Happy Sunday dispatchers!

Africa's largest economy has an awkward relationship with cryptocurrencies.

Like a disapproving parent whose child has become unexpectedly successful, Nigerian authorities have spent years wrestling with how to respond to the unstoppable wave of crypto adoption sweeping through their nation.

While the government files billion-dollar lawsuits against exchanges with one hand, it cautiously builds a regulated crypto ecosystem with the other.

In today's Rabbit Hole, we explore how a collapsing naira, resourceful youth, and unstoppable peer-to-peer networks have transformed Africa's largest economy into a crypto powerhouse—no matter what the regulations say.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

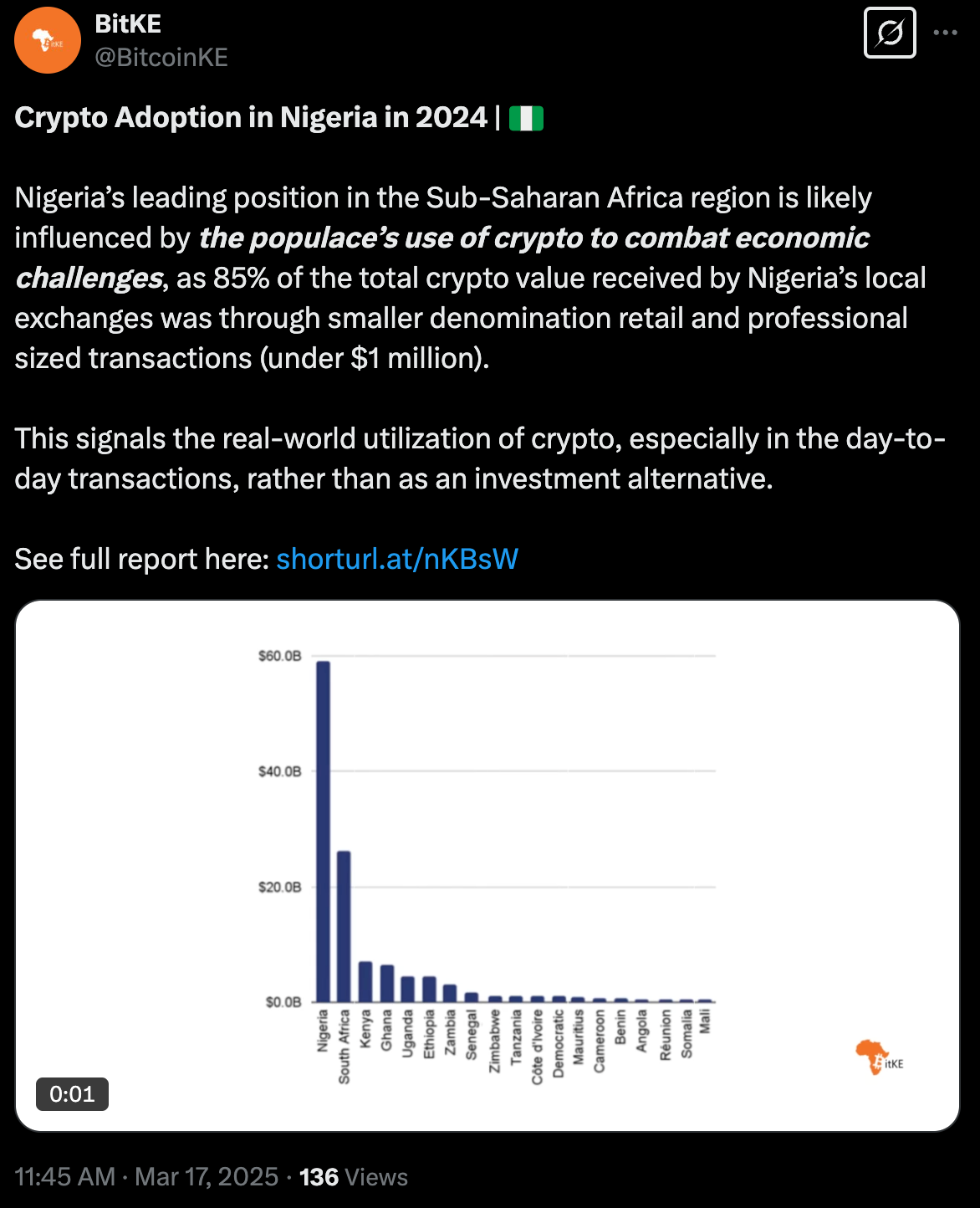

Nigeria ranks second globally for crypto adoption according to Chainalysis, with an estimated 22% of the population (about 47 million people) owning or using digital assets.

Between July 2023 and June 2024 alone, Nigerians received $59 billion in cryptocurrency — an astounding figure for a country whose entire annual GDP hovers around $400 billion.

This isn't happening because Nigerians are entranced by blockchain technology or because they're betting on the next meme coin. It's happening because the naira has become a burning house that people are desperate to escape.

