Today’s edition is brought to you by Changelly. Instant crypto exchange platform trusted by millions since 2015. Buy, sell, and swap 700+ crypto assets 🫵

Hello, y'all. Wednesday is apparently for watching stablecoin wars unfold. Ripple just scored a New York knockout that's got USDT and USDC looking over their shoulders.

NYDFS approves RLUSD

XRP's wild ride from $1.90 to $2.82 and back

Inside the $200M super PAC that reshaped Washington

Breaking down the $48 XRP prediction

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

The stablecoins war just got interesting. USDT's got competition. USDC's sweating. Why? Ripple just entered the chat.

On Tuesday afternoon, Ripple CEO Brad Garlinghouse dropped the announcement: New York's Department of Financial Services had approved RLUSD, Ripple's new stablecoin.

The evolution

April: RLUSD announcement.

August: Testing begins on XRP Ledger and Ethereum.

October: Exchange partnerships revealed.

December: NYDFS approval secured.

The price reacts

XRP, which had been languishing below $2 just hours earlier, suddenly surged 10% on the news. This was the latest act in a story that's been building since Trump's election victory sent XRP soaring to seven-year highs.

But let's rewind the tape a bit

A week ago, XRP was riding high at $2.82, up an astounding 237% in just one month.

The catalyst? Donald Trump's election victory and the subsequent announcement that SEC Chair Gary Gensler - long seen as Ripple's nemesis - would resign when Trump takes office in January.

With Trump's return to the White House looking certain and his appointment of crypto-friendly Paul Atkins, the regulatory landscape was shifting dramatically.

After years of battling the SEC under Gensler's watch, Ripple suddenly found itself with not just a light at the end of the tunnel, but a whole new playground.

The NYDFS approval of RLUSD isn't just about launching another stablecoin - it's about legitimacy. And in crypto, legitimacy is worth its weight in digital gold.

Getting approved in New York is the holy grail of crypto compliance. The state's BitLicense regime is notoriously strict, making NYDFS approval something of a golden ticket in the crypto world.

The stablecoin stakes

With RLUSD, Ripple is aiming for the crown. We're talking about a projected $2 trillion market cap by 2028, positioning it as a direct challenger to Tether's USDT and Circle's USDC, which currently command a combined market cap of about $180 billion.

That's quite an ambition for a company that's spent the last few years in regulatory courtrooms rather than boardrooms.

Impossible? Let's do the math.

Current stablecoin kings (USDT + USDC): $180B combined

RLUSD's target: 11x larger

Timeline: 4 years

Focus: Pure institutional play

A mainstream migration

While regulatory headlines grabbed attention, there’s something more to it.

Ripple's Q3 growth wasn't just about price action - it was about institutional adoption.

Think about this sequence: The Chicago Mercantile Exchange introduces an XRP reference price. Bitnomial announces plans for XRP futures.

Then comes a wave of ETF applications from heavyweight names like Bitwise, Canary Capital, WisdomTree, and 21Shares.

Even Grayscale joins the party, launching an XRP Trust and working to convert its Digital Large Cap Fund - which includes XRP alongside BTC, ETH, SOL, and AVAX - into an ETF.

Ripple's already lined up an impressive roster of partners for RLUSD's launch: Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish.

With market makers B2C2 and Keyrock providing liquidity, they're building an ecosystem rather than just a stablecoin.

The two-token strategy

How does Ripple plan to juggle both XRP and RLUSD?

RLUSD will follow the standard stablecoin playbook - a 1:1 dollar peg backed by USD deposits, short-term Treasury bonds, and other cash equivalents. But unlike other stablecoin issuers, Ripple brings something unique to the table: a battle-tested network and a token (XRP) that's already proven its utility in cross-border payments.

Effortless Exchange Process for Everyone

Since 2015, Changelly has been providing an intuitive platform for fast crypto exchanges. Driven by the goal to bring the day of mass adoption closer.

An ecosystem of products and services that allow customers to have a one-stop-shop experience for purchasing, selling, swapping, and trading cryptocurrencies.

In The Numbers 🔢

$48.12

That's Ali Martinez's wild price target for XRP.

Current price: ~$2.33

Potential upside: 1,888%

First stop: $8.40

Final destination: $48.12

Take a look at XRP's weekly chart and you might notice something peculiar. For the first time in seven years - yes, seven years - it's made a higher high.

