Today’s edition is brought to you by bitsCrunch - an AI-enabled Data Analytics & Forensics Protocol backed by Coinbase, Animoca Brands, and Chainlink.

Their native token $Bcut is now listed on dYdX (with 20x leverage) for perpetual trades 👇

TGIF, crypto raiders! Seems like Santa took a wrong turn at the North Pole. But hey, who doesn't love a good holiday discount?

How Powell stole the crypto Christmas

Why this crash might actually be bullish (no, really)

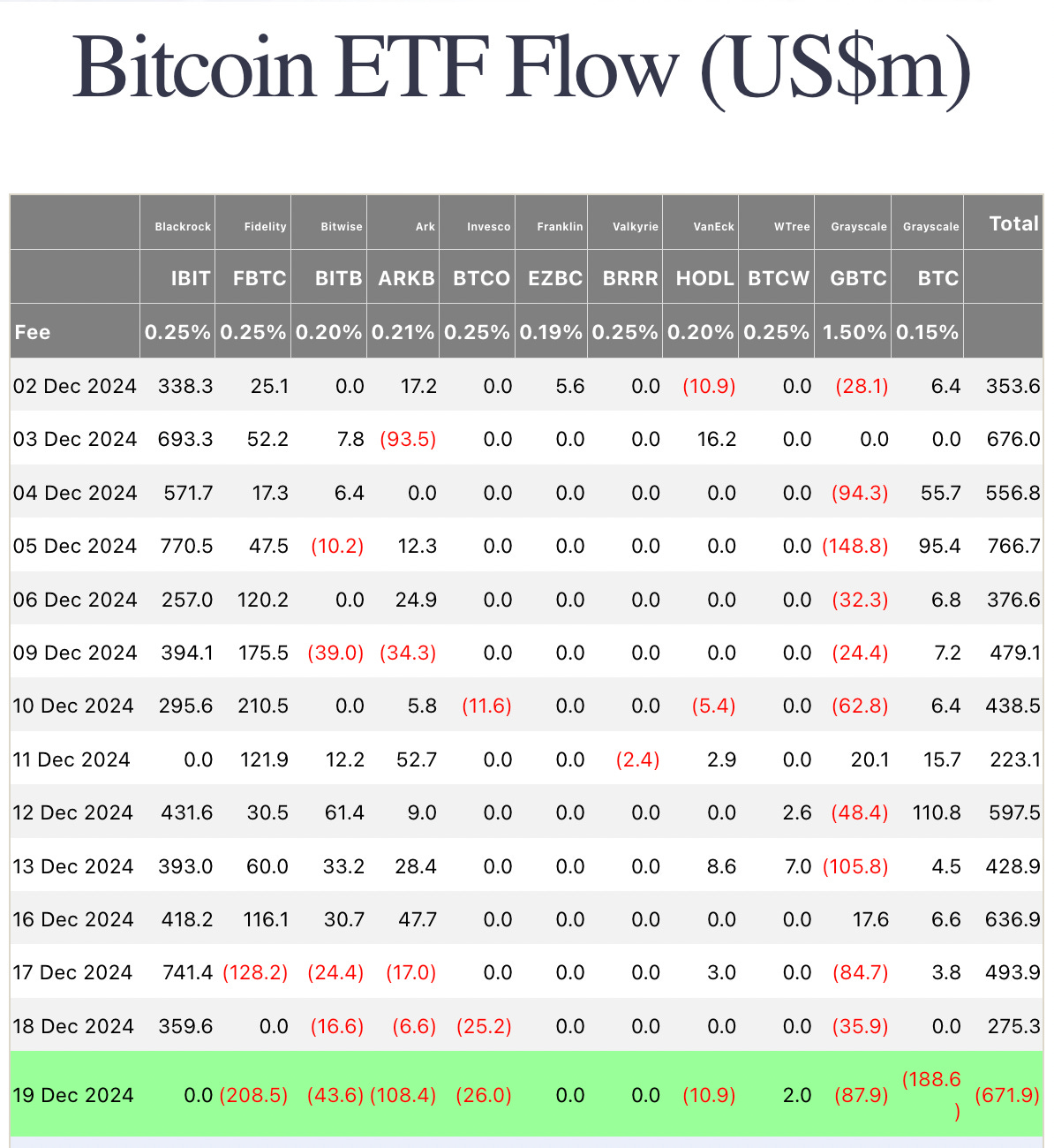

ETF flows go negative for the first time in 15 days

What Week 7 corrections tell us about market cycles

The least volatile Bitcoin bull run... so far

First up, show us some love on Telegram 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Crypto market poetry, December 2024

"'Twas the night before Fed day, when all through the charts Not a trader was shorting, all long in their hearts..."

