Tears follow Euphoria 😔😭

Bitcoin’s Wall Street debut ends in 10% price drop. Crypto stocks get clobbered. BlackRock's CEO calls Bitcoin an asset class that protects you. Grayscale’s court victory led to Bitcoin ETF approval.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin Price Crashes After ETF Approval

Bitcoin price surged to nearly $49,000 following the launch of spot bitcoin ETFs, but quickly reversed course.

The price plunged below $42,000 on Friday, a drop of almost 10%.

Bitcoin price has now stabilised around $42,000-$43,000 on Saturday.

ETF Buzz Fades

The initial enthusiasm surrounding the debut of spot bitcoin ETFs didn't translate into sustained price gains.

Investors seem to have taken a "sell the news" approach, cashing in on the initial hype.

Coinbase Shares Slide: Shares of Coinbase, the largest cryptocurrency exchange in the US, fell 7.4% on Friday, mirroring Bitcoin's decline.

The exchange's performance is often seen as a proxy for broader sentiment in the crypto market.

Bitcoin Miners Hit Hard: Bitcoin mining companies also experienced significant losses:

Marathon Digital (MARA) dropped 11.8%

Hut 8 Mining (HUT) fell 10.4%

Riot Blockchain (RIOT) plunged 10.1%

Why the crash?

SkyBridge Capital founder Anthony Scaramucci said that the recent downturn in Bitcoin is partly due to selling pressure from Grayscale's GBTC and the FTX position, but he expects the selling pressure to be resolved in the next six to eight trading days.

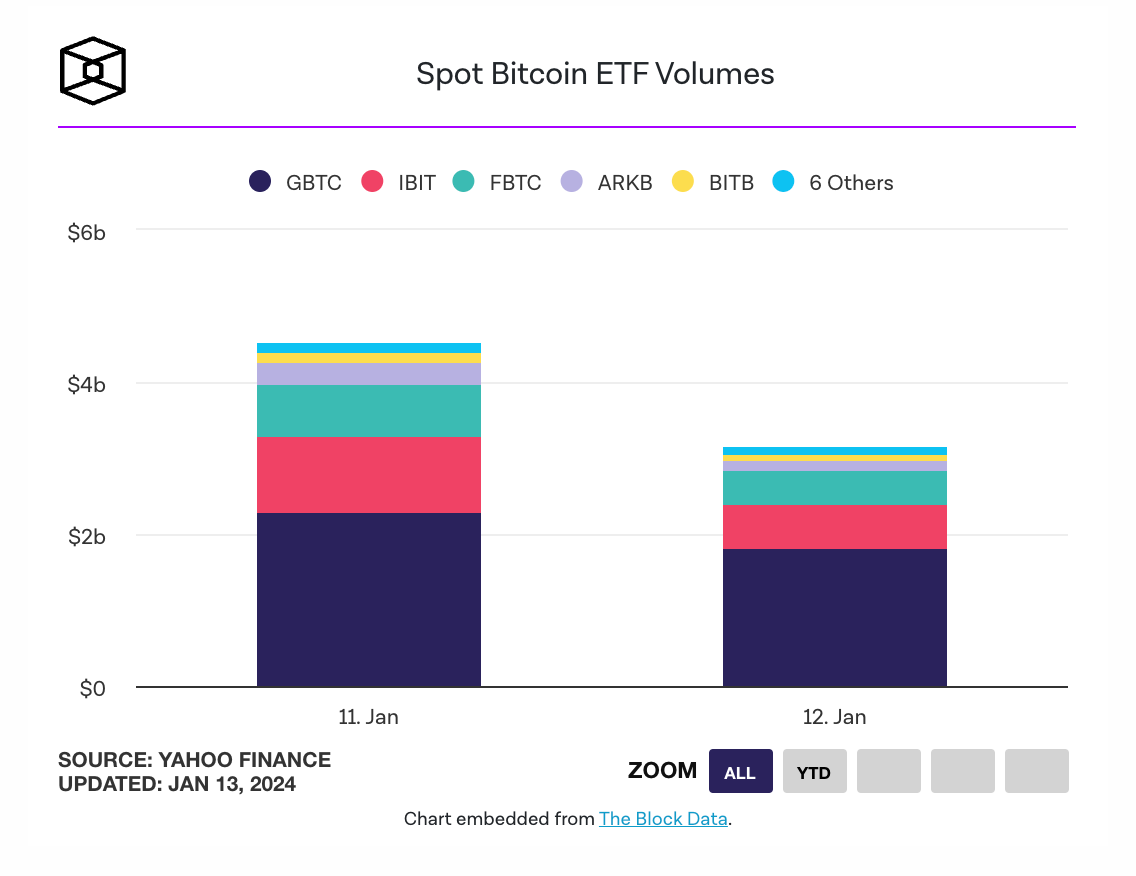

ETFs Trading Volume

Spot bitcoin ETFs saw strong trading volume on their second day, with a cumulative total of $7.1 billion.

