Today’s edition is brought to you by Blockonomics. A decentralised and permissionless Bitcoin payment solution to track and accept payments 🫵

Hello, y'all. They say Tuesday is for tacos, but today it's about a dip. And why this "dip" might actually be a blessing in disguise.

$1.7B worth of positions said goodbye

$3.85B institutional inflows

BlackRock, MicroStrategy, and friends buying the dip

Mainstream media finally apologising

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

A little over a week in December, and what a month it's been. Bitcoin hit $100K, Etherem hit $4K, mainstream media has found new love for crypto currencies, and crypto friendly SEC chair announcement.

Read: 5,815 Days 💯

In the volatile world of crypto, celebrations can be short-lived. Within days of this historic milestone …

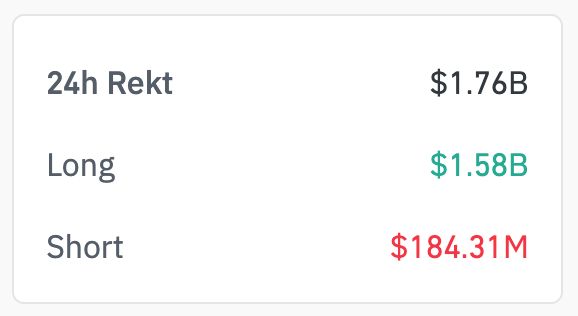

The last 24 hours in numbers

Bitcoin dipped to $94,900 ($96K atm)

Total liquidations: $1.7 billion

Longs wiped: $1.5 billion

Shorts rekt: $184 million

Traders liquidated: 514,400

Market cap down: 6.1% to $3.6T

That's what happens when markets get too cozy with leverage.

But here's the thing about market corrections: sometimes they're exactly what we need.

The leverage problem

The path to $100,000 Bitcoin wasn't easy. A rocket ship fuelled by leverage and speculation.

When Bitcoin briefly touched $103,679 this week, the market wasn't just hot – it was overheated.

You're at a party, and everyone's had a bit too much to drink. That's basically what the crypto market looked like last week.