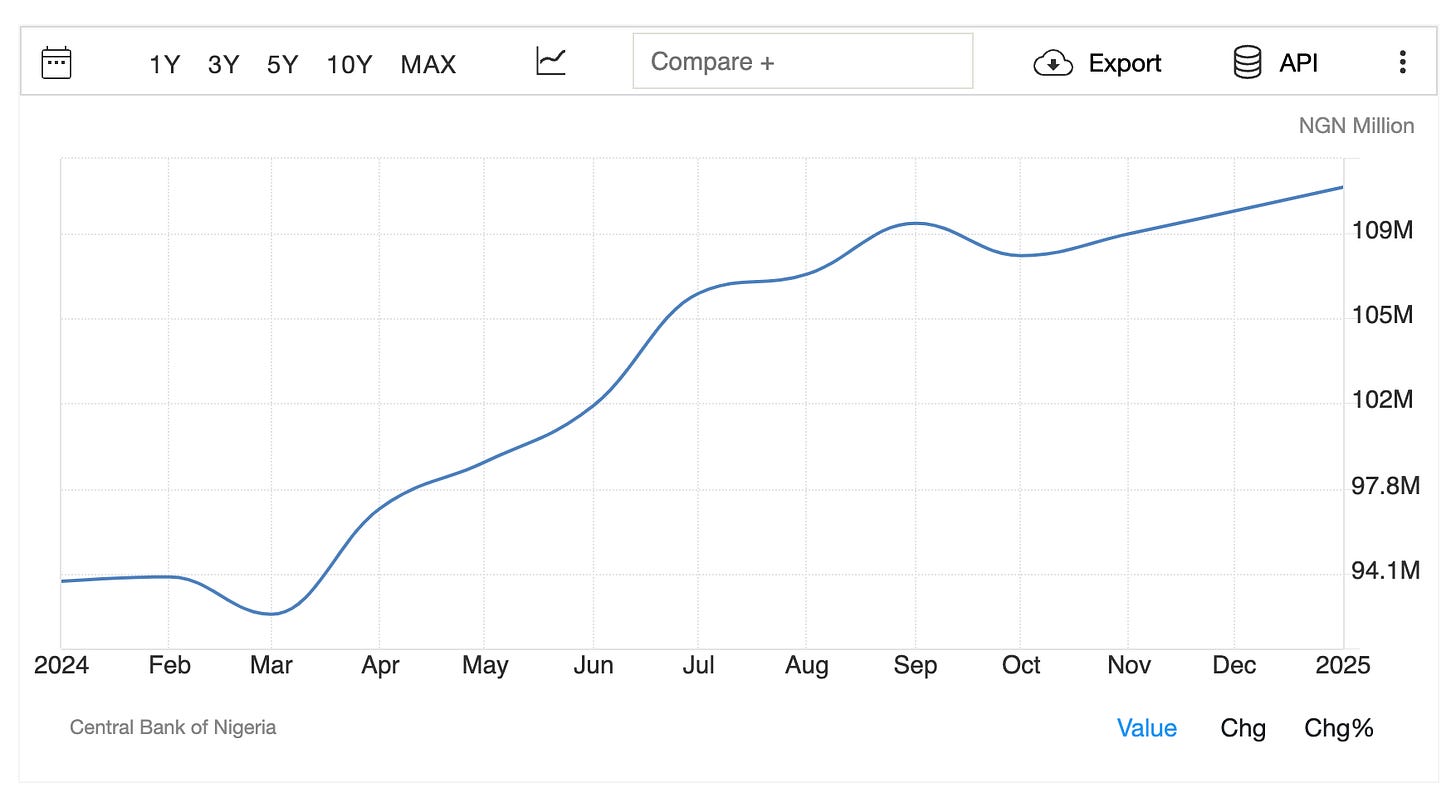

The currency has experienced catastrophic devaluation, with inflation rates climbing from 12.10% in 2018 to 24.66% in 2023, and hitting a 30-year high of 34.80% in December 2024.

As of March 23, 2025, the official exchange rate of the Nigerian Naira (NGN) to the US Dollar (USD) is approximately ₦1,559.65 to $1. A far cry from the 360 level it maintained just a few years ago.

For everyday Nigerians, cryptocurrencies aren't speculative assets — they're financial lifeboats.

The Hand That Both Slaps and Welcomes

Despite this widespread adoption — or perhaps because of it — the Nigerian government has spent years trying to control the crypto narrative.

The latest chapter in this saga came this month when Nigerian Information Minister Mohammed Idris told Semafor that many crypto businesses operate inside the country without facing litigation or criminal prosecution.

"This is part of the effort to strengthen our laws, not to cripple anybody," said Idris, attempting to smooth over the rough edges of Nigeria's approach to regulation. "We are ensuring that no one comes and operates without regulation."

His comments came amid the ongoing $81.5 billion lawsuit against Binance and the high-profile detention of Binance executive Tigran Gambaryan, which had sparked concerns about Nigeria's posture toward the crypto industry.

The minister's reassurance rings somewhat hollow given the government's track record of regulatory whiplash.

What he didn't say is equally telling.

Nigeria needs cryptocurrency, even as it attempts to control it.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

