Today’s edition is brought to you by CexIO. The crypto asset management platform for beginners as well as experienced users 🫵

Hello, y'all. Thursday's bringing us a $200 billion bombshell in the stablecoin saga.

Stablecoins strengthening USD?

Tether's printer goes brrr with another billion

Binance partners with Circle for treasury reserve

Stablecoins transaction volume goes over the roof

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

The crypto world's most boring aspect may well be its most important one.

The technology that many thought would end the US dollar's dominance, might actually make it stronger.

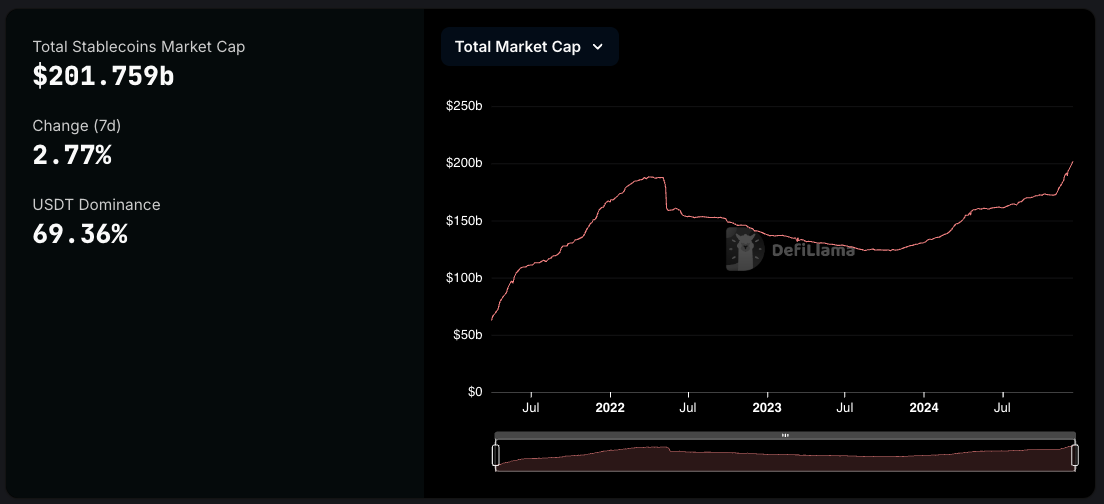

Stablecoins - crypto's least exciting yet most useful invention - just crossed $200 billion in market cap. A big deal innit?

How big?

$10 billion added in two weeks.

$30 billion since Trump's victory.

And now? The predictions are getting wild.

But wait ... why now?

Mass adoption.

And while all this might sound like just another number in crypto's sea of statistics, it tells a story about how the future of money is unfolding in unexpected ways.

The Dollar's Digital Double

Remember when Bitcoin was supposed to replace the dollar?

Well, it turns out that crypto's killer app might just be ... digital dollars.

Stablecoins now account for more than four-fifths of all cryptocurrency trading volume.

But, instead of challenging the dollar's supremacy, they're reinforcing it.

Tether (USDT), the heavyweight champion of stablecoins, just hit a record $139 billion in circulation (up 12% in a month).

Its closest competitor, USDC - with $41 billion grew 9% in a month.

