SEC vs SEC 🤼

Commissioner Mark Uyeda calls SEC's crypto approach disastrous. Says Chair Gary Gensler drives the agenda at the agency. Calls for reforms. SEC persists with crackdowns. Industry fights back.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

No lack of drama in the world of crypto.

Is there, ever?

The US Securities and Exchange Commission (SEC) just pulled off something that only the agency could have.

Mark Uyeda, one of the SEC commissioners, just conceded that agency messed up in its approach towards crypto.

He called it “disaster”, to be precise. During a recent broadcast interview, with Fox Business.

Block That Quote

SEC Commissioner Mark Uyeda

“I think our policies and our approach over the last several years have been just really a disaster for the whole industry.”

What did Uyeda say?

Slammed the SEC's ‘policy without providing clear guidance’ approach

Argued that this approach has led to inconsistent court rulings

Admitted that the approach created an atmosphere of uncertainty for investors

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Uyeda didn’t stop there

After consistently trying to defend himself against all the grilling that followed Gary Gensler wherever he went, the SEC Chair’s colleague Uyeda has just thrown him under the bus.

“Within the agency, our agenda is directed by the Chairman Gary Gensler. The staff all follow his lead,” said Uyeda.

“The joke we have is, ‘We got 5,000 points at the SEC, he [Gensler] controls 4,995. I got 5.’”

Ouch. That hurt?

And this is not the first time Gensler’s had to deal with dissent internally at the agency.

It’s a repeat of what happened at last month’s congressional hearing.

Grilled for four hours by the congressmen.

Then, too, his own peers at the SEC slammed him while being in the same room.

Commissioner Hester Peirce said the SEC's view on crypto regulations has led to a confusion about whether certain tokens qualify as securities.

“We’ve taken a legally imprecise view to mask the regulatory lack of clarity.”

So, all complaints? Or any solutions?

Uyeda has some suggestions.

SEC needs to

Provide clear guidance on what falls within and outside securities laws

Rethink on regulating crypto as securities

Consider a fresh approach to crypto regulation

Why it matters?

The internal criticism comes at a crucial time.

Crypto industry’s push for clearer regulations

Companies countering SEC’s crackdowns with legal suits

Recent announcement of exit of SEC former director Gurbir S Grewal, who helped lead crypto crackdown

