Stablecoins: Too Big To Ignore? ☝️

US Treasury's got mixed feelings about stablecoins' growing power. Tether's flexing $81B in Treasury Bills. Circle CEO dreams of $10T stablecoin market. Kazakhstan's showing how CBDCs actually work.

Hello, y'all. Welcome to Token Dispatch, your daily crypto fill. Today we navigate through the US Treasury and the stablecoins conundrum.

Overwhelmed by prediction markets? Want a simpler betting experience that’s more social, more fun?

Make the Kutt 🚦 Peer-to-peer betting platform with tons of social features: friend groups, chats, leaderboards, H2H history, and user profiles. US only social betting platform that’s legal in 40+ US states 👇

They said stablecoins were just a crypto thing.

They said traditionalists would never notice.

Look who's paying attention now.

The US Treasury just dropped a bombshell report, and guess what?

They're watching stablecoins.

Very, very closely. Not just watching – they're getting nervous about the whole thing.

In The Numbers 🔢

$120 billion

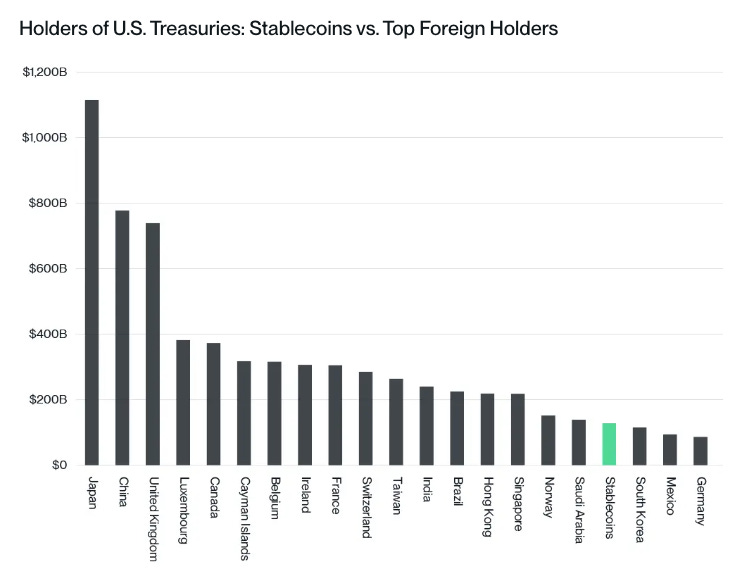

That's how much stablecoin issuers have parked in Treasury Bills.

