Hello dispatchers! Happy Thursday.

Remember when getting Democrats and Republicans to agree on crypto seemed impossible? Well, both parties just dropped competing stablecoin bills - and they're racing to pass them in Trump's first 100 days.

Welcome to 2025, where the only thing moving faster than Bitcoin price is Washington's newfound urgency to regulate them.

Today we're diving into

Race to regulate $230 billion in digital dollars

Why both parties are suddenly in a hurry

What happens when politics meets stablecoins

Why this might be bigger than just crypto

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

Tale of Two Bills

When Senator Bill Hagerty introduced the "Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act" last week, it seemed like standard Washington procedure.

Something unusual happened - Democrats actually showed interest.

🎙 Block That Quote

Senator Tim Scott, Senate Banking Committee Chair

"Creating a regulatory framework for stablecoins is critical to ensuring the industry can innovate and grow here in the United States – while promoting the US dollar's global position, protecting consumers, and facilitating financial inclusion."

The GOP's GENIUS Act reads like a crypto industry wishlist

Split oversight between Fed and states ($10 billion threshold)

Monthly audited reserve requirements

Criminal penalties for false reporting

State-level innovation sandbox

Even before the ink could dry, Representative Maxine Waters unveiled her own framework - one built on three years of bipartisan work with former Committee Chair Patrick McHenry.

The difference? Waters' bill gives the Federal Reserve significantly more power, creating what she calls "urgently needed guardrails" for the industry.

Beyond two competing bills, this is about a fundamental shift in how Washington views digital assets. Just days after Crypto Czar David Sacks proclaimed crypto's coming "golden age," both parties are racing to write its rulebook.

Read: Crypto Czar Hits Regulatory Reset 🔄

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

$230-Billion Question

Why the sudden urgency? When your money printer goes digital, everyone pays attention.