In The Numbers 🔢

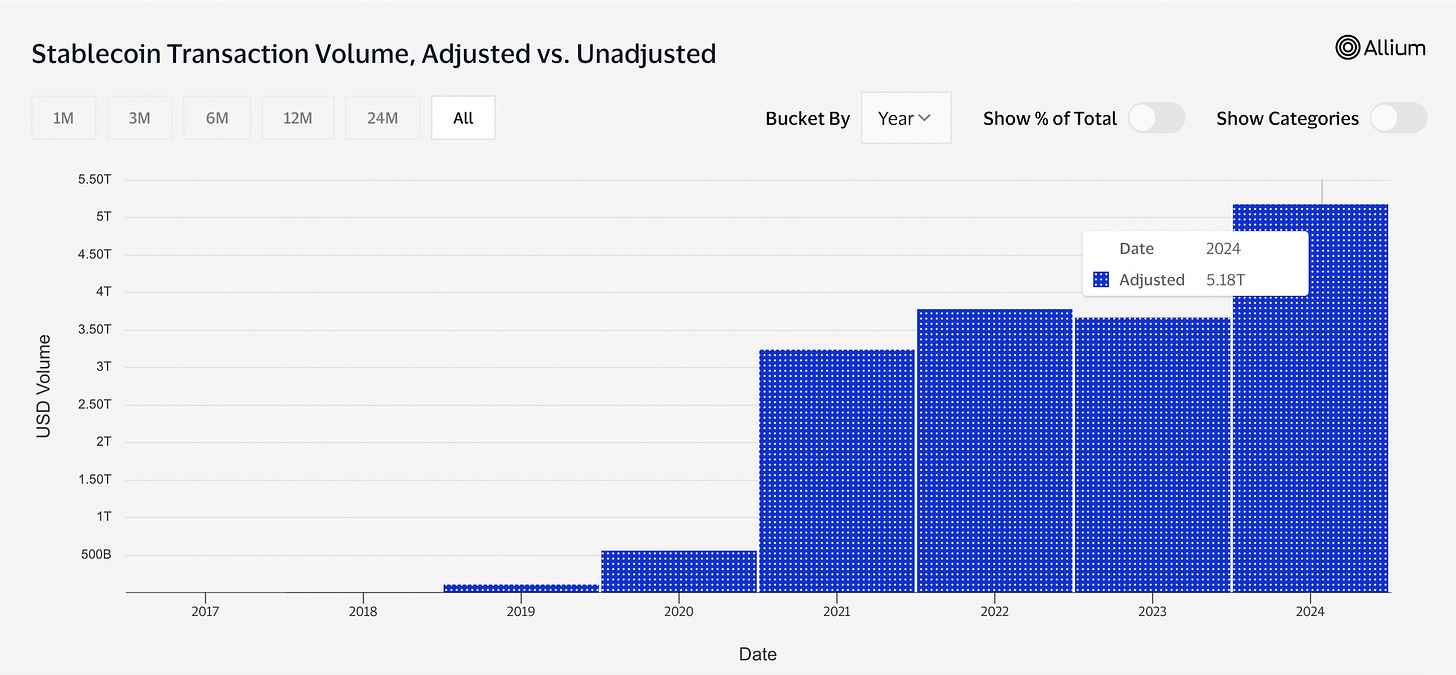

$5.5 trillion

That's the stablecoin payment volume in 2024.

That’s more than 40% of what digital payment giant Visa processed in 12 months ending September 2024 - $13.2 trillion.

Not bad for what's essentially just dollars wearing a crypto costume.

But this isn't just about trading crypto. There’s more to it.

Stablecoins are quietly becoming the go-to solution for people in countries with wobbly currencies.

They're being used for everything from daily payments to remittances, creating a sort of parallel financial system that runs on digital dollars.

And unlike their volatile crypto cousins, stablecoins are actually being used as, well, currency. Who would've thought?

Become a Member of a Global Crypto Community

CEX.IO has been innovating since 2013. Guiding millions of global users on their digital assets journey.

It’s all-in-one crypto platform to buy, sell, trade, hold and earn cryptocurrencies.

More than six million crypto enthusiasts around the world have accessed our award-winning ecosystem.

The Innovation Paradox

While Bitcoin maximalists were busy predicting the death of fiat currency, innovative products like Ethena's USDe token emerged, offering yield through clever market neutral strategies.

It's surged to $5 billion in market cap, up 90% in just a month.

Traditional finance isn't sitting this one out either.

PayPal launched PYUSD, and rumours suggest JPMorgan might be next.