Market is bleeding.

Sellers are selling.

Hodlers are sweating.

You are panicking.

And we asked you to stay calm: Markets Do Market Things 📉

But today, we need to talk.

Looks like Santa's sleigh hit some turbulence.

The crypto market just witnessed its biggest bloodbath of Q4.

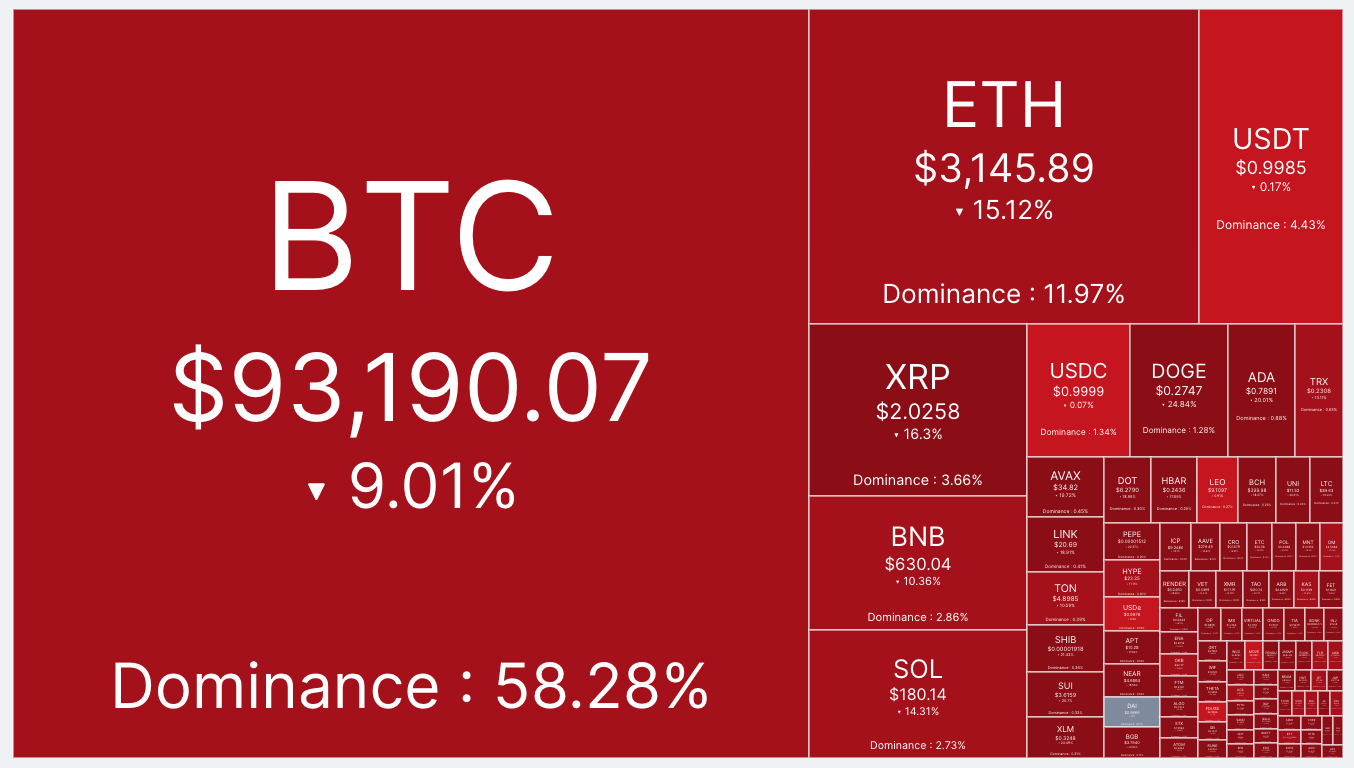

The broader crypto market cap down almost 20%.

Bitcoin plunged from all-time high of $108,366 to the lows of around $93,000.