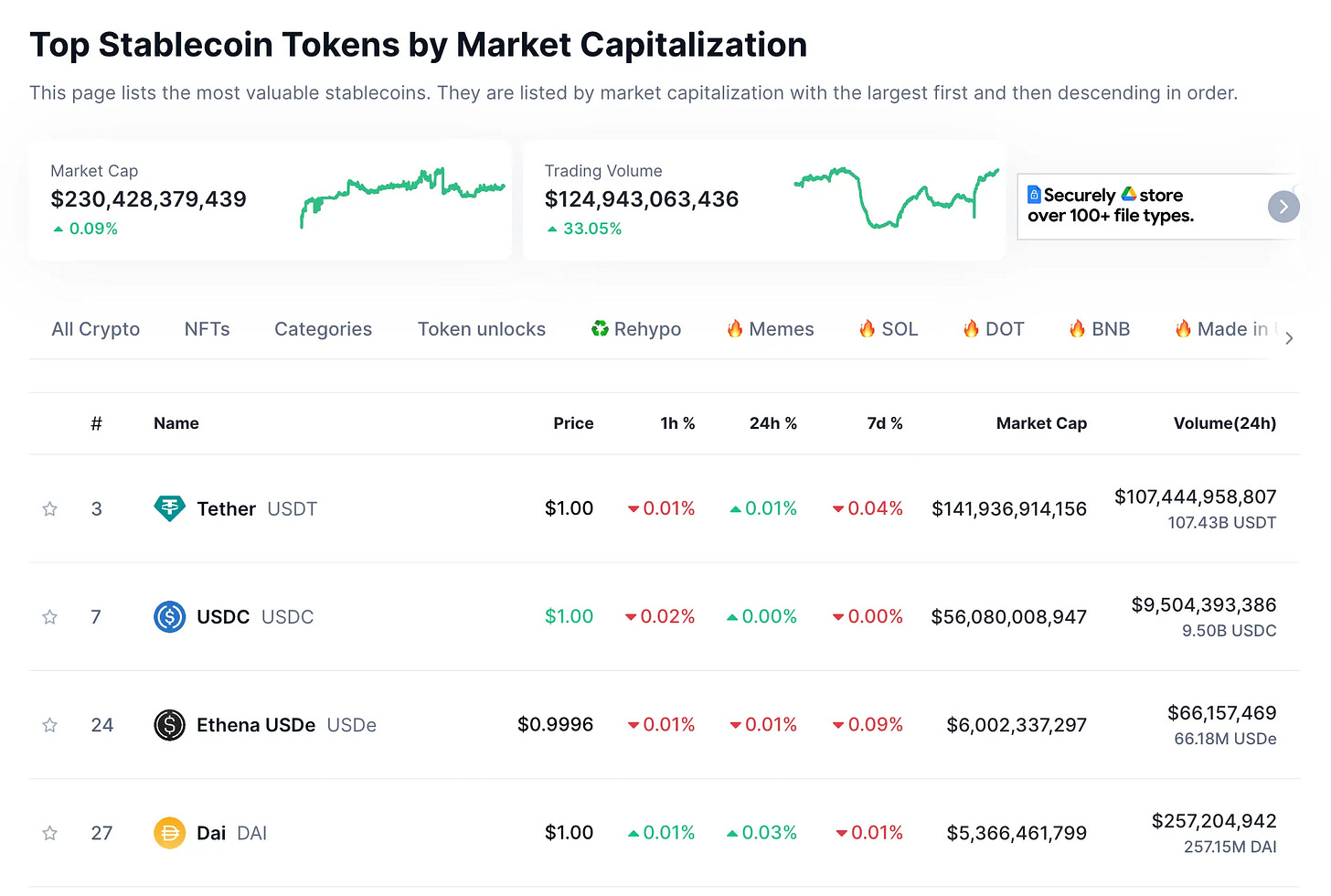

The stablecoin market has quietly grown to $230 billion, with Bitwise projecting it to hit $400 billion by year-end. It's not the numbers that have Washington scrambling - it's what they represent: the evolution of the US dollar itself.

"Stablecoins have the potential to ensure American dollar dominance internationally, to increase the usage of the US dollar digitally as the world's reserve currency, and in the process create potentially trillions of dollars of demand for the US Treasury," David Sacks, White House Crypto Czar, said.

Dissent

As Republicans and Democrats face off over stablecoin regulation, deeper divides are emerging about America's crypto future.

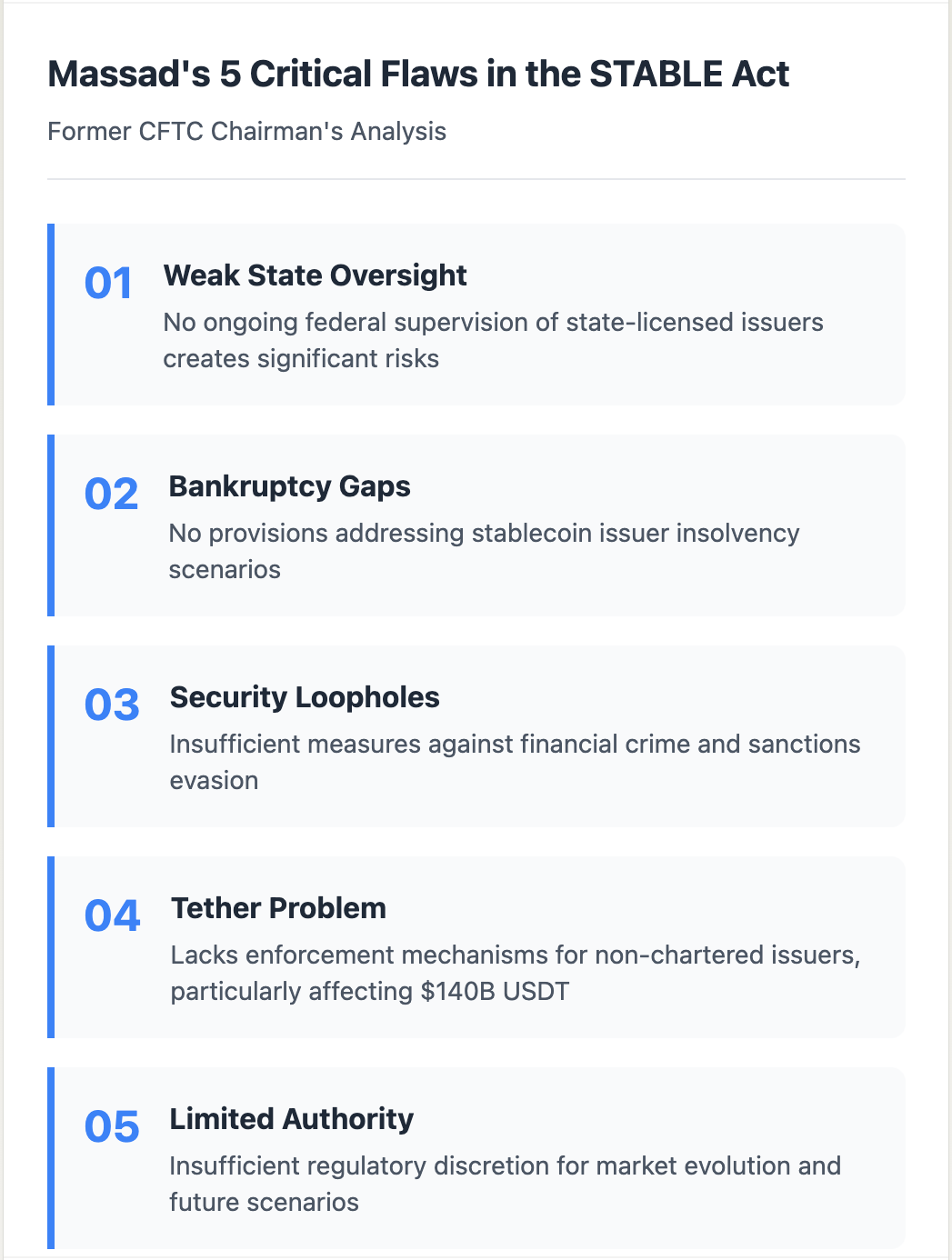

Former CFTC Chairman Timothy Massad warns it won't be easy: "There are many areas where it is deficient... it is substantially weaker than what was negotiated between the former committee chair and the ranking member last fall."

