SEC loses again 👀

SEC tried a courtroom do-over against Ripple. Gets a nope, try again. Crypto cowboys, y'all better saddle up for the sunset. Satoshi tweets? Take-Two and Zynga dropped "Sugartown" and sup Samsung?

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

We’re jammin to 👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Remember when the SEC battled Ripple Labs in court, aiming for a clear victory but ended up on the losing side?

Well, round two went down, and the SEC is yet to gain traction.

The agency's attempt to appeal against their defeat was squashed like a bug, leaving many in the crypto community cheering.

Judge Says "No Redos" 🚫

US District Court judge Analisa Torres, the crypto community's latest MVP, had ruled in July that Ripple's XRP token sales weren't playing illegal hide and seek as unregistered securities.

Fast forward to this week.

The SEC tried to wave the "we disagree" flag, hoping for a do-over.

But Torres, being consistent, Torres denied the SEC's ability to pursue an interlocutory appeal on the grounds that her previous order.

The SEC's hope to get the decision flipped before the final judgment next spring?

Down the drain.

Why the denial? 🛑

Diving into the meat of the matter, Judge Torres highlighted that the SEC's wish for an interlocutory appeal didn't check the necessary boxes.

Firstly, her previous order in favour of Ripple wasn't what you'd call a classic "question of law," which is a must-have for these mid-case appeals.

Moreover, she didn't spot any significant grounds for differing opinions. She mentioned that the SEC didn't pitch a crystal-clear legal question that could be addressed without diving deep into case records.

Instead, the SEC appeared to nitpick on how the Howey test—a classic benchmark for identifying investment contracts—was applied to the case facts.

Torres cited the SEC's own words, noting that they had previously mentioned that the Howey test should be tailored to specific facts and scenarios. Seems like the SEC's own stance came back to bite.

"Here, the SEC has not presented a 'pure question of law' that could be 'decided quickly and cleanly without having to study the record. The SEC does not argue that the Court applied the wrong legal standard in deciding the cross-motions for summary judgment," she continued. Rather, the core of the SEC's argument is that the Court improperly applied the Howey test to the facts in the undisputed record."

And of course, XRP rallied about 5% following the decision.

While they've faced this setback, the SEC can still challenge Judge Torres' ruling.

But there's a catch – they have to wait until the grand finale next April after all the trial drama concludes.

Here's the reactions

Who's the happiest?👇🏻

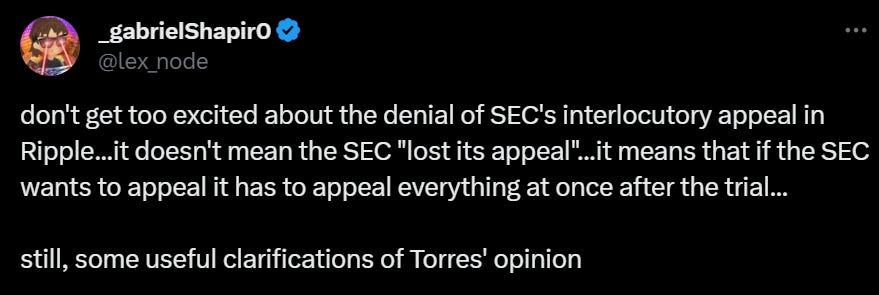

Gabriel Shapiro, general counsel at Delphi Labs says 👇🏻

And what does Bill Hughes, a lawyer at blockchain firm ConsenSys think?👇🏻

Crypto lawyer Jeremey Hogan thinks that the decision was a "disaster" for the SEC👇🏻

Singapore Approves

Ripple's Singapore arm has received a license as a major payments institution from the Monetary Authority of Singapore, allowing it to continue offering digital payment token services in the region.

This big approval follows a preliminary one in June and lets Ripple's Singapore arm operate as a major payments institution.

In layman's terms, They can keep spreading their digital payment token magic in this rapidly growing fintech hub.

Ripple CEO Brad Garlinghouse praised Singapore for its fintech and digital asset hub status.

Ripple’s global ambitions are no secret, with the company revealing that nearly 90% of its business operations are outside the US.

And with Singapore emerging as a leading fintech and digital asset center, it's no wonder Ripple’s had its Asia Pacific HQ there for six years.

TTD Blockquote🎙️

Television star and Canadian entrepreneur, Kevin O’Leary

“All the crypto cowboys that were the founders of this industry, they’re all going to be gone soon. ... They all have arrows in their backs.”

Television star and Canadian entrepreneur Kevin O’Leary believes the days of the "crypto cowboys" are numbered.

As he told CoinDesk TV, those pioneering, freewheeling figures of the crypto world are nearing their end, hinting that it's the dawn of a new era where the industry is steered by regulations.

Michael Lewis's recent book, “Going Infinite,” threw a spotlight on O’Leary’s lucrative collaboration with the FTX exchange.

$15.7 million was transferred to O'Leary's coffers.

For what?

20 service hours.

20 social posts.

One virtual lunch.

50 autographs.

Though O'Leary's prognosis for crypto cowboys is bleak, he remains a crypto enthusiast.

He’s all in on the potential of the technology, but he’s clear: He won’t saddle up with any exchange unless they’re playing by the rulebook.

"The promise of crypto still remains, it's still there," he said. "When you invest in venture capital ... eight out of 10 fail."

TTD WTF 🙄

The Twitter account with the handle @satoshi, associated with the enigmatic Bitcoin creator Satoshi Nakamoto, has ended its 5-year tweeting hiatus.

But is it really Nakamoto?

