Today’s edition is brought to you by Infinity Hash. Transparent and reliable system to own part of a real mining farm. Sign-up here and get 10% bonus shares on the first purchase 👇

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Hello all! Welcome to Wednesday’s Token Dispatch. Today, we're unpacking Solana's rise in 2024 and what 2025 has in store.

From the ashes of FTX's collapse to setting all-time highs in both price and developer activity, Solana's 2024 journey has been one for the books.

With Donald Trump heading back to the White House and a new SEC chair on deck, 2025 could make 2024 look like a warm-up act.

Before we look at what 2025 could look like for Solana, let’s see how it fared in 2024.

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

2024: A Year of Redemption

For those who wrote Solana off after FTX - and there were many - 2024 was an eye-opener. In December 2022, you could buy SOL for $9, with critics dismissing it as just another "Sam coin."

Fast forward to 2024, and that same token could have cost as high as $263.83 at its peak. A staggering 2,800% return in just 24 months.

But how did it get here?

Developer Dominance

For the first time since 2016, a blockchain ecosystem grew faster than Ethereum.

Beating Ethereum at its own game - attracting developers?

And that too by a massive 83%.

All those "Ethereum killer" conversations no longer seemed unrealistic.

Read: 7,625 Reasons Why Solana Might Win ✌️

Electric Capital's latest report shows that of 39,148 new developers entering crypto this year, 7,625 chose Solana—marking an 83% year-over-year explosion.

What's particularly notable is the geographic shift - 27% of these developers are from India, making it the only country where new developers are joining Solana faster than any other blockchain.

If you thought developer count was a fluke, you’d be wrong.

2024 was all-round domination by Solana. Not just developers.

Corporate Treasury

Sol Strategies, the MicroStrategy for Solana, saw its share price shoot up from 0.12 Canadian dollar to 3.02 CAD in 2024.

That’s a staggering 2500% rise.

DeFi Giant

Remember when everyone said DeFi was dead? Solana's DEXs didn't care.

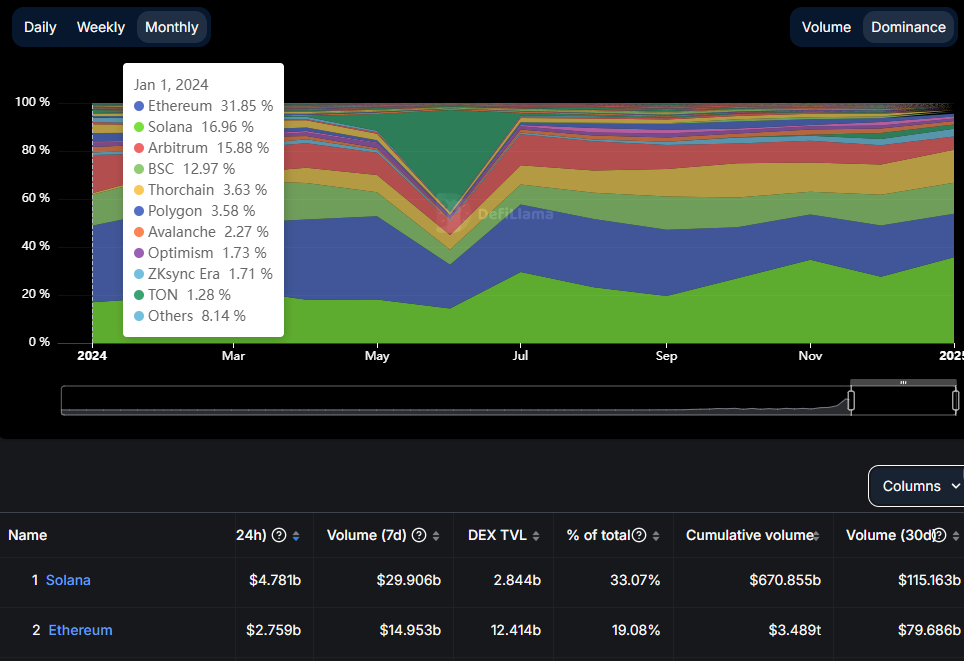

The network generated 43% more volume than Ethereum's mainnet in the last quarter, with five of the top 10 fee-generating protocols calling Solana home.

Solana started 2024 with 17% market share and ended with 33%.

This wasn't overnight success - back in October 2024, Raydium first flipped Uniswap, Ethereum’s leading DEX, in trading volume ($124.6 billion vs $90.5billion monthly), marking a historic shift in DeFi dominance.

The Number Game

All-time high: $263 (November 2024)

Market cap: $112 billion

Daily active users: 2.5 million

Total value locked: $200 billion

What drove these numbers?

The Memecoin Effect

If you told someone in 2023 that memecoins would drive serious institutional interest, they'd have laughed you out of the room. But here we are.

This shift began in late 2024 with pump.fun revolutionising token launches, generating nearly $400M in revenue and turning Solana into crypto's go-to playground for retail traders.

This was despite the major challenge it faced.

In November, the platform had to discontinue its livestream feature after reports of violence, self-harm and animal cruelty led to community backlash.

Read: When Pump.fun Is No Longer Fun 🥵

How did it strike gold then?

