NFTs Dead? 💀

Once the darling sector of crypto's rise, NFTs have been crushed. Forget the last bull run, memecoins are the story this season. Can NFTs make a comeback? Where are we at, and what now from here.

Hello, y'all. What the hell’s an NFT … 🎵

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Remember those heady days of 2021?

We were all chasing Bored Ape Yacht Club and Crypto Punks like they were digital gold tickets.

But something went wonky in the ol' crypto world.

Those jpegs of monkeys aren't flying off the shelves as fast anymore.

So, what gives? Did someone unplug the router? Actually, a few things went down.

The market got flooded with, well, forgettable NFTs.

Remember Beanie Babies? Yeah, same idea.

Plus, the whole crypto rollercoaster took a nosedive, making people a little less jazzed about risky investments.

So is NFT market dead?

Or more like taking a nap after a sugar crash from all that hype.

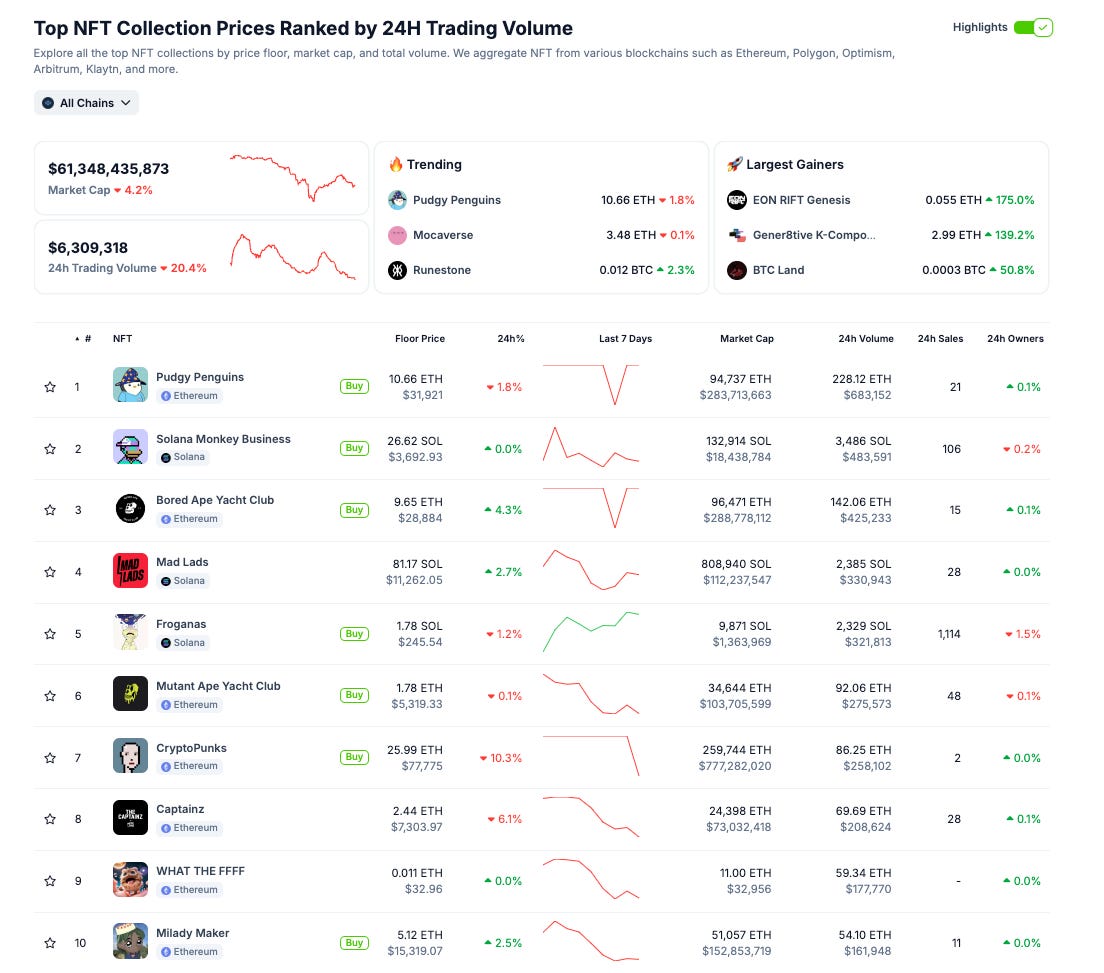

What does it look like now?

That don’t look good.

The rise and fall: Hype surrounding AI overshadowed NFTs, and search volume for NFTs dropped a whopping 82%. Then came the memecoins and the value of collectibles plummeted 90% from their peak.

Token Dispatch View: NFTs are trapped in a brutal bear market.

It’s not going to make a comeback until crypto traders feel rich. Even that scenario will bring in money only for the blue chip (reliable and valuable) collections.

It’s been memecoins that has the trader’s fancy this season.

It’s not going away anywhere - why?

Memecoins compared with NFTs, have a far lesser entry barrier and also serves as a fast moving consumer good (FMCG) for the trader’s appetite.

Yes, the NFT market has crashed, but the underlying tech is revolutionary.

