Five years ago, launching a blockchain during a global pandemic seemed like terrible timing. Today, that same blockchain is trading on Wall Street.

Solana futures made their debut on the Chicago Mercantile Exchange (CME) this week, marking a landmark moment for a network that has travelled from experimental technology to institutional asset class in just half a decade.

In today’s edition, we explore Solana's journey to the trading floors of the world's largest derivatives marketplace

What CME futures mean for a potential SOL ETF

How Solana went from Covid-era launch to $140B+ powerhouse

The FTX collapse that nearly killed the "Ethereum killer"

Why memecoins became Solana's unexpected growth engine

How smartphones are bridging crypto to everyday consumers

Driving the Next Generation of Wealth

Blockchain applications and digital assets change the fundamentals of how we invest, save, and grow our financial resources. This is the future Nexo is building.

It brings blend cutting-edge blockchain technology with time-tested financial principles, offering a platform where your assets can truly work for you 🫵

If this chart, right here, brings back some memories, you know you rode one of the most eventful journeys the crypto ecosystem has ever seen.

You’d understand what it felt like to buy Solana at the highs of $251 in late 2021 - expecting more upside. Much worse if you sold your holdings at the lows of $9 at the end of 2022, expecting it to slide further.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Solana got its historic breakthrough at the bourses on Monday.

FalconX and StoneX completed the first-ever SOL futures block trade on the CME, setting the stage for Monday's official launch.

Within 24 hours, futures representing about 40,000 SOL (around $5 million) changed hands on the regulated exchange, with more than 11,300 unique accounts participating in CME's crypto products.

The exchange now offers two contract sizes: standard contracts representing 500 SOL and more accessible "micro" contracts representing 25 SOL.

For Solana, CME acceptance represents institutional validation that few blockchain assets ever achieve. It could pave way for the launch of the long-awaited exchange-traded funds (ETF).

"Solana has come a long way in the last five years. Solana futures are going live on the CME today, and SOL ETFs will surely follow shortly behind,” Chris Chung, founder of Solana-based swap platform Titan, told Cointelegraph.

That path from experimental technology to regulated financial instrument wasn't always guaranteed for a blockchain that was fighting for survival two years ago.

A Long Road from Pandemic

While Solana's Wall Street debut marks a triumphant moment, its origins couldn't have been more precarious.

In March 2020, when Covid-19 sent financial markets into a tailspin and Bitcoin crashed below $4,000, Anatoly Yakovenko and the Solana team made a bold move. Launched their mainnet beta into the teeth of a global crisis.

The bet was equivalent to a walk into the mouth of danger for a blockchain promising something revolutionary: Proof of History (PoH). Unlike traditional consensus mechanisms, PoH created a historical record that allowed nodes to verify transaction timestamps without waiting for network-wide agreement.

This innovation became Solana's secret weapon, enabling theoretical transaction speeds of 65,000 per second when most blockchains struggled to process double digits.

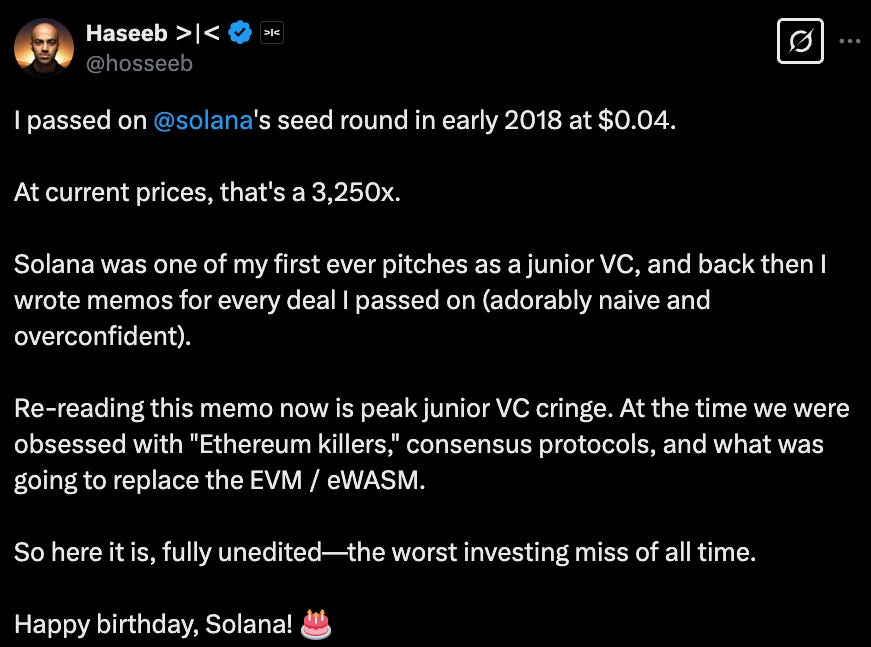

Even the technical experts got their bets wrong when they missed the Solana bus. The scepticism around the blockchain wasn't limited to technical critics though.

Venture capitalist Haseeb Qureshi recently shared his painful miss.

His early investment memo dismissed Solana's ambitious claims outright: "Their numbers are complete bullshit. 710K TPS is laughable; Google doesn't even do 100K searches/second."

