TGIF Dispatchers.

From a small apartment in Genoa, Italy, to controlling more than $140 billion in digital assets backed by US Treasuries. The sum that makes his company one of the largest holder of American government debt, $113 billion in direct and indirect holdings as of December 2024.

Meet Paolo Ardoino, the CEO of Tether, who sits at the centre of crypto's most important yet controversial piece of infrastructure - the stablecoins.

Tether’s USDT - a dollar-pegged stablecoin - records more daily transactions than Bitcoin and Ethereum combined.

Ardoino has transformed from a behind-the-scenes coder to one of the most influential figures in global finance.

In 2024 alone, Tether reported $13.7 billion in profits.

Let's explore how a computer science graduate from Italy became the steward of crypto's most essential asset. And what his plans for Tether's massive war chest reveal about the future of finance.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in our weekly News Rollups.

Earn, Swap, Borrow - All at One Place!

“Wait, so I don’t need three tabs open just to trade tokens?”

Exactly. Kamino just made swapping crypto super simple.

You open the app, pick what you want to swap, and done. No bouncing between platforms, no weird buttons, no wondering if you did it right.

It’s like if your wallet, trading app, and DeFi dashboard all got together and said: “Let’s make this make sense.”

Why’s this a big deal?

You can swap tokens without leaving Kamino

No shady popups or confusing steps

It’s fast (like, Solana-fast)

It’s built for people who don’t live on Crypto Twitter

Just clear, easy swaps that work - check it out.

The Coder From Genoa

Paolo Ardoino's journey to crypto kingpin began with a single computer – an Olivetti 386 from 1991 with 4MB of RAM and a 3.5-inch floppy disk port.

"I remember my father telling me the computer cost a couple of months' salary," Ardoino recalls. A math teacher at his school dismissed computers as "just a waste of money, time and would never be useful to people."

Born in Genoa, Italy around 1984-1985, Ardoino was captivated by technology from an early age. Living far from friends in a rural part of northern Italy, he spent afternoons teaching himself to code so he could create his own games when commercial applications bored him.

His immersion in early open-source communities shaped a philosophy that would later inform his approach to financial technology.

He devoured works of Linus Torvalds, Richard Stallman's "GNU Manifesto," and Eric Raymond's "The Cathedral and the Bazaar" – foundational texts arguing for open, collaborative software development.

"From the outside it can look messy and noisy — it's not poetic at all, but if you are inside, if you look, the bazaar is extremely efficient," he says of open-source development. "You can take away parts from a bazaar and it remains what it is, it is flexible and resilient, whereas a cathedral is a monolith."

Ardoino stayed close to home for education, attending the University of Genoa for computer science and mathematics. His interests gravitated toward distributed computing, parallel computing, and peer-to-peer systems – technical foundations that would later prove crucial for his career in cryptocurrency.

He can recite the specifications of file-sharing software from Gnutella to Napster to BitTorrent "the way some people recall the kings and queens of England," according to those who've worked with him.

Get 17% discount on our annual plans and access our weekly premium features (Game On, News Rollups, HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

The Path to Tether

After finishing his studies in 2008, Ardoino worked briefly in military research, focusing on high-availability systems and cryptographic applications. The work was intellectually stimulating but financially unrewarding.

"Being Italian, you weren't paid much," he notes, saying researchers earned about $800 per month. "So I started looking for other opportunities."

Read: Paolo Ardoino: The Hardest Working Man in Crypto

He taught himself finance and economics, taking his first job with a hedge fund in 2011, designing trading systems. By 2013, he had moved to London to run his own startup called Fincluster, creating trading software products for hedge funds.

His entry into the crypto world came in 2014 when he met Giancarlo Devasini, now Tether's Chief Financial Officer, in London. Devasini, who was running crypto exchange Bitfinex at the time, offered Ardoino a job.

Joining as a Senior Software Developer in October 2014, Ardoino's technical skills quickly earned him a promotion to Chief Technology Officer at Bitfinex by March 2015. His focus on backend development and trading engine integration proved invaluable as the exchange navigated volatile crypto markets.

Ardoino's transition from Bitfinex to Tether wasn't so much a career change as an expansion of responsibilities within a closely connected ecosystem.

Bitfinex and Tether shared not only office space but leadership. The cryptocurrency exchange and the stablecoin issuer operated under the same corporate umbrella with executives like Giancarlo Devasini playing key roles at both companies.

By December 2017, recognising his technical expertise and the synergies between the two projects, Ardoino added the role of CTO at Tether to his responsibilities.

