Proof-of-Work Mining Not a Security: SEC

This clarity will provide a major regulatory reprieve for Bitcoin miners and other mining pools.

The Securities and Exchange Commission (SEC) has clarified that proof-of-work mining isn't a security, removing a massive cloud of uncertainty for Bitcoin miners and mining pools.

This regulatory green light allows the industry to operate without SEC registration requirements — a shift from the previous administration's crypto crackdown.

"A miner's Self (or Solo) Mining is not undertaken with a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others," declared the SEC yesterday.

Under acting Chair Mark Uyeda and Commissioner Hester Peirce, we're witnessing a regulatory reset that Bitcoin miners have desperately needed.

Since China's 2021 mining ban, American operations have expanded dramatically. This clarity could accelerate that trend, potentially cementing the US as a global mining powerhouse.

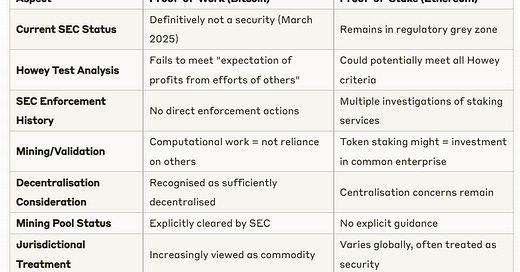

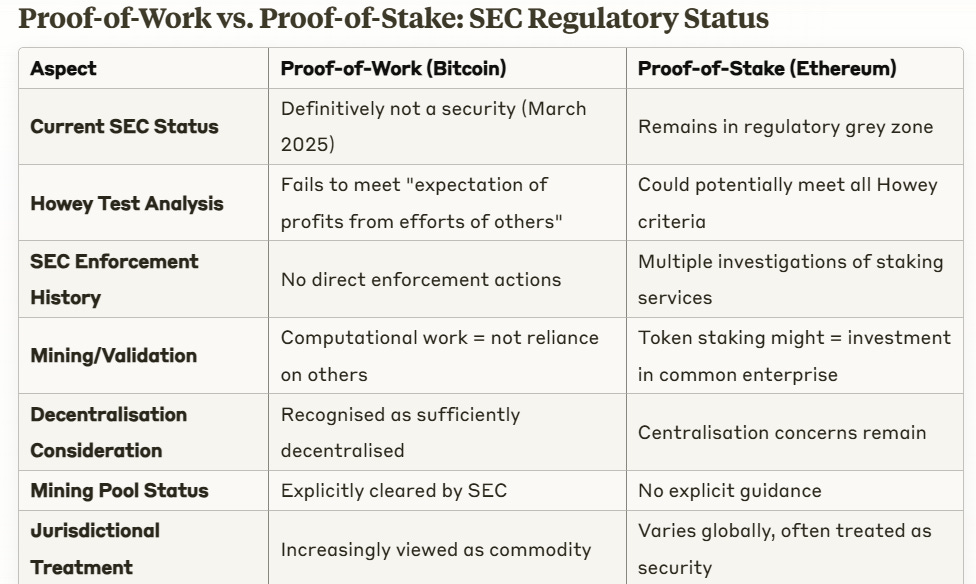

The SEC shielded:

Solo mining operations

Mining pools that combine computational resources

Public, permissionless networks like Bitcoin

The cover wasn’t extended to:

Proof-of-stake mechanisms

Ethereum stakers also shouldn't pop the champagne just yet.

The Big Question

Is regulatory clarity enough to overcome the ongoing economic anxiety?

With total crypto exchange-traded products outflows reaching a record $6.4 billion and Bitcoin down more than 20% from its January peak, investors seem more concerned with Trump's tariff policies and recessionary fears than regulatory wins.

The mining industry has its answer. The market's answer may take more time to materialise.