In the House Financial Services Committee hearing on Tuesday, the battle lines became clear.

"Crypto technology shifts economic power from centralised institutions back to the people," argued Rep. Tom Emmer, taking aim at the previous administration's enforcement-heavy approach.

Meanwhile, Democrats like Sean Casten raised concerns about market volatility, pointing to Trump's own memecoin as evidence of the risks.

"It doesn't have the value that maybe a Bible, or a pair of sneakers, or a steak or a bottle of water has," Casten said.

The debate has become entangled with broader political tensions.

The recent moves to shutter the Consumer Financial Protection Bureau (CFPB), championed by Trump's new Department of Government Efficiency head Elon Musk, have made some Democrats hesitant to cut deals.

As Rep. Ayanna Pressley put it, "Elon Musk and his so-called DOGE bros have kicked out the employees, locked the door and stopped all the work from continuing."

Yet beneath the political theatre, compromises are emerging.

TD Cowen's analysis suggests the Waters and Hill bills are "close enough that a deal is feasible." The obstacle won’t be technical - it will be striking political trust in an increasingly polarised Washington.

The urgency isn't coming from politicians - it's coming from the market. With Hong Kong welcoming crypto firms and the EU implementing MiCA, America's lawmakers face a stark choice: regulate now or risk losing leadership in the next evolution of finance.

Technical Details

Both bills aim to regulate something inherently borderless while keeping innovation alive - and their approaches couldn't be more different.

The GENIUS Act introduces a two-speed system. For stablecoin giants with over $10 billion in circulation, it's all federal oversight and monthly audits.

Think Tether and USDC facing direct Fed supervision, criminal penalties for false reporting, and strict rules against rehypothecation. The message is clear: with great market power comes great regulatory scrutiny.

For smaller players, there's room to breathe. State-level registration, basic reserve requirements, and even innovation sandboxes. It's a calculated bet that the next great stablecoin innovation might come from somewhere unexpected.

"The STABLE Act has many features I support, such as full reserves for tokens and limitations on issuer activities, but there are many areas where it is deficient. And it is substantially weaker than what was negotiated last fall," Timothy Massad, Former CFTC Chair.

Waters' counter-proposal tears up this playbook entirely.

Her vision? The Federal Reserve as supreme overseer, no state-level exemptions, and stricter reserve requirements across the board. It's regulation designed to bring stablecoins fully into the traditional financial fold.

Implementation Challenge

The challenging part is beyond writing these bills - it's in their execution. Both face the same fundamental challenge: how do you enforce US law on digital assets that don't respect borders?

Take reserve management. It's one thing to mandate monthly audits, but who verifies them? When a stablecoin issuer claims Treasury bills as collateral, who checks the receipts?

The bills demand transparency but the mechanisms for ensuring it remain murky.

Then there's the thorny question of timing. The market doesn't pause for regulation.

Every day of the transition period is another day of uncertainty - for issuers, users, and the broader crypto ecosystem. Neither bill has fully addressed what happens to existing stablecoins during this limbo.

Most critically, both bills skirt around a crucial reality: in crypto, innovation moves faster than legislation.

By the time these rules take effect, the stablecoin landscape could look entirely different. The challenge isn't only implementing these rules - it's making them flexible enough to matter tomorrow.

Token Dispatch View 🔍

The stablecoin regulation race reveals some crucial insights about where digital assets are heading in 2025.

The US is not rushing to regulate stablecoins to primarily control crypto - rather it is doing so to preserve dollar dominance in a digital age. When David Sacks talks about "trillions of dollars of demand for US Treasury," he's describing a future where America's financial power flows through stablecoins.

The bipartisan urgency we're seeing isn't driven by Washington's sudden love for crypto. It's fear - fear of losing ground to Hong Kong's welcoming stance, fear of Europe's MiCA framework setting global standards, and fear of missing the next evolution of finance.

When both parties race to write rules, it's because they've realised doing nothing is no longer an option.

This tells us volumes about the future of financial regulation itself. The old model of state-versus-federal oversight was built for a world where money respected borders. Stablecoins don't merely cross borders - they ignore them entirely. Neither the GENIUS Act's two-speed system nor Waters' federal-centric approach fully solves this fundamental challenge.

The next few months will determine not just how America regulates stablecoins, but whether traditional regulatory frameworks can adapt to truly borderless assets.

It will be interesting to see if one of these bills could come up with provisions that can keep pace with crypto's relentless innovation.

The new rules will dictate if America gets to foster the next financial revolution - or send it overseas.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.