Saylor Strategy: 0️⃣ Interest, ♾️ Bitcoin?

As the MicroStrategy's Bitcoin bet keeps touching new heights, one question eludes: is this a calculated genius or a costly gamble?

Hello, y'all. Happy Saturday. On November 25, while most of us were busy battling our Monday blues, it was just another day in the office for Michael Saylor at MicroStrategy.

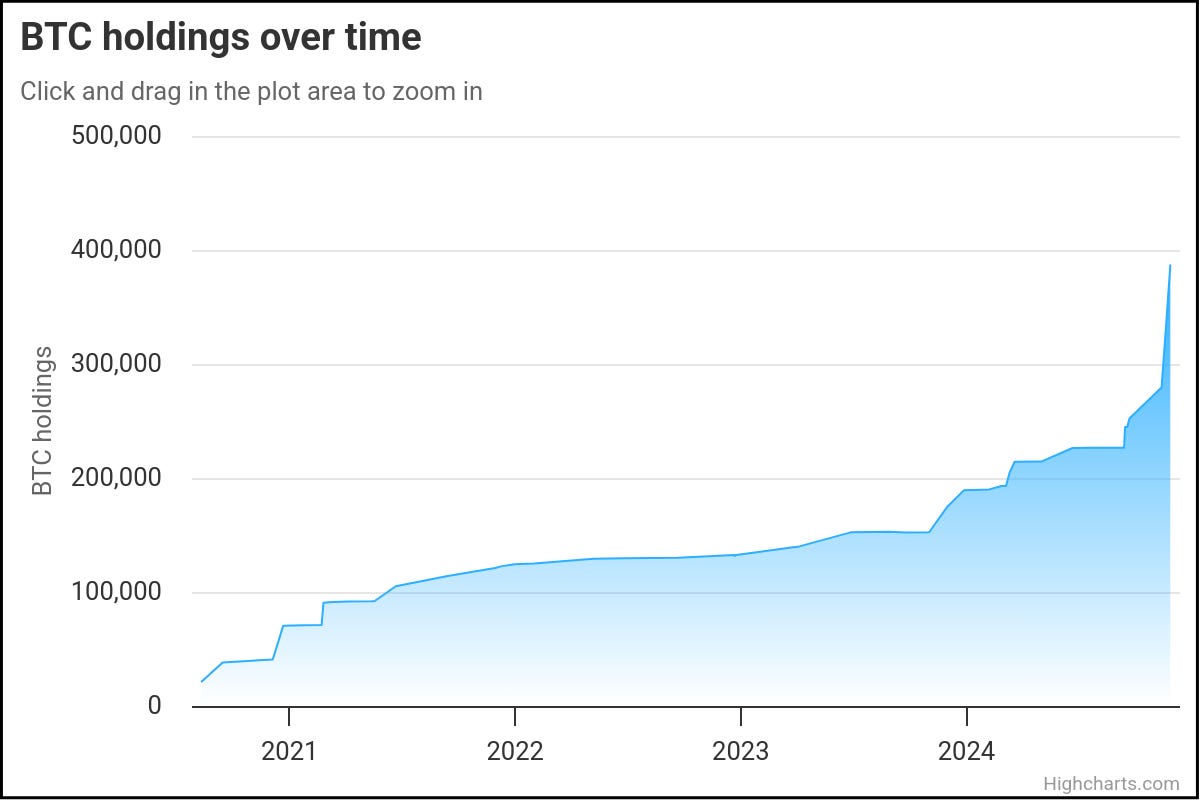

The man who has turned Wall Street's debt game into a Bitcoin-buying machine, just raised $5.4 billion to buy 55,000 Bitcoin, pushing MicroStrategy's total holdings to 386,700 BTC.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 170,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Translation? The company’s Bitcoin treasury isn’t racing forward anymore, it is now galloping vertically. Literally climbing heights.

Don’t understand? Look at the chart below

Over time, Saylor has become arguably the biggest champion of building Bitcoin corporate treasuries.