Bitwise thinks the stablecoin market could hit $400 billion by 2025.

That's double the current size.

Standard Chartered goes even further, suggesting stablecoins could reach 10% of US money supply and forex transactions, up from today's 1%.

But perhaps the most interesting take comes from Citi. Their strategists point out that since stablecoin issuers hold US Treasuries as reserves, they're actually increasing demand for dollar-denominated assets.

Talk about unintended consequences.

What now?

All the stablecoin issuers are fighting for a bigger share of the pie.

And in this game, everyone's playing for keeps.

Block That Quote 🎙

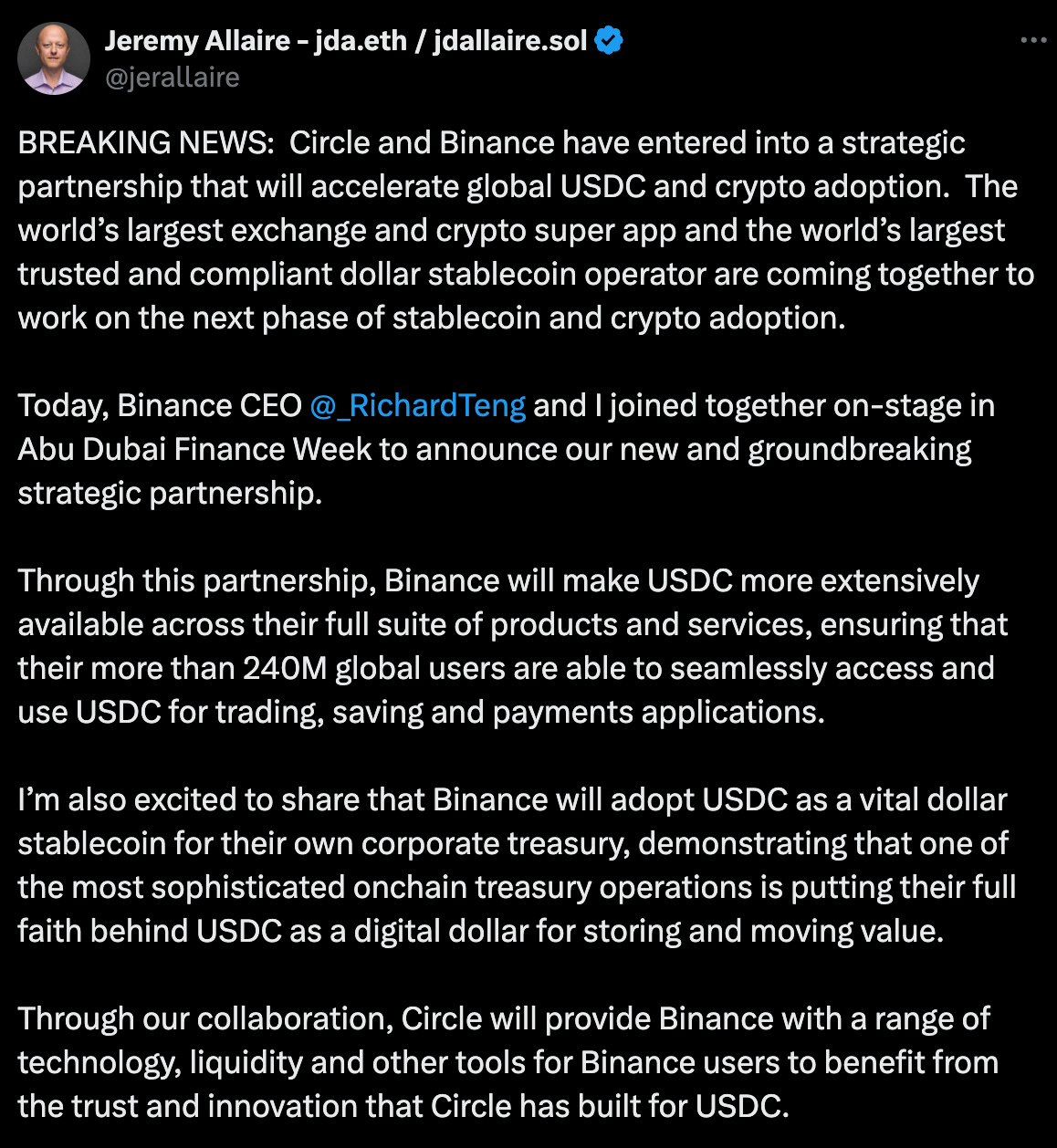

Jeremy Allaire, Circle CEO

"The world's largest exchange and crypto super app and the world's largest trusted and compliant dollar stablecoin operator are coming together to work on the next phase of stablecoin and crypto adoption."

Yes, Circle, the mastermind behind USDC stablecoin, and Binance, the world's largest crypto exchange, announced a partnership.

It's the marriage of the largest and fastest growing compliant stablecoin with their global platform.

When? Just in time for what Allaire calls "a major and material shift in the emerging crypto market structure as we enter 2025."

The deal is deceptively simple: Binance will make USDC more available across its platform and even use it for its corporate treasury. Circle, in return, will provide the technology and liquidity that makes it all work.

Circle is also expanding their empire.

They've set up shop in Abu Dhabi's financial district and struck another deal with LuLu Financial Holdings, a powerhouse that handles $10 billion in annual transactions across the Gulf states and Asia.

They're planning to move their headquarters to New York in 2025 and are eyeing a public offering.

