Hello y’all. Happy Tuesday.

The US Securities and Exchange Commission (SEC) took its first step towards a crypto détente last Friday, yet did not provide the industry all the answers it was seeking.

After years of "regulation by enforcement," the securities watchdog gathered industry heavyweights for its inaugural crypto roundtable, billed as the "Spring Sprint Toward Crypto Clarity."

Despite the promising title, participants spent much of the two-hour session debating the same decades-old Howey Test rather than charting a clear path forward.

There were some takeaways - sure. Would they be enough, though? We flirt with the topic in today’s Token Dispatch.

We explore what this regulatory reset means for crypto:

How the SEC acknowledged past failures while struggling to define the future

What the proposed DART tracking system means for transparency

Why NFTs could be the next sector to receive regulatory guidance

What's missing from the dialogue that the industry desperately needs

Crypto Taxes Made Easy (Finally)

Keeping up with tax rules, tracking every trade, and sorting through reports? No one signed up for that. Blockpit takes the headache out of crypto taxes so you can focus on what actually matters.

Here’s how

Automated tax reports that keep you compliant without the hassle

All your transactions in one place—no more spreadsheet nightmares

Exclusive 15% discount for The Token Dispatch subscribers

Works globally so you’re covered no matter where you trade

Get your crypto taxes done in minutes — before the deadline sneaks up.

Claim your exclusive discount & get started with Blockpit.

New Leadership, New Approach

The contrast between the two regimes of the SEC — before and after Donald Trump’s second term as the US President — couldn't be more stark.

Where former SEC Chair Gary Gensler once declared most cryptocurrencies securities and wielded enforcement as his primary tool, Acting Chair Mark Uyeda and Commissioner Hester Peirce opened Friday's roundtable by acknowledging the need for a collaborative reset.

“I think we're ready for the sprint ahead”, Peirce told attendees, referencing the task force's ambitious "Spring Sprint Toward Crypto Clarity" initiative.

"Can we translate the characteristics of a security into a simple taxonomy that will cover the many different types of crypto assets that exist today and may exist in the future?" was one of the questions Peirce asked as part of addressing the dilemma around treating crypto as securities.

This public invitation to dialogue represents a shift in the SEC's approach.

The roundtable featured a dozen securities attorneys and crypto experts, including prominent voices like Miles Jennings, a16z Crypto Head of Policy & General Counsel, alongside more critical perspectives from figures like former SEC attorney John Reed Stark.

What stood out for the industry was the candid acknowledgment that previous approaches of the agency had failed.

Jennings, Head of Policy & General Counsel, Crypto at Andreessen Horowitz, didn't mince words. "I don't think that anyone could credibly argue that the last administration's approach to the industry accomplished any of the SEC's objectives."

"It did not lead to investor protection, it did not lead to capital formation, and it did not lead to efficient markets. As a result of that, the current approach is clearly a failure and we have to do better," Jennings said.

Even more surprising: the SEC seemed to agree.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Old Problems, Limited Progress

Despite the fresh faces and collaborative tone, the roundtable quickly found itself mired in a familiar debate: what makes something a security under the 1946 Howey Test?

Participants spent almost the entire discussion debating how this nearly 80-year-old framework for orange groves applies to tokens, decentralised exchanges, and other crypto innovations.

For an industry hoping for a clean break from the past, this focus on refining old tools rather than building new ones left many disappointed.

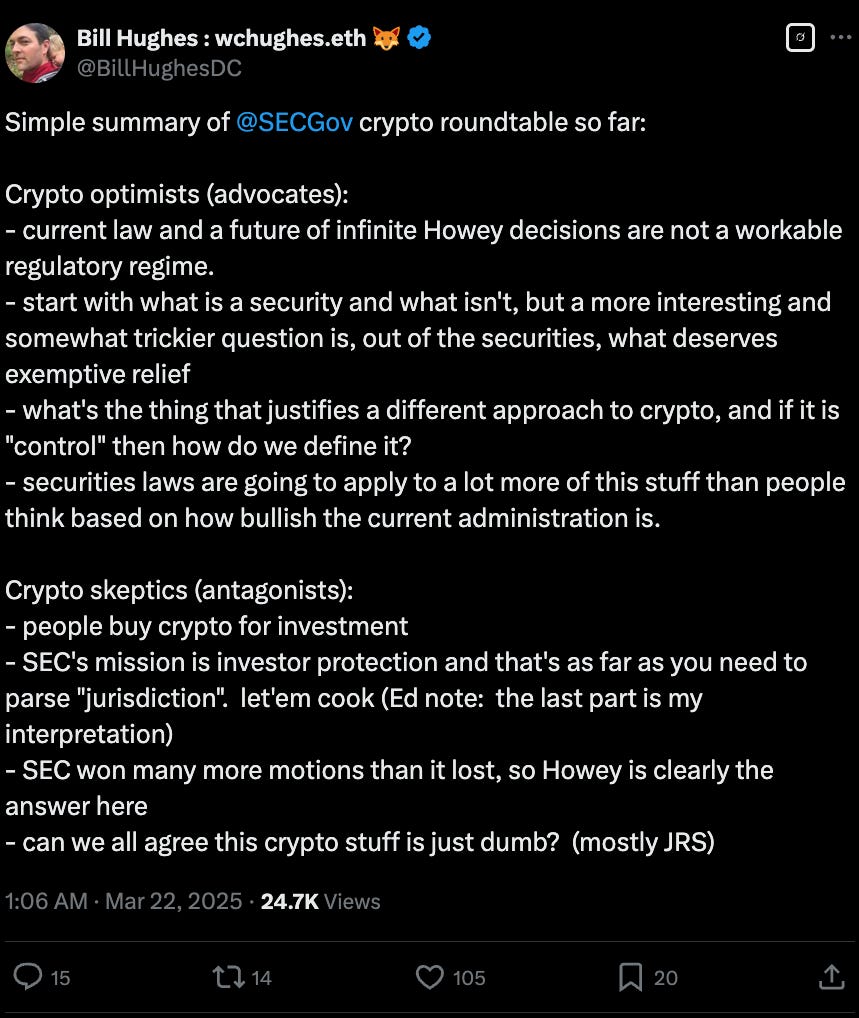

"Crypto optimists (advocates) argue that current law and a future of infinite Howey decisions are not a workable regulatory regime,” crypto lawyer Bill Hughes said in a post on X.