Tether, a stablecoin launched in 2014 was already controversial but nowhere near its current size. The stablecoin had a market cap of roughly $1 billion – a fraction of today's $140+ billion.

Under his technical leadership, Tether successfully weathered multiple crypto winters and market panics.

When the TerraUSD algorithmic stablecoin collapsed in 2022, causing investors to rush for the exits across all stablecoins.

The company processed around $7 billion in withdrawals within 48 hours and over $20 billion over the next 20 days – about 25% of its total holdings at the time.

His eventual rise to CEO came in October 2023, when Tether announced Ardoino would succeed Jean-Louis van der Velde in the top position by December.

Today, he holds what might be the most unusual executive portfolio in finance: CEO of Tether, Chief Technology Officer of Bitfinex, and Chief Strategy Officer of Holepunch, a peer-to-peer communications platform.

If there's one thing that separates Ardoino from most executives, it's his approach to coding.

His GitHub is pretty impressive: 3,782 contributions in 2023 and 2,468 contributions in 2024 – when 2-3 daily is considered average for a full-time engineer. In 2017, he notched a staggering 37,720 commits.

Even after becoming CEO, Ardoino insists on staying close to the code.

"My main tasks during the day are coding, of course," he says. "When I agreed to become CTO of companies, the way I do things in both companies is that I need to set up my daily schedule and my weekly schedule. That leaves enough time for me to keep coding."

His technical involvement extends beyond maintenance to leading innovation. Ardoino spearheads a team of 25-30 engineers working on new technologies that could diversify Tether's business beyond stablecoins. He personally coded the first version of Moria, a system designed to coordinate and manage bitcoin mining operations.

This approach exemplifies a leadership philosophy rare in finance: leading by doing rather than delegating.

The $142 Billion Question

At its core, Tether operates a simple business: it takes in money and hands out tokens. Each USDT is meant to be backed 1:1 by a corresponding dollar or dollar-equivalent asset in reserve.

This structure has proven extraordinarily profitable in an era of rising interest rates. With a market cap of just under $142 billion, Tether presumably holds nearly that amount in interest-bearing assets.

Tether's profits have grown quarter by quarter: $4.52 billion in Q1 2024, $1.3 billion in Q2, over $2.5 billion in Q3, and $6 billion in Q4 culminating in a staggering $13.7 billion for the full year.