Veteran trader Peter Brandt calls it "the most powerful chart in all of crypto world."

The optimists are pointing to a bullish pennant formation that suggests $3.80 could be just a pit stop on the way to higher targets.

Some analysts are even throwing around numbers like $8.40, with the more ambitious ones eyeing $48 - a whopping 1,888% upside from current levels.

Outlandish? Perhaps. But remember, this is crypto, where seven years of compression can lead to explosive results. Just ask anyone who watched XRP surge 237% in a single month.

What are we looking at here?

Rising Adoption: XRP Ledger's active addresses surged by over 440%, reaching 108,771, indicating increased user engagement and network activity.

Transaction Growth: The number of transactions on the XRPL rose by 190%, from 1.4 million to 3.9 million, suggesting heightened blockchain adoption.

Whale Accumulation: Large investors are accumulating XRP, with significant withdrawals from exchanges like Binance, including a notable transfer of 21.7 million XRP.

Decreased Exchange Supply: XRP supply on exchanges dropped by 10% recently, indicating a shift towards self-custody and potential bullish sentiment.

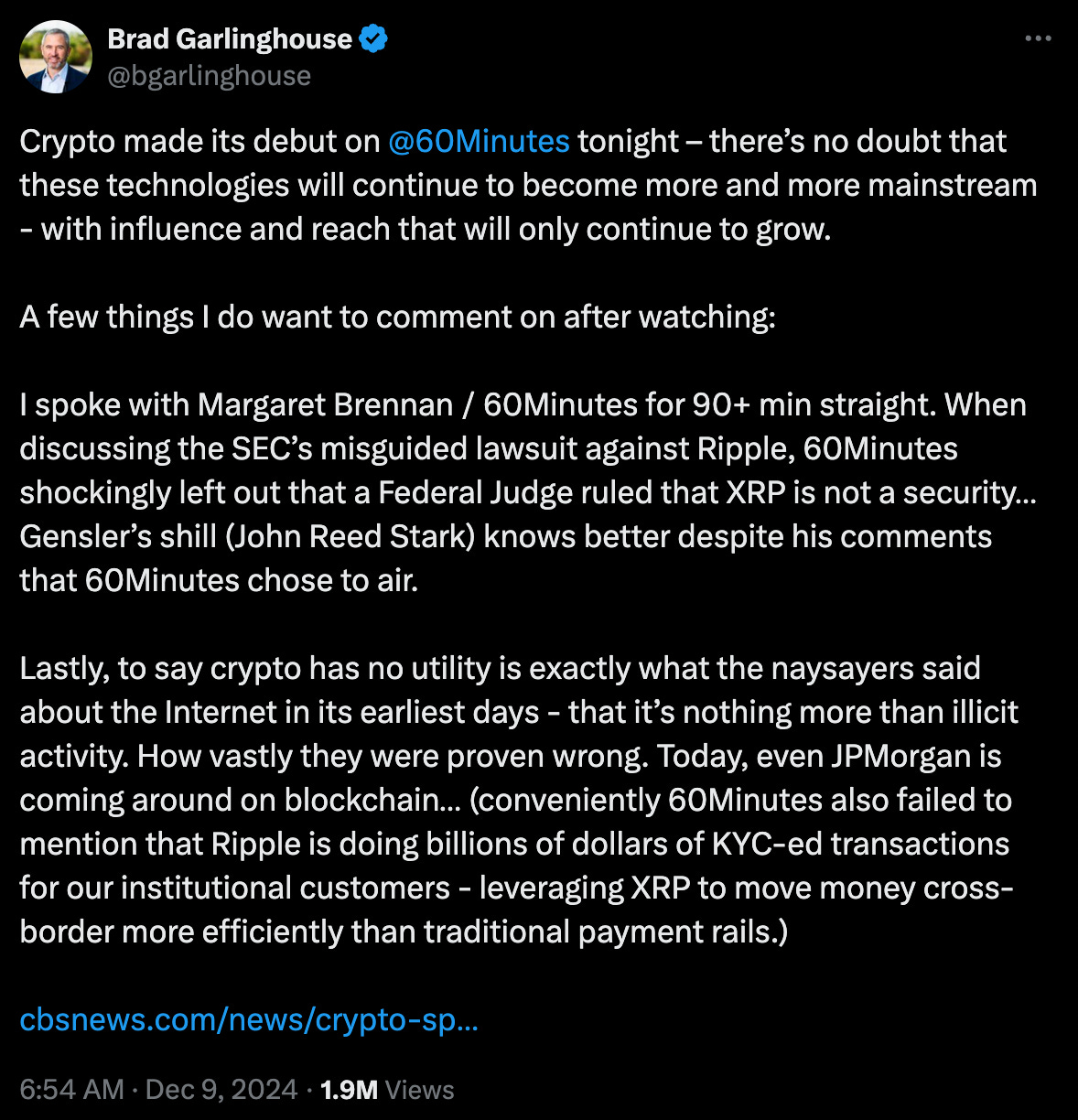

Block that quote

Brad Garlinghouse, CEO of blockchain firm Ripple Labs

"I'm not sure Fairshake would exist"

Simple words, huge impact.

What's he talking about? The $200M crypto super PAC that changed the game.

What about it?

Response to SEC's "war on crypto"

Backed by Coinbase and a16z

Supported both sides of the aisle

85% success rate in Congress races

Garlinghouse spoke about the crypto super PAC during his interview at the CBS's "60 Minutes”.

The conversation about Fairshake was not just around crypto's role in the 2024 election, but really about something much bigger: the industry's fight for survival.

He thinks the election was a chance to “educate voters”.

"Of the 29 Republicans and 33 Democrats the industry backed in congressional races, 85% won. It's incredible."

The Ripple CEO's showing how crypto played the game:

"Do I think we had an impact to elect a Democratic senator in Michigan—Elissa Slotkin? Yes, absolutely. Do I think we had an impact in Arizona? A Democratic senator in Arizona, Gallego? Absolutely."

But something was missing from the interview segment that went on air, and Garlinghouse wasn't about to let it slide.

After the show aired, he took to X to point out the "shockingly left out" fact that a federal judge had ruled XRP wasn't a security in programmatic sales. It was a crucial detail in the larger story of crypto's regulatory battle.