$81 billion - Just Tether's T-Bill holdings

80% - Crypto transactions using stablecoins

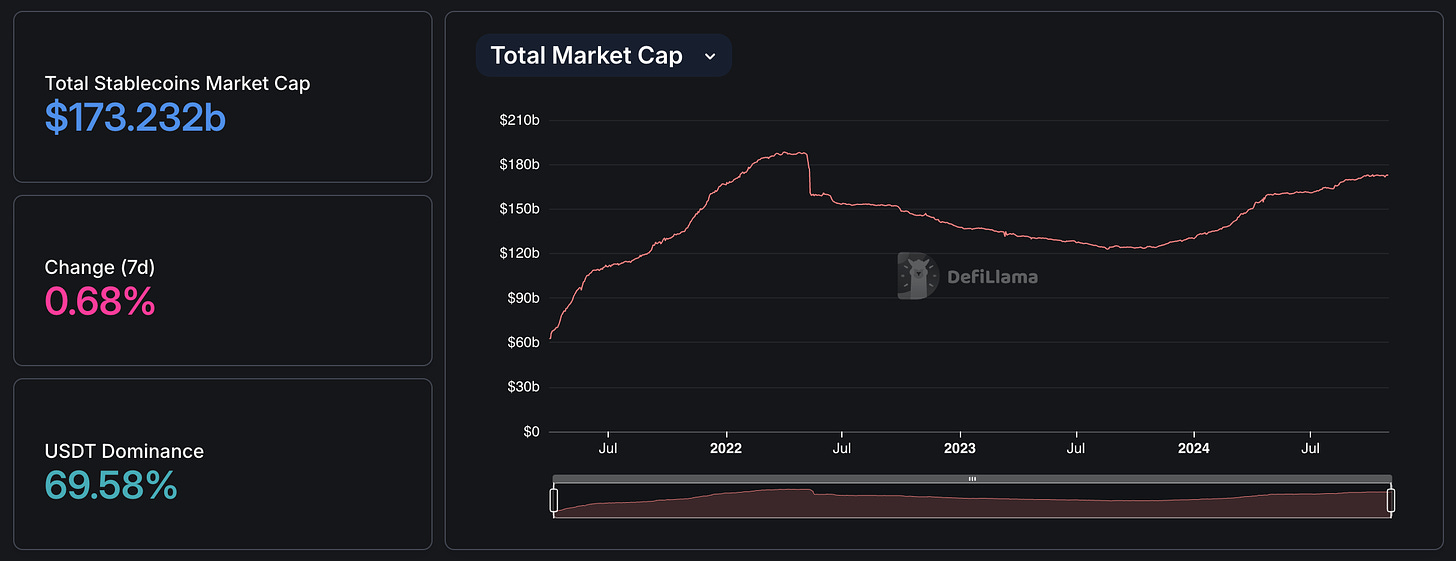

$177 billion - Total stablecoin market size

But here's where it gets interesting.

Tether, our favourite stablecoin giant, is flexing hard.

CEO Paolo Ardoino isn't just buying T-Bills – he's buying more than entire countries.

More than UAE, Australia, and Spain combined.

Represents 63% of Tether's $120B token reserves

Part of $177B total stablecoin market

"We are finding hundreds of millions of new buyers of US debt because, through us, we can expose these emerging markets to the best currency in the world, and in that process, we are purchasing immense quantities of US debt," Ardoino said.

Read: Stablecoin That Conquered Crypto 👑

But not everyone's celebrating.

The Wall Street Journal recently reported investigation allegations.

Claims of money laundering probe.

Tether's response? "Old noise."

Ardoino calls it "irresponsible reporting" and claims no evidence of federal probe.

Tether released a statement.

“It is wildly irresponsible for WSJ to write articles with reckless allegations with such certainty when no authorities have gone on the record to confirm these rumours, and no sources are named.”

And the Treasury's watching all this with ... mixed feelings?

On the one hand

Stablecoins are boosting T-Bill demand

Creating "structural demand" for Treasuries

Helping maintain dollar dominance

Providing market liquidity

But on the other hand, they are concerned.

Why?

Treasury's worried about a potential Tether collapse triggering a massive T-Bill selloff. Like a crypto-powered domino effect nobody asked for. And given that stablecoins are used in 80% of all crypto transactions, it’s not a small concern.

The control issue: Remember those private "wildcat" currencies from the 1800s? Treasury's drawing some uncomfortable parallels.

"If history serves as any guide, stablecoins will need to be regulated like narrow banks or money market funds to prevent contagion of stress in stablecoin markets to broader financial markets and the Treasury market."

The Treasury's Solution?

"Let's replace stablecoins with CBDCs."

(Somewhere, Donald Trump just spat out his coffee.)

The Treasury wants to swap private stablecoins for government-controlled digital currencies.

Translation: "Thanks for buying our T-Bills, but we're watching you."

The irony? CBDCs face massive political headwinds.

Republicans strongly oppose and Trump even vows to "never allow" them.

Read: Trump's WLF: Triumph or Fiasco? ⚠️

Public skepticism is growing and privacy concerns are also mounting.

Meanwhile, stablecoins keep

Growing bigger

Buying more T-Bills

Dominating crypto trades

Gaining mainstream adoption

Put Your Money Where Your Mouth Is

Kutt is a p2p / friend-to-friend social betting platform that's legal in 40+ states

Bet directly against your friends or other fans on sports, politics, pop culture, personal events and more

Unlike prediction markets, Kutt is a community to build relationships with other bettors who have shared interests

Kutt handles the payment side of things, so you never have to chase anyone down for $$

Fully customisable odds and tons of social features: group chats, betting leaderboards, H2H history, and user profiles

Rewards - get cash back just for betting against your friends

Block That Quote

Tether CEO, Paolo Ardoino.