How? By pivoting MicroStrategy (MSTR) from being a software company to the “world’s first Bitcoin development company”.

We wrote a piece on the journey of MicroStrategy from a software company to Bitcoin champion, a few months ago.

Read: Should You Invest in MicroStrategy’s Bitcoin Bet? 🍔 🤔

But the pivot has been such that the strategy of Bitcoin acquisition almost seems flawless just like how we used a cheat code for infinite lives in the peak gaming era.

Result? The Bitcoin bet has not just paid off but driven up MSTR’s share price in a way that could put its very underlying asset - Bitcoin - to shame.

Now, after its recent record-high purchase of Bitcoin, the company just cleared the eligibility criteria of NASDAQ 100 index. And if all goes well, may well see itself being included in the list on December 13 when the verdict comes out.

But today’s Wormhole is not about that. Rather, it is about how Saylor is consistently pulling off this ingenious Bitcoin heist using the zero-interest debt route and if it is really fail-proof.

The Zero Interest Magic

Picture this: You borrow money and pay no interest. Sounds impossible?

Zero-interest bonds are Wall Street's equivalent of free money. But what happens when you combine them with Bitcoin? Ask MicroStrategy, which just cracked what traders are calling the "infinite money glitch."

Infinite ... what? We will come to that in a bit.

But, Saylor calls this strategy: "Debt, with a twist"

Here's his magic formula

Borrow at near-zero rates (0.625% to 2.25%)

Let bondholders bet on Bitcoin's upside

Convert debt to equity if Bitcoin soars

Keep the Bitcoin if it doesn't

Still don’t understand?

Stay with us. We will help you break down these zero-interest bonds to the T.

Think of it like this: Imagine borrowing $100 from your friend, promising to either pay them back in cash or give them something more valuable later - their choice.

Now imagine your friend is so excited about this deal, they charge you almost no interest for the loan.

That's exactly what Saylor is doing, but with billions.

He borrows money at nearly zero interest (0.625% to 2.25%) through these "convertible notes." The lenders can either get their money back or get MicroStrategy shares if Bitcoin moons. It's heads I win, tails I might win bigger.

"The notes are like free Bitcoin lottery tickets for Wall Street. They get guaranteed returns with Bitcoin upside," explains BitMEX Research.

And boy hasn’t the zero interest debt trick worked like a charm.

The 2024 numbers are staggering.

September: $1.01 billion raised at 0.625%

June: $700 million at 2.25%

March: $800 million at 0.625%

Another March raise: $600 million at 0.875%

Now, back to the infinite money glitch.

MicroStrategy's shares trade at 2.4 times its Bitcoin holdings' value. That's like getting $95,000 worth of Bitcoin for $228,000 per share.

Isn’t that unrealistic? Well, the Wall Street doesn't think so.

The premium has created what traders call an "infinite money glitch".

It’s a five-step process.

Issue zero-interest bonds

Buy Bitcoin

Watch stock premium grow

Use premium to raise more debt

Repeat

"We're making $500 million a day. I'm staring at my screen, and we're selling dollar bills for $3, sometimes a million times a minute," Saylor told CNBC.

But wait, this sounds too good to be true.

So much debt - too much risk, no?

Well, Saylor’s taken care of that with the smart timing of these debts.

The maturities of the zero interest convertible notes are perfectly staggered between 2028 and 2032. No single repayment can sink the ship.

So, is there anything that could go wrong? Read on…

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

Risk Roulette

Many have argued that MicroStrategy carries a risk of competition.

Well, they surely got company.

From the likes of Cathedra Bitcoin and Marathon Digital in their own backyard to Metaplanet across the Pacific.

So, should Saylor be worried?

"The days when MicroStrategy shares represented a rare way to gain Bitcoin exposure are over," warns Kerrisdale Capital.

But are they?

Well, he seems to be loving all the competition. In fact, he went all out as a salesman offering to help tech giant Microsoft start building its own Bitcoin treasury.

