Hello dispatchers!

It’s Friday and we are just a weekend away from the start of a new crypto era.

Even before Donald Trump takes the oath on Monday as the 47th US President, the crypto world is already seeing sweeping changes.

Most are awaiting favourable policy changes in crypto, while some others are busy making big moves already. Even before the official inauguration.

XRP and RLUSDT issuer Ripple is right at the top of that list.

In today’s edition, we take you through:

XRP’s ride to a multi-year high

Ripple’s changing fortunes ft. White House

Potential ETFs driving the optimism

Ripple’s stablecoin warm-up act

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

The Ripple Effect

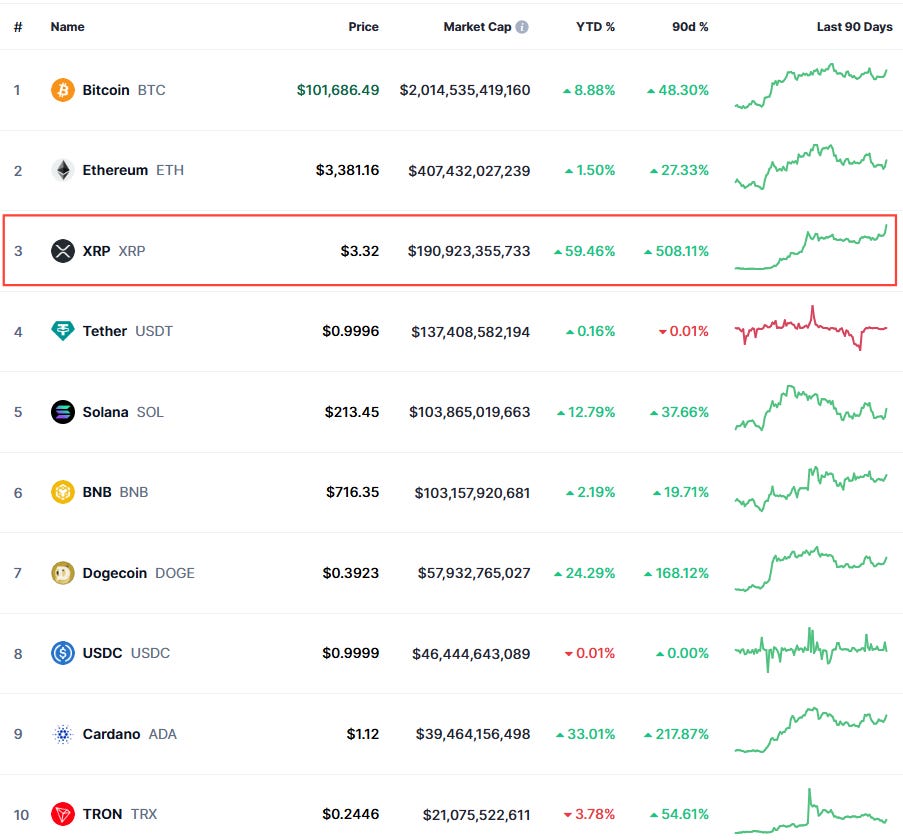

XRP just flipped BlackRock. Yes, you read that right - Ripple's token now has a larger market cap than the world's biggest asset manager.

Trading at a multi-year high of $3.37, a few pennies away from its all-time high, XRP has pushed past both BlackRock ($149 billion) and Disney, cementing its position as crypto's third-largest player.

While the euphoria of the upcoming Trump inauguration drove the larger crypto market up north in the past 24 hours, XRP is painting the markets a different shade of green.

More than 8% return in a day and a stunning 500% quarterly return.

What’s transpired is a classic story of political chess played to perfection.

A Lobbying Masterstroke

From Ripple CEO Brad Garlinghouse's Mar-a-Lago pilgrimage to the company's strategic $5 million inauguration fund contribution (the largest from any crypto entity), Ripple's moves are looking less like luck and more like calculated precision.