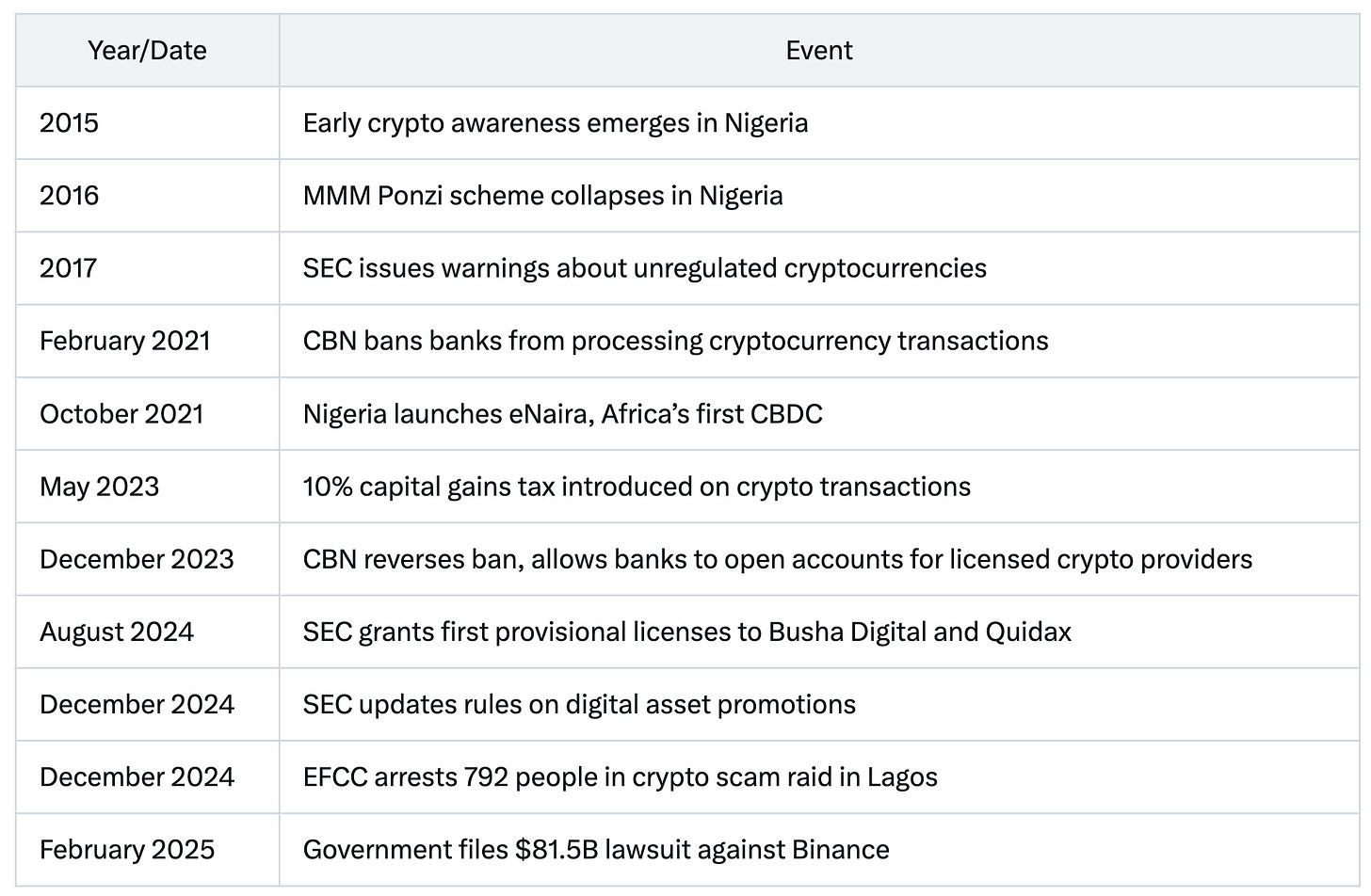

From Warnings to Bans to Grudging Acceptance

A story of gradual recognition punctuated by sudden U-turns.

In 2017, the Nigerian Securities and Exchange Commission(SEC) first issued warnings that cryptocurrencies were unregulated, while the Central Bank of Nigeria (CBN) advised banks to steer clear of facilitating crypto transactions.

By February 2021, these advisories had hardened into an outright banking ban, with the CBN prohibiting financial institutions from processing cryptocurrency transactions. This led to widespread account closures for anyone linked to crypto activities.

Read: When Banks Can't Bank 🖐🏾

The ban simply pushed the market underground, sparking a boom in peer-to-peer trading on platforms like WhatsApp and Telegram.

P2P trading exploded on Paxful, WhatsApp, and Telegram, creating an impromptu financial network beyond government reach. This isn't regulatory dodging — it's economic survival in a country where the naira's value evaporates daily.

The system's genius lies in its simplicity: crypto for value storage, mobile money for local transactions. No banks required.

This invisible infrastructure — decentralised, nimble, and embedded in daily life — may outlast any regulatory framework Nigeria builds to contain it.

In a strange twist of regulatory gymnastics, the government launched its own digital currency, the eNaira, in October 2021 — becoming the first African nation to introduce a central bank digital currency (CBDC).

It was a contradictory message: "Cryptocurrencies are dangerous, but here's our version that you should use instead."

Unfortunately for the CBN, Nigerians weren't buying it. The eNaira has struggled to gain traction, with less than 0.5% of the population using it. Meanwhile, Bitcoin, Ethereum, and stablecoins continue to thrive.

By December 2023, the government appeared to recognise the futility of its ban. The CBN issued new guidelines allowing banks to open accounts for licensed crypto service providers, effectively reversing its previous position.

This reversal wasn't a recognition of crypto's legitimacy, but rather an admission that the genie couldn't be stuffed back into the bottle.