Industry persons calling for Gary Gensler’s exit from the top post

Upcoming US election that is expected to rejig SEC's leadership and approach

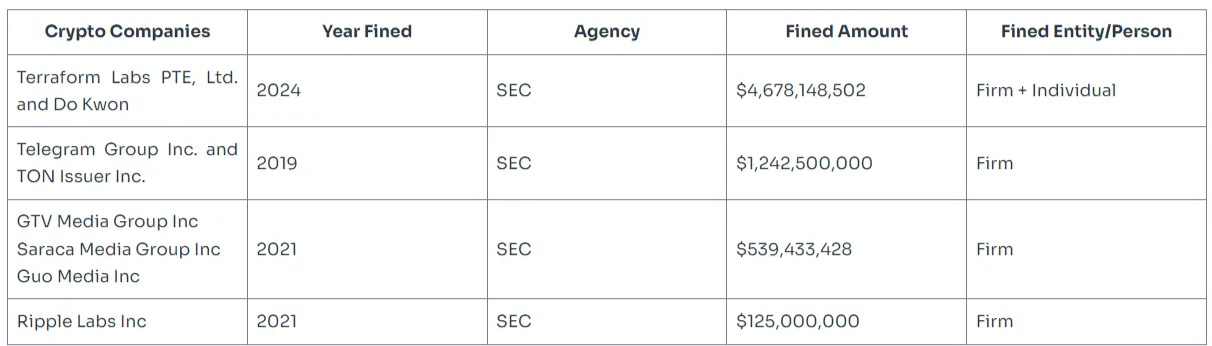

In The Numbers 🔢

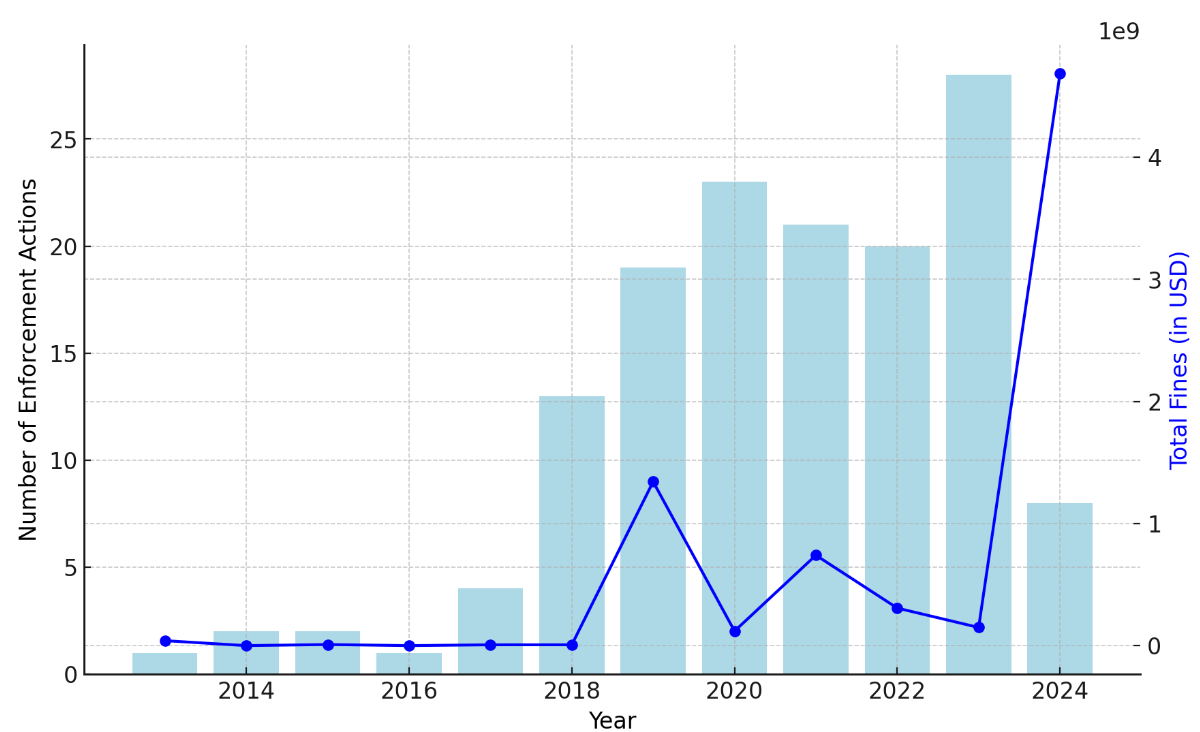

$4.7 billion

Total amount in fines the SEC booked in 2024.

That’s a 3,000% increase from 2023.

Read: Crypto Wars: Gensler's SEC v Digital Asset Industry ⚔️

Don’t let the fall in number of enforcements fool you.

Even the average fine for 2024 stood at $426 million, the highest ever.

The big fish Terraform Labs PTE, Ltd. and Do Kwon. were slapped with $4.68 billion fine.

Meaning? SEC wants to go for the big kill.

Other big fish fined in 2024

So, what’s the SEC busy doing when one of its commissioners is complaining about its irrational crackdowns?

Ironically, doing more of them.

Latest target? Cumberland DRW, a Chicago-based crypto trading firm.

Charges: Operating as an unregistered dealer, handling over $2 billion in crypto.

And, yet again, SEC labels Solana, Polygon, Cosmos, Algorand and Filecoin as securities.

Cumberland isn’t alone.

SEC filed similar lawsuits against against Binance and Coinbase in the past.

Cumberland’s response?

Vows to defend itself, referencing a previous win against the CFTC

“We’re ready to defend ourselves again.” The company referred to a 2018 lawsuit from the Commodities and Futures Trading Commission, which it won.

And Cumberland isn’t the lone warrior.

SEC might be cracking down continuously.

But nobody in the crypto world is giving in.

They are all fighting back with legal suits on SEC’s overreach and claims.

Crypto World Fights Back ⚖️

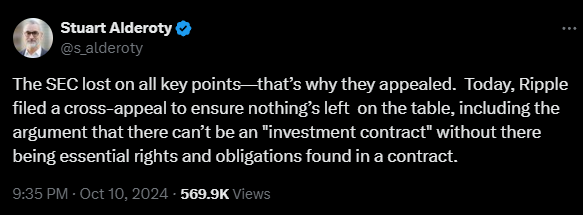

Ripple's cross-appeal

Ripple Labs filed a notice of cross-appeal in its ongoing battle with the SEC.

In 2020, the SEC accused Ripple of raising $1.3 billion through the sale of XRP, which it says is an unregistered security.

“There can’t be an 'investment contract' without there being essential rights and obligations found in a contract," said Stuart Alderoty, Ripple's chief legal officer in a post on X.

Bitnomial's fightback

The crypto exchange is suing the SEC and all five commissioners.

Accusation: SEC is "overextending its jurisdiction over digital assets.”

Bitnomial had self-certified its XRP Futures contract in August.

SEC intervened soon after the certification and claimed that XRP futures should be classified as “security futures,” subject to both SEC and CFTC oversight.

Bitnomial argued that XRP tokens are already regulated as a commodity by the CFTC and that the SEC “duplicates and compounds the regulatory burden” by saying it’s a security.

And all this while the SEC is handling dissent within.

Tough time ahead for the agency?

Well, the in-fighting just got intense.

Time to grab some popcorn, perhaps? 🍿

The Surfer 🏄

Uniswap Labs introduces its own Layer 2 chain, Unichain, built on Optimism’s Superchain for enhanced scalability. Initial block times will be one second, dropping to 200-250 milliseconds, significantly faster than Ethereum's 12-second block time.

Stripe has brought back crypto payments in the US, allowing customers to pay with USDC or USDP on Ethereum, Solana, and Polygon. Stripe charges a 1.5% fee for crypto transactions, which is lower than its standard 2.9% plus $0.30 fee for card payments.

About 50% of traditional hedge funds are now investing in crypto, a Bloomberg report shows. Up from 29% in 2023 and 37% in 2022. Among those already invested, 67% plan to maintain their current capital in crypto, while others intend to increase their investments by the end of 2024.

The SEC settled with Rimar LLC and its executives over a $4 million fraud scheme involving misleading claims about AI capabilities. Rimar's CEO Itai Liptz and board member Clifford Boro allegedly used "AI buzzwords" to attract investors for a non-existent trading platform.

A Charles Schwab survey reveals that cryptocurrencies are the second most sought-after asset class among ETF investors, following equities. 45% of ETF investors plan to invest in crypto, compared to 55% for equities.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

While I agree the SEC’s approach has been heavy-handed, I’m curious how the agency plans to reconcile its stance with the increasing calls for clarity. Simply labeling everything as a security isn’t a solution. The lawsuits are just a symptom of a deeper issue – the lack of a cohesive regulatory framework for crypto that allows innovation while protecting investors.

I’m not surprised by Uyeda’s statements – this is what happens when regulators try to apply old frameworks to new technology. The SEC needs to stop treating crypto like a threat and start working with the industry to develop guidelines that make sense. Otherwise, we’ll keep seeing more lawsuits and more crypto companies moving overseas.