NFTs see explosive growth with 876.89% increase in unique traders

Hello,

In today’s dispatch we have:

NFTs and DeFi continues to thrive

Central African Republic eyes legal framework for crypto

UAE leaps forward with crypto adoption

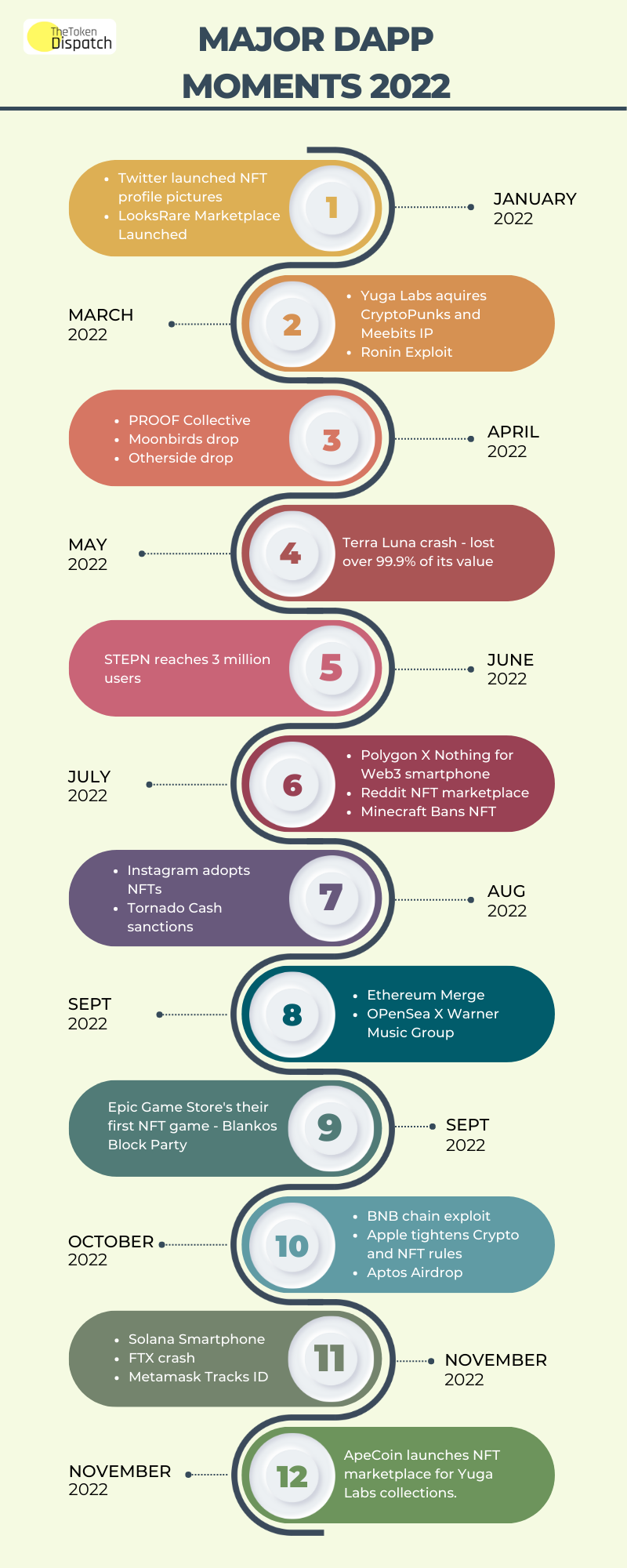

2022 was a wild ride for the blockchain and Dapp scene, filled with cool tech advancements like the Ethereum Merge and zero-knowledge proof. We saw big players get on board and even some major dips!

Dapp Industry Report 2022 has all of that covered. And it says that even through the rough patches, the DeFi sector kept on chugging along, with creative, smart contract financial apps and traditional institutions getting on board with the DeFi train.

A closer look:

Dapp industry saw a 50% increase in unique active wallets (dUAW) on average, rising from 1.58 million to 2.37 million.

Industry challenges caused a 73.97% drop in Total Value Locked (TVL) to $55 billion in December.