How a Ponzi Scheme Shaped Policy?

To understand Nigeria's initial wariness of crypto, we need to rewind to 2016.

That year, the Russian Ponzi scheme MMM gained extraordinary popularity in Nigeria, promising 30% monthly returns. When it inevitably collapsed, millions of Nigerians lost their savings.

Many of these schemes used Bitcoin as a payment method, creating an early association between cryptocurrency and fraud in the minds of regulators.

The Nigerian Deposit Insurance Commission and the CBN set up a commission to investigate Bitcoin specifically because of MMM's collapse. That investigation laid the groundwork for the harsh regulatory approach that followed.

This explains the government's persistent framing of cryptocurrency as a consumer protection issue rather than an innovation opportunity. The memory of MMM's collapse continues to influence policy decisions today.

Competing in a Global Race for Crypto Dominance

Nigeria's approach to cryptocurrency doesn't exist in a vacuum. It's part of a global competition for influence in the emerging digital economy.

While Nigeria has taken a cautious, sometimes adversarial, approach other nations with similar economic challenges have chosen different paths.

Kenya, for instance, has embraced crypto innovation while maintaining oversight. The success of M-Pesa in Kenya created a culture comfortable with digital finance, allowing for a smoother integration of cryptocurrency.

India, currently ranked first in global crypto adoption, maintains a complex relationship with digital assets, imposing high taxes but stopping short of outright bans.

El Salvador made the boldest move by making Bitcoin legal tender—a controversial decision that Nigeria has shown no interest in replicating.

Read: Crypto Exodus to El Salvador 🇸🇻

The stakes in this global race are high. Nations that successfully integrate cryptocurrency into their financial systems could gain significant economic advantages, while those that reject it risk being left behind.

For Nigeria, with its youthful population and widespread smartphone ownership (92%), the potential upside of embracing rather than fighting crypto is considerable.

Nigeria is now attempting to build a regulated crypto ecosystem from the ground up.

The SEC has begun granting provisional licenses to local exchanges. Busha Digital and Quidax have been the first to receive approval under the SEC's Accelerated Regulatory Incubation Programme (ARIP).

The pattern is clear: Nigeria is slowly accepting that crypto is here to stay, but on terms the government can control and, importantly, tax.

Nigeria's crypto revolution is partly a function of demographics.

With a median age under 20 years, Nigeria has one of the youngest populations in the world.

This youth-heavy demographic naturally gravitates toward digital solutions. They're comfortable with technology, skeptical of traditional institutions, and eager to participate in the global economy.

For young Nigerians facing unemployment, cryptocurrency offers both an investment opportunity and a potential career path. The emergence of crypto startups, training programs, and communities has created a vibrant ecosystem that provides economic opportunities in an otherwise challenging job market.

In December 2024, the SEC updated its rules on digital asset promotions, requiring VASPs to obtain prior approval before engaging third-parties to promote their products. The revisions also targeted "Finfluencers," who must now secure authorisation before publishing crypto advertisements. Penalties include fines up to 10 million naira ($6,400) or three years in jail.

For crypto businesses looking to operate legally, the compliance burden is substantial: legal incorporation in Nigeria, physical office, resident chief executive, and extensive documentation.

These requirements create significant barriers to entry, potentially concentrating the market among a few well-resourced players.

The updated rules are scheduled to take effect on June 30, 2025, giving the industry time to adapt to the new regulatory framework.

Taxation: Following the Money

Perhaps most revealing about the government's true intentions is its approach to taxation.

In May 2023, the government introduced a 10% capital gains tax on cryptocurrency transactions as part of a broader finance bill.

These measures could generate up to 200 billion naira ($250 million) annually for government coffers.

The tax push comes as Nigeria grapples with one of the lowest tax-to-GDP ratios globally — just 6%, according to the World Bank.

With only 9% of Nigeria's 70 million taxable adults paying income taxes in 2022, the government is desperate to expand its revenue base.