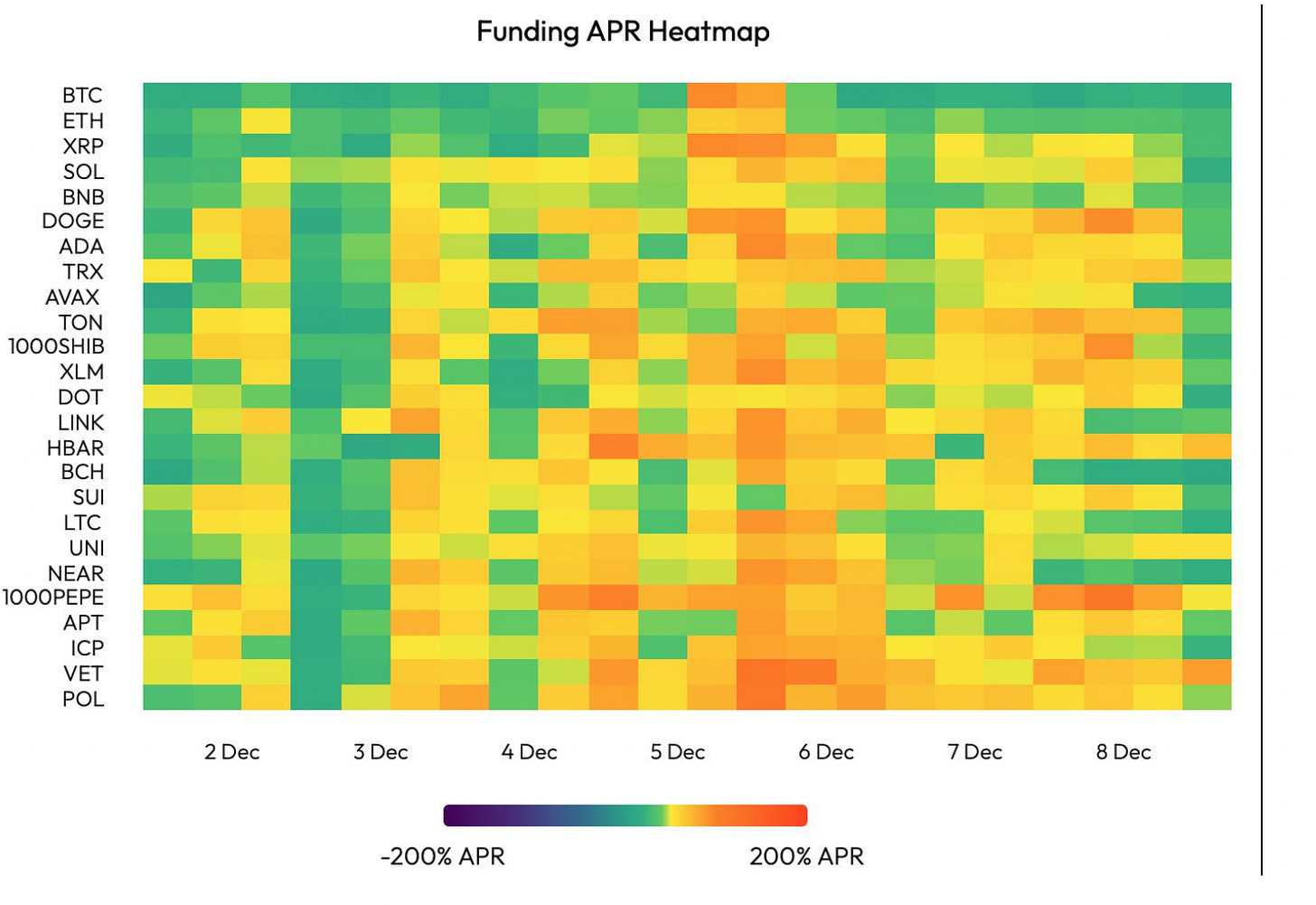

Funding rates through the roof

Leverage at all-time highs

Everyone betting on the same direction

FOMO hitting peak levels

Something had to give.

That spark came in the form of a simple market correction, sending Bitcoin below $95,000 and triggering a cascade of liquidations that rippled through the entire crypto ecosystem.

The domino effect

Bitcoin futures: $163.4M liquidated

Ethereum futures: $204.7M gone

Altcoins taking an even bigger hit

Then Bitcoin sneezed, the whole market caught a cold.

ETH dropped below $3,800

XRP fell 11%

DOGE tumbled from $0.484 to $0.428

SOL, BNB, and others following suit

The culprit? Our old friend leverage.

A healthy reset?

But before we start writing crypto's obituary (again), let's put this in perspective. Monday's liquidations, while dramatic, follow a pattern we've seen before.

The last time we saw liquidations of this magnitude was in December 2021 – coincidentally, also during a period of extreme market optimism.

Some analysts are already calling this a "leverage flush" – a necessary clearing of excessive speculation from the system.

It's like hitting the reset button on market dynamics that had become dangerously unbalanced.

What the smart money is saying?

CrypNuevo (Crypto Analyst)

"Is it a possibility that price goes up from here without filling the 50% wick at $94k? Yes, it is. But I'd NOT trust that move because there is a major imbalance to the downside that needs to get filled sooner than later."

Bitfinex Analysts

“Realised Profit RP, which tracks the USD gains from moved coins, peaked at $10.5 billion daily during Bitcoin's surge towards $100,000. However, it has since fallen to around $2.5 billion per day, reflecting a 76 percent drop.

With such a decline in realised profit and sell-side pressure, we can expect future declines to be less abrupt than the one experienced last week."

Glassnode's James Check

"Sell-side pressure by existing holders is tremendous right now."

But is that necessarily a bad thing? Markets need sellers as much as they need buyers.

Follow the money

The current total crypto market cap is down 6.1% in the last 24 hours. But here's the perspective: we're still up over 150% from last year.

While crypto Twitter was busy posting loss porn and "got rekt" memes, something remarkable was happening behind the scenes.

The smart money was buying. A lot.