But why would he do that?

Copycats maybe queueing up, but they're missing the secret sauce.

MicroStrategy's institutional backing tells the story

Vanguard: $2.6 billion

BlackRock: $2.1 billion

Total institutional holdings: $15.3 billion

All good so far. But then, there are other risks.

Perhaps in a bet that seems so flawless and fail-proof, one of the biggest risks will be the risk of the unknown.

Says who? Anthony Pompliano, investor and CEO of the investment firm Professional Capital Management.

Since MSTR is playing in a field that has no precedents, it is likely to be met with the unknown and the unexpected.

Imagine a scenario where Bitcoin crashes big.

We have seen that happen multiple times in the past when scams were exposed or macros didn’t work out in favour.

And in such times, the bonds will still need payment regardless of price.

The steep premium that MSTR’s stocks enjoy right now? Could very well evaporate.

New funding might dry up in case Saylor wants to keep going on his Bitcoin shopping spree.

Kerrisdale Capital warns of the "Trump Max" scenario - what if interest rates spike? Or Bitcoin crashes to $15,000? The company would need to start selling Bitcoin to pay its debt.

Speaking of Saylor, he is another point of risk.

The Saylor factor driving this strategy means that the current bull run is heavily dependent on one man with no clear succession plan.

It’s been a classic case of ‘market trusts the architect’ and if something were to happen to Saylor (we really hope not), it’s uncertain if the company will be able to carry on with its dream run.

Then there’s competition from mainstreaming of Bitcoin ETFs that is already making Bitcoin more accessible.

Then why do people still bet on MicroStrategy?

Simply because, it works.

The numbers speak for it

Total 386,700 Bitcoin acquired at an average price of $56,850

Total investment? $21.9 billion

Current value? Over $37 billion

Above $15 billion unrealised gains

Ever since Saylor went all guns out on Bitcoin, MicroStrategy's market cap has shot from $3.6 billion to $85 billion.

The Bitcoin treasury? That's worth $37 billion.

Secondly, why would people settle for slow and small chunks of Bitcoin returns (relatively) when Saylor can offer astronomical returns.

Bernstein sees MSTR owning 4% of all Bitcoin by 2033 in their base case - about 830,000 BTC or $830 billion at their projected $1 million Bitcoin price. The bull case? Six percent of supply.

So, should you take the risk?

Token Dispatch View

Saylor's strategy is often looked at as either genius or madness with no middle ground.

Often, most of the ecosystem thinks the strategy works until it doesn't. And when it works, it works spectacularly.

For bulls, MicroStrategy is a levered bet on Bitcoin's future with nearly zero carrying cost. For bears, it's a house of cards waiting for a gust of wind.

Either of these routes are way too extreme.

No doubt the Saylor strategy is an innovative and never-before thought of approach. And that’s probably why it has worked like magic all this while.

Hoping it will continue to do so.

But when it comes to money, you should exercise caution and prudence just like you’d do while betting on any asset.

Would you put all your money in one basket?

And if history has taught us anything, it was those who were prepared for black swan events in the past who came out relatively unscathed.

So, perhaps the best way out is to de-risk by not putting 100% money through this one single route.

And even if it does sound extreme, prepare for a rainy day and maybe not put all your dollars in there.

Week in Funding 💰

Rarimo. $2.5M. ZK identity registry social app, for users to stay private without losing historical actions, networks, and identities.

Bleap. $2.3M. Wallet-connected debit card, spend funds directly from any EVM non-custodial wallet without off-ramping or locking/transferring on-chain balance.

Margarita Finance. $1M. DeFi yield boosters for Solana chain. Personalised derivative contracts, offering higher yields than traditional stablecoin staking.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

No moon predictions, no "web5," no celebrating hacks as "good stress tests." Just clear analysis on the intersection of crypto, tech, and traditional finance, delivered with enough cultural references to make the heavy stuff digestible.