NFTs aren't just expensive pictures, they're verifiable ownership records for digital and real-world assets.

Art, finance, music, gaming - NFTs are changing the game across the board. And it will continue to do so.

The NFT market in 2024: The bear side.

From the highs of 2021, it’s been a one-way ride for NFTs.

Down. Close to 90% in market cap.

Sales slump: Compared to the previous quarter, NFT sales volume took a nosedive – a 45% drop in 30 days.

June and July saw the lowest average sale value since March.

On track for the fewest transactions since early 2021.

The leading players in the NFT game – Bitcoin, Ethereum, and Solana – all saw significant slowdowns in sales.

Why the crash?

Many saw NFTs as a quick way to riches, not a long-term investment. This bubble eventually burst.

The NFT market is linked to crypto, and the crypto market's struggles in 2022 impacted NFTs. Crypto survived big time, but NFTs are still recovering.

Discussions about scams and fraudulent schemes continued to cast a long shadow, hindering hopes of a rapid recovery.

Wash trading – a practice where investors manipulate markets by buying and selling NFTs to themselves – was a particular concern.

Memecoins took over the hype train with a huge price surge and mainstream adoption.

Read: Memecoin mania

BAYC Crashes 90%

The price of a Bored Ape NFT has plummeted 92% from its peak of $350,000 in May 2022. Today, you can snag one for less than 10 ETH (around $33,000) – that's back to where it was in August 2021, before the NFT boom.

Derivative collections like Mutant Ape Yacht Club and Bored Ape Kennel Club are down a 95% and 97% respectively from their highs.

The reason?

Yuga Labs' (BAYC's creators) planned metaverse project, Otherside, failed to generate sustained excitement.

Their attempt to engage fans with a mobile game (Dookey Dash) fell flat.

Some blame Blur, a popular NFT marketplace, for incentivizing selling sprees that drove prices down.

Even with Bitcoin's 2024 rally, NFTs haven't bounced back.

Scams are on the rise

1/A Blur user lost a treasure trove of NFTs:

40 Beanz – additional NFTs with value.

Three Elementals – even more NFTs.

The scam siphoned these valuable NFTs, worth roughly $239,676, by listing them for practically nothing (one wei, a tiny unit of Ethereum).

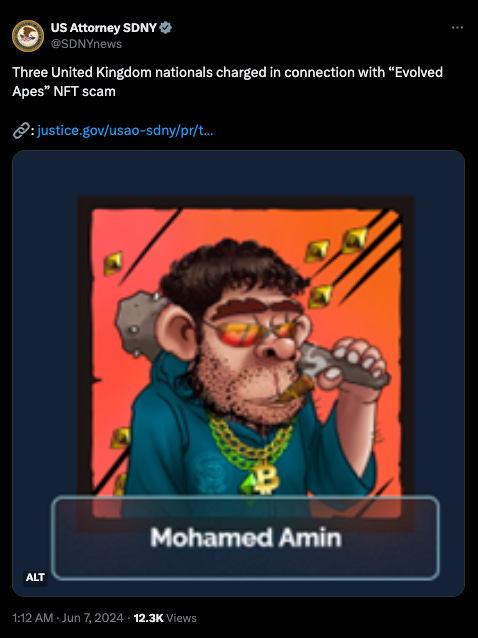

2/Three UK nationals have been charged with orchestrating a $3 million scam involving the "Evolved Apes" NFT collection.

The defendants promised to release a battle royale game but instead pocketed the crypto and ran.

3/ There was a security breach of Mark Cuban's Gmail account on June 23rd. Cuban reported a suspicious call claiming a Google security issue.

It's unclear if the hack is linked to the NFT sales.

But.. Cuban did a firesale

The billionaire investor's crypto wallet has been on a selling spree, offloading a collection of NFTs after nearly two years of inactivity.

A mix of NFTs including EulerBeats Genesis, DeepBlack, Pudgy Penguins, and Wrapped MoonCats were sold.

The most valuable sale: Pudgy Penguin #6239 fetched $30,578.

Total sales from the 14 NFTs: around $38,533.

This isn't Cuban's first brush with crypto misfortune. In 2023, one of his wallets was drained of approximately $870,000 in crypto assets.

The NFT market in 2024: The bull side

Are NFTs toast? not quite, but they're evolving.

In fact, they're quietly revolutionising entire industries.

Financial Markets: Tokenisation with NFTs is streamlining traditional financial instruments like stocks and bonds, making it more efficient and accessible markets.

Real-World Assets: From carbon credits to luxury goods, NFTs are bringing verifiable ownership and authenticity to physical and intangible assets.

Hybrid NFTs: Forget the all-or-nothing approach. The ERC-404 standard is allowing fractional ownership of high-value NFTs. Projects like Pandora are leading the charge.

Digital Art & Collectibles: Artists can now create and sell verifiably unique digital works, opening new revenue streams.

Play to Earn, Own to Win: Players can create, own, and trade unique digital assets within this virtual world, adding a whole new layer of value and engagement.

Get em satoshis: Bitcoin Ordinals are pushing the boundaries by embedding digital artefacts directly into individual satoshis (the smallest unit of Bitcoin).

