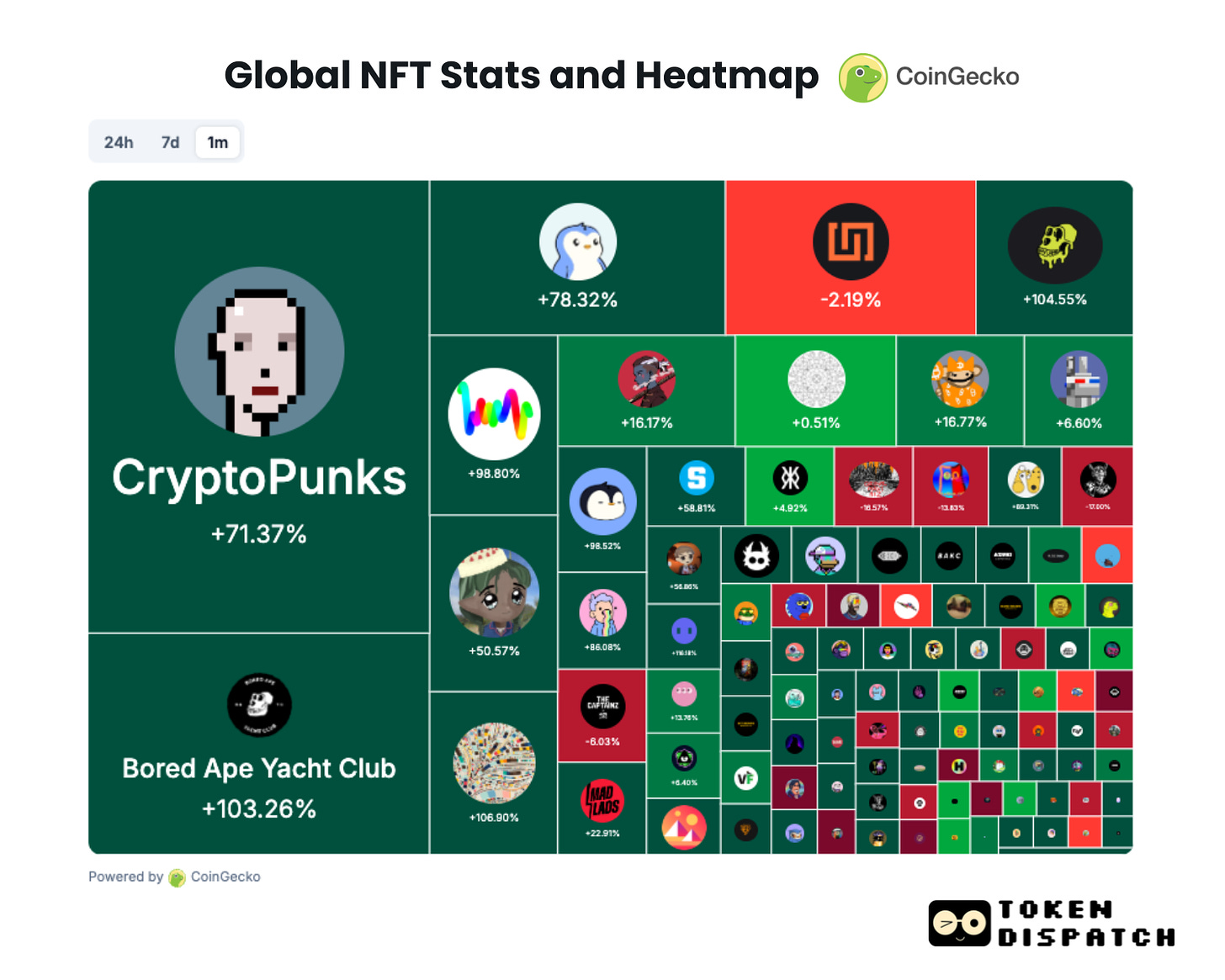

Collectibles recorded six-month high sales in November

ETH rally is driving the fund flow towards blue-chip NFTs

How NFTs are linked to Ethereum fortune

CryptoPunks show collateral utility

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 170,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

♫♫“We are young, we are strong, we will rise … 'Cause I'm back, back, back from the dead tonight”♫♫

Remember these lines from the masterpiece by the nineties’ American rock band Skillet?

Still hooked to those lines?

Well, somebody else is also singing that on loop lately.

A "dead" jpeg.

Remember the obituaries? "NFTs are dead," they said. "It's over," they declared. Even the true believers were starting to wonder if their precious jpegs would ever see the light of day again.