"If the US wanted to kill us, they can press a button and kill us anywhere. We are not going to fight the US."

Now that's what you call brutal honesty.

The Tether boss’ real talk in Lugano.

On compliance and cooperation

"We may not be the best in presenting ourselves, but what matters is that we onboarded the FBI ... We onboarded the US Secret Service. We have thank-you letters from the DOJ."

On illicit finance accusations

"You have to be a very, very, very stupid criminal if you want to use USDT or crypto in general."

Story through numbers

$120B USDT market cap

$80B in US Treasury bills

Working with 180 government agencies

Among top 20 holders of US debt

Why's he so chill about keeping billions with US institutions?

"Wherever you hold T-bills, the T-bills are actually ultimately in the Fed account."

With elections coming, Ardoino's playing both sides.

Democrats: "Should understand financial inclusion"

Republicans: "We're buying US debt"

Message: "What we're building makes sense for both parties"

His final mic drop

"The Chinese are selling T-bills and we are buying them now. I think the US government and regulators came to the conclusion that, 'oh yeah, that's a great thing.'"

Circle CEO's $10 Trillion Dream

Think stablecoins are big now?

$177 billion market cap. Good enough?

Here's what Circle's CEO, Jeremy Allaire sees coming: A stablecoin market capturing 5-10% of global money supply, hitting a $10 trillion market cap within 10 years.

All this from today's $177B.

Circle is firm on IPO ambitions, despite delay.

Current standings

USDT (Tether) dominates with $120B.

USDC (Circle) follows at $35B.

Everyone else? Fighting for crumbs.

Who else is dipping their toes in stablecoins

Ripple is set to launch its RLUSD stablecoin, pending regulatory approval from the New York Department of Financial Services (DFS).

Payments giant Stripe has acquired stablecoin platform Bridge for $1.1 billion, marking the largest deal in the crypto industry to date.

BitGo is set to introduce USDS, a dollar-backed stablecoin, next year.

Visa and PayPal (who already has a stablecoin) executives advocate for stablecoin adoption to enhance global payment systems during DC Fintech Week.

"Open, public infrastructure for digital dollars" Allaire thinks.

No deals needed. Build what you want. Use when you want. A new company every week joining the party.