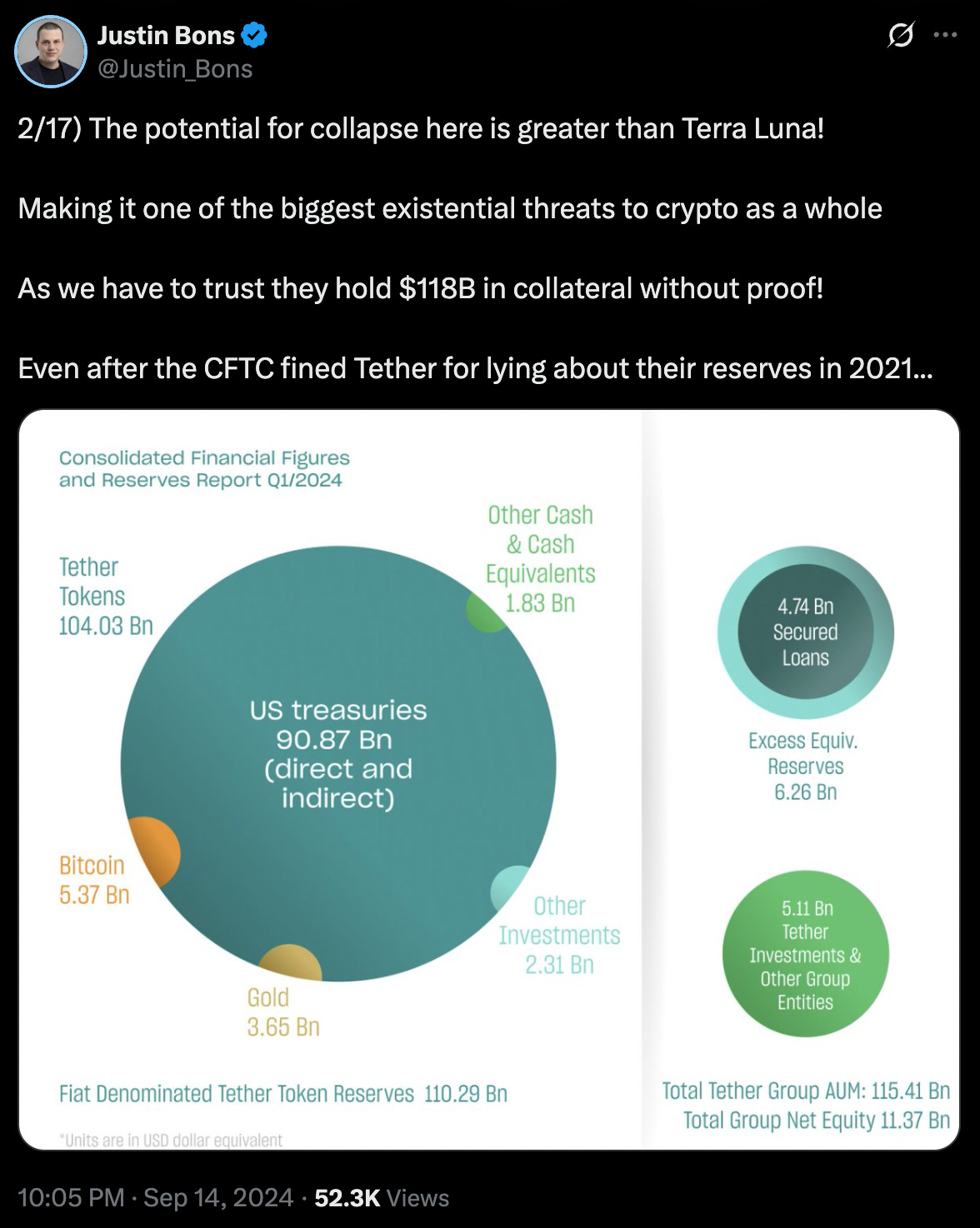

The company keeps its reserves primarily in US Treasuries, which are considered essentially risk-free. It also invests in slightly riskier asset classes like repo agreements, money market funds, and corporate bonds with greater expected returns. In 2023, Tether took the unprecedented step of putting over 1% of its holdings directly into Bitcoin.

As for how those profits are deployed, Ardoino has outlined ambitious plans. During a recent interview, he revealed that Tether would invest half of its 2024 profits – approximately $6.85 billion – into strategic initiatives including decentralised AI, Bitcoin mining, and even a "very tall tower" in El Salvador, where the company now has its headquarters.

Beyond the Standard Playbook

Ardoino has pushed Tether far beyond its core stablecoin business. His vision for the company spans multiple industries.

Bitcoin Mining: The company has invested heavily in Bitcoin mining operations powered by renewable energy, constructing hydropower facilities in Uruguay and geothermal facilities in El Salvador.

Tether has invested $32 million in Bitcoin mining company Bitdeer as the market struggles. Tether is also supporting the Bitcoin mining pool Ocean by providing hash rate to enhance mining efforts.

Artificial Intelligence: Tether has allocated resources to AI research, with Ardoino personally overseeing a small team exploring applications like machine translation and potentially building cost-effective large language models. The company also invested in EU data company Northern Data, positioning it to become a major AI infrastructure provider in Europe.

Peer-to-Peer Technology: Through Holepunch, Ardoino is developing alternatives to traditional communication platforms like Telegram and WhatsApp. Keet, a decentralised video calling application, represents his first foray into creating peer-to-peer alternatives to centralised services.

Real World Assets: Tether has moved into sectors as diverse as agriculture and telecommunications, including investments in food company Adecoagro.

Ardoino frames these initiatives as part of a cohesive strategy to build resilient systems that reduce dependency on centralised infrastructure. "We are building all these tools. While they might seem scattered from the outside, they have their part of the same story: how to make people more resilient, how to make people more independent and how we can empower people."

The Lightning Rod for Criticism

Despite its financial success, Tether remains one of the most scrutinised entities in crypto. For years, critics have questioned whether each USDT token is truly backed by the equivalent in stable reserves.

In 2021, those concerns reached a regulatory crescendo when the New York Attorney General found that Tether was not always consistently "honest" about its reserve assets. Tether paid a $18.5 million fine to settle the charges. That same year, the US Commodity Futures Trading Commission said much the same, and fined the firm $41 million for making misrepresentations about its backing and bank accounts.

While Tether has worked to improve transparency through quarterly attestations, sceptics note that it has never completed a comprehensive audit from a Big Four accounting firm. Ardoino has explained that Tether relies on attestations from BDO Italia rather than full audits and has published extensive documentation to satisfy regulators.

Critics have also alleged that Tether has been used to manipulate cryptocurrency prices or facilitate illicit finance.

Ardoino strongly rejects these claims, pointing to Tether's cooperation with law enforcement agencies and its ability to freeze suspicious addresses – actions that have led to the recovery of stolen funds in several high-profile cases.