In The Numbers 🔢

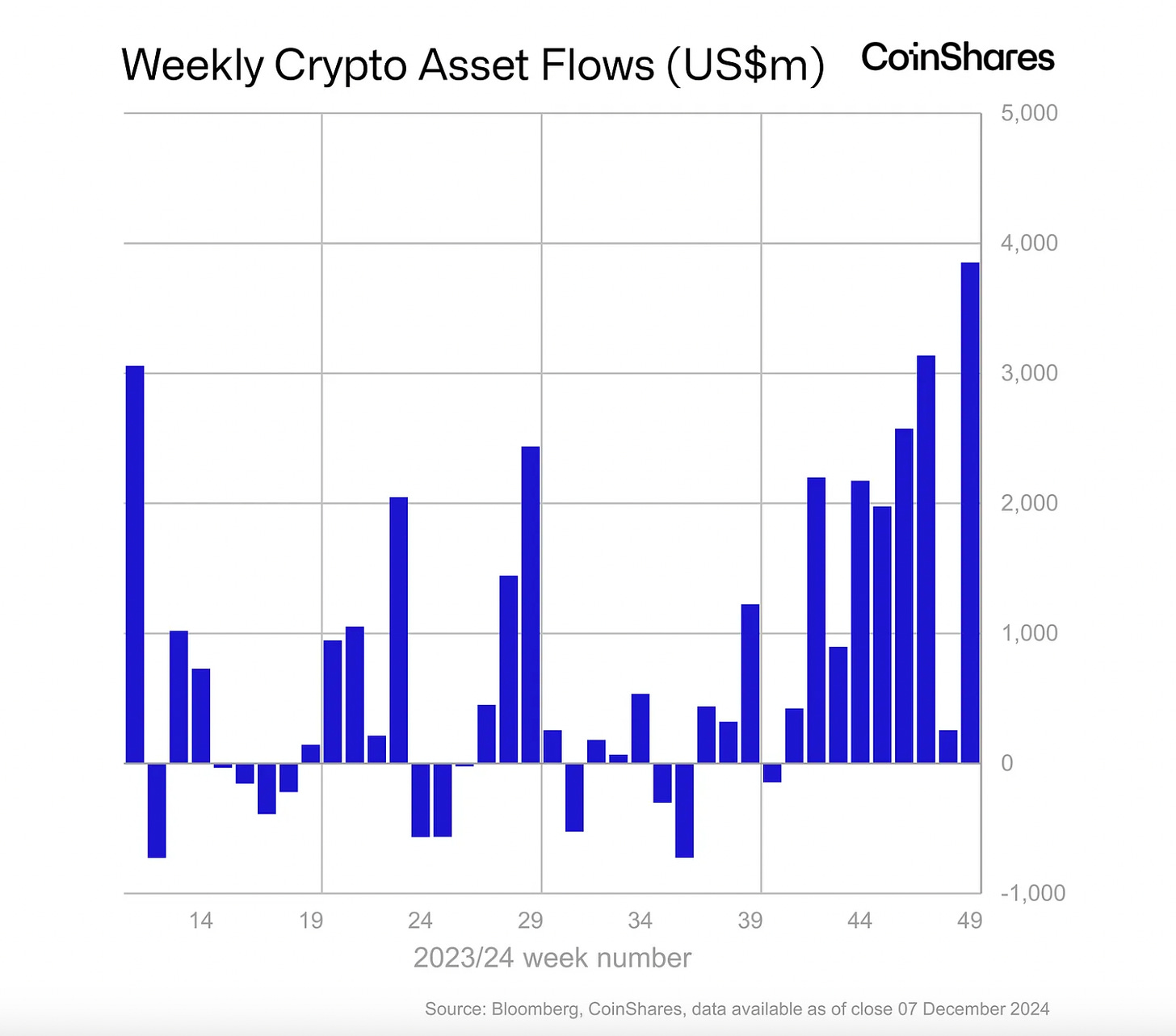

$3.85 billion

That's how much crypto investment products pulled in last week - the largest weekly inflow ever recorded.

Compare that to the previous bull run in 2021 which saw total yearly inflows of $10.6B. We just did one-third of that ... in a single week.

While traders were getting liquidated, institutional investors were deploying almost $4 billion in fresh capital.

No typical dip-buying either. The numbers tell a story of methodical, institutional accumulation.

Bitcoin captured $2.5 billion in inflows

Ethereum set its own record with $1.2 billion

Total year-to-date inflows hit $41 billion

Even blockchain stocks got $124 million

For perspective, the previous bull market peak in 2021 saw total inflows of just $10.6 billion. We're nearly quadruple that now.

The Bears' Dilemma: Perhaps the most telling signal? Short-bitcoin products saw only $6.2 million in inflows – a fraction of what we typically see after sharp price rises. Even the bears seem hesitant to bet against this momentum.

Accept Bitcoin Payments on Blockonomics

Accept Bitcoin directly. Invoice in fiat, get paid in Bitcoin. Be your own bank

Each online sale is deposited directly into your wallet. No KYC documentation required. Get set up in under 5 minutes.