Lesson learnt? Looks like that - Qureshi’s admission of it being "the worst investing miss of all time" shows how even seasoned crypto investors failed to see what Solana would become.

Solana Labs co-founder Anatoly Yakovenko's reply to the tweet shows how much the ecosystem has grown.

Despite the turbulent market conditions of the 2020, Solana's ecosystem began expanding rapidly. By the end of the year, over 100 projects spanning DeFi, dApps, wallets, and exchanges had established themselves on Solana's mainnet beta.

Early adopters cited the network's sub-second finality and transaction costs measured in fractions of a penny as game-changers.

Yet these early days were marked by both promise and problems. Network outages occurred with frustrating regularity. Critics questioned whether Solana's speed came at the cost of decentralisation. And looming on the horizon was a relationship that would nearly destroy everything the project had built — its close association with Sam Bankman-Fried and FTX.

The FTX Collapse and Improbable Recovery

Few blockchain projects have faced the existential threat that Solana did in November 2022. When FTX imploded and Sam Bankman-Fried's empire crumbled, Solana wasn't just collateral damage — it was widely seen as fatally wounded.

The price of SOL crashed to just $10, a staggering 97% drop from its all-time high of $260 within a year.

Why was Solana the collateral, though?

The network's close association with SBF and Alameda Research cast a long shadow. FTX and Alameda had been major Solana supporters, investing in numerous ecosystem projects and promoting the blockchain as a faster, cheaper alternative to Ethereum.

“ETH-killer” was the reputation Solana had earned in the industry.

When FTX and Alameda collapsed, they pulled down much of Solana's market value and reputation with them.

Many observers wrote obituaries for the "Sam coin." The network kept running, though, and the developer community — the true backbone of any blockchain ecosystem — continued building.

The catastrophic price action masked an important reality: Solana's underlying technology remained intact, and its fundamental value proposition hadn't changed.

By late 2023, signs of life began to appear. Transaction volumes started climbing. Developer activity, rather than contracting, actually expanded. The market cap began a remarkable recovery journey, eventually climbing back above $140 billion by early 2025 — nearly 50x from its post-FTX lows.

Read: 7,625 Reasons Why Solana Might Win ✌️

This resurrection was more than merely price action. It was validation that Solana's technology could stand on its own merits, independent of its early backers and their controversies. The network had grown resilient enough to survive what many considered a fatal blow — setting the stage for what would become its most transformative chapter yet.

All this isn’t even the main catalyst that drove its resurrection in 2024. Then?