The reality is that Nigeria's informal economy accounts for 65% of GDP — and much of the crypto economy resides there, where it's resistant to conventional taxation efforts.

The government wants to tax crypto activity, but the more aggressively it taxes, the more that activity will move underground.

While crafting regulations, Nigeria is also cracking down on crypto-related fraud.

In December 2024, Nigeria's EFCC arrested 792 people in a Lagos raid targeting a cryptocurrency romance scam operation. The suspects included 148 Chinese and 40 Filipino nationals.

"Nigerian accomplices were recruited by foreign kingpins to prospect for victims online," an EFCC spokesperson explained. "Once Nigerians won the confidence of would-be victims, foreigners would take over the actual task of defrauding them."

The scale of this bust suggests the problem is widespread and well-organised. It also demonstrates that Nigerian authorities have the capacity for enforcement when motivated.

The Binance Saga

Nigeria's most dramatic move has been its $81.5 billion lawsuit against Binance, filed in February 2025.

The lawsuit claims $2 billion in back taxes and $79 billion in economic damages for allegedly crashing the naira.

The dispute escalated when Nigerian authorities detained two Binance executives during what was supposed to be a routine regulatory meeting.

While Nadeem Anjarwalla escaped custody, Tigran Gambaryan — a US citizen — was held for nearly seven months, triggering diplomatic tensions with the United States.

Read: Nigeria's Crypto Crime Thriller 🇳🇬

Following pressure that included calls from the US ambassador, Gambaryan was finally released in October 2024.

While Binance halted all naira trading after the executives' detention, the damage was already done to both Binance's reputation in Nigeria and Nigeria's reputation among international businesses.

Token Dispatch View 🔍

Nigeria's approach to crypto isn't unique. It mirrors the struggle many emerging markets face as they try to balance the benefits of financial innovation against threats to monetary sovereignty.

Countries like India and Kenya face similar pressures, though their regulatory responses have been less confrontational.

El Salvador took the opposite approach by making Bitcoin legal tender — a radical move that Nigeria has shown no interest in replicating.

For Nigerian authorities, the calculation is complex: how to harness the benefits of blockchain technology and digital assets without undermining the central bank's control of monetary policy or enabling capital flight.

The current strategy seems to be grudging acceptance coupled with attempts to funnel activity through regulated channels where it can be monitored and taxed.

But this approach may be too little, too late. Nigeria's crypto ecosystem has already evolved into a resilient, decentralised network that operates largely beyond government reach.

The fundamental driver of crypto adoption in Nigeria remains unchanged: a rapidly devaluing currency coupled with a young, tech-savvy population seeking financial alternatives.

Until the government addresses these root causes, crypto will continue to serve as both a lifeline for ordinary Nigerians and a headache for regulators.

So the dance continues — with the government and crypto users moving to different tunes, occasionally stepping on each other's toes, but always in motion.

Despite the regulatory challenges, cryptocurrency has become a powerful tool for financial inclusion in Nigeria.

With 45% of adult Nigerians unbanked but 32% using crypto, digital assets are reaching populations that traditional banking has failed to serve.

The reasons are straightforward: opening a crypto wallet requires only a smartphone and internet connection, while opening a bank account often involves paperwork, minimum deposits, and physical branch visits.

Crypto also offers access to global financial services that were previously unavailable to ordinary Nigerians. From lending platforms to investment opportunities, the crypto ecosystem creates pathways to financial services that traditional banks don't provide.

For Nigeria's freelancers and digital workers, cryptocurrency solves a critical problem: getting paid. Traditional international payment systems often exclude or restrict Nigerian users, making it difficult to receive compensation for work done online.

Crypto bypasses these restrictions, allowing Nigerian freelancers to participate fully in the global digital economy.

The challenge for regulators is how to capture the benefits of this financial inclusion while addressing legitimate concerns about consumer protection, financial stability, and tax compliance.

Week That Was 📆

Thursday: XRP Fortune Fires Post SEC Relief 👨🏼⚖

Wednesday: When Bots Stop Talking 🤖

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.