By making token creation as simple as opening an email account.

While 95% of its tokens faced "rugging" within 24 hours, it sparked something bigger.

When Peanut (PNUT) hit a $2.4 billion market cap and Dogwifhat (WIF) landed on Coinbase, even the sceptics had to pay attention.

But here's what everyone missed: While memecoins grabbed headlines, they actually drove massive infrastructure improvements.

Raydium's $11.3 million single-day fee record wasn't just about dog coins - it showed Solana could handle retail mania without breaking a sweat, a far cry from the network congestion issues that plagued it in early 2024.

Where do we go from here? Read on …

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

2025: The Perfect Storm?

ETF Expectations

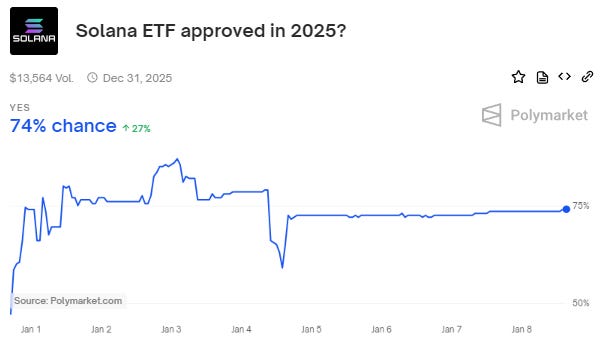

The odds of a Solana ETF approval in 2025 are at 85% on Polymarket.

Here's why this isn't just random bets.

Paul Atkins replacing Gary Gensler at SEC

Trump administration's crypto-friendly stance

Brazil's successful Solana ETF blueprint

BlackRock's deepening crypto involvement

Infrastructure Evolution

While everyone was watching price charts, Solana's developers were solving the "state growth problem."

The new SIMD-215 proposal introduces lattice-based homomorphic hashing that could allow the network to scale to billions of accounts.

Sounded French? Well, in one word - scalability.

This technical evolution is particularly notable given the network's journey - in October 2024, Edward Snowden criticised Solana's centralisation at Token 2049, sparking intense community debate about the balance between scalability and decentralisation.

Security Upgrades

Quantum computing threats? Solana's got that covered.

The new Winternitz Vault implementation means the network is now quantum-resistant, generating new keys for each transaction.

When Google's Willow chips are questioning the safety of Bitcoin, this sets up 2025 on a high already for Solana.

Layer-1 battles are heating up, but Solana's entering 2025 with serious momentum:

30,000+ total developers (up from just 7,625 new devs in all of 2024)

2.5 million+ daily active users

125,000+ mobile subscribers

$5.55 billion in stablecoin market cap

What Could Go Wrong?

While outages have become rarer, the upcoming Firedancer client rollout could introduce new vulnerabilities.

The network's throughput will increase dramatically—good for scaling, tricky for stability.

Regulatory Uncertainty

Yes, Trump's win changes the game. But comprehensive crypto legislation remains elusive, and regional fragmentation (think EU's MiCA vs US approach) could complicate global adoption.

Competition

Ethereum isn't standing still. With Layer 2s gaining traction and the Pectra upgrade on horizon, 2025's battlefield will be fiercer than ever.

Remember, Ethereum still maintains 3.6x more developers than Solana's ecosystem.

Looking Ahead

Market Dynamics

CryptoSea’s founder expects Solana to hit $300 in a conservative case, and $900 in the optimistic case, by Q2 2025.

Stablecoins on Solana

Their market cap? If its 2024 journey is anything to go by ($1.831 billion to $5.12 billion), then we expect it to at least touch $15 billion by 2025 end.

Few more predictions

Multiple Solana ETF approvals by Q3

Firedancer client full deployment

Scalability through the new SIMD-215 proposal

Token Dispatch View 🔍

Looking at Solana's trajectory from the $9 "Sam coin" days to today's $225+, one thing becomes clear: 2024 wasn't just about price recovery - it was about fundamental transformation.

The numbers tell part of the story - 7,625 new developers, 2.5 million daily active users, $200 billion TVL.

The story got interesting when Solana turned its biggest criticisms into strengths.

Network outages? Became rare enough that we barely mention them.

FTX association? Ancient history.

Centralisation concerns? Addressed through technical evolution like quantum-resistant upgrades.

What's fascinating is how different catalysts compounded throughout 2024: Pump.fun brought retail enthusiasm, which drove infrastructure improvements, which attracted institutional interest, which brought more developers, creating a virtuous cycle.

While critics focused on memecoin mania, they missed how these "distractions" actually stress-tested and strengthened the network.

The convergence we're seeing in 2025 - Trump's return, potential ETF approvals, BlackRock's involvement, quantum computing threats - couldn't come at a better time for Solana.

The network has matured exactly when traditional finance needs a battle-tested, quantum-resistant blockchain that can handle retail volume without breaking a sweat.

Will Solana reach that ambitious $900 target? Maybe.

But focusing on price misses the bigger picture: we're watching the first blockchain ecosystem simultaneously win over retail traders, institutional players, and serious developers.

That's not just growth - that's evolution.

Remember when everyone said crypto needed to find real utility beyond speculation? Well, Solana just might be showing us what that looks like.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.