The Memecoin Factory

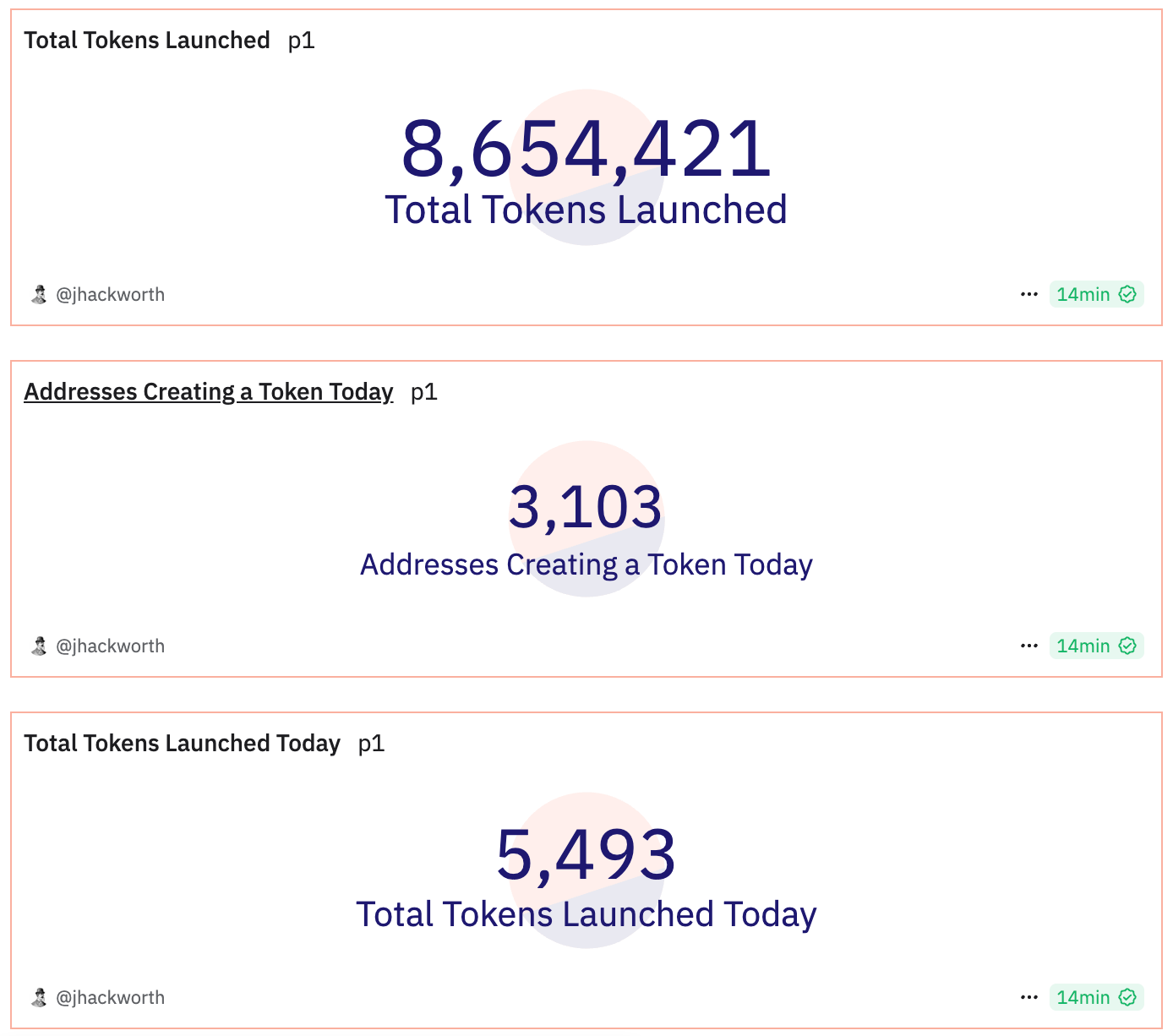

If you had told Solana's developers in 2020 that silly dog tokens would drive their next growth phase, they likely would have laughed. Yet the January 2024 launch of pump.fun — a platform enabling anyone to create tokens with just a few clicks — became Solana's most powerful catalyst since its inception.

Over 2.5 million tokens were created on the platform within months. Daily fees on Solana skyrocketed, with pump.fun alone generating millions in revenue. What started as a playful experiment transformed into a fundamental driver of network activity.

This democratisation of token creation had profound implications.

The vast majority of these tokens had little intrinsic value and many didn’t even last a day. Yet, the platform brought a new wave of users to Solana who might never have engaged with blockchain technology otherwise.

Critics, of course, were quick to dismiss this activity as unsustainable speculation. Market manipulation and token failures were rampant. Yet beneath the surface of meme-driven madness, something more significant was happening: Solana was proving it could handle unprecedented transaction volumes without the network outages that had plagued its earlier years.

This newfound stability didn't go unnoticed by institutional observers, setting the stage for Wall Street's embrace.

The Physical World Push

While other Layer 1 blockchains focused exclusively on protocol development and DeFi applications, Solana made a bold bet on consumer hardware that initially drew skepticism but is now paying dividends.

The Saga phone, launched in 2022-2023, represented a significant departure from typical blockchain projects. This Android-based device, designed to enhance mobile blockchain interactions, initially faced slow adoption.

By December 2023, the phone sold out completely, driven partly by the value of the BONK tokens airdropped to Saga owners.

Building on this success, Solana is now preparing to ship the Solana Seeker in 2025, a next-generation Web3 smartphone that has already secured approximately 140,000 preorders.

The device integrates blockchain applications seamlessly with innovations like a hardware Seed Vault and mobile wallet featuring fingerprint sensors for enhanced security.

This push into consumer hardware serves a strategic purpose beyond revenue generation. By creating devices optimised for blockchain interactions, Solana is addressing one of crypto's most persistent challenges: the complicated user experience that prevents mainstream adoption.

If the history of technology has taught us anything, it's that consumer-friendly hardware often drives software adoption — a lesson Solana seems to have taken to heart.

As traditional companies like Stripe, Shopify, and Visa increase their Solana integration, these mobile initiatives create a natural bridge between crypto enthusiasts and everyday users who may never have considered owning cryptocurrency before.

Token Dispatch View 🔍

Solana's five-year transformation from a ridiculed whitepaper to CME futures represents a perfect case study in market misjudgment. The blockchain that venture capitalists, engineers, and crypto maximalists alike dismissed has become a fascinating comeback story in crypto.

Beyond the price recovery, what’s stood out for the onlookers is the complete reinvention of Solana's identity along the way. The "Sam coin" shed its tainted association by leaning into what traditionalists considered its worst attribute - retail speculation.

By embracing memecoins, it addressed the biggest pain-point for crypto ecosystem - mass adoption and accessibility. With pump.fun, Solana discovered its killer app wasn't another DeFi protocol but democratised token creation.

This move reveals a fundamental truth about blockchain adoption: accessibility trumps technical perfection. While Ethereum focused on scaling solutions and layer-2 architectures, Solana built phones and meme factories - meeting users where they actually live rather than where blockchain purists thought they should be.

The futures debut signals something more profound than institutional validation. It shows that the line between "serious" and "speculative" crypto is blurring. When even the Chicago Mercantile Exchange embraces a network powered by dog tokens and mobile gaming, the old rules about what constitutes legitimate blockchain utility no longer apply.

Solana's greatest achievement might be forcing the industry to reconsider what blockchain success actually looks like. Five years on, it turns out retail engagement and access might matter more than theoretical transaction throughput.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Great summary! Thank you for sharing!

Very motivational. Mucho gracias!!