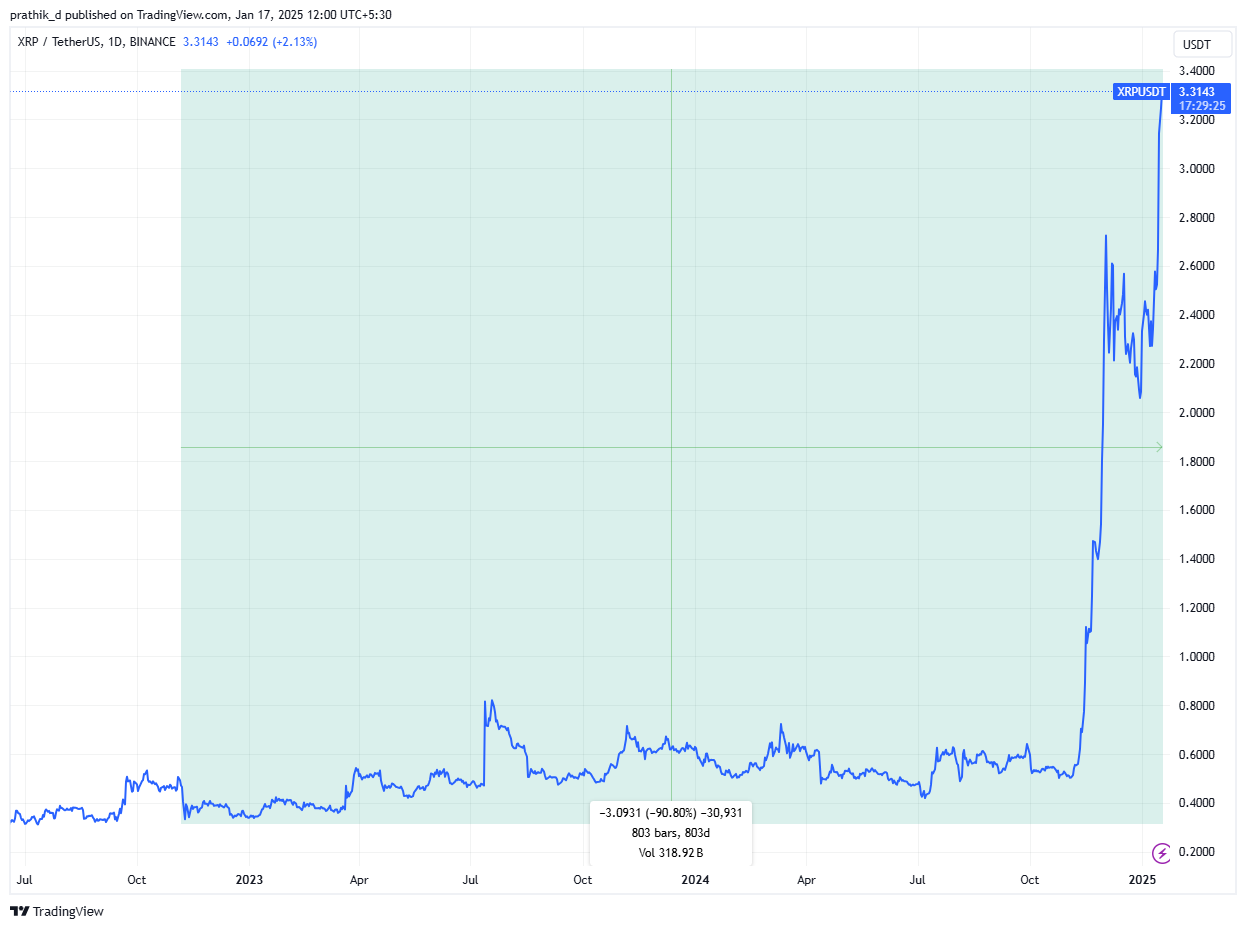

A cryptocurrency - which saw no breakouts, little upward movement for two whole years and a lot of regulatory tiffs with the US Securities and Exchange Commission (SEC) - has smashed through ceiling post Trump’s re-election.

Read: XRP Leads the Altseason 🪙

Ripple, along with Coinbase and Andreessen Horowitz, led a $300 million super PAC campaign that's now paying dividends.

Their $5 million contribution to Trump's inauguration fund looks like pocket change compared to the $125 billion their XRP holdings have gained since election day.

Read: Democrats Warming Up To Crypto? ☕️

XRP - In The Numbers

$192 billion: Current market cap, up 5x+ from pre-election mark

455%: Growth in last quarter

38%: Price surge in past week

Political lobbying isn’t the only thing driving up XRP.

The ETF Gold Rush 📈

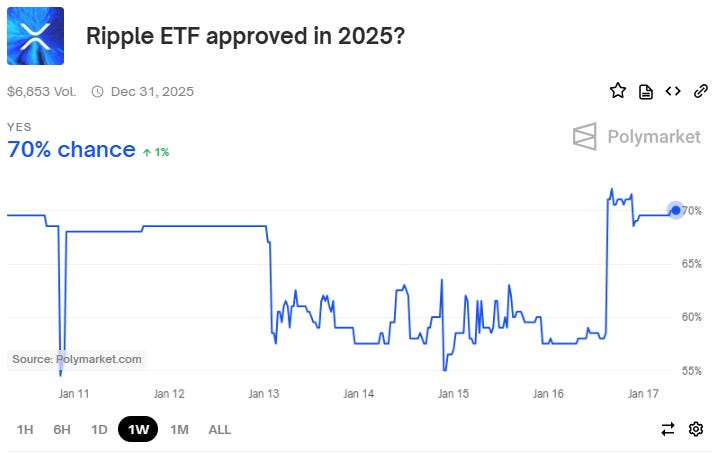

Even as the crypto world’s barely begun warming up to Bitcoin and Ethereum ETFs, XRP is already queuing up.

