NFT's F-bombs 💣

Ben, Bitboy and the saga of PSYOP. Crypto finds itself in divorce trials. US senator. Tough road for Biden's 30% Bitcoin mining tax. A malicious attack on Tornado Cash DAO. Huobi and Hotbit shut down.

Hello, y'all. Not just Burj Khalifa, Dubai's got a new icon in town—the Bitcoin Tower. Who needs traditional skyscrapers when you can reach for the moo👇

This is The Token Dispatch. Hit us on telegram 🤟

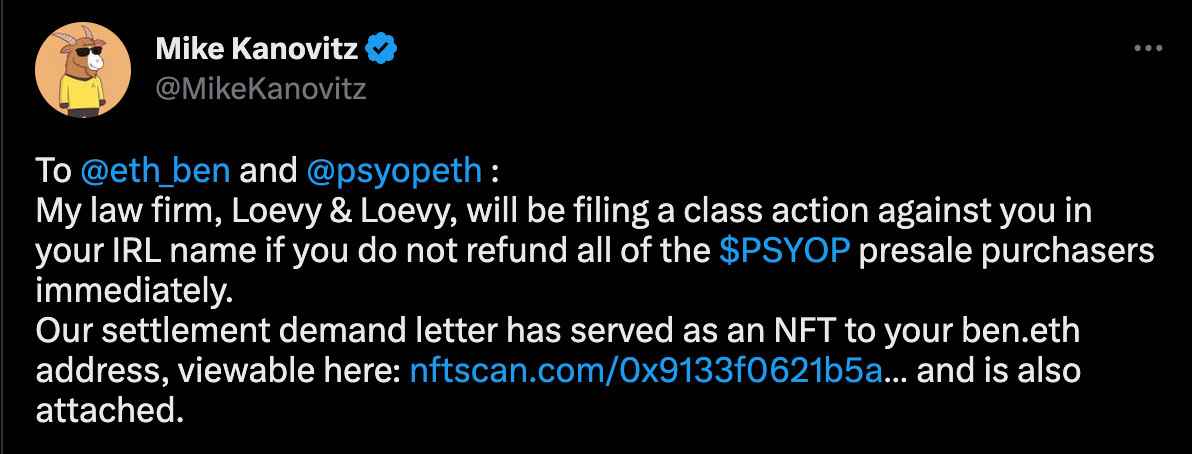

In the latest episode of the NFT saga, an influencer was served with a settlement demand that was as unique as their digital tokens.

An NFT dropped the legal bomb, sprinkled with a few F-bombs for extra flavour, accusing the influencer of some sneaky business during a $7 Million token presale.

Here's the backstory: Pseudonymous NFT collector Ben.eth, has been on an incredible winning streak. In just seven days, Ben.eth managed to scoop up an absolutely massive $7 Million in ETH sales through the presale of his latest memecoin called $PSYOP.

Investors were practically foaming at the mouth to get a piece of Ben.eth's latest meme coin project, riding high on the coattails of his first triumphant launch, the legendary $BEN. That little gem skyrocketed by a mind-melting 5,000% in just one day back on May 8th.

How? Well, it all started with a nod from the crypto influencer himself, Ben Armstrong. The project soon changed hands, with Armstrong taking the reins for a secret, undisclosed fee.

About the $PSYOP presale: despite having a few warning signs flashing bright red, it didn't deter investors. They fearlessly sent their hard-earned money directly to Ben.eth's Ethereum address - forking out a total of more than 3,843 ETH.

Ben.eth unleashed his creation on Uniswap. And the $PSYOP's market cap instantly skyrocketed to a jaw-dropping $570 Million.

Back to present: Apparently, Ben.eth, allegedly pulled off a "manipulative launch strategy" with their Psyop (PSYOP) token.

Who says? A lawyer named Mike Kanovitz from the law firm Loevy & Loevy, took the settlement demand to the next level by serving it as an NFT. Imagine receiving a legal notice in the form of a digital collectible.

Talk about merging technology and litigation.

He accused Ben.eth of wire fraud, which could potentially lead to a whopping $21 million in damages.

The lawyer suggested a simple solution: just send back the ETH and make things right. Otherwise, legal consequences await, including the unveiling of co-conspirators and a not-so-pleasant subpoena party.

The reply: Ben.eth had his own thoughts on the matter and retaliated by claiming the lawyer's approach was "so unprofessional."

The Inferno Drainer👾

There's a new phishing scam in town: Now one has been wreaking havoc in the crypto world, snatching up nearly $6 million in cryptocurrencies and NFTs faster than you can say "blockchain."

Inferno Drainer disguises itself as innocent websites but is secretly plotting to drain your digital assets.