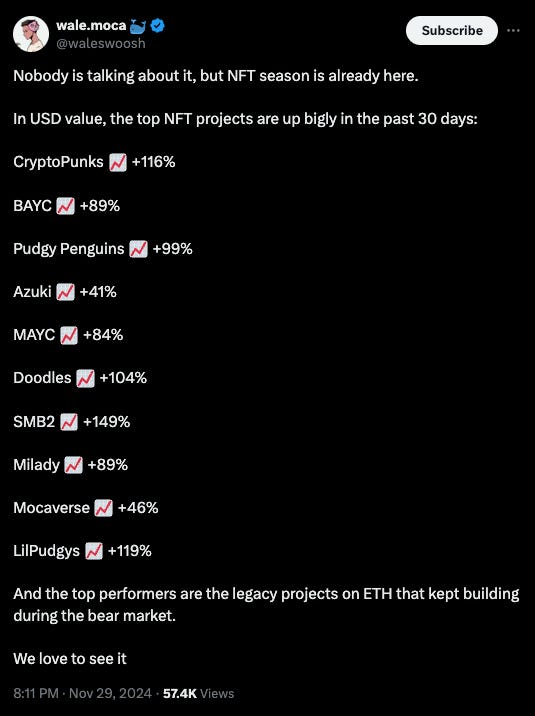

Look how the tables have turned.

