SEC Out, CFTC In? 🔄

CFTC set to take SEC's crown. Trump team plans major oversight shift. World follows the crypto Trump run: From Brazil's Bitcoin reserves to UK's sprint. Justin Sun's $30M bet on Trump.

Hey there. Welcome to another wild Wednesday. Trump's about to flip the regulation game on its head, and the crypto world is waiting …

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

January 20, 2025 is when things get real.

Gensler's out.

Trump's in.

The great regulatory flip begins.

If crypto regulation was a game of Monopoly, the SEC has been owning like 90% of the board.

The crypto industry has been begging for regulatory clarity.

Well, it might finally get its wish – just not from where everyone expected.

Now Trump's about to flip the table and start a new game with different rules.

As he prepares to take office, his team is crafting what could be the most significant overhaul of crypto regulation since the asset class emerged.

The target? Not just personnel changes, but a fundamental restructuring of who oversees what in crypto.

The Great Power Shift 🔄

Word from Trump's transition team? The CFTC might soon be crypto's main overseer.

At least for assets deemed commodities, like Bitcoin and Ethereum.

Why this matters? Because for years, crypto's been caught in a regulatory tug-of-war between the SEC and CFTC. Now, that war might finally end.

The new framework

CFTC oversees crypto exchanges

Direct oversight of BTC and ETH markets

Clearer commodity vs. security rules

Streamlined compliance pathways

Reduced SEC jurisdiction

"For years, American crypto innovators have been targeted and, in some cases, driven offshore by a hostile regulatory regime," says the Blockchain Association.

And this hostility from the SEC has costed a lot.

How much exactly?

Nearly half a billion dollars in legal expenses between 2021 and 2023 alone, The Blockchain Association revealed recently.

That's not just money spent on lawyers – it's capital that could have funded innovation, created jobs, or developed new technologies.

In The Numbers 🔢

$426,000,000

That's how much crypto companies spent defending against SEC lawsuits between 2021-2023.

Breaking it down

104 SEC enforcement actions

Half a billion in legal fees

Only from "small slice" of industry

3 years of regulatory warfare

On top of all this, countless innovations have been stifled over the years.

Well, not anymore, says The Blockchain Association, which represents over 100 crypto organisations.

They've already presented Trump with an ambitious five-point plan for his first 100 days:

Five-point revolution

End the "debanking" of crypto companies

Overhaul leadership at key regulatory agencies

Revise SEC accounting guidelines

Reform Treasury and IRS tax policies

Create a crypto advisory council

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Betting on Change

The industry isn't just talking – they're putting money where their mouth is.