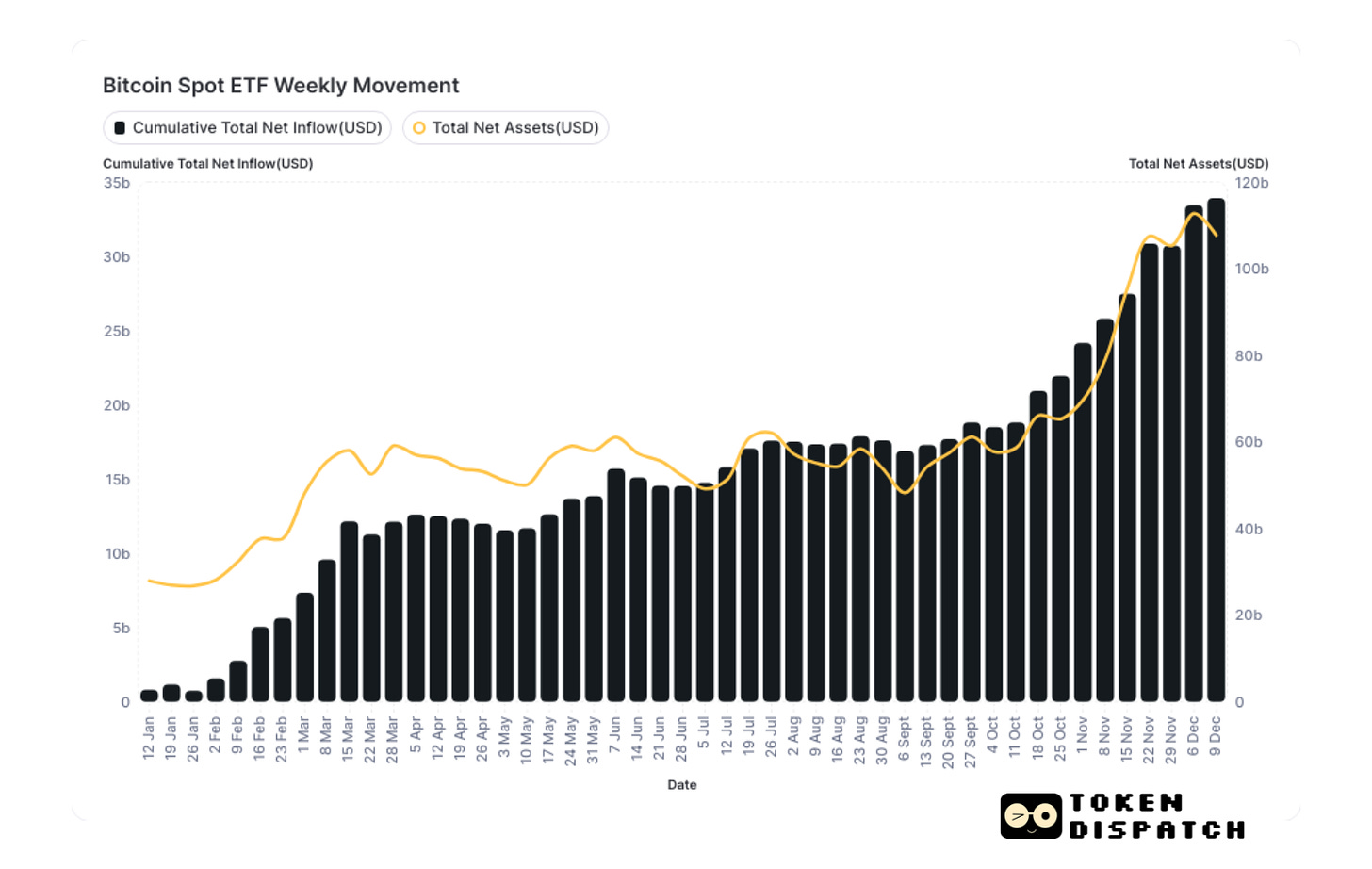

The ETF Effect

The numbers from spot ETFs tell a compelling story of consistent institutional accumulation.

From early October to December, Bitcoin ETF assets have nearly doubled, climbing from $57.73 billion to $112.74 billion.

More importantly, look at the weekly inflows.