The Stablecoin Wars Heat Up 🔥

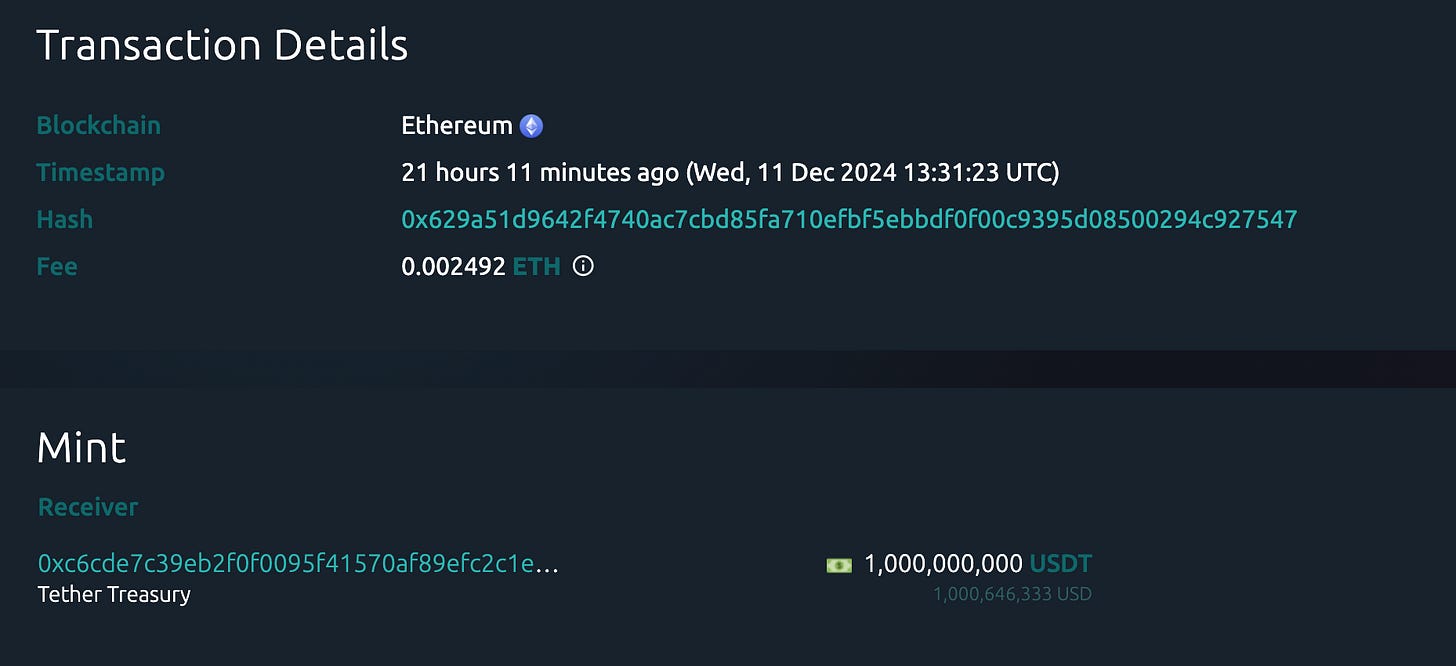

Meanwhile, Tether’s feeling the space heating up.

Read: Stablecoin That Conquered Crypto 👑

Just hours after the Circle-Binance bombshell, USDT's printer went brrr ... again.

How much? Another billion dollars. Just like that.

$2B on December 6

$19B in the last month

Record profits in Q3

On the surface, it looks like business as usual for the industry leader, fresh off record Q3 profits and a regulatory win in Abu Dhabi.

But beneath the surface, storm clouds are gathering. Coinbase is about to delist USDT in Europe over regulatory concerns.

Robinhood and Revolut are circling like sharks, eyeing their own stablecoin launches.

Read: Stablecoins: Can the traditional players beat Tether? 🏋️

Now, Circle and Tether have more company in Ripple.

The XRP-issuer has secured approval for RLUSD - its own stablecoin, adding another heavyweight to the ring.

Is Tether's aggressive minting a show of strength, or a sign of concern?

The company that once printed its way to dominance now faces a challenge from all sides. Circle's USDC, backed by both Coinbase and Binance, represents a rare alliance between longtime competitors.

The Token Dispatch View 🔍

While Tether, Circle, and now Ripple battle for market share, the real winner might just be the dollar itself.

As traditional finance giants like JPMorgan eye their entry, we're witnessing something remarkable: the merging of two worlds that were supposed to be enemies. It's as if the dollar looked at crypto and said, "If you can't beat 'em, join 'em."

The stablecoin wars of 2024 might just be remembered as the moment when digital finance finally grew up. And ironically, it did so by embracing the very thing it was meant to replace.