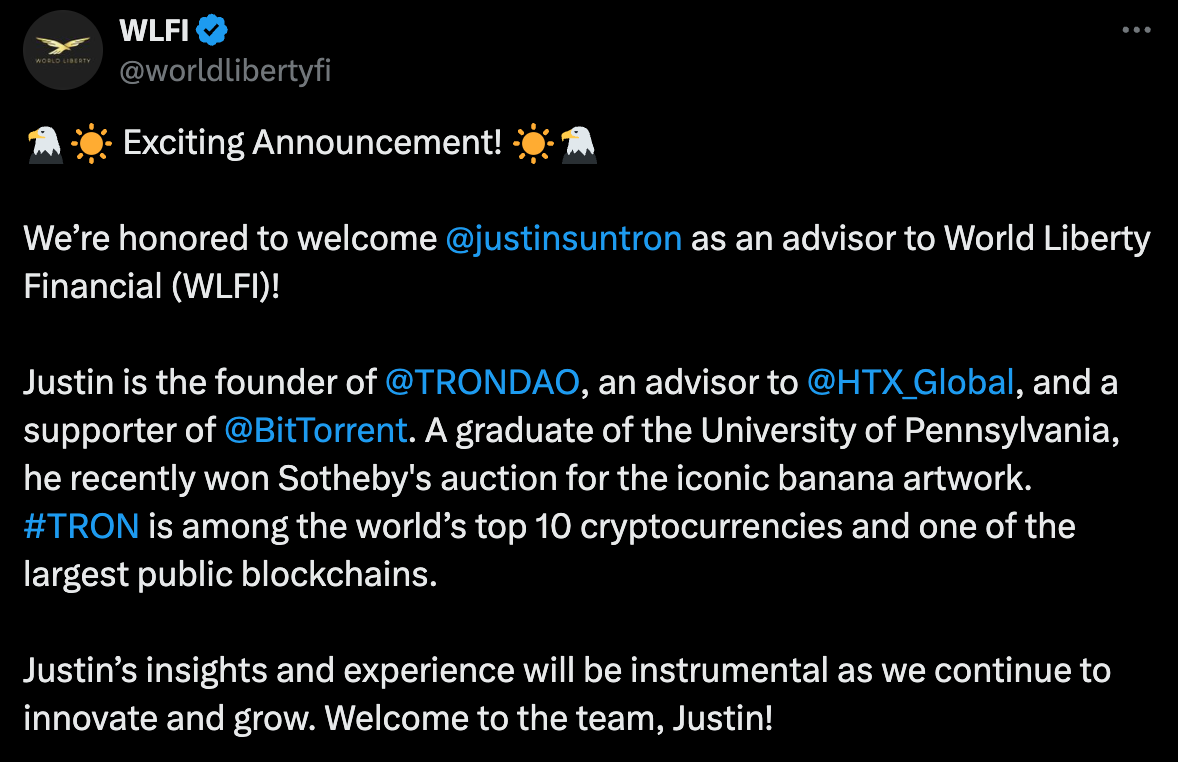

World Liberty Financial, his DeFi project, just received a $30 million investment from Tron founder Justin Sun – making Sun the majority token holder.

Bought majority of WLFI tokens

Controls over 50% supply

Nets Trump Co. $15M

Shows confidence in policy shift

"The U.S. is becoming the blockchain hub," Sun tweeted. "And Bitcoin owes it to Donald Trump!"

The Kevin Warsh Factor

Reports suggest former Federal Reserve Board member Kevin Warsh is a strong contender for Treasury Secretary. This isn't just another cabinet appointment – it could be a game-changer for crypto.

Warsh, who could potentially replace Federal Reserve Chair Jerome Powell in 2026, brings a unique perspective:

Deep understanding of monetary policy

Previous criticism of traditional banking's approach to innovation

Recognition of crypto's potential role in the financial system

The Trump effect is not just in the US, we can already see Global FOMO?

"When America sneezes, the world catches a cold." — Old Wall Street saying—

Friend-Shoring With Bitcoin?

El Salvador might be Trump's first call.

VanEck just dropped a spicy report calling the tiny Central American nation "Latin America's ultimate comeback story."

And with Trump's Bitcoin-friendly administration incoming, this could be just the beginning.

The Numbers? Pretty wild

5,900 BTC in reserves ($546.6M)

8% population using BTC for payments

GDP growth beating expectations

Sovereign bonds outperforming

"From fiscal reforms to Bitcoin adoption and energy innovation, the nation has defied global skepticism," says Matthew Sigel, VanEck's head of digital assets research.

But here's where it gets interesting.

With Trump's focus on "friend-shoring" supply chains and his pro-Bitcoin stance, El Salvador could become America's strategic partner in reshaping regional alliances.

President Bukele's moves

Made BTC legal tender (2021)

Built Bitcoin mining operations

Offers "freedom visas" for crypto folks

Keeps stacking sats through market cycles

Others follow suit

Brazil isn't waiting around

Just days after Trump's election, its Congress introduced legislation to establish a sovereign Bitcoin Reserve (RESBit). The timing isn't coincidental – the bill explicitly references El Salvador's success story, but the real catalyst appears to be anticipated US policy changes.

The proposed legislation would allow Brazil to hold up to 5% of its $355 billion reserves in Bitcoin. For perspective, that's potentially $17.75 billion worth of BTC – dwarfing El Salvador's current $550 million holdings.