October saw modest inflows around $300-900 million

November accelerated to $1.6-3.3 billion per week

December kicked off with another strong $2.73 billion inflow

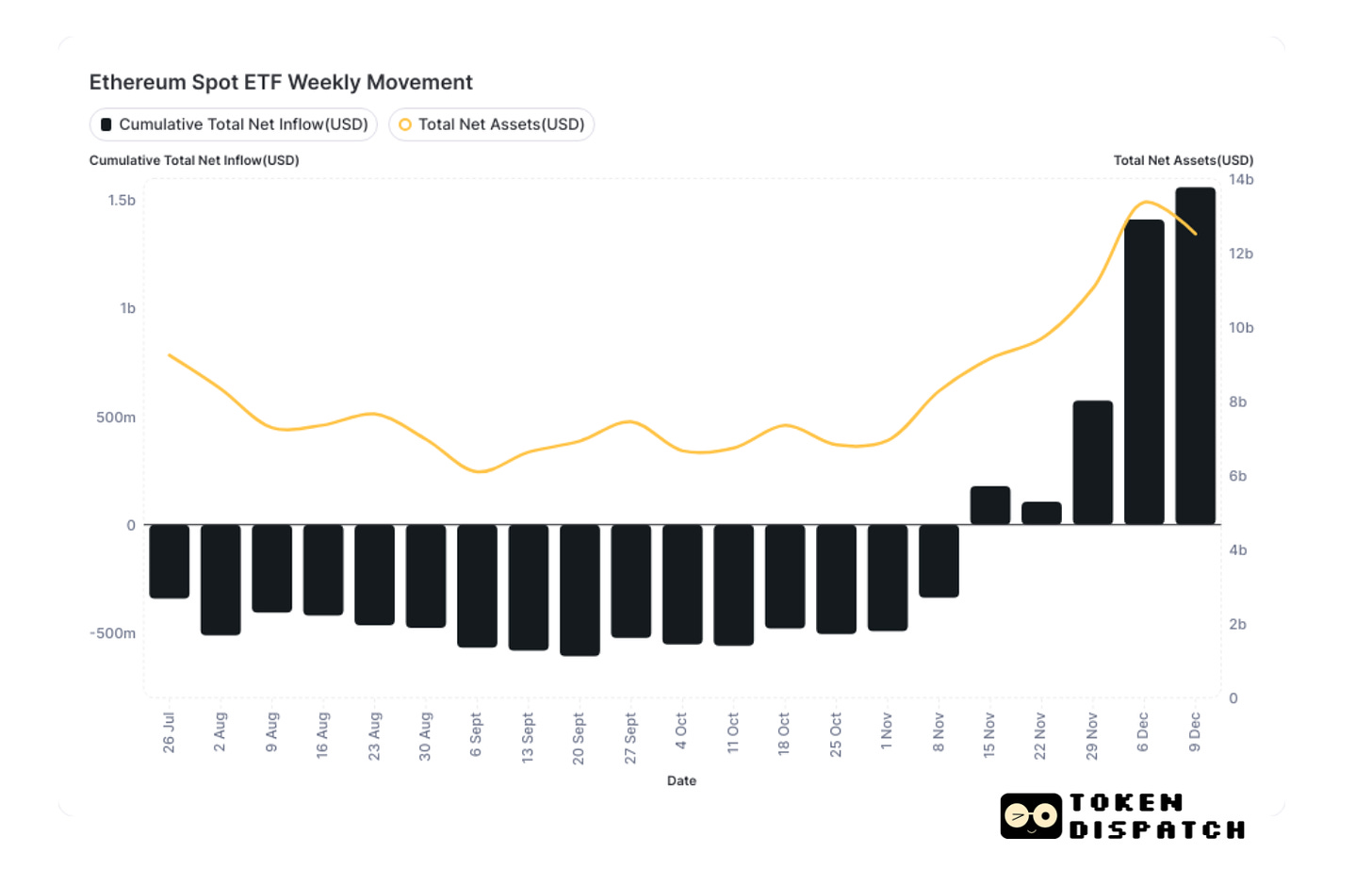

Ethereum's trajectory is equally impressive. Since October, ETH ETF assets have doubled from $6.74 billion to $13.36 billion.

The transformation is stark.

October started with negative cumulative flows (-$558 million)

By November, sentiment shifted dramatically with inflows up to $515 million weekly

December opened with a massive $836.69 million inflow

This isn't just about the numbers – it's about the pattern. Both ETFs show a clear shift from cautious participation to aggressive accumulation. The steady increase in total net assets, despite market volatility, suggests these institutional investors are playing the long game.