The industry wants a fresh start — defining what is and isn't a security — rather than endlessly debating case-by-case applications of aging precedent.

This tension played out in real-time as some participants tried steering the conversation towards more forward-looking approaches.

Rodrigo Seira, special counsel at Cooley LLP, challenged the underlying premise that investment intent automatically creates a security.

"I think it's key for us to understand that just because there's investment intent behind the purchase doesn't turn that transaction automatically into a security," Seira argued, using the example of art purchases that have both aesthetic and investment value.

Although the dialogue remained stuck on securities definitions, subtle hints of more practical progress emerged around the edges of the event.

Commissioner Peirce told reporters on the sidelines that non-fungible tokens (NFTs) could be the next category to receive SEC guidance, following recent statements on memecoins and proof-of-work mining.

Read: Proof-of-Work Mining Not a Security: SEC

"I think we'll see that we could do it on NFTs, as well," Peirce said.

This casual remark carried significant implications for projects like Stoner Cats and Flyfish Club, which previously faced SEC lawsuits for using NFT sales to fund their ventures.

A formal clarification could potentially open the door for creators to use NFTs as legitimate fundraising tools without securities registration.

DART: The New Transparency Push

Something did standout beyond the few concrete outcomes from the roundtable - a parallel development that could fundamentally reshape crypto transaction reporting.

The SEC’s recently announced Digital Asset Reporting and Tracking System (DART) will change how regulators monitor crypto markets. Unlike the philosophical debates about the Howey Test, DART represents a practical approach to addressing one of the SEC's core concerns: transparency.

The proposed system would track not just public blockchain transactions but also private off-chain trades, creating a comprehensive picture of digital asset ownership across platforms. This addresses a long-standing regulatory blind spot — while transactions on DeFi protocols are publicly visible on-chain, centralised exchanges often process trades internally without recording them on blockchains.

"Digital asset securities transactions—both 'on-chain' and 'off-chain'—should adhere to the same trade reporting requirements as standard securities,” the SEC statement read.

What makes DART particularly significant is that it's being developed in collaboration with the Commodity Futures Trading Commission (CFTC) — a stark contrast to the roundtable, which notably failed to include CFTC representatives despite their shared jurisdiction over digital assets.

This cross-agency approach suggests that beneath the surface debates, regulators are quietly working towards more unified oversight. For an industry that has long complained about fragmented regulation, this could eventually deliver the coordination that speeches and roundtables cannot.

Yet the DART system also raises serious privacy concerns. By capturing both public blockchain data and private off-chain trading activity, it gives regulators unprecedented visibility into crypto markets. For traders who value the pseudonymity of blockchain transactions, this level of surveillance represents a significant shift towards traditional financial monitoring.

Industry observers are watching closely to see how DART balances its transparency goals with privacy considerations — and whether it will spark another round of innovation in privacy-preserving technologies.

Token Dispatch View 🔍

Four days after the roundtable, the industry is left wondering if this will pave way for a new era in crypto regulation, or simply rebrand the same old challenges.

The SEC's Crypto 2.0 initiative, led by Commissioner Peirce, has shifted the tone. Staff statements on memecoins and mining, the potential NFT guidance on the horizon, and the agency's willingness to engage directly with industry all point to tangible changes in approach.

Read: Hester Peirce: Crypto's Favourite Regulator 👩⚖️

The timing is critical as Congress advances legislation resembling last year's FIT21 bill, which would create new frameworks for digital asset classification. Attorney Renato Mariotti said, "Friday's roundtable was a missed opportunity" to inform this legislative process by fostering ideas that could shape industry regulation for years to come.

While Commissioner Peirce's "Spring Sprint" signals a welcome departure from the enforcement-first era, Friday's discussion remained stuck in decades-old frameworks rather than building new ones.

This halfway approach isn't surprising when you consider the institutional constraints.

Operating with just three commissioners and awaiting Paul Atkins' confirmation hearing this Thursday, the SEC lacks both the mandate and mechanisms for sweeping reform. Non-binding staff statements on memecoins and mining are the limit of what's possible today.

The proposed DART system represents the most tangible step forward, potentially creating unprecedented transparency in crypto markets through collaboration with the CFTC. Yet even this initiative applies traditional monitoring paradigms to new financial realities.

What's missing is regulatory velocity. Blockchain innovation moves at the speed of code deployment; the SEC operates at the pace of committee consensus. This widening gap — call it the "regulatory innovation deficit" — is the elephant in the room.

For crypto businesses navigating this uncertainty, the strategic path ahead will be: look to Congress, not roundtables, for meaningful change. The FIT21 bill offers a more promising framework than endless debates about Howey's application to digital assets.

Until then, this "Spring Sprint" feels more like a cautious stroll — better than standing still, but hardly fast enough to catch an industry already running at full speed.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.