SEC Can't Stop Suing 👨⚖️

As SEC goes on crypto crusade,a busy lawsuit season looms. Robinhood ain't backing down. More enforcement within 2 years - CFTC chair. Crypto matters in 2024 US elections. Trump good for Bitcoin?

Hello, y'all. O America, how exactly do we deal with thee … 🤔

If tomorrow all the things were gone | I worked for all my life | And I had to start again | With just my children and my wife | I thank my lucky stars | To be living here today'… 🎶

Do try the quiz game for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

The US Securities and Exchange Commission (SEC) has been about regulate through enforcement, and it's war on crypto shows no signs of stopping.

The latest target? Robinhood.

They have received a Wells notice.

What's a Wells Notice? It's basically a warning shot from the SEC, letting a company know they might take enforcement action.

What's the SEC investigating? Robinhood's crypto listings and how they handle crypto custody. The SEC believes some crypto assets on Robinhood might be classified as securities, and Robinhood might not be following the proper regulations.

What does Robinhood say? Robinhood disagrees. They believe the listed assets are not securities and plan to fight the SEC's claims.

Before we get into that, the string of lawsuits against crypto firms by the SEC.

Coinbase: The SEC’s lawsuit accuses Coinbase of operating as an unregistered securities exchange and broker-dealer.

Read: Coinbase > SEC < Beba 🤼♀️

Coinbase won a partial victory in its SEC lawsuit. A March court ruling dismissed claims that its self-custody wallet acts as a broker.

Binance: Faces charges similar to Coinbase’s, plus additional scrutiny over its customer access policies.

Changpeng Zhao was sentenced for money laundering violations, and Binance was fined $4.3 billion.

Read: Binance Bites the Bullet 🙊

Ripple: After a partial victory in court, Ripple continues to fight allegations that its XRP sales were unregistered securities offerings. The SEC seeks $2 billion in fines from Ripple.

Kraken: Faced with a $30 million penalty for previous violations, Kraken is now defending against another SEC lawsuit over its operations as an unregistered securities exchange.

Read: A $4 billion trouble 💸

Current Investigations and Notices

Ethereum Foundation: Under scrutiny for its involvement with Ethereum transactions, considered securities by the SEC.

Consensys: Received Wells Notice in April concerning MetaMask’s crypto swapping and staking features. Consensys countersued, challenging the SEC’s stance on Ethereum as a security.

Uniswap Labs: Issued a Wells Notice over its operation of a decentralized exchange (DEX), which the SEC claims requires registration similar to traditional securities exchanges.

Read: SEC Corners Uniswap 🫷

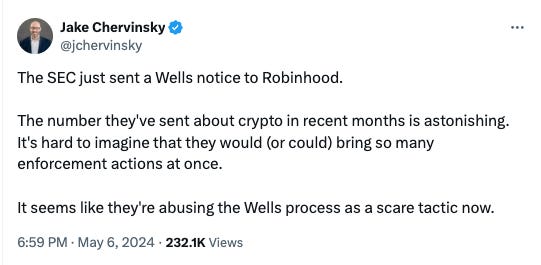

Is it a scare tactic?

SEC chair Gary Gensler has been actively trying to rein in the crypto industry since 2021. This latest move might be an attempt to paint crypto as unregulated.

Some legal experts believe the SEC might be overusing Wells Notices to intimidate crypto firms.

Read: The Major Questions Doctrine's Domain

What does Gensler think?

We are no special.

“Crypto is a small piece of our overall markets,” - Gensler, said on CNBC’s Squawk Box.

He is done with answering questions about crypto.

His math? SEC oversees $110 trillion capital market.

And the crypto market? $2.4 trillion.

Crypto market doesn’t comply with US securities laws.

So, he says … “an outsized piece of the scams and frauds and problems in our markets. And so thus, you end up with like an outsized ratio of journalist questions and crypto journalists to market cap.”

What does former commissioner think?

John Reed Stark, a former SEC official, slammed claims that the SEC is "regulating by enforcement," arguing the agency is simply doing its job.

“The rest of us simply call it enforcing the law.”

“The catchphrase of SEC regulation by enforcement [...] falls squarely into that last category. Just plain false. [...] Crypto promoters represent the most important recent example of industry players accusing the SEC of unfairly policing the markets. I’ve never witnessed such a well-funded, coordinated and unfounded assault on the SEC and its mission.”

What do lawyers think?

