Teng's got a plan 🧠💡

New CEO Richard Teng pledges a smooth Binance transition. Cosmos wants a network fork. Crypto fund managers hit the jackpot. Indexed Finance survives hijack attempts.

Hello, y'all. Music fans can now discover new and unique sounds from up-and-coming artists. Check out 👉 Asset - Your Music Stats.

What we feelin?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Same old, same old.

Changpeng "CZ" Zhao, the charismatic face of Binance, is stepping down as part of a settlement with the US Department of Justice.

Read here: What’s next for CZ?🔮

But who's taking his place?

Richard Teng, Binance's former global head of regional markets, is taking the helm as CEO.

But the big question remains: How will Teng steer the ship as the exchange navigates US oversight and adjusts to CZ's absence?

A Smooth Transition?

Richard Teng, in a blog post, expressed his commitment to driving growth at Binance while maintaining a user-focused approach. He assured customers that they would be hearing more from him soon.

Teng, previously Binance's Global Head of Regional Markets, brings extensive regulatory experience to his new role.

He has served as👇

The CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market

Chief regulatory officer at the SGX.

13 years at the Monetary Authority of Singapore, enhancing his regulatory expertise.

"As an industry, we require more focus than ever on collaborating with policymakers. Only then may we effectively contribute to the development of a globally harmonised regulatory framework that will foster innovation while providing critical consumer protections.” - Teng said.

The Post-CZ Era

Binance has faced challenges following the DOJ settlement, including significant outflows ($1 billion) and a decline in market share among non-USD exchanges.

With CZ's departure, some speculated a mass exodus of funds from Binance, but blockchain analytics firm Nansen reported that this didn't materialise.

In fact, Binance's total holdings increased to over $65 billion within 24 hours of the US settlement.

CZ's settlement includes pleading guilty to a felony charge and paying $150 million in fines, while Binance faces approximately $4.3 billion in penalties.

Authorities are working to restrict CZ's travel, and he could potentially face up to 18 months in prison following sentencing in February 2024.

Lawless legacy?

Founded in 2017 by Changpeng Zhao (CZ), it initially embraced decentralisation, had no headquarters, and had a cavalier approach to regulations.

However, recent legal challenges and regulatory pressures have prompted Binance to change course.

It hired former US regulatory officials, vowed to follow the rules, and admitted to past compliance shortcomings.

Facing investigations in multiple countries, including the US, Binance aims to shed its rebellious image and align itself with regulatory requirements.

Now, according to the Wall Street Journal, the SEC is still investigating Binance.US for potential fraud similar to FTX.

Read: What’s next for CZ?🔮

And CZ is stuck in US for the time being👇

TTD Numbers 🔢

$1.5 billion

Year-to-date total inflow of funds in crypto.

Crypto fund managers had a field day last week, raking in the largest inflow of funds since late 2021, to $346 million.

This surge in investment was primarily driven by funds dedicated to bitcoin and ether.

The anticipation of a US-based spot bitcoin ETF played a significant role in this increase.

As a result of price surges and increased inflows, crypto fund managers now oversee more than $45 billion in total assets.

This represents the highest AUM level in over 18 months.

Bitcoin Dominates

Bitcoin investment products attracted the majority of the inflows, - $312 million

Short bitcoin funds, often used by traders betting against bitcoin's price, experienced their third consecutive week of outflows, with a total reduction in assets of over 60% since their peak in April.

Ether investment products also saw positive inflows, with $34 million added last week.

This four-week streak of inflows helped offset outflows earlier in the year, signalling improved sentiment towards ether.

Other altcoins, including Solana, Polkadot, and Chainlink, collectively received $3.5 million, $0.8 million, and $0.6 million in inflows, respectively.

Canada and Germany were the leading contributors to the surge in inflows, accounting for 87% of the total.

The US market witnessed more modest inflows, totaling $30 million.

Circulating BTC

The amount of circulating bitcoin that is in profit has reached a multi-year high of over 83%, the highest level since November 2021.

This is due to bitcoin trading at yearly highs above $37,000.

The magnitude of unrealised profit is still modest, and not enough for long-term investors to divest.

Over 16.3 million Bitcoin are currently in profit, which is substantially higher than the all-time average of 74%.

The Open interest?

Read here: Bitcoin FTW? 💪

Bitcoin hash rate reaches record high - passed 500 exahashes per second👇

BTC balances on exchanges are declining once again - Major exchanges hold a total of 2.332 million BTC as of Nov. 26.

TTD NFTs 🐝

New wallet in town?

Magic Eden is conjuring up a crypto utopia with its latest trick – a closed beta release of its crypto wallet browser extension.

The NFT marketplace believes in a multi-chain future for NFTs, sparing users the hassle of juggling multiple wallets.

The deets

The wallet will initially be available for Google Chrome, with plans for a Safari browser version and mobile app in the future.

It will be compatible with four blockchains: Bitcoin, Ethereum, Solana, and Polygon.

Users will have full control over their crypto assets with self-custody, requiring them to secure a seed phrase.

The wallet aims to provide a user-friendly, cross-chain solution, allowing for cross-chain token swaps without the need for bridging.

The wallet will enable users to buy crypto with fiat currency through a MoonPay integration and offer NFT-focused features like portfolio tracking and multi-chain connectivity.

What's in a Pudgy box?

Pudgy Penguins releases exclusive "influencer box" for Cyber Monday via Walmart.com.

What does it have? a 12-inch plush toy, an action figure, a clip-on plush, an igloo toy, and a certificate for a free NFT on the Pudgy World gaming platform.