The crypto community was all excited when the Twitter account with the handle @satoshi broke its silence with posts referring to the 2008 white paper. Despite its 'verified' blue checkmark, many questioned its authenticity and link to the real Nakamoto.

What's intriguing? Well, the tweetstorm isn't just about revisiting the white paper. Some Twitter sleuths have linked the revived account to Craig Wright, a man who’s claimed (and been disputed) to be Satoshi Nakamoto for a long time.

Christen Ager-Hanssen, the ex-CEO of nChain, pointed fingers directly at Wright.

Ager-Hanssen has been quite vocal about Wright and nChain’s antics since his recent departure.

Craig Wright's claim to be the Bitcoin brainchild has been a roller coaster of assertions and legal tussles for nearly a decade.

His most recent adventure? Losing a copyright case in the UK, where he claimed that Bitcoin forks infringed upon his intellectual property rights.

Wright's company nChain launched Bitcoin SV, which is ... a fork of Bitcoin Cash (and that's a fork of Bitcoin).

Where’s ETF?🚨

The launch of the ether futures products may lead to optimism that spot bitcoin products will be approved👇🏻

TTD Gaming 🎮

Grand Theft Auto's crypto game

Take-Two, renowned for the iconic 'Grand Theft Auto' series, has delved into the blockchain gaming arena through its subsidiary, Zynga.

Sugartown Takes Center Stage: Launched in August, "Sugartown" is Zynga and Take-Two’s very first crypto game, built atop the Ethereum blockchain. It's considered the first significant venture by a leading mobile game developer into creating a crypto-centric game from scratch.

Millions in Trading: OpenSea reports that the game's access tokens (dubbed "Oras") have facilitated over $5 million in trading volume in just three weeks.

Tokenomics: Although initial plans mentioned releasing 10,000 Oras tokens, only 6,000 have been dropped so far. These tokens, built as ERC-721 on Ethereum, not only grant access to "Sugartown" but also allow players to amass "energy," an in-game currency.

Background: Take-Two's acquisition of Zynga, known for the massively successful FarmVille, was a highlight last year. "Sugartown" marks their collaborative journey into the expansive world of web3 gaming.

Cooler Master's Sneaker X

PC hardware company, Cooler Master, through its lifestyle division CMODX, introduces "Sneaker X," a gaming PC designed to resemble a running shoe.

Pricing: This unique PC ranges between $3,500 to $3,800 in the US. In Europe, the price fluctuates from approximately 3,500 to 4,500 Euros ($3,600-$4,700), with more configuration options available to European customers.

Origin Story: The Sneaker X PC was conceptualised by the PC modding group JMDF and was initially named the JMDF Sneaker. This unique design won Cooler Master's "Best Art Direction" award in 2020, prompting the company to mass-produce and update the design with its brand-specific cooling system and power supply.

Configuration Varieties: The European market gets four distinct configurations, including two Intel CPU models and two AMD CPU models. They also have the option to upgrade to either an Nvidia GeForce RTX 4070 Ti or 4080 graphics card. In contrast, the US customers only have two Intel models with graphics card options of 4070 and 4070 Ti.

TTD AI📍

Samsung builds AI chips in Texas?

Tenstorrent, the Toronto-based chip designer, is joining hands with Samsung Foundry US to roll out its next-gen AI chips.

And Samsung's cooking up these chips right in the heart of Texas.

Here's the dish:

Tenstorrent's got Samsung on board to create AI chips with the new SF4X process.

Not just the AI chips, Samsung's also crafting Tenstorrent's central processing units (CPUs), all jazzed up with the RISC-V chip design.

Why this is BIG? This move's got "Made in the USA" vibes all over. Samsung's flexing with its Austin, Texas factory to produce these chips. And they're not stopping there. Another factory is sprouting up nearby to up the chip game in the US.

The tech geeks might already know, but Samsung’s 4nm chip process is pretty much top-tier stuff. And with plans for a 3nm chip on the horizon?

That's like upgrading from a latte to a double espresso.

But let's not count the chips before they're made - mass production for the 3nm ones won't kick off till 2024.

Deepfakes or Deep Trouble?

Picture this: You're scrolling through your feed and boom! MrBeast is giving away the iPhone 15 Pro for a cool $2. Too good to be true?

Yep, because it's a deepfake scam.

The popular YouTuber took to X (probably Twitter) to alert fans.

And it's not just MrBeast.

Icons like Elon Musk aren't safe either. Last month, scammers even used Musk-themed deepfake vids for crypto cons on TikTok.

Europe's AI Conundrum

Everyone agrees that AI needs a leash, but how tight should it be? The debate is boiling hot in the EU corridors.

Věra Jourová, big gun at the European Commission, is pushing for balance. “We should not mark as high risk things which do not seem to be high risk at the moment. There should be a dynamic process where, when we see technologies being used in a risky way we are able to add them to the list of high risk later on.”

The EU's been cooking up an AI bill for a couple of years now. Word is they'll dish out the final draft by end-2023.

But it's spicy - they're suggesting that AI models spill the beans on the copyrighted content they train on.

OpenAI, the big brain behind me, ChatGPT, isn't vibing with the EU's draft. CEO Sam Altman even hinted at an EU exit if the bill's set in stone without tweaks.

TTD Surfer 🏄

During a televised presidential debate in Argentina, candidate Sergio Massa promised to implement a central bank digital currency (CBDC) if elected.

The US Treasury's OFAC has sanctioned crypto wallets linked to individuals and companies involved in the production of fentanyl.

The U.S. DOJ has charged eight Chinese companies with illegal drug production and distribution, accusing them of using crypto to move money.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