And the traditional finance giants on the Wall Street are betting big on them.

JPMorgan's latest projections put potential XRP ETF inflows between $4.3 billion to $8.4 billion in the first year - if approved.

"I think we will see one very soon. XRP is likely to be next in line after Bitcoin and Ether," says Ripple President Monica Long.

With four heavyweight contenders - WisdomTree, Bitwise, Canary Capital, and 21Shares - already in the race, the odds on Polymarket have surged to 70%.

There’s been a little bit of luck, too, that’s helping out Ripple.

The exit of its archenemies - SEC Chair Gary Gensler, who left no stone unturned to strangle the company with a series of regulatory mess. Read on…

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

The SEC Hiccup

Even as Gary Gensler prepares to leave, his SEC team isn't going down without a last ditch-effort to fight Ripple.

The agency refused to postpone its appeal hearing until after Gensler's departure on January 20.

Is that concerning Ripple? They couldn't care less.

"What a waste of time and taxpayer dollars," said Ripple's Chief Legal Officer Stuart Alderoty about the SEC's persistence.

When the agency was busy appealing the July 2023 ruling that declared XRP not a security for retail sales, XRP went about registering another double-digit return in a day.

Brad Garlinghouse put it more bluntly.

Confidence, much?

Ripple isn't waiting for things to happen. It's moving quick and it’s going aggressive on capitalising on the momentum.

Building The Empire

Ripple is lining up the entire artillery to strike as soon as the iron gets hot.

It’s preparing to spread itself across the ecosystem instead of taking one step at a time.

Political lobbying? Check.

Resolving SEC conflict? Check.

Prep for XRP ETFs? Check.

Stablecoin? Loading …

RLUSD takes centre stage

Barely a month after launch, Ripple's stablecoin RLUSD is making news with a series of ecosystem collaborations including its Chainlink partnership to boost DeFi presence.

That’s not all.

The stablecoin, now listed on Bitstamp with a $72 million market cap, might soon expand to Cardano's ecosystem, with Charles Hoskinson confirming ongoing talks.

Read: Ripple Goes Stable 🎯

While the ecosystem is being set up in place, the company CEO is busy building the ‘Make America Great Again’ narrative.

US expansion drive

Ripple's betting big on a Trump-led America, with three-quarters of its new positions based in the US, including major roles in its expanded San Francisco and New York offices.

The strategy's already paying off - the company closed more US enterprise deals in the last six weeks of 2024 than in the previous six months combined.

The Trump factor

This is part of a larger strategy that's already bearing fruit.

Strategic $5 million inauguration fund contribution

Increased US enterprise deals post-election

Expected regulatory relief under new SEC leadership

Potential dismissal of ongoing SEC case

This is not lucky timing - it's a “great dinner” in strategic positioning to kick-start 2025.

CEO Garlinghouse is giving the entire crypto world a masterclass in playing political chess.

Hope you are taking notes.

Token Dispatch View 🔍

XRP's rise is a classic lesson on how to transform regulatory headwinds into tailwinds. While most crypto companies were struggling with their deal of cards, Ripple pulled out an ace out of nowhere.

Three key insights from this transformation.

Political capital is real: The $300 million super PAC investment and $5 million inauguration contribution might seem hefty, but they've helped secure something priceless: regulatory clarity. Against the $125 billion gained in XRP holdings since election day, that's not merely good ROI - it's brilliant strategy.

Build first, wait never: Even with ongoing SEC battles, Ripple isn't sitting idle. From aggressive US hiring to RLUSD partnerships with Chainlink and potential Cardano integration, they're building like there's no tomorrow. The message is clear: regulatory uncertainty won't stop innovation.

Power of strategic timing: Ripple didn't just bet on Trump's victory - they cooked the recipe for it. The Mar-a-Lago dinner, the US expansion, the stablecoin launch - these were carefully orchestrated plays in a larger game.

While the market focuses on XRP's price surge and potential ETF approval, what you shouldn’t miss is how Ripple is positioning itself as America's crypto champion. By aligning with the incoming administration's "America First" narrative while expanding globally through RLUSD, they're crafting a narrative that's both nationalist and internationalist.

2025 will show whether Ripple can transform from crypto's regulatory rebel into its establishment player.

If their political chess game so far is any indication, we are in for an interesting year ahead.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.