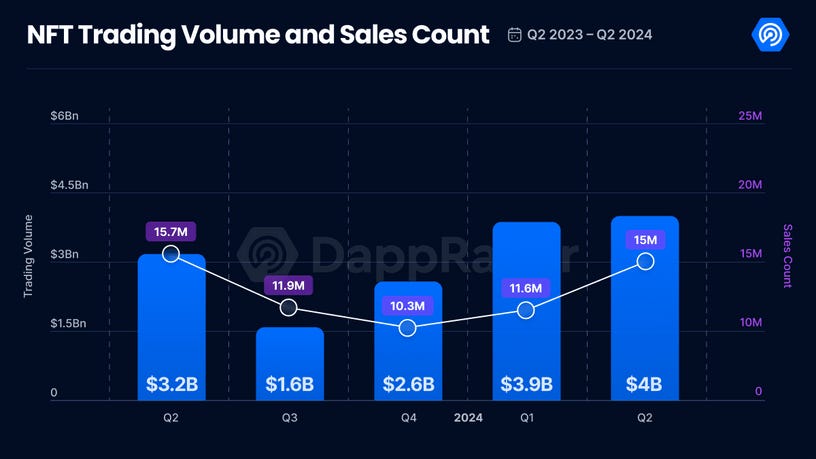

Strongest quarter since early 2023: DappRadar

According to DappRadar, the second quarter of 2024 saw the NFT market's best performance since early 2023.

The number of NFT sales jumped by 28%, reaching levels not seen since Q1 2023.

Trading volume hit $4 billion in Q2, a 3.7% increase compared to the previous quarter.

Blur remains the leading NFT marketplace, but its market share has shrunk from 50% to 31%.

The Bitwise Ad

Bitwise's latest Ethereum ad, a 39-second clip, can be minted as an NFT. This marks the first time a national TV commercial is minted as an NFT.

Vitalik’s new idea

Ethereum co-founder Vitalik Buterin sees potential in Token for Image Tokenizer (TiTok), a new method for image compression.

TiTok AI significantly reduces image size for efficient blockchain storage.

Potential applications include storing profile pictures (PFPs) and non-fungible tokens (NFTs) on-chain.

Japanese Village Uses NFTs

Yamakoshi village in Japan is battling a declining population and aging residents.

Enter the NFTs: The village launched the Neo-Yamakoshi Village project, selling digital assets called Nishikigoi NFTs.

These NFTs act as both a unique identifier for "digital citizens" and a voting token for community decisions.

The NFT market: Lookahead

Key trends shaping the NFT market

Hybrid NFTs: Blending NFTs with fractional ownership via standards like ERC-404 to increase liquidity and accessibility.

Real World Asset (RWA) tokenisation: Digitising tangible assets like real estate and art on the blockchain to democratise investment.

NFTs in gaming: Integrating NFTs to give players true ownership of in-game assets, transforming player engagement and game economies.

Bitcoin-based NFTs: Ordinals are expanding Bitcoin's utility by introducing NFTs to Bitcoin by embedding digital artifacts in satoshis.

Metaverse integration: Driving growth and innovation by incorporating NFTs as virtual lands, collectibles, and art within the emerging metaverse.

Forecasts estimating it will reach a market size of $231 billion by 2030, growing at a compound annual rate of 33.7%.

This growth is expected to be driven by increasing adoption and use cases for NFTs across industries like gaming, music, and ticketing.

TTD Week That Was 📆

Saturday: Is The Bottom In? 🪨

Friday: Fire Sale 📉

Thursday: Crypto Report Card 🗂️

Wednesday: Circle Wins EU 🏆

Tuesday: Anarcho-tyranny 🤔

Monday: Hamsters Are A Comin 🐹

TTD Week in Funding 💰

Sentient. $85M. Open-source AI development platform. campaigns for specific metrics for evaluating contributions and rewards based on these metrics.

Lombard. $16M. Unlocking Bitcoin's potential by connecting it to DeFi. Enable the yield-bearing BTC to move cross-chain without fragmenting liquidity.

Prodia. $15M. Distributed cloud computing firm of graphics processing units (GPUs) for efficient computing services at a lower cost using web3 infrastructure.

RedStone. $15M. Cross-chain data oracle for fast, cost-efficient access to data. Full historic audit trail and an insurance-backed decentralised dispute mechanism.

Pi Squared. $12.5M. Zero-knowledge proof (ZK) to verify the correct execution without relying on a specific programming language (PL) or virtual machine (VM).

SendBlock. $8.2M. Blockchain data management. Fully customisable platform with flexibility and scalability in high-throughput blockchains.

OpenLedger. $8M. Permissionless and data-focused infrastructure for artificial intelligence development.

QED. $6M. Bitcoin’s native execution layer, designed to address the challenges of Web3 development.

Compute Labs. $3M. Compute Tokenisation Protocol to financialise AI, enable direct exposure to compute assets and create compute derivates for investors.

FreeBNK. $3M. Blockchain-based financial ecosystem. With over 300 DeFi & CeFi liquidity providers to low-fee payment methods.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