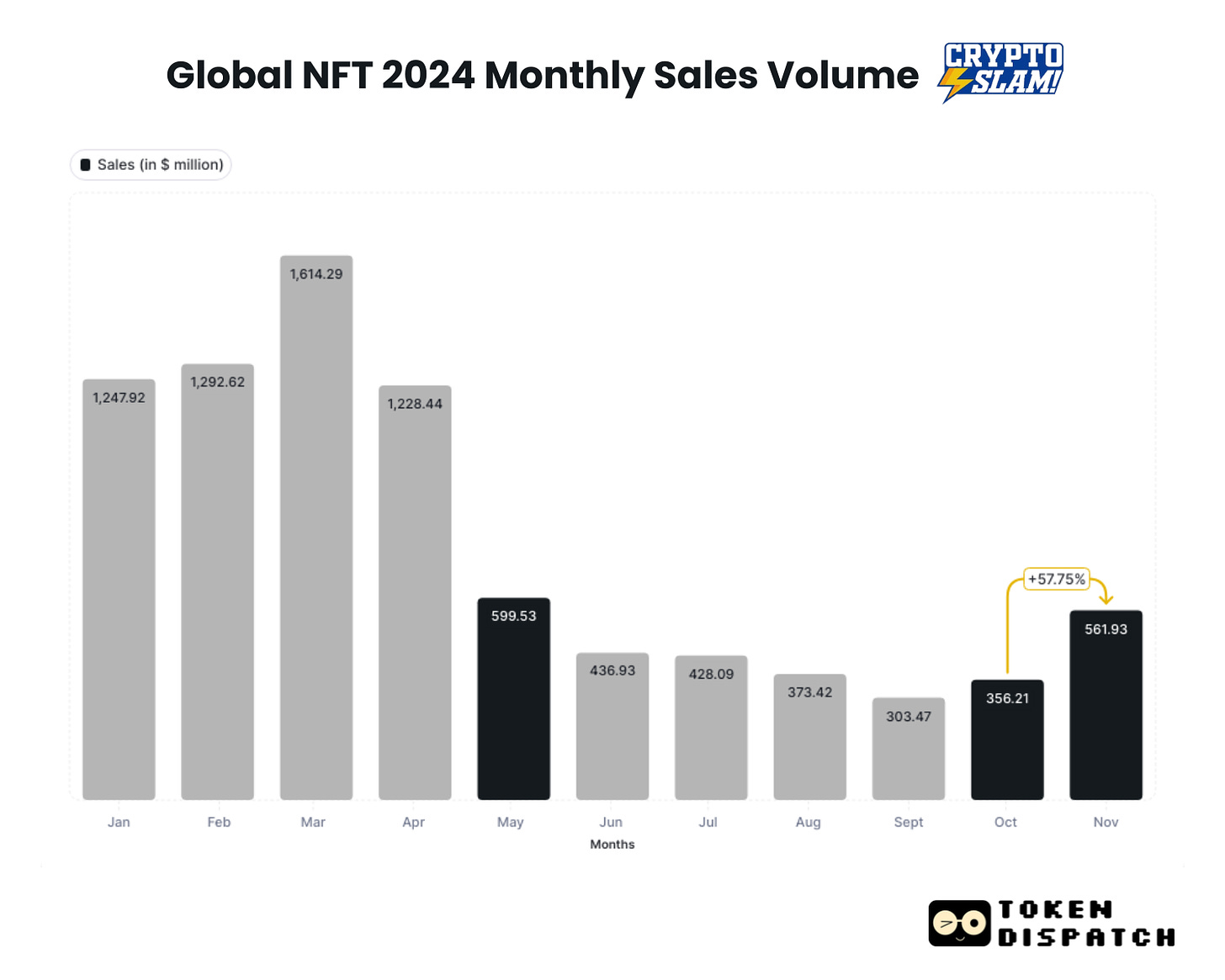

NFTs just came back from their grave and in style - wearing designer pixels and flexing a $562M monthly sales receipt for November.

That’s a six-month record high.

Incoming NFT season?

🔢 In The Numbers

$356M → $562M

That's the jump from October to November in NFT sales. Talk about a resurrection.

$562M in monthly sales (highest since May)

57.8% jump from October

$8.8B total market cap

48% surge in daily trading

But what’s driving the great NFT renaissance?

The altcoin leader - Ethereum’s own rally towards the $4,000 mark.

The top 10 NFT collections by market cap are all trading on Ethereum.

About 73% of the market activity is from the blue-chip collections, most of which are built on ETH network.

See the connection?

The most recent liquidity rotation shows how Bitcoin profits are flowing into ETH.

Read: ETH Elephant Finally Awake? 🐘

And now, all the ETH gains made during its recent rally are trickling down into NFTs.

ETH NFT sales accounted for $216 million, out of the $562 million worth monthly sales.

Meanwhile Bitcoin recorded $186 million and rest of the altchains accounted for $163 million.

However, ETH recorded the highest wash-trading ratio (quality trading).

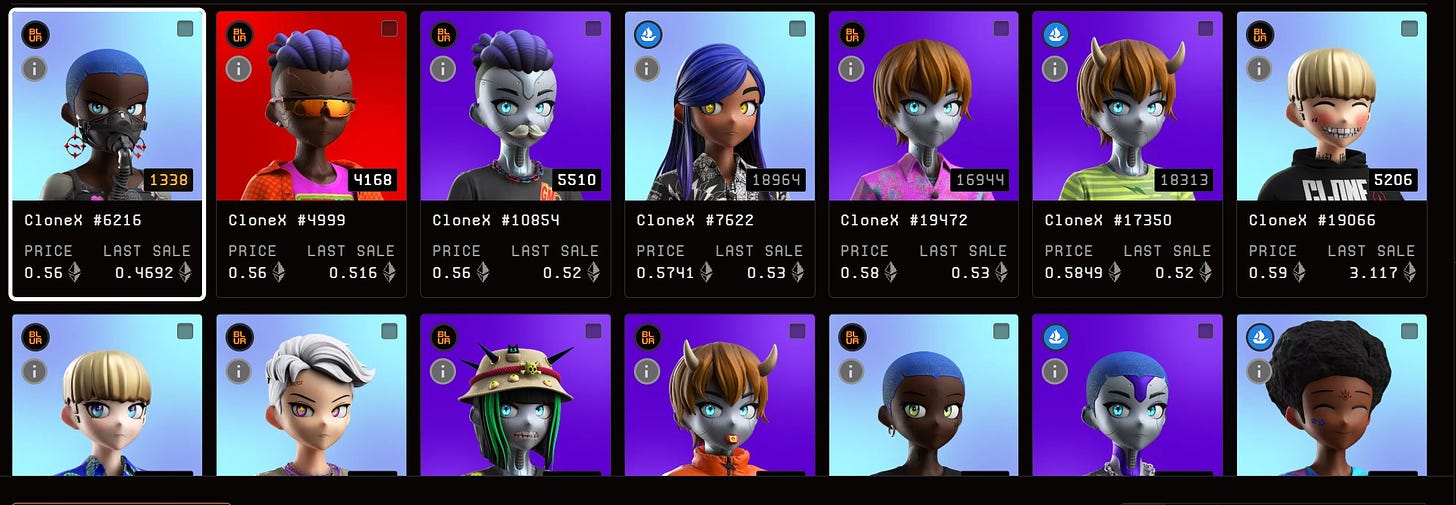

Recent Blur transactions prove just that.

4 CryptoPunks swept for 149.79 ETH ($539K)

12 BAYC sales for 186 ETH ($672K)

6 Pudgy Penguins swept for 63.99 ETH ($230K)

10 Milady sales for 62.1 ETH ($224K)

And that’s not all.