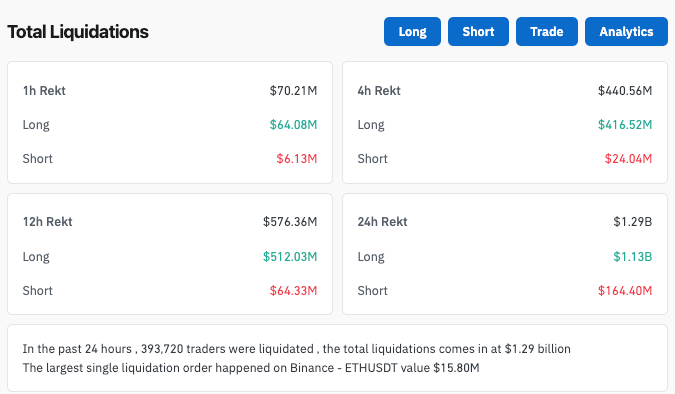

The liquidation numbers also paint a caught-you-wrong-step picture, and it’s slipping further … not stopping this train that easy.

We know what happened. Jerome Powell happened.

A hawkish rate cut. Fed cut rates by 25 basis points. BUT reduced expected 2025 cuts from three to two. AND raised inflation concerns.

The S&P 500 haemorrhaged $1.5 trillion in market value, making crypto's losses look almost modest in comparison.

In The Numbers 🔢

$671.9 million

That's the single - day outflow from Bitcoin ETFs on December 19.

The highest single day outflow in history + first single day net outflow in 15 days.

BlackRock (IBIT): -$208.5M

Grayscale (GBTC): -$188.6M

ARK 21Shares (ARKB): -$108.4M

Fidelity (FBTC): -$43.6M

Block That Quote 🎙

Pav Hundal, Swyftx Lead Analyst

"We've had such a bullish narrative over the last month that the market was completely unprepared for bad news. Now we're seeing indiscriminate selling."

But was the market really "unprepared for bad news," as Hundal suggests, or was this a correction waiting to happen?

The Signs Were There

For those paying attention, the warning signs were flashing well before Powell's press conference.