"When [criminals are] finally trying to use blockchain and move money on the blockchain in USDT, we see them and we freeze them," he says. "It takes 15 minutes to freeze an address from our stock. We are much more granular and faster than any bank or any other financial institution."

Recent political developments have brought new challenges. While the Trump administration appears to view stablecoins favourably, Tether faces headwinds in Europe. The European Union's Markets in Crypto-Assets (MiCA) regulatory framework, which went into effect at the end of 2024, has led major exchanges like Kraken and Crypto.com to delist USDT.

Moreover, Tether was notably absent from the list of 10 firms approved to issue stablecoins under MiCA. Ardoino has claimed that competitors are actively working to "kill Tether" through regulation rather than competition.

"While our competitors' business model should be to build a better product and even bigger distribution network, their real intent is 'Kill Tether,'" he wrote in a February X post. "Every single business or political meeting that they have culminates with this intent."

Banking connections remain another challenge. Although Tether now has a seemingly stable relationship with Cantor Fitzgerald, whose CEO Howard Lutnick has taken position as Secretary of Commerce in the Trump administration, the company previously struggled to maintain banking partnerships.

To National Security Asset

One of the most interesting aspects of Tether's evolution story under Ardoino is its transformation in the political narrative – from potential threat to potential national security asset.

In early March 2025, Treasury Secretary Scott Bessent shocked the financial world by declaring: "We are going to keep the US the dominant reserve currency, and we will use stablecoins to do it."

This statement came after Japan and China, the two largest holders of US Treasuries, reduced their holdings. With Tether emerging as one of the largest holders of short-term US government debt, the stablecoin has become an unlikely ally in maintaining dollar hegemony.

Ardoino has seized on this narrative shift. "We have 400 million users in emerging markets," he says. "We are basically selling the US debt outside the US... We are decentralising the US debt as well, basically pushing for dollar hegemony. That's how the US can maintain its dominance when it comes to its currency."

This alignment with US strategic interests may explain why Tether faces less hostility from American regulators today than it did a few years ago.

Token Dispatch View 🔍

Paolo Ardoino's story represents the cryptocurrency industry's broader evolution – from scrappy outsider to systemically important financial infrastructure.

What began as a technical solution to banking problems for crypto companies has transformed into a financial colossus with macroeconomic significance. Tether is no longer just a crypto company; it's a substantial holder of US government debt, a banking alternative for the unbanked, and increasingly, a geopolitical asset in the dollar's competition with other potential reserve currencies.

This transformation raises profound questions about the nature of money in the digital age. When a private company can create a digital representation of the dollar that achieves greater global adoption than many central bank digital currencies, the line between state and private money becomes increasingly blurred.

Ardoino stands at this intersection, wielding influence that would have been unimaginable for a computer science graduate just a decade ago. His dual identity as both a hardcore coder and a financial executive makes him uniquely suited to navigate this territory between technology and finance.

Yet the lack of regulatory clarity surrounding stablecoins remains a challenge. While the Trump administration appears to view dollar-pegged tokens as tools for extending American financial influence, the EU's more cautious approach suggests that a global consensus on stablecoin regulation remains elusive.

What's clear is that Tether under Ardoino has survived multiple "extinction events" that were predicted to destroy it. The company has emerged stronger from each crisis, expanding from a controversial $1 billion token to a $140 billion financial juggernaut that reported profits exceeding most Wall Street banks.

The next chapter in this story will likely be defined by how Ardoino deploys Tether's massive war chest. Will investments in AI, Bitcoin mining, and peer-to-peer technology diversify the company beyond stablecoins? Can Tether maintain its dominant market position against competitors like USD Coin (USDC) and emerging central bank digital currencies?

One thing is certain: the once-obscure Italian coder now sits atop one of the most important nodes in the global financial system. The decisions he makes about Tether's future will ripple far beyond cryptocurrency markets into the broader economy.

As Tether continues to grow, it will be interesting to find out if Ardoino's bazaar approach to finance – open, resilient, and decentralised – can truly coexist with the increasingly cathedral-like structures of global monetary policy.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Watching this guy gain more public attention lately reminds me a lot of Sam Bankman-Fried’s rise. To be clear, I’m not suggesting that Tether is fraudulent—on the contrary, I’m actually quite bullish on the company. But there are some striking parallels: Tether’s business model functions like a money printer (in more ways than one), their controversial early history, and now their CEO’s growing media presence—it all echoes the trajectory we saw with SBF and FTX.

With that being said, I do not think it ends the same way. I actually believe tether will become one of the most prolific and profitable companies of our generation. I would own it if I could. NFA