Lawyers say the SEC is sending out too many notices, focusing on crypto over other markets, and potentially abusing the process.

What does Bitwise say?

Bitwise CIO Matt Hougan says this whole thing is helping Coinbase?

What about Robinhood?

Dan Gallagher, Robinhood Markets’ chief legal, compliance and corporate affairs officer said in a statement.

“We firmly believe that the assets listed on our platform are not securities. We look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Why does this matter? This adds to the uncertainty surrounding crypto regulation in the US. Robinhood argues the lack of clear guidelines makes it difficult to comply with regulations and hinders crypto adoption.

Robinhood's compliance officer compared the current crypto regulatory landscape to the chaotic stock market regulations of 1932.

They Tried to Play Nice: Robinhood claims they've been in talks with the SEC for years and even attempted to register as a special purpose crypto broker-dealer (SPBD). The SEC rejected Robinhood's SPBD application after 16 months of waiting.

Block That Quote 🎙️

Rostin Behnam, Chair of the United States Commodity Futures Trading Commission (CFTC).

“We’re going to probably see in the next 6 to 18 months, or 6 to 24 months, another cycle of enforcement actions because of this cycle of asset appreciation and interest by retail investors”

More enforcement actions within the next two years?

Behnam said that “without a regulatory framework, without that transparency, without those tools that we typically use, as regulators, you’re going to continue to see this fraud and manipulation.”

Despite the 2022 crash, crypto continues to attract investors and entrepreneurs. This growth fuels concerns about investor protection.

Both the SEC and CFTC are already taking action against crypto firms. Behnam expects this trend to continue for the next 24 months.

2023 Enforcement Numbers: The SEC saw a record number of crypto-related enforcement cases in 2023, with actions against major players like Kraken and Coinbase.

Democrats, Republicans Clash Over SEC Role

Democrats and Republicans had a SEC v crypto debate during a House Financial Services subcommittee hearing Tuesday.

Rep. Maxine Waters defended the SEC's actions, highlighting its role in protecting investors and maintaining market integrity.

"The crypto industry, which publicly claims to want regulation, is suing the SEC for trying to regulate it, despite the fact that the courts agree that the laws on the books are applicable. Crypto can't have it both ways. My message to the crypto industry and everyone else - Democrats will always press for compliance, investor protection and market integrity."

Republicans' Perspective

Rep. Mike Flood criticised the SEC's enforcement tactics, citing the lawsuit against crypto startup DEBT Box.

Rep. Ann Wagner expressed concerns about the SEC's handling of the DEBT Box case, particularly accusations of misleading statements and unprofessional conduct.

In the Numbers 🔢

$1 Billion

Susquehanna International Group, a giant quantitative trading firm, has invested over $1 billion in Bitcoin ETFs during the first quarter of 2024.

Trump Good For Bitcoin?

Analysts at Standard Chartered believe that a second term for President Trump could be good for Bitcoin compared to Biden administration.

“While officials in the Biden administration have taken a relatively tough stance on digital assets, Trump said in a March interview that if elected, he would not crack down on Bitcoin or other digital assets.”

If Trump wins, foreign buyers of US treasuries may shift to alternative assets like Bitcoin, driving up its price. The analysts also predict that import tariffs under Trump could lead to large reserve managers buying Bitcoin in 2025.

The odds? 47%

Voters' positions on digital assets

The Digital Currency Group (DCG) and The Harris Poll survey suggested that voters in swing states consider crypto a key issue in 2024 US elections.

The Surfer 🏄

FTX proposes a plan to repay creditors as much as $16.3 billion, including "billions in compensation for the time value of their investments." Only creditors with claims below $50,000 will be eligible for a 118% recovery, which is expected to cover 98% of FTX's creditors.

Former NFL star Rob Gronkowski has agreed to pay $1.9 million to settle a lawsuit from Voyager Digital investors. Gronkowski, along with basketball player Victor Oladipo and race car driver Landon Cassill, were all named as promoters in the suit. Gronkowski will contribute $1.9 million to a $2.4 million settlement pool. Oladipo will contribute $500,000, and Cassill will pay $25,000.

A Bitcoin "epic satoshi" was sold for $2.1 million and has now been used to inscribe an Ordinals asset with Grimes' AI-generated voice.The inscribed artwork, called "Spikes," was created by the pseudonymous Nuro, a doctor turned Bitcoin enthusiast.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