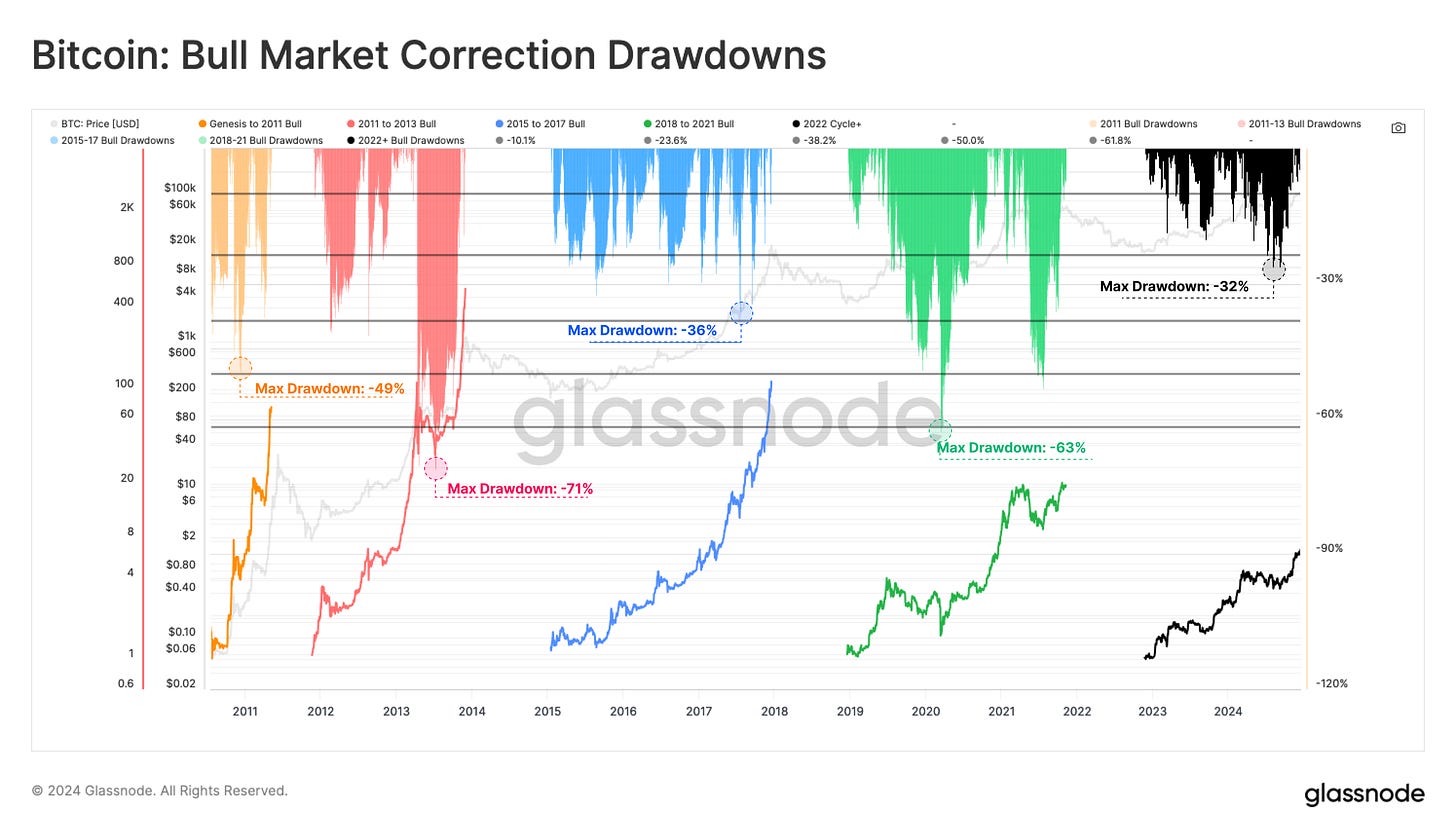

First, there's the eerily consistent pattern of Bitcoin corrections during bull markets. According to data from Rekt Capital, Bitcoin has historically faced significant pullbacks around week 7 of its price discovery phase.

2013 cycle: Major correction in Week 7

2017 cycle: 34% retrace in Week 8

2020/21 cycle: 16% pullback after 6 weeks

We're currently in Week 7 of this cycle.

But this wasn't just about technical patterns or Fed speak. Three key factors combined to create the perfect storm.

Extreme leverage: The market had become dangerously leveraged, with open interest reaching historic highs. When markets are this stretched, even small moves can trigger cascading liquidations.

Low volatility trap: The VIX index was hovering near historic lows, leading systematic traders to pile into risk assets. As Tyler Neville notes, this created a powder keg of positioning.

Options expiry: The largest options expiry in history coincided with the Fed's announcement, amplifying market moves through dealer gamma hedging.

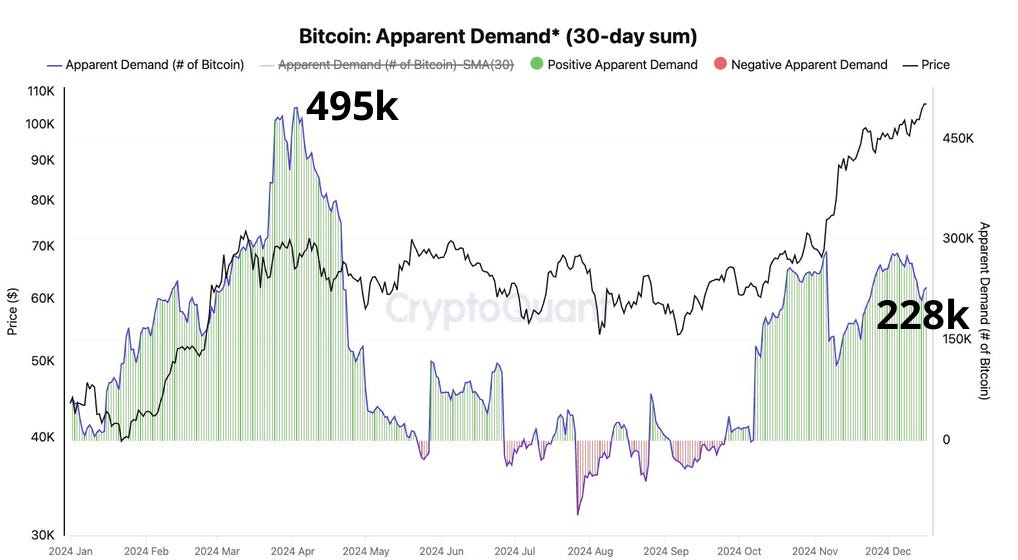

Supply Shock in the Making?

The data from CryptoQuant reveals an intriguing backdrop to this correction. Bitcoin's sell-side liquidity has dropped to 3.397 million - the lowest since 2020. Meanwhile, accumulator addresses are adding 495,000 Bitcoin monthly.

This creates a potentially explosive situation: once the correction ends, the reduced supply could amplify any recovery rally.

What Happens Next? If historical patterns hold, this correction could set the stage for an even stronger advance. In previous cycles, these Week 7-8 pullbacks were followed by substantial rallies.