Walmart is offering this "influencer box bundle" for just $25, marking it down significantly from the combined value of these delightful items.

For context, the 12-inch plush toys usually go for $20 to $25 individually.

Pudgy Penguins joined forces with Walmart back in September, bringing their whimsical toys to over 2,000 stores across the US.

This move aims to bridge the gap between physical and digital play, providing a fun experience for kids.

TTD Cosmos 🧩

Jae Kwon, the founder of Cosmos, is rallying community members to consider forking the network following a contentious governance decision.

The dispute revolves around a proposal to reduce inflation from staking rewards for Cosmos's ATOM token.

Inflation Debate: The heart of the matter lies in differing views on the necessity of inflation to secure the Cosmos blockchain.

Proposal 848, which passed narrowly, sought to lower ATOM's inflation rate from 14% to 10%.

Proponents argue that high inflation incentivises staking but negatively affects ATOM's price.

Kwon's Opposition: Jae Kwon openly opposed Proposal 848, reflecting his divergent stance within the Cosmos community.

Some believe this is indicative of Kwon's diminishing influence in the network he co-founded in 2014.

The proposal narrowly passed with 41.1% of votes in favour and 38.5% against, making it the highest turnout vote in the Cosmos ecosystem.

Resolving Years of Discord

Cosmos has been marred by internal disputes for years, and a chain split could potentially resolve long-standing political tensions within the network.

If the fork, informally known as AtomOne, materialises, it could lead to one of the largest airdrops ever received by ATOM holders.

Kwon's advocacy for a fork is seen as a way to drive innovation within the Cosmos ecosystem by removing dissidents from the original chain.

The underlying goal is to improve tokenomics and the network's performance.

TTD Hacks 🦹🏻

The Inferno Drainer Tale

Inferno Drainer, a prominent crypto wallet-draining service, has announced its closure after aiding phishing scammers in stealing nearly $70 million worth of crypto in 2023.

The team behind Inferno Drainer stated it's "time to move on" but will keep the necessary files and infrastructure active for users to transition to other services smoothly.

Since February, Inferno Drainer has stolen nearly $70 million from over 100,000 victims, though the team suggested the amount was over $80 million.

The closure follows the shutdown of Monkey Drainer earlier this year, leaving other active providers in the field.

Blockchain security firm CertiK called Inferno Drainer "one of the most damaging phishing kits" to the crypto community.

Indexed Finance Rescues Treasury

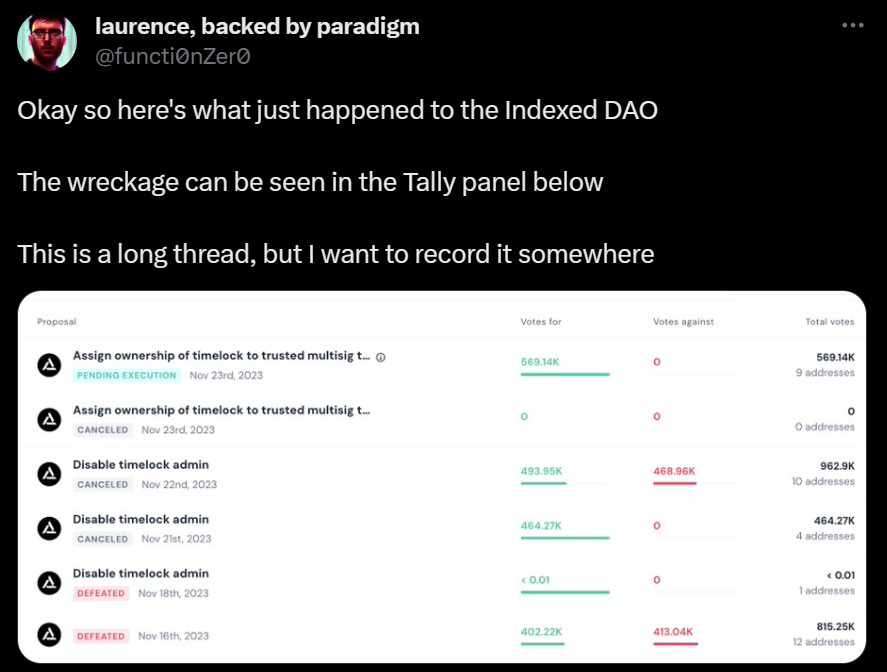

Indexed Finance, an Ethereum-based project that got hit with a $16 million hack in 2021, successfully repelled not one, but two hijacking attempts, saving the day.

Here's the plot twist: they're now ready to return control of the project's DAO to its founders.

Their mission? To help victims of the 2021 hack by putting the remaining treasury funds to good use.

Laurence Day, a former core contributor, described the heroic efforts of the Indexed community. Two attackers tried to snatch the DAO's treasury, which had around $120,000 in digital assets.

The first attack, a title-less and description-less proposal, was swiftly defeated thanks to the coordinated efforts of the community.

Although the attacker's proposal nearly succeeded, a sufficient number of "No" votes saved the day.

They knew the attackers might strike again, so they approved a "poison pill" proposal to burn the treasury funds if needed, sending a clear message to potential attackers: don't even think about it.

Then came the second attack, and the villains tried to negotiate, but our heroes stood firm.

The attackers finally agreed to a fair deal and backed down.

TTD Surfer 🏄

eToro and M2 have been granted licenses to operate in the United Arab Emirates by the ADGM Financial Services Regulatory Authority.

MicroStrategy's stock reached a nearly two-year high as its Bitcoin holdings turned a profit.

Researchers have developed an AI model called "Lightning Cat" to detect vulnerabilities in DeFi platforms' smart contracts.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