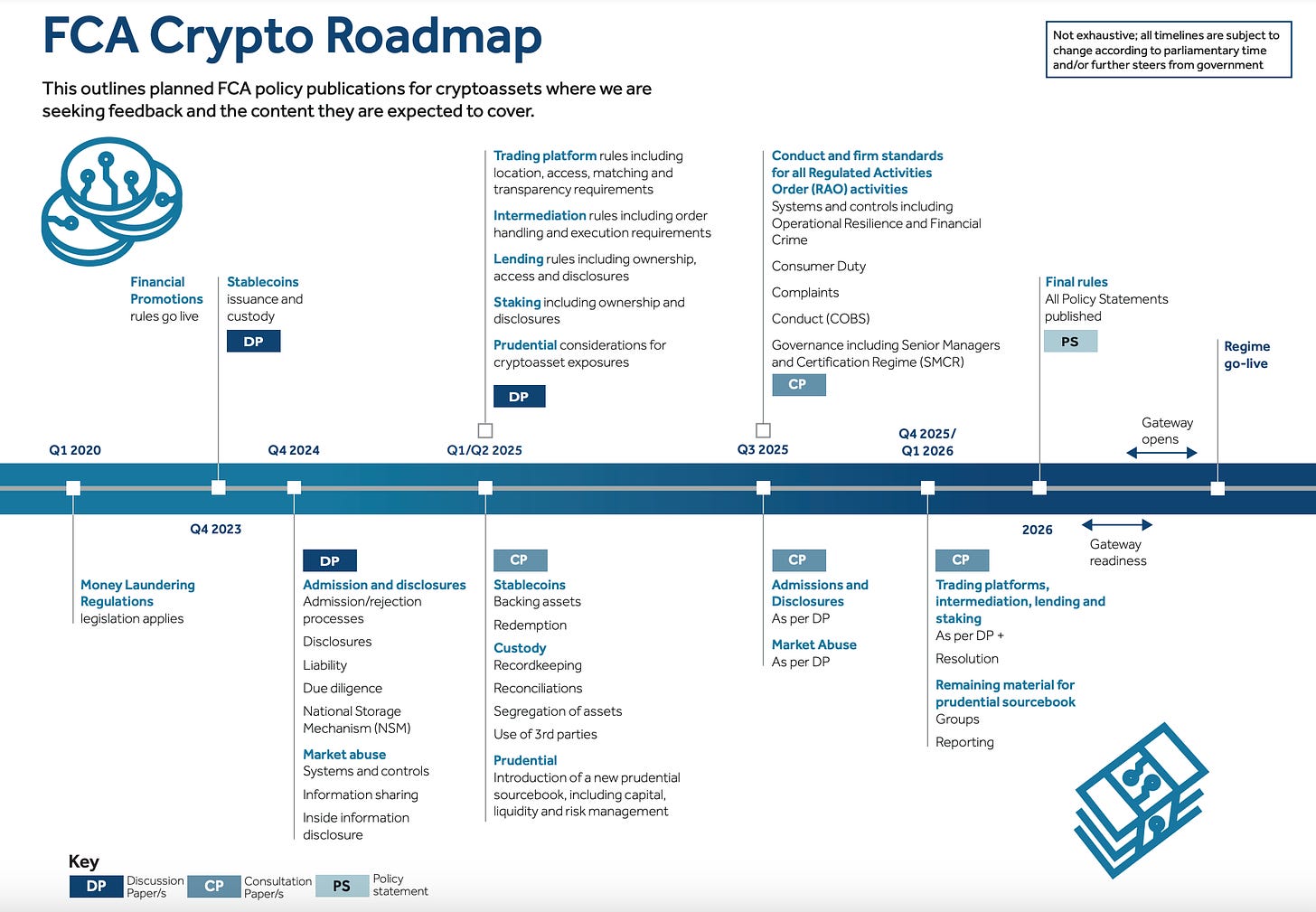

UK's race against time

United Kingdom, historically ahead in crypto regulation with MiCA, suddenly finds itself in an interesting position.

While its comprehensive framework kicks in by year-end, new players are emerging.

Schuman Financial, led by former Binance executives, is launching a MiCA-compliant euro stablecoin

The UK is accelerating its own framework, promising comprehensive regulations by early 2025

European nations are scrambling to position themselves for what many see as an incoming wave of U.S.-driven innovation

The Unexpected Movers

Perhaps most intriguing are the shifts in traditionally restrictive markets.

Morocco is drafting legislation to lift its 2017 crypto ban

The UK has seen crypto ownership jump to 12% of adults

Iran is pushing forward with CBDC plans, eyeing sanctions relief

Australia is aligning with OECD's crypto reporting framework

Token Dispatch View 🔍

What we're witnessing isn't just a change of guards – it's a fundamental rethinking of how crypto should be regulated in America.

The emphasis on CFTC oversight suggests a preference for treating major cryptocurrencies more like commodities than securities. This could provide the regulatory clarity the industry has been seeking, while potentially making compliance less burdensome than under the SEC's securities-focused framework.

But the real test will be in the execution. Can Trump's team balance innovation with consumer protection? Will the CFTC be better equipped than the SEC to oversee digital assets? And how will this shift affect America's position in the global crypto race?

One thing's certain: between the regulatory overhaul, key personnel changes, and Trump's own crypto ventures, 2025 is shaping up to be a pivotal year for digital assets in America.

The industry wanted change. It's about to get it – in spades.

The Surfer 🏄

VanEck has extended the fee waiver for the VanEck Bitcoin ETF (HODL) until January 10, 2026, increasing the asset threshold from $1.5 billion to $2.5 billion. The ETF is currently managing approximately $1.28 billion in assets.

Ripple Labs has contributed an additional $25 million to the Fairshake political action committee, bringing its total funding for the 2026 US congressional elections to $103 million, bolstered by donations from Coinbase and a16z.

Bitwise has filed an S-1 registration with the SEC for a new exchange-traded product (ETP) that will hold both Bitcoin and Ether, to provide investors with balanced exposure to these cryptocurrencies.

Kraken has announced the closure of its NFT marketplace, transitioning to withdrawal-only mode after November 27, 2024, and fully shutting down by February 27, 2025. The decision aims to reallocate resources towards new projects and services, as the NFT market has struggled with stagnant sales since earlier this year.

Uniswap has launched a record-breaking $15.5 million bug bounty programme aimed at identifying critical vulnerabilities in its v4 core contracts. This is the largest bounty ever offered in the crypto space.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

I can’t wait for all the crypto bros to get fucked when one of these scumbags does a pump and dump