Ethereum remains the dominant DeFi protocol, and BNB Chain is the second-largest DeFi ecosystem.

Layer-2 solutions appeared to be the least affected by crypto turbulence, with Optimism's TVL increasing by 127.60%.

Blockchain games in 2022 accounted for 49% of all dapp activity, with Splinterlands remaining the most popular game.

Hacks and attacks:

In 2022, there were 312 crypto attacks resulting in losses of $48.74 billion.

Terra Luna scandal caused the largest loss at $40 billion.

Centralized platforms were the favorite target, with $44.71 billion in losses.

BNB and ETH chains were the most hacked

Rug pulls were the most common type of attack.

Excluding the Terra Luna scandal, the median loss per hack was $283k and total losses per month were $728 million.

Regulatory landscape:

The Financial Action Task Force's (FATF) Travel Rule - to improve the traceability of virtual assets.

SEC issued new guidance for digital assets.

A White House bill for crypto regulations was introduced.

Joe Biden issued "Executive Order on ensuring Responsible Development of Digital Assets."

In Europe, the Markets in Crypto-Assets (MiCA) regulation aimed to establish a harmonized framework.

The NFT scene:

Trading volume generated $12.46 billion in Q1, (the best Q) but saw a dip in Q2, generating $8.4 billion.

Unique traders saw an impressive 876.89% increase, with a 10.16% boost in sales as well.

Yuga Labs domination continues: Snatching up CryptoPunks, Meebits, and WENEW Labs and owning 55% of the most valuable NFT collections worth $15 billion.

The mainstream adoption of NFTs and decrease in crypto prices sparked even more interest in the market.

NFT blue-chip collections, like VeeFriends and PROOF, raised a whopping $50 million each to grow their brands even bigger.

The introduction of zero-royalty NFT marketplaces, like SudoSwap, sparked a heated debate about the role of royalties in the NFT market.

Big picture: NFTs have been the superheroes of the web3 world, saving the day even in a bear market! Projects ensure that everyone focuses on building useful things for the long term instead of just chasing hype. And with NFTs leading the charge, we're sure to see some epic battles between good and evil and, of course, some cool art and collectables.

Central African Republic eyes legal framework for crypto adoption

The Central African Republic (CAR) seems ready to take the crypto world by storm! The government of CAR is reportedly working on a legal framework to support the adoption of digital currencies in the country.

Now, you might be thinking, "But wait, isn't the Central African Republic one of the poorest countries in the world? Why would they be interested in crypto?" Well, my friends, that's exactly why they're interested. The CAR government sees the potential for digital currencies to provide financial services to the unbanked population and to boost the country's economy in trade.

"It makes a lot of sense to solve this problem by using crypto as the vehicle. Crypto is a faster and cheaper route that can bridge the gap and help reduce fees in moving money globally. This is the core of the problem we want to solve," said Roqqu CEO Benjamin.

Not every day, you hear about a country in the midst of economic struggles turning to crypto as a solution, but that's what the CAR is doing.

This move by the CAR government is not only forward-thinking but also a sign of the growing acceptance of digital currencies worldwide. The CAR might not be the first country that comes to mind when you think of crypto adoption, but it might be the next big thing in the crypto world.

UAE leaps forward with crypto adoption in international trade

It's official folks, the United Arab Emirates (UAE) is ready to embrace the world of cryptocurrency. In a recent statement, the country's foreign trade minister announced that crypto will play a "major role" in the UAE's trade.

But what does that mean for us? Well, It means that the UAE is joining the ranks of countries like Japan and South Korea, who have already recognized the potential of crypto in boosting international trade.

This is great news for the crypto community, as it opens up a whole new market for digital currencies. But it's also great news for businesses operating in the UAE, as it means they'll have more options for international transactions.

It's clear that the UAE is on a mission to become a leader in digital innovation, and this move to integrate crypto into their trade operations is just the latest example of their progressive approach

"The most important thing is that we ensure global governance when it comes to cryptocurrencies and crypto companies. We started attracting some of the companies to the country with the aim that we'll build together the right governance and legal system, which are needed."