This time around it is unlike anything we have seen before.

Much different from the 2021 NFT season.

How? We got real utility being showcased using NFTs.

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

CryptoPunks As Collateral for Loans?

Unlike newer collections, CryptoPunks offer something rare in crypto: provable history. They're the Picassos of NFTs – not just art, but pieces of blockchain history.

And the whales? They're not just buying – they're using these pixelated faces as serious financial instruments.

Block That Quote🎙️

Seedphrase, investor and advisor to NFT lending platform GONDI

"This is comparable to using a Picasso as collateral in the traditional art world—an asset that appreciates over time but can also unlock substantial liquidity when needed."

This is what someone who just secured a loan against his NFT said about his one-of-one CryptoPunk.

Not surprising enough? Wait for it then.

He had bought this CryptoPunk for 85 ETH ($18,000) in May 2020.

And he has just used it as a collateral to secure a $2.75 million in capital without giving up ownership of the NFT.

"This liquidity enables me to strategically deploy funds into the crypto markets, particularly as I potentially approach my fourth crypto bull cycle."

Looks like these "worthless jpegs" are worth quite a bit after all.

Back to glory days? Not quite…

The Reality Check

The CryptoSlam 500 NFT Index is still down 53.77% from its peak. March saw $1.6B in sales – we're not quite there yet.

And every now and then, somebody somewhere is shutting their NFT shops.

Who now?

While blue chips are partying, Nike's RTFKT, once the poster child of NFT innovation, just announced it's shutting down.

Yes, the same RTFKT that was acquired by Nike in 2021.

And it was quite a big deal back then.

Ranked 9th in NFT earnings ($50M lifetime)

Generated $1.5B in trading volume

Collaborated with Takashi Murakami

Had 2+ dozen collections

So, what went wrong? The metaverse dream faded faster than a digital sneaker. Despite backing from Nike and a $33.3 million valuation, the project couldn't sustain the hype beyond the pandemic-era digital fashion boom.

"To honour and preserve this pioneering legacy, we will be launching an updated website that showcases the groundbreaking work that defined the RTFKT journey," reads their final announcement.

Translation: Another NFT gravestone in the digital cemetery.

So what does this mean for the future of NFTs?

Token Dispatch View 🔍

It's a stark reminder that while CryptoPunks and BAYC might be thriving, the broader NFT ecosystem is still finding its feet. The path from hype to sustainable utility? Still under construction.

So, how can NFTs revive?

We said it back in October when we wrote NFTs Story - From Boom to Bust.

“The challenge is to find genuine utility amidst the speculative frenzy.”

With the most recent possibility of NFTs being used as a collateral to raise funds, it raises a lot more utility beyond speculative gains and mere digital collectibles that could turn into fad and vanish - just like the Nike’s RTFKT.

And this time, the NFT market does show signs of maturity:

Fewer but bigger traders

Focus on established collections

Cross-chain expansion

Better trading infrastructure

While we might not see the wild speculation of 2021, what's emerging could be more sustainable: a market driven by serious collectors, institutional players, and genuine utility.

Fingers crossed then?

The Surfer 🏄

Crypto exchange volumes surged to a three-year high in November, reaching $2.9 trillion, the highest since May 2021.Increased interest and investment in cryptocurrencies were noted globally, with many exchanges reporting their strongest trading months in the past year.

Coinbase has fully integrated Apple Pay into its Onramp app services, live for all users starting December 2. App developers do not need to take any steps to enable this integration, making it seamless for users.

Bernstein Research suggests that US Ethereum ETFs may soon include staking yields, enhancing their investment appeal. The firm highlights rising investor interest in ETH compared to Bitcoin, viewing it as a promising opportunity. As of December 2, staking ETH offers approximately 3.1% annualised returns, with potential increases to 4-5% during high activity periods.

The US government transferred $1.9 billion worth of Bitcoin (approximately 19,800 BTC) seized from the Silk Road marketplace to a Coinbase Prime wallet. The Bitcoin was seized during a 2021 investigation of James Zhong, who was convicted of wire fraud related to Silk Road activities.

WisdomTree has filed with the SEC to launch a spot XRP ETF, aiming to gain exposure to XRP's price. The proposed WisdomTree XRP Fund would be listed on the Cboe BZX Exchange, with the Bank of New York Mellon as the administrator. The SEC has not previously approved a spot XRP ETF and is currently involved in a legal battle with Ripple over XRP's status as a security.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