BlackRock's iShares Bitcoin Trust (BITC) was the most traded spot bitcoin ETF with $1 billion in volume on the second day.

Grayscale's Bitcoin Trust (GBTC) saw $1.5 billion in trading volume on the second day.

Bitwise's Bitcoin ETF (BIT) had the most inflows of any spot bitcoin ETF on the second day, with $238 million.

ETF Fees War

The launch of the first Bitcoin ETFs in the United States has sparked intense competition among different ETF providers to offer the lowest fees.

Franklin Templeton has emerged as the winner in this fee war, reducing its fees to 0.19%, the lowest among all the new ETFs.

TTD Blockquote 🔊

Larry Fink, BlackRock CEO on Bitcoin

"It’s no different than what gold represented over thousands of years ... it's an asset class that protects you."

In an interview with CNBC, Fink stated his belief in Bitcoin, viewing it as an alternative form of wealth storage rather than a contender to replace national currencies.

He doubts the practicality of using Bitcoin for everyday transactions, reiterating it should be publicly perceived as purely an asset class.

Where’s ETF?🚨

Democrat Elizabeth Warren joins Republicans in commenting on SEC bitcoin ETF decision👇🏻

TTD Gary 🎙️

Gary Gensler, SEC chairman, acknowledged on Jan. 12 that Grayscale’s court victory was crucial in approving spot Bitcoin.

Gensler said during an interview with CNBC’s Squawk Box that the court decision in favour of asset manager Grayscale in August 2023 changed the SEC’s perspective.

Grayscale Wins Legal Battle, Unlocking Bitcoin ETFs

Denials Pile Up: Since 2013, the SEC repeatedly rejected applications for spot Bitcoin ETFs, citing concerns about market manipulation and investor protection.

Grayscale Fights Back: In June 2022, Grayscale challenged the SEC's rejection of their GBTC ETF conversion application, filing a petition for review in D.C. Circuit Court.

Court Rules in Grayscale's Favour: A landmark victory arrived on August 29, 2023, as the court deemed the SEC's reasoning insufficient and sent the case back for reconsideration.

Green Light for Bitcoin ETFs: On January 10, 2024, the SEC finally approved 11 spot Bitcoin ETFs, acknowledging the court's decision as a key factor.

Gensler Respects the Law

"I'm a deep believer in the rule of law and respect for the courts. Gensler stated, clarifying that approval wasn't an endorsement of Bitcoin. We had disapproved a number of these [applications for a spot Bitcoin ETF] over the years, and something had changed. Taking a new court decision into consideration, we move forward. I think this is the most sustainable path forward."

TTD Stocks 💹

The launch of spot Bitcoin ETFs in the US could have a negative impact on crypto stocks.

The ETFs could make it easier for investors to gain exposure to Bitcoin, possibly replacing crypto stocks that have traditionally acted as proxies for Bitcoin.

Three stocks most likely to be affected

Coinbase: A major cryptocurrency exchange. With it’s revenue heavily tied to the trading volume of cryptocurrencies, and Bitcoin is the most popular cryptocurrency.

Marathon Digital: A Bitcoin mining company. The price of Bitcoin is the main factor that determines the profitability of Bitcoin mining, so a decline in the price of Bitcoin could lead to a decline in the price of Marathon Digital's stock.

MicroStrategy: A business intelligence company that has invested heavily in Bitcoin. The price of Bitcoin is the main factor that determines the value of MicroStrategy's Bitcoin holdings.

Quinn Thompson, head of capital markets and growth at Maple Finance, told DL News.

“Coinbase is a good business no doubt but the ETFs bring a lot of new competition to the playing field. Some estimates are calling for $2 billion to $4 billion of inflows to the new Bitcoin ETFs in the first few days of trading. This is a serious level of encroachment on a previously large moat in the US.”

“The halving poses a serious risk to profitability that can only be solved by either much higher prices — over $75,000 by my estimations — or much higher transaction activity and fees — at least double or triple from current levels. It’s likely the higher cost producers will face some difficulties in the months following the halving. This will force [miners] to issue more equity to extend their runway and dilute existing shareholders. It’s a tried and true playbook they continually run and should not surprise people.”

TTD Surfer 🏄

Robinhood now offers 11 SEC-approved Bitcoin ETFs in the US, allowing trading in retirement and brokerage accounts.

Genesis Global Trading settles with New York Department of Financial Services (DFS), will forfeit BitLicense and pay $8 million penalty.

The South Korean Financial Services Commission has warned local firms against brokering spot Bitcoin ETFs from the US.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