RIP Signature Bank. Crypto gone bankless? 🙅♀️

Signature Bank shuts down. That's the third bank after Silicon Valley and Silvergate. Who is going to bank the crypto industry now?

Hello y'all. This is The Token Dispatch. It's all up in the air. We feel bankless. We want the old days back.

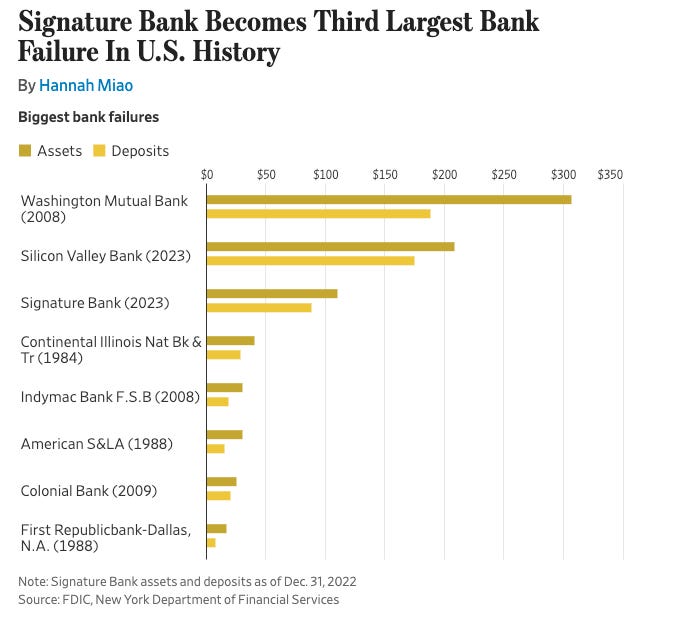

New York's Signature Bank has been closed by state financial regulators, making it the third-largest bank failure in the US history.

Also, the third bank that has collapsed in the last week:

Silvergate Capital announced that it would wind down bank operations on Thursday - total assets of $11 Billion.

Silicon Valley Bank was shut down on Friday - the 16th largest in the US and held $209 billion in assets as of Dec. 31

Signature Bank was seized by banking regulators on Monday - total assets of $110 billion in assets as of the end of 2022.

Why not sponsor us, eh?

Why do these banks matter to crypto?

Silvergate Bank - crypto firms say, "we have no exposure."

Silicon Valley Bank - Circle disclosed $3.3 b in exposure to SVB.

Signature Bank - Coinbase holds around $240 million at Signature and Paxos said it currently holds $250 million

How is the crypto world taking it?

Crypto community is not so sure about the future.

Why were these banks important for crypto?

Silvergate Capital has been a central lender to the crypto industry, and Signature also had a strong crypto focus - go-to banks for crypto firms.

Almost half of the venture-backed startups in the U.S. kept their cash with Silicon Valley Bank - including some real crypto geniuses!

Silvergate Exchange Network (SEN) and Signature's Signet were real-time payment platforms that allowed commercial clients to make payments 24/7.

Why has this crisis come about?

Here’s what happened with SVB - SVB Financial Group's startup and venture-capital firm clients generated tons of cash during the pandemic - it ended up with almost $200 billion in deposits! To keep all this money safe, the bank bought a bunch of what they thought were super-safe assets, like government-backed mortgage securities and US Treasury. These assets paid a fixed interest rate for many years, but suddenly they weren't worth as much on the open market, which made them lose around $17 billion.

Meanwhile, the clients started burning cash and stopped depositing money. To make things worse, it became more expensive to attract new deposits. This led to the company losing even more deposits and forecasting it would lose even more.

So, they decided to sell some of its assets to reset its interest earnings and raise some capital. But this didn't work because everyone got scared and started pulling out their deposits, causing the bank to run out of cash.

What is the FED doing about it?

The Department of the Treasury will make available up to $25B in funding to backstop banks, the funds will be made available to eligible firms in a bid to avoid further banking liquidity issues.

Depositors of Silicon Valley Bank (SVB) will have full access to their money the Federal Deposit Insurance Corporation said (FDIC), after confirming a successful transfer of deposits to a new bridge bank.

TTD Number Picker

£1

Silicon Valley Bank UK arm acquired by HSBC

HSBC officially announced on March 13 that its subsidiary, HSBC UK Bank, is acquiring Silicon Valley Bank UK (SVB UK) for 1 British pound ($1.21). The deal excludes the assets and liabilities of SVB UK’s parent company - SVB America.

TTD What are we following

Y Combinator has started a petition urging the startup community to come together in this time of crises.

TTD Surfer🏄

Banks trouble aside, payments giants Mastercard and Visa are still signing new debit card deals with crypto startups around the world.

Web3 startup Quantum Temple helps Indonesia’s tourism economy survive to recover from the Covid impact.

Solo miner mines a valid BTC block for $150K reward. That's happened only 270 times out of the 700K blocks produced in the last 13 years.

Euler Finance hacked for over $195M in a flash loan attack that drained decentralised stablecoins and synthetic ERC-20 tokens.

If you like us, if you don't like us .. either ways do tell us✌️

You can follow us on telegram to stay tuned to all crypto things 🤟

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋

preciesly why crypto works. banks are going round in circles. shooting themselves in the foot