What makes this particularly bullish is the acceleration. Each month's inflows are getting larger, not smaller. When institutional money moves in this consistently, it's rarely for short-term trades. They're building positions for the long haul.

The Accumulation Gang

The race to accumulate is on. Price doesn't matter anymore.

24 Hours in Bitcoin.

MicroStrategy buys 21,550 BTC at $98K (5th purchase this month)

BlackRock adds 4,100 BTC to their stack

Riot Platforms raising $500M to buy more

When corporations treat $2B Bitcoin purchases like ordering office supplies, you know something's changed.

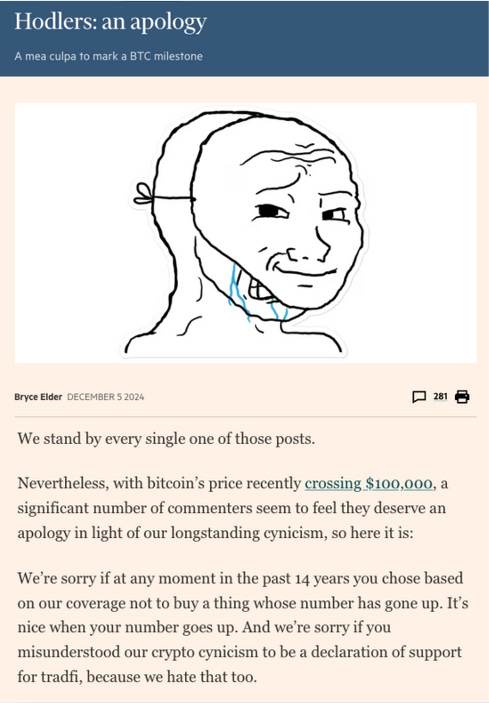

Media Attention

If you're wondering where we are in the market cycle, just look at the headlines.

The Financial Times has issued a sarcastic apology note to crypto holders. The BBC is running stories about Bitcoin FOMO, and NBC News has crypto on their front page.

We're entering what market veterans call the "Media Attention" phase of the bull cycle – that crucial period where mainstream attention starts driving new money into the market.

The Token Dispatch View 🔍

Here's the thing about market corrections: they're like Black Friday sales that nobody seems to want to attend. When Bitcoin drops 10%, everyone panics – forgetting that smart money just poured in $3.85 billion this week alone.

Think about it this way: The same institutions that have methodically accumulated through ETFs, pushing Bitcoin holdings past $112 billion and Ethereum past $13 billion, aren't suddenly going to change their minds because of a leverage washout.

They're probably buying more.

After all, when was the last time you saw:

Record-breaking $3.85 billion weekly inflows

Consistent month-over-month ETF growth

Mainstream media shifting from skepticism to FOMO

And a discount on entry prices?

Sure, $1.7 billion in liquidations makes for scary headlines. But while the leverage traders are nursing their wounds, institutional money is quietly treating this as what it likely is – a sale.

Remember: Bull markets don't end with record institutional inflows. They end with euphoria. And right now, all we're seeing is smart money quietly accumulating while traders panic over a healthy correction.

As the old Wall Street saying goes: "The time to buy is when there's blood in the streets" – even if it's just the blood of liquidated leverage traders.

So, are you buying the panic, or are you the panic?

The Surfer 🏄

Ripple CEO Brad Garlinghouse said in a "60 Minutes" interview that the formation of the Fairshake super PAC was a direct response to the SEC's regulatory stance under Gary Gensler, describing it as a reaction to a "war on crypto."

XRP has broken a seven-year price trend, achieving its highest weekly close at $2.60 and forming a bullish pennant pattern that could propel it to $3.80 by year-end.

Pudgy Penguins has overtaken Bored Ape Yacht Club (BAYC) to become the second-largest NFT collection by market cap, reaching $772.5 million after a 8.4% increase in its floor price to 22.1 ETH ($86,922).

El Salvador plans to ease its mandatory Bitcoin acceptance policy for businesses to secure a $1.3 billion loan from the IMF, which could unlock an additional $2 billion from the World Bank and Inter-American Development Bank.

The total stablecoin market cap has surpassed $200 billion, marking a 13% increase over the past month, driven by investors seeking higher yields from on-chain lending.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