So here we are, in a world where the technology that was feared to challenge the dollar's dominance might end up being its saving grace.

The $200 billion milestone is a sign that the future of money might not be about replacing the old system, but about giving it new digital wings.

And maybe that's not such a bad thing after all.

After all, sometimes the best revolutions don't destroy the old order. They just help it evolve.

The Surfer 🏄

FTX debtors have successfully recovered over $14 million in political donations, settling with various political action committees, including $6 million from the House Majority PAC and $3 million from the Senate Majority PAC.

BlackRock and Fidelity have collectively purchased $500 million worth of Ethereum (ETH) in the past two days, primarily through Coinbase's institutional platform. This comes as both firms' spot ETFs, ETHA and FETH, continue to attract record inflows.

The CFTC has charged pastor Francier Obando Pinillo with promoting a $6 million crypto Ponzi scheme to 1,500 individuals, including church members in Washington state.

The Pudgy Penguins NFT collection has surged past $100,000 in floor price, and overtaken 1 Bitcoin price, driven by hype over the upcoming PENGU token launch on Solana.

US CPI numbers for November met expectations at 2.7%, with core inflation at 3.3%, providing optimism for risk-on assets like Bitcoin and helping it reclaim $100K.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

It's as if the dollar looked at crypto and said, "If you can't beat 'em, join 'em."

It’s the other way around. Crypto joined dollar after realizing it can’t end it.