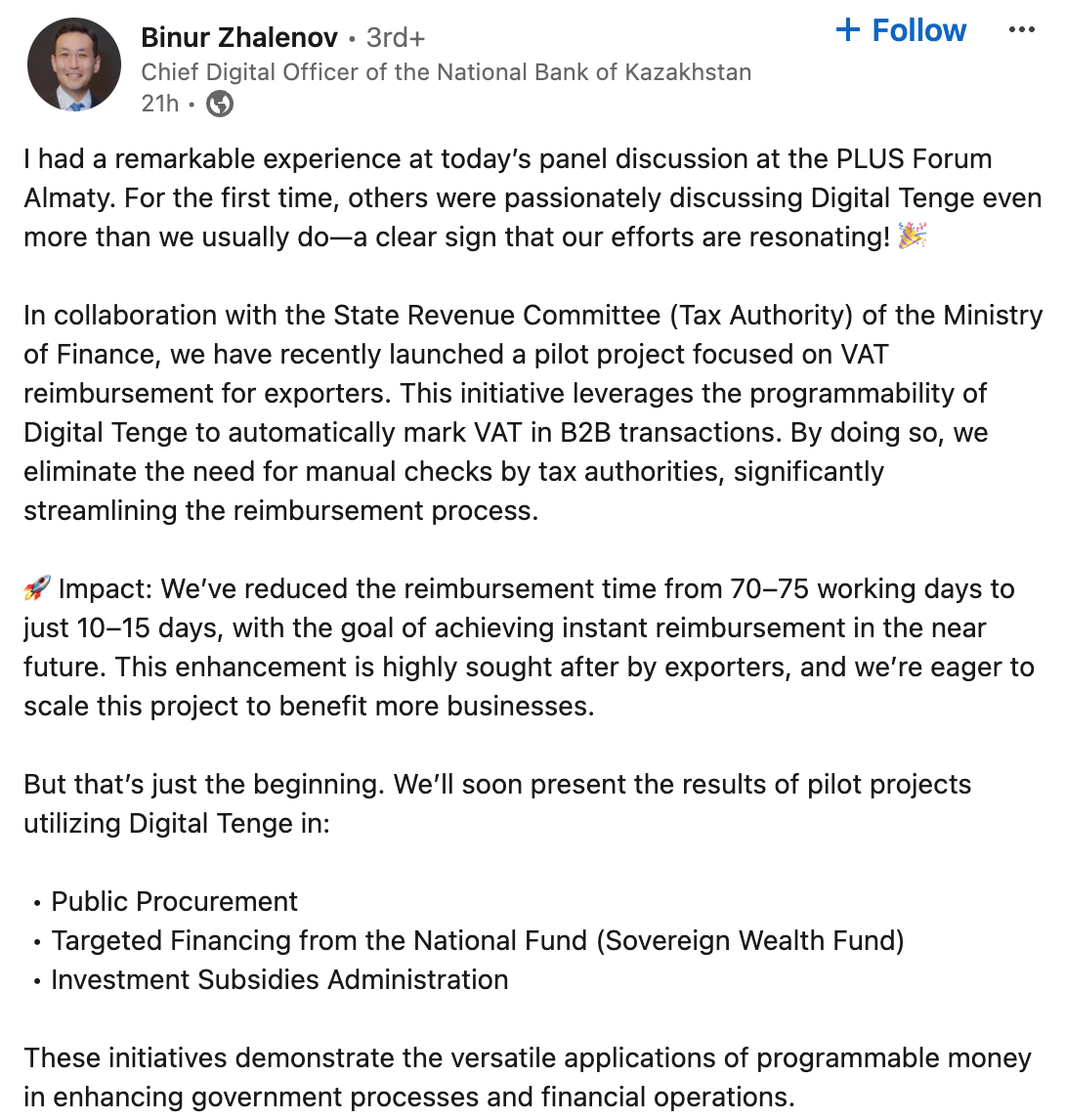

Kazakhstan Reduces VAT Refund Wait

While others debate CBDCs, Kazakhstan's out here actually making them work.

Old way: Businesses had to wait 70-75 days to get their tax refunds.

New way: Using digital tenge (Kazakhstan's CBDC), it only takes 15 days.

How'd they do it?

Simple. Programmable money. Digital tenge (the CBDC) tracks VAT automatically in B2B deals. No human checks. No paperwork. Just code doing its thing.

Plans for pilot projects involving

Digital tenge in public procurement

Targeted financing from the sovereign wealth fund

Investment subsidies

Current CBDC Circulation: Approximately 40 billion tenge (around $81.8 million) is currently in digital form.

The Surfer 🏄

Solana's decentralised exchange (DEX) volume has surged to 168% of Ethereum's mainnet DEX volume, a significant increase from just 48.85% at the beginning of the year.

MicroStrategy has announced its "21/21 Plan" to raise $42 billion over the next three years, to fund its bitcoin acquisitions through $21 billion in equity and $21 billion in fixed-income securities.

Coinbase reported a decline in Q3 2024 revenue, falling short of expectations with $1.2 billion compared to the anticipated $1.26 billion.

Reddit has sold off the majority of its Bitcoin and Ether holdings in Q3 2024, reporting proceeds of $6.87 million from the sales. The company stated that the net carrying value and gains from these transactions were immaterial, as it continues to navigate a challenging advertising market.

Crypto exchange Kraken has announced layoffs as part of a restructuring effort to become "leaner and faster," coinciding with the appointment of Arjun Sethi as co-CEO alongside David Ripley.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

The stablecoin vs. CBDC debate is not just regulatory; it’s ideological. Private stablecoins promote decentralization and financial inclusion without direct government control, while CBDCs are centralized and, for many, raise privacy concerns. The Treasury’s support for CBDCs might not align with the public's desire for financial autonomy.

Stablecoins are essentially functioning like shadow banks, holding massive amounts of U.S. debt and even influencing Treasury yields. This raises the question: should they be regulated as banks, or will new frameworks emerge? It's a balancing act between leveraging their demand for T-Bills and ensuring they don't pose systemic risks, especially if a major player like Tether collapses.