As one analyst on X noted, "Corrections are a natural part of bull markets." What's unnatural is the increasing institutional presence in this one.

bitsCrunch Gets Listed on dYdX DEX

The $Bcut listing on dYdX is a boost for institutional interest, trading volume and liquidity for the platform.

At a critical juncture in their growth trajectory, their first perpetual listing signals a turning point in the evolution and adoption of $BCUT, with further listings on the horizon 🫵

bitsCrunch has indexed several blockchains including Ethereum, Solana, Bitcoin, Linea, Polygon and Binance Chain. They have partnered with top DeFi protocols, NFT marketplace and aggregators, wallet projects, NFT Lending protocols, gaming, and NFT projects.

“Least volatile cycle” in 2024?

That’s what a Dec 18 Glassnode report says.

Behind those billions lay a tale of two holder groups. The newer veterans - those who'd held for 6-12 months - were leading the selling charge.

The true old guard, those holding for three years or more, barely budged. Like ancient redwoods in a storm, they stood firm while the younger trees swayed.

The numbers tell the story.

Of all profits taken since November, coins aged 6-12 months accounted for $27.3 billion - nearly 40% of all selling. In contrast, coins aged 3-5 years contributed just $10.1 billion to the exit parade.

But perhaps the most fascinating part isn't who was selling - it's who was buying.

For every $2.1 billion worth of Bitcoin being sold, there was an equal amount of fresh capital flowing in, absorbing these sales like a sponge soaks up water.

This wasn't just market mechanics; it was a changing of the guard, a transfer of wealth from crypto's old believers to its new converts.

Yet unlike previous market peaks, where such massive profit-taking often spelled doom, this time feels different.

The market's volatility is actually decreasing with each cycle. The deepest drawdown this year was just 32% - practically a gentle dip by Bitcoin's historical standards.

The Token Dispatch View 🔍

So what's the real story behind this Christmas correction? Like all great market tales, this one's written in layers.

On the surface, it's about Powell's hawkish surprise and $1.25 billion in liquidations. But dig deeper, and you'll find a market that's fundamentally different from its previous incarnations.

Perhaps that's the real message hidden in this pre-Christmas correction. In a market historically known for its volatility, we're witnessing something new: maturity. The wild swings are smoothing out, the institutions are staying put, and even the corrections follow a more predictable pattern.

About Santa …

"It's not the start of the Christmas run-in we'd hoped for," admits Hundal, "but it looks like short-term angst."

Perhaps the real gift this Christmas isn't the rally everyone expected, but a reminder that in crypto, the most profitable opportunities often come gift-wrapped in fear and red candles.

When everyone's expecting Santa to rally, sometimes he brings coal instead. Innit?

AND, while you were panicking about the red candles.

El Salvador casually added 11 Bitcoin (worth over $1 million) to their Strategic Reserve

Marathon Digital (MARA) loaded up their stockings with $1.53 billion worth of Bitcoin

BlackRock kept their ETF buying spree going with another $359 million

Hut8 joined the party with a $100 million Bitcoin purchase

The SEC quietly approved Nasdaq's Bitcoin & Crypto Index ETF.

After all, Week 7 corrections have a funny way of looking like buying opportunities in hindsight. Just don't forget to check twice if you're on the naughty (leveraged) or nice (spot) list.

The Surfer 🏄

Bitcoin investors achieve millionaire status in an average of 10.3 years, compared to 227 years for blue-chip stock investors, a recent study by NFTEvening and Storible showed.

Bitcoin's market cap has reached a new all-time high, accounting for 14% of gold's market cap, as total assets under management for Bitcoin ETFs surpass those of gold ETFs.

BlackRock's recent video explaining Bitcoin's fixed supply of 21 million has reignited debate in the crypto community after it included a disclaimer stating there is "no guarantee" that this cap won't change.

Binance.US plans to restore its USD services in early 2025, after having suspended fiat trading due to regulatory pressures from the SEC.

Craig Wright, who claims to be Bitcoin's creator, has been sentenced to 12 months in prison, suspended for two years, for contempt of court after filing a £900 billion lawsuit related to his intellectual property claims.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

Big players aren't running away 😂 - while small investors are selling, companies like Marathon Digital bought $1.53 billion worth of Bitcoin. Smart money seems to be buying the dip...

Bitcoin is getting less wild - biggest drop this year was only 32%, way calmer than the crazy swings we used to see. This might attract more regular investors