The Token Dispatch View 🔍

As XRP oscillates between dips and rallies, and RLUSD prepares for its grand entrance, there's a bigger story unfolding here. We're watching the transformation of a company that spent years as regulatory crypto's public enemy number one into something that looks increasingly like a mainstream financial powerhouse.

Think about the pieces on this chessboard: a regulatory-approved stablecoin, a token that's broken a seven-year price pattern, institutional adoption accelerating, and a political action committee that's helped reshape Washington's crypto landscape. All while the old guard at the SEC prepares to exit stage left.

Is $48 XRP outlandish? Maybe. Is a $2 trillion stablecoin market cap ambitious? Certainly. But then again, who would have predicted a company under SEC investigation would end up with New York's seal of approval?

The same regulators who once tried to paint Ripple as a threat to financial stability are now being replaced as the company positions itself at the heart of institutional finance.

As we head into 2025, one thing's becoming clear: in the world of crypto, sometimes the longest routes lead to the most interesting destinations.

Just ask Brad Garlinghouse - he's been playing the long game all along.

And this time, it looks like he might be winning.

The Surfer 🏄

Magic Eden's recent airdrop of its ME token has raised security concerns as users faced a convoluted process that required downloading the platform's wallet, potentially compromising their crypto safety.

Bitwise predicts that 2025 will see at least five major companies, including Kraken and Circle, go public. The firm also forecasts Bitcoin could reach $200,000 or even $500,000, while Ethereum and Solana are projected to hit $7,000 and $750, respectively, driven by increased institutional adoption and favourable market conditions during the year.

Tether's USDT stablecoin has been approved as an Accepted Virtual Asset by the Financial Services Regulatory Authority in the Abu Dhabi Global Market, allowing licensed entities to offer related financial services. This recognition enhances USDT's integration into the UAE's financial ecosystem.

Raydium has outperformed Uniswap in monthly decentralised exchange trading volumes for the second consecutive month, surpassing Uniswap by approximately 30% in November.

JPMorgan has raised price targets for four Bitcoin mining stocks, including MARA Holdings, CleanSpark, Riot Platforms, and IREN, reflecting the value of their electrical power assets and Bitcoin holdings.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