There are thousands of victims, with a whopping $5.9 Million in cryptocurrencies and NFTs disappearing into thin air. 1,699 ETH have been stolen and distributed across five addresses, each holding between 300 and 400 ETH.

Inferno Drainer has created 689 phishing websites since March 27.

They're even charging a hefty 20% to 30% of the stolen assets as payment for their devilish software.

TTD WTF 🤭

In the midst of a divorce battle, a New York wife stumbled upon her husband's secret Bitcoin stash.

The couple have been married for 10 years. She had a hunch that her husband wasn't being completely honest about his assets. And turns out, her high-earning hubby, raking in a cool $3 million a year, had more than meets the eye.

Sarita appointed a forensic accountant, who uncovered a whopping 12 Bitcoins ($500,000) stored in an undisclosed crypto wallet.

And she didn't even know he was into crypto.

The court has ruled that he must share the spoils of his digital treasure with his soon-to-be ex-wife.

No wonder why crypto holdings are becoming an increasingly common conflict in divorces.

TTD Blockquote 🔊

Cynthia Lummis, US senator from Wyoming

"That isn't going to happen."

Senator Cynthia Lummis expressed skepticism about President Joe Biden's proposed 30% excise tax for Bitcoin miners. During a fireside chat at the Bitcoin 2023 conference in Miami, Lummis dismissed the possibility of the tax being implemented.

Lummis highlighted that Bitcoin miners have the freedom to operate anywhere globally, diminishing the effectiveness of such a tax in deterring mining activities in the United States.

She emphasized the importance of national security and energy security in allowing Bitcoin mining to flourish in the country.

Wyoming, where Lummis is from, was mentioned as a state with significant mining, oil, gas, and renewable energy resources, making it an attractive location for Bitcoin miners to utilize excess energy.

Lummis stated that Bitcoin mining has the potential to contribute to environmental cleanup. The senator acknowledged the challenges in persuading fellow lawmakers about the benefits of Bitcoin mining.

TTD Hijack 🤷

The Tornado Cash DAO, a crypto mixing service running on Ethereum, experienced a malicious attack on its governance system.

The attacker successfully passed a deceptive upgrade proposal that granted them complete control over the governance system.

By utilising this control, the attacker obtained an additional 1.2 million votes, effectively taking control of the entire governance system.

The attacker swiftly withdrew 10,000 votes in the form of TORN tokens and sold them for $25,600.

They also drained the remaining locked votes, resulting in a total of 483,000 TORN being taken from the vault.

On-chain analysis suggests that 6,000 TORN was deposited on Bitrue exchange, 379,000 TORN was sold on-chain for around $680,000 worth of ether, and the attacker still retains control over almost 100,000 TORN.

Binance suspended deposits and withdrawals of TORN, while Huobi continued to allow them.

With control over the governance system, the attacker has the ability to drain the tokens in the governance contract and potentially disrupt the protocol's operations, but they cannot access the funds held within the protocol except for one pool on Gnosis Chain.

The price of TORN initially dropped significantly from $7.3 to as low as $3.75 but has since rebounded to around $4.60.

TTD Shutdown ⏹️

The Securities Commission of Malaysia has ordered Huobi, a Seychelles-based cryptocurrency exchange, to shut down its operations in the country.

The exchange was found to be operating without the required registration and license.

Huobi's CEO, Leon Li, has been instructed to oversee the closure process, including ceasing communications with Malaysian investors and disabling the website and app.

A public reprimand has also been issued against Huobi and its founder. The action was taken due to concerns about the exchange's compliance with local regulations and protecting investors' interests.

Hotbit, a cryptocurrency exchange, has announced the cessation of its operations due to deteriorating operating conditions and uncertainties surrounding the future of centralised exchanges.

The exchange cited a forced suspension, regulatory challenges, cyber attacks, and high risks on certain assets as contributing factors.

Hotbit urged users to withdraw their funds by June 21.

The closures of other centralised exchanges have increased skepticism about their viability, leading to calls for greater decentralisation and individual custody of cryptocurrencies.

TTD Surfer 🏄

Crypto exchange Gemini claims that Digital Currency Group (DCG) has missed out on a $630 Million payment that was due last week.

US sanctions watchdog alleges Russia-linked crypto wallet to help wealthy Russians evade sanctions and hide money in UAE, and OFAC.

Swiss canton Zug increases Bitcoin, Ethereum tax payment to CHF 1.5 Million from the previous CHF 100k. The canton began accepting crypto for tax payments in 2021.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋

"The couple have been married for 10 days. " DAYS?! is that correct? 10 days